Sonia Mutreja

Koyel Ghosh

The Evolution of Warehouse Robotics in Modern Supply Chains

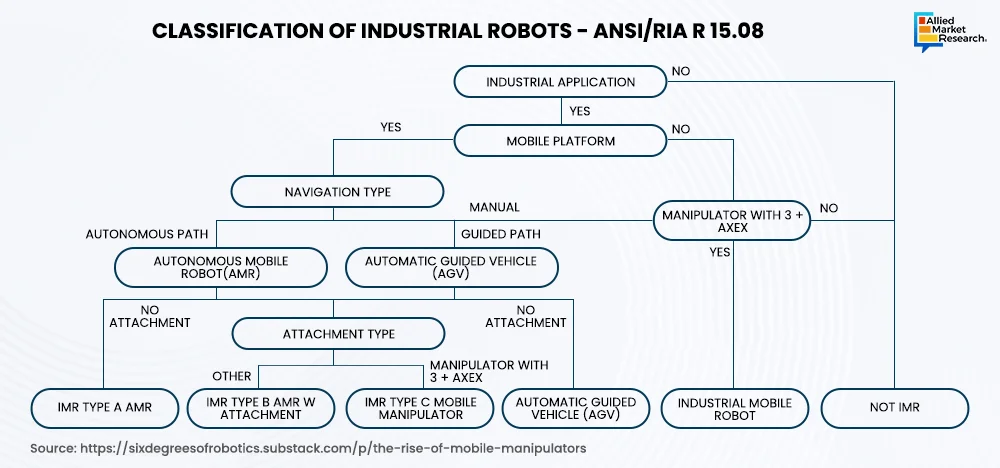

Warehouse robotics includes various robotic systems designed to boost efficiency and safety in operations. Autonomous Mobile Robots (AMRs) use AI and sensors to navigate autonomously, while Automated Guided Vehicles (AGVs) follow predetermined paths to transport goods. Automated Storage and Retrieval Systems (ASRS) streamline storage and retrieval processes, maximizing space utilization and speed. Collaborative Robots (Cobots) work alongside human workers to enhance both productivity and workplace safety. Automated Guided Carts (AGCs) are used to carry lighter loads along fixed routes. Together, these robotic systems play a vital role in automating tasks such as inventory management and order fulfillment.

Supply side analysis

The supply side of the warehouse robotics industry is undergoing rapid transformation, driven by technological advancements and growing investments. Industry leaders are focused on developing innovative solutions to address the increasing demand for warehouse automation. For example, Amazon introduced its new ‘Sequoia’ robotic system in 2023, which integrates advanced AI and robotics to improve fulfillment efficiency.

Companies are heavily investing in research and development to advance robotics technologies, particularly in areas, such as AI, ML, and the IoT. These technologies empower robots to perform complex tasks with greater precision, adaptability, and intelligence. The most widely adopted solutions are Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs), which offer scalability and flexibility in warehouse operations.

The sector has also experienced a notable increase in venture capital funding, accelerating innovation and industry expansion. For instance, in April 2025, Agility Robotics secured $400 million to advance its development of humanoid warehouse robots. Such funding is vital for startups and established players to bring cutting-edge robotics solutions to the industry and expand their global presence.

The adoption of Industry 4.0 technologies is further revolutionizing the landscape, transforming conventional warehouses into smart, interconnected hubs. This shift is observed in industries such as e-commerce, retail, and manufacturing, where demand for automation continues to surge. The booming e-commerce sector is a major growth driver as businesses seek efficient solutions to manage increasing order volumes. Also, labor shortages and the ongoing need to reduce operational costs are encouraging companies to adopt robotic process automation.

Value chain analysis

The value chain of the warehouse robotics industry comprises several critical stages, each contributing to the sector's efficiency and technological advancement. The first phase starts with R&D, where companies focus on innovating and building advanced robotics solutions. For instance, Boston Dynamics introduced “Stretch” in 2023, a robot specifically engineered for warehouse operations. It features a long-lasting battery, allowing it to operate continuously through multiple shifts. Its computer vision system enables autonomous detection and retrieval of fallen packages. With a compact design and high mobility, it is well-suited for maneuvering in confined warehouse spaces.

The next phase is manufacturing, where these innovations are converted into tangible products. Leading companies such as ABB and Fanuc are known for producing high-quality robotic components and systems. This is followed by system integration, in which these robotic systems are seamlessly incorporated into existing warehouse infrastructures. This process involves collaboration between robotics manufacturers and integrators like Dematic and Swisslog to ensure smooth implementation.

Another key stage is distribution and logistics, which is responsible for delivering robotic systems to warehouses across the world. Logistics giants including DHL and FedEx play a major role in ensuring timely and efficient transportation. After delivery, the installation and commissioning phase begins, where specialists set up and test the robots to ensure they function optimally in their designated environments.

Operation and maintenance represent a vital stage for ensuring long-term robot performance. Companies like Ocado, which deployed a fully automated warehouse system in 2024, allocate significant resources toward regular maintenance and software updates to sustain operational efficiency. The last stage, that is the after-sales service phase, includes ongoing support, system upgrades, and performance enhancements to keep up with evolving warehouse demands.

Building the future of smart warehouses

The future of warehouse robotics is experiencing remarkable growth and innovation, driven by growing demands for e-commerce and increasing need for streamlined, efficient supply chain operations.

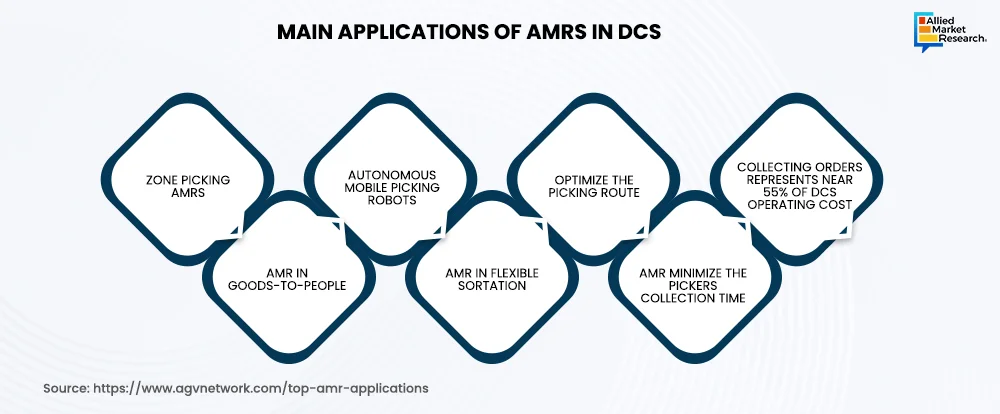

Autonomous Mobile Robots (AMRs) offer a new level of flexibility and efficiency as compared to earlier automation technologies. Equipped with advanced sensors, AI coprocessors, and machine vision algorithms, these robots can traverse warehouse environments in real-time, adapting seamlessly to fluctuations in demand and shifting operational requirements. This adaptability makes AMRs particularly effective in addressing the logistical challenges of e-commerce and eliminating the impact of labor shortages.

In the future, warehouses are expected to feature a diverse ecosystem of robotic solutions working in collaboration with human workers. Technologies such as conveyor and sortation systems, shuttle systems, and even humanoid robots are predicted to become common. Amazon, for example, already employs thousands of robots and is currently developing 'Digit', a bipedal humanoid robot capable of walking warehouse floors and performing tasks such as picking and packing items much like a human worker.

AI and ML play a central role in the advancement of warehouse robotics. These technologies stand to empower robots to take on intricate tasks, including quality control and real-time inventory management. For instance, in February 2024, DHL Supply Chain partnered with Robust.AI to deploy a fleet of warehouse robots, including a collaborative mobile robot named Carter, to optimize the picking process and adapt to real-time warehouse conditions.

While concerns about job displacement persist, the future of warehouse robotics relies on human-machine collaboration. Robots are expected to take on repetitive, hazardous, or low-value tasks, enabling human workers to focus on more strategic, creative, and value-added responsibilities. This collaborative model promises improved efficiency, cost-effectiveness, and faster, more accurate order fulfillment.

With the ongoing evolution of automation technology, the use of RFID, smart data capture, and drones is accelerating. This shift is driving the development of an intelligent and highly interconnected warehouse environment, where every stage, from inventory tracking to order processing and shipping is optimized through the coordinated efforts of robots and AI systems.

Industry players and innovations

The warehouse robotics sector is progressing rapidly, with major players unveiling significant innovations in recent years. In October 2024, Amazon Robotics introduced its next-generation fulfillment center in Shreveport, Louisiana, showcasing Proteus, the first fully autonomous mobile robot to boost safety and operational efficiency. Proteus incorporates advanced navigation capabilities, allowing it to operate smoothly alongside human workers, minimizing workplace injuries and maximizing throughput. These innovations highlight the transformative impact of technology on modern fulfillment operations.

Also, Geek+ introduced three state-of-the-art solutions at LogiMAT 2025 in March. Among them is PopPick v2, which boosts picking efficiency by 67%, significantly improving order accuracy while cutting labor costs. RoboShuttle v4 is tailored for high-volume order fulfillment, offering enhanced scalability and adaptability to complex warehouse layouts. Meanwhile, SkyCube v2, engineered for cross-floor operations, delivers up to 35% higher storage density, promoting superior vertical space utilization and improving inventory accessibility.

Case studies

Humanoid Robotics at GXO Logistics

GXO Logistics, a leader in warehousing and logistics, is at the forefront of integrating humanoid robots to boost operational efficiency and adaptability. By utilizing AI-driven humanoid robots, GXO has enhanced task handling and processing capabilities.

A key initiative in this space is the Humanoid Robotics Initiative, launched in October 2024. This program introduced robots such as Digit and Apollo, designed to carry out tasks, such as lifting heavy containers and moving empty boxes. Their deployment led to a 30% improvement in task completion speed, saving approximately $800,000 annually. In addition, their ability to learn through human demonstrations cut training time by 20%, contributing to a 15% boost in overall productivity.

Efficiency Gains at DSV with Locus Robotics

DSV, a global leader in logistics and distribution, partnered with Locus Robotics to manage seasonal demand surges and enhance productivity. By adopting a robots-as-a-service (RaaS) model, DSV is expected to scale its robotic fleet based on demand.

In October 2024, DSV successfully used Locus robots to navigate peak seasonal demand for a major client in the health and beauty sector. These robots, which require minimal changes to existing infrastructure, boosted order fulfillment rates by 25%, translating to annual savings of about $1 million. The RaaS model also helped reduce downtime during peak periods by 15%, leading to a 10% increase in customer satisfaction.

In conclusion, warehouse robotics is rapidly transforming operations through AI, machine learning, and IoT, creating smart, efficient environments. These systems boost productivity, reduce labor dependency, and enhance safety by automating repetitive tasks. Despite challenges like high costs and cybersecurity concerns, the future of the industry lies in seamless human-robot collaboration, enabling flexible, scalable, and efficient supply chain management to meet growing industry demands.

Allied Market Research serves as a trusted partner for stakeholders in the warehouse robotics industry, delivering in-depth insights and tailored strategies to drive innovation across diverse applications. These include e-commerce, retail, manufacturing, logistics, and distribution centers. With AMR’s expertise, businesses can discover growth opportunities, evaluate industry trends, and develop advanced robotic solutions to enhance efficiency, productivity, and competitiveness in an evolving automation landscape.

For more details about technologies, innovations, and dynamics in the warehouse robotics industry, contact our specialists today!