Warehouse Robotics Market Research, 2032

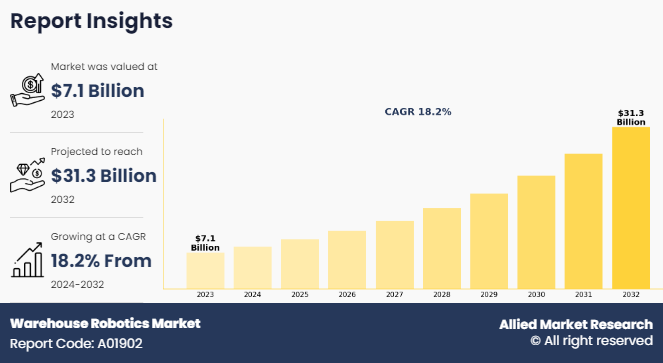

The global warehouse robotics market was valued at $7,069.1 million in 2023, and is projected to reach $31,343.7 million by 2032, growing at a CAGR of 18.2% from 2024 to 2032.

Warehouse Robotics, particularly those designed for order picking and packing, have gained popularity. The advancement of Warehouse Robotics Market has been driven by significant breakthroughs in robotics technology, including improvements in artificial intelligence (AI), computer vision, and machine learning. Companies such as Amazon have deployed large fleets of robots to facilitate the movement of goods and expedite order processing in their fulfillment centers.

Report Key Highlighters

- The warehouse robotics market has been analyzed across 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2022 to 2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

- The Warehouse Robotics Market share is marginally fragmented, with players such as KION Group, Honeywell International Inc., KUKA Industries GmbH & Co. K, BlueBotics, Omron Corporation, ABB Ltd., FANUC, Kawasaki Heavy Industries, Ltd., Hirata Corporation, and Delta Electronics, Inc.

Advancements in automation technologies

As the demands of the e-commerce industry have grown, warehouses have changed to accommodate and support multi-channel fulfillment. Order types from B2C to D2C must be handled by warehouses in an efficient manner due to the continuous growth of online platforms and sales channels. Warehouses simplify order processing across multiple sales channels and maximize space utilization through adaptable design and layout strategies, which increases overall operational efficiency.

Furthermore, warehouse robotics market size is contineously growing with incorporation of cutting-edge technologies is an essential element in the development of warehouse design. Warehouse automation solutions such as autonomous mobile robots (ARMs), drones, and automated storage/retrieval systems enable businesses to process orders faster, safer, and more reliably compared to relying solely on human labor. This results in increased customer satisfaction, improved operational efficiency, and reduced overall risk for businesses. such development and advancement in automative create market opportunities in warehouse robotics market

Increase in e-commerce sector

Online shopping is predicted to account for 30% of all retail sales worldwide, up from 20% currently. The 'U.S Robotics sales have increased to previously unheard-of heights during the warehouse robotics market projection through 2024. With 12,305 units sold in the previous quarter, there was a notable 25% increase over the same period the previous year. Companies are also investing in creating their own customized robotic solutions. Robots and artificial intelligence are examples of warehouse automation technologies that Amazon plans to improve with $1 billion in funding. Walmart responded by saying it would be spending a whopping $14 billion in the automation of the warehouse robotics industry as well as other areas. Because robots are more dependable and economical than human labor, there are clear benefits to investing in warehouse automation, even for smaller businesses.

The important factor driving the need for warehouse robotics industry expansion is the increase in online shopping. Today's e-commerce businesses have to manage large inventory and fulfill orders efficiently, as more customers choose to shop online owing to its convenience. The demand for warehouse space has therefore increased significantly. Furthermore, Direct-to-Consumer brand growth is majorly responsible for the increase in the demand for warehouse space. owing to their direct sales to consumers and lack of involvement in traditional retail channels, these brands require specialized warehouse space in order to properly store their inventory and process orders.

Increasing number of stocks keeping units

The rise in the number of SKUs caused by customization and the growth of e-commerce requires effective automation solutions to manage a wide range of products. Cost-effective small-load storage and retrieval systems not only improve storage capabilities but also boost the efficiency of the supply chain. Effective inventory management is a key factor fueling the demand for warehouses in the e-commerce industry. E-commerce companies are required to manage extensive and varied inventories to meet customer needs. Warehouses are essential for the organizing, storing, and supervision of large inventories to ensure timely order fulfillment. According to CBRE modeling, with every additional $1 billion spent online, there is a increasing need for an additional 70,000 sq. m. of warehouse space. This shows a total of 1,050,000 sq. M. of dedicated e-commerce space required by 2027. The rapid expansion of online shopping and the necessary infrastructure to sustain it is truly remarkable and create warehouse robotics market opportunity.

Furthermore, while AGV technologies have paved the way for AMRs to become the new norm, other exciting trends are also making their mark. Companies are discovering bottlenecks in their operations where automation can make a significant difference, leading to the rise of trailer unloading technologies and advanced Fleet/Robot Management software. These trends are gaining momentum as companies strive to expand their automation capabilities and streamline their control over complementary solutions. such increasing demand from warehousing industry create several oppotunities for warehouse robotics market to grow during forecasted period.

Market Segmentation

The warehouse robotics market is segmented on the basis of type, operation, end user, and region.

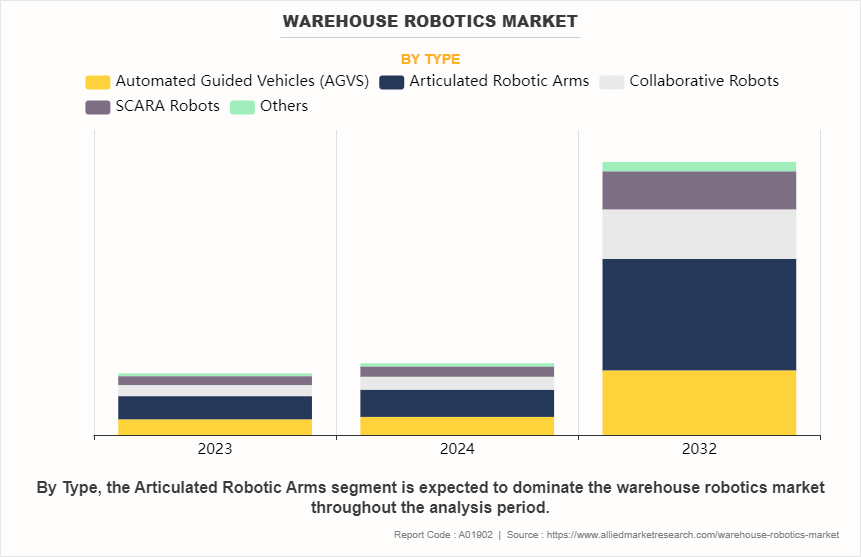

By type, the market is categorized into automated guided vehicles (AGVs), automated storage and retrieval systems, cobots, articulated robotic arms, and others.

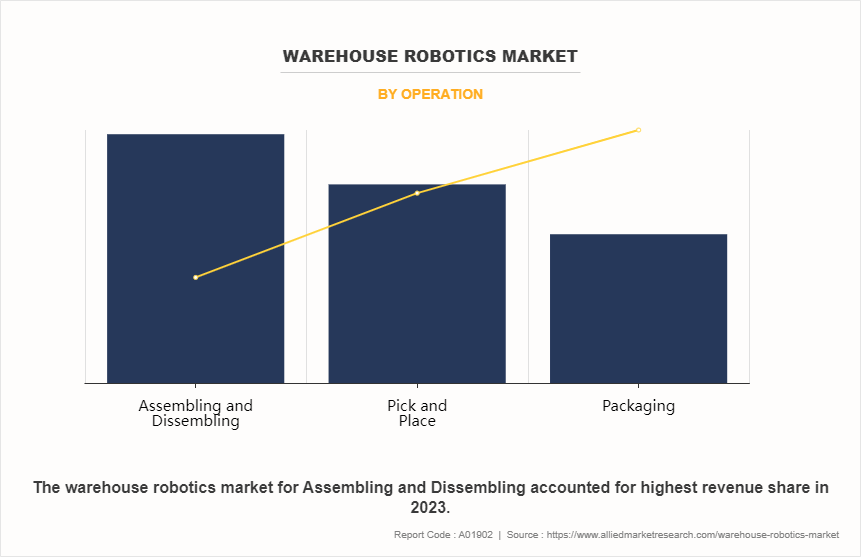

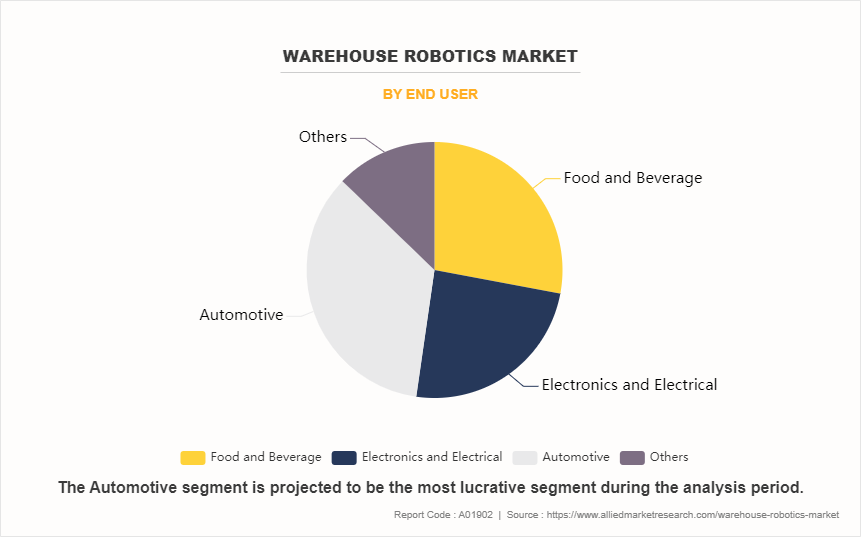

Depending on operation, it is divided into pick & place, assembling & dissembling, and packaging. By end user, the market is segregated into food & beverage, electronics & electrical, automotive, and others.

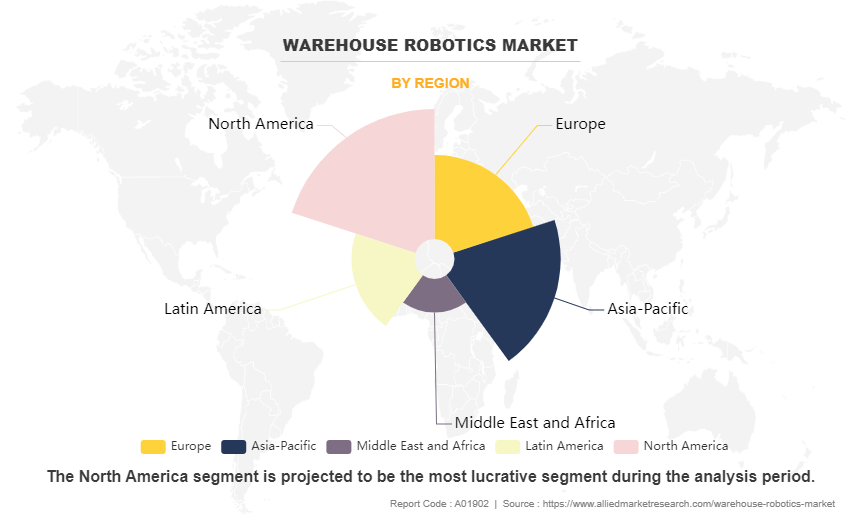

Region wise, the market is analyzed across North America, Europe, Asia-Pacific, LA, and MEA.

Competitive Analysis

Competitive analysis and profiles of the major global warehouse robotics market players that have been provided in the report include KION Group, Honeywell International Inc., KUKA Industries GmbH & Co. K, BlueBotics, Omron Corporation, ABB Ltd., FANUC, Kawasaki Heavy Industries, Ltd., Hirata Corporation, and Delta Electronics, Inc.

Top Impacting Factors

Global industry change is being brought about by the fusion of automation improvements and the expanding e-commerce sector. Moreover, this shift in the e-commerce sector, where supply chain management and sophisticated logistics are required owing to quick expansion, shifting consumer preferences, and the ease of online shopping. Automation assists companies streamline operations, increase productivity, and cut costs in a variety of sectors.

Key Developments/ Strategies in Warehouse Robotics Market

For Instance, In June 2023, KUKA Industries GmbH & Co. KG, based in Obernburg, sold its robotic automation integration company. The new owners are presenting KUKA Industries and its employees with a better-suited business model and a fresh strategic approach. This will result in increased market presence and the establishment of more autonomous sales systems.

For instance, in May 2023, BlueBotics unveiled ANTdriven.com a novel educational platform that empowers factories, supply chains, and warehouse managers to explore and delve into various automated vehicle technologies offered by the ANT navigation ecosystem. ANTdriven.com serves as a valuable resource for learning and experimentation in this rapidly evolving field.

For instance, in February 2023, KION Group completed the construction of a state-of-the-art warehouse in Germany dedicated to shipping spare parts. The newly established automated distribution center significantly improved the speed and efficiency of spare parts acquisition for customers.

For instance, in February 2023, Honeywell International Inc. unveiled a new research and development center aimed at enhancing its technology and supporting the logistics and warehouse sectors in Europe.

For instance, in December 2022, Omron Corporation inaugurated a new automation center in Singapore to cater to the logistics industry in Southeast Asia and Oceania. The center showcases cobots (cooperative robots) and AMRs (autonomous mobile robots).

For instance, in August 2022, ABB Robotics introduced the FlexPicker IRB 365 robot, which is specifically designed for picking and packing tasks weighing up to 1.5 kg. This robot, known for its exceptional speed, is widely utilized in various applications such as bottle handling, parcel sorting, and shelf-ready packaging.

For instance, in March 2022, FANUC introduced the CRX-5iA, CRX-20iA/L, and CRX-25iA collaborative robots. These robots are capable of handling payloads ranging from 4 to 35 kg, leading to an increased adoption of warehouse robotics in various industrial sectors.

For instance, in July 2021, Omron Automation unveiled an impressive mobile robot boasting a remarkable payload capacity of 1500 kg. With its exceptional capability to handle bulky objects, the HD-1500 mobile robot offers producers a wider range of options for autonomous material delivery.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the warehouse robotics market analysis from 2023 to 2032 to identify the prevailing warehouse robotics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the warehouse robotics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global warehouse robotics market trends, key players, market segments, application areas, and market growth strategies.

Warehouse Robotics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 31.3 billion |

| Growth Rate | CAGR of 18.2% |

| Forecast period | 2023 - 2032 |

| Report Pages | 290 |

| By Operation |

|

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Honeywell International Inc., Delta Electronics, Inc., Kawasaki Heavy Industries, Ltd., Omron Corporation, Fanuc, KUKA AG, KION Group, BlueBotics, ABB Ltd., HIRATA Corporation |

Analyst Review

Warehouse management is critical to any logistics system and is an essential part of supply chain management. Robotics is a technology that designs, constructs, develops, and operates robots & its automation. Integration of warehouse and robotics technology has helped ensure that there is accuracy and automation while increasing the warehouse storage space and operation efficiency.

The strategic move of takeover of Kiva robotics by Amazon.com, Inc. has been a game changer for warehouse robotics. The move of Amazon.com to stop selling warehouse robots to other customers except itself has forced customers to start their own ventures, which brought players such as Fetch Robotics, Locus Robotics, and others in the industry.

The key factor in the growth of warehouse robotics is the increased demand for automation due to prevailing competition in e-commerce. Success in e-commerce is dependent on those who deliver the right quality in the right place at the right time and can meet the expectations of their customers. The rise of e-commerce and faster delivery times pressure the supply chain and logistics companies to get orders out the door as the earliest.

Warehouse robotics has reduced the time and effort required to scan and update stock inventory, pack parcels, arrange items on shelves, and complete other related tasks in a short span of time. The increasing collaboration of warehouse robotics with e-commerce drives the growth of the global warehouse robotics market.

The global warehouse robotics market was valued at $ 31343.7 million by 2032, registering a CAGR of 18.2% from 2024 to 2032.

The top companies analyzed for warehouse robotics market report are KION Group, Honeywell International Inc., KUKA Industries GmbH & Co. K, BlueBotics, Omron Corporation, ABB Ltd., FANUC, Kawasaki Heavy Industries, Ltd., Hirata Corporation, and Delta Electronics, Inc.

The forecast period in the warehouse robotics market report is 2024 to 2032.

The company profile has been selected on the basis of revenue, product offerings, and market penetration.?

The automotive segment holds the maximum market share of the warehouse robotics market

The articulated robotic arm segment is the most influential segment in the Pneumatic tools market.

The market value of the Warehouse robotics market in 2023 was $ 7069.1 million

The base year calculated in the warehouse robotics market report is 2023

Loading Table Of Content...

Loading Research Methodology...