Table Of Contents

Onkar Sumant

Koyel Ghosh

Role of Generative AI in Compliance and Risk Management across the Banking Industry

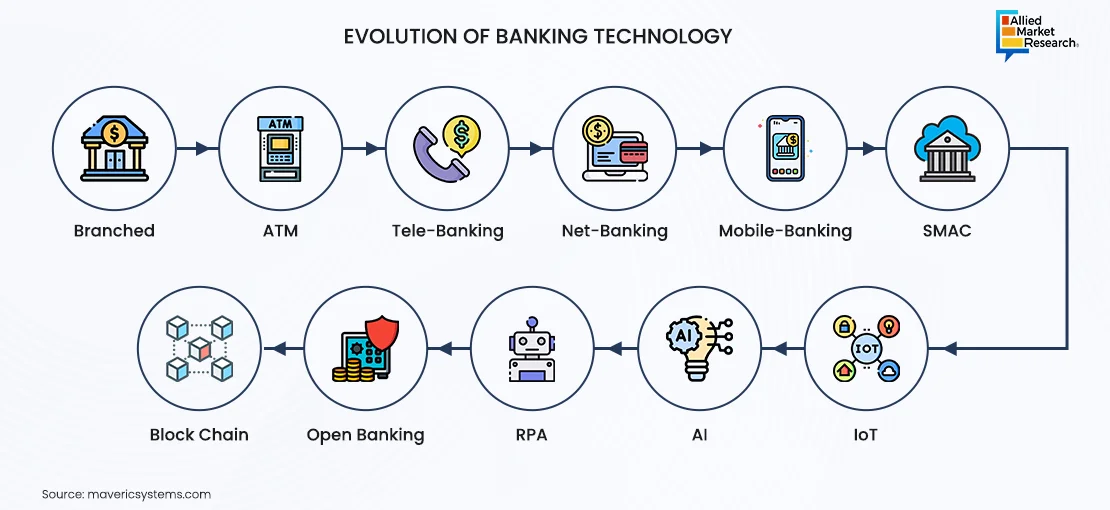

Generative AI is ready to drive productivity enhancements across diverse sectors, including the financial services industry. This technology is already transforming the operations of banking functions, impacting tasks such as modeling analytics, automating manual processes, and synthesizing unstructured content. Notably, it influences how financial institutions handle risks and adhere to regulatory compliance standards.

Establishing boundaries for the deployment of gen AI within an organization is crucial for risk and compliance functions. Technology further improves the efficiency and effectiveness of these functions.

Evolving Functions of Gen AI in Risk and Compliance

Among the numerous promising applications of gen AI within financial institutions, there exists a specific set of possibilities that banks are currently exploring as a preliminary phase of adoption. These include regulatory compliance, financial crime detection, credit risk assessment, modeling and data analytics, cyber risk management, and climate risk evaluation. In essence, gen AI is being applied across various risk and compliance functions, categorized into three main types of uses.

The first archetype involves a virtual expert, allowing users to pose questions and receive synthesized summary answers generated from extensive documents and unstructured data. The second archetype, manual process automation, entails gen AI undertaking time-consuming tasks. The third archetype, code acceleration, enables gen AI to either update or translate existing code or generate entirely new code. Each of these archetypes plays a role in fulfilling key responsibilities within the realms of risk and compliance. Some of the use cases of gen AI in banking are depicted in the figure below.

In regulatory compliance, enterprises employ gen AI as an expert with specialized training to respond to inquiries regarding regulations, company policies, and guidelines. Technology excels at comparing policies, regulations, and procedures, acting as a code accelerator. It evaluates code to spot compliance issues, automating checks and flagging potential breaches for quick action. For financial crime detection, gen AI generates suspicious activity reports based on customer and transaction information. It also automates the creation and updating of customers' risk ratings by considering changes in know-your-customer attributes. Furthermore, by generating and refining code to identify suspicious activities and analyze transactions, the technology enhances transaction monitoring. For example, JPMorgan Chase in late 2023 integrated gen AI for fraud detection and client team guidance.

In the context of credit risk, gen AI streamlines the end-to-end credit process by summarizing customer information, expediting credit decisions, and even drafting credit memos and contracts post-credit decision.

Financial institutions utilize Generation AI (Gen AI) to create credit risk reports, extract customer insights from credit memos, and generate code for collecting and analyzing credit data. This helps in evaluating customers' risk profiles and estimating probabilities of default and loss through predictive models. HSBC, Deutsche Bank, and Royal Bank of Canada for example, have integrated gen AI for loan approvals in late 2023.

In modeling and data analytics, gen AI accelerates the transition from legacy programming languages, such as the shift from SAS and COBOL to Python. It also automates the monitoring of model performance, issuing alerts if metrics deviate from tolerance levels. Companies utilize gen AI to draft model documentation and validation reports.

When it comes to cyber risk, gen AI again plays an important role in checking cybersecurity vulnerabilities, using natural language to generate code for detection rules, and expediting secure code development. Video gaming proves invaluable in "red teaming," simulating adversary strategies and testing attack scenarios. Moreover, it acts as a virtual expert for analyzing security data, enhancing risk detection by accelerating and consolidating security insights and trends from events and behavioral anomalies. After integrating gen AI into these roles and functions, companies have observed a subsequent wave of emerging use cases within various facets of risk management. Gen AI helps businesses manage risks more effectively by analyzing existing data and reports to create concise summaries of enterprise risk management. It speeds up the process of assessing internal capital adequacy by using relevant data for modeling. Banks also take recourse to gen AI to concisely summarize risk positions and generate risk reports, as well as executive briefings tailored for senior management.

Operational risk is another significant area where gen AI plays a pivotal role. It automates control processes, monitors operations, and detects incidents effectively. Furthermore, Gen AI can generate self-assessments for risk and control, enhancing their quality and efficiency.

Winning Strategies for Planning a Gen AI Journey

To unlock the potential of Gen AI, organizations should start with a focused, top-down approach. Given the shortage of talent to expand Gen AI capabilities, it's recommended to begin with three to five key risk and compliance scenarios aligned with strategic goals. Executing these cases within three to six months, followed by assessing the business impact, ensures a smooth journey into Gen AI adoption. Creating a robust Gen AI ecosystem is essential for scaling applications, with a focus on seven key areas:

- A collection of ready-to-use Gen AI services and solutions, designed for seamless integration into diverse banking scenarios and applications across the value chain.

- A secure technology stack, ready for Gen AI, supports hybrid-cloud deployments, enabling unstructured data support, vector embedding, machine learning training, execution, and pre- and post-launch processing.

- Incorporating enterprise-grade foundational models and tools allows for tailored selection and coordination of both open and proprietary models.

- Automating supporting tools such as MLOps, data, and processing pipelines accelerates the development, release, and upkeep of Gen AI solutions.

- Governance and talent models encourage collaboration among language experts, reinforcement learning specialists, cloud professionals, AI product leaders, and legal experts, fostering cross-functional expertise and knowledge exchange.

- Streamlining processes to develop Gen AI, enabling fast and secure end-to-end testing, validation, and deployment of solutions.

- A plan detailing when different capabilities and solutions will be launched and expanded, in line with the organization's overall business strategy.

In today's business world, companies in every industry are exploring the possibilities of Gen AI. Banks need to understand that transitioning from testing to full implementation with Gen AI takes longer compared to traditional AI and machine learning. When choosing how to use Gen AI, risk and compliance teams should avoid working in isolation and instead coordinate with the organization's overall Gen AI strategy and objectives.

Talent and Operating-Model Requirements

As Gen AI emerges as a game-changer, understanding its talent needs becomes important for organizations. Banks should place operational changes into their culture and routines. This includes thorough training for newcomers, covering both Gen AI usage and its strengths and weaknesses. Simultaneously, forming a team of "Gen AI champions" would greatly assist in guiding and promoting the widespread adoption of this cutting-edge technology.

Final Words

It’s anticipated that Gen AI will revolutionize how banks manage risk and compliance. This shift will bring about a significant cultural change, urging all risk professionals to acquaint themselves with this emerging technology and grasp its capabilities, limitations, and strategies for mitigating risks. The integration of Gen AI is anticipated to mark a substantial transformation for organizations, benefiting those who effectively leverage its potential while managing associated risks to achieve significant productivity gains.

Allied Market Research aims to equip stakeholders with comprehensive knowledge about the transformative role of Generative AI in compliance and risk management within the banking industry. By understanding this practice, vendors can strategically position themselves to make the most of its benefits. We encourage vendors to explore opportunities for integrating Generative AI into their business processes, leveraging its capabilities to enhance efficiency, mitigate risks, and ultimately drive success in an evolving marketplace. Embracing this innovative approach will not only optimize operations but also foster growth and competitive advantage in the dynamic landscape of banking and finance. For more insights into Gen AI and its use cases in banking, contact our specialists today!