Table Of Contents

- A Thriving Sector that Encourages Expansion

- Strategies Implemented by Semiconductor Manufacturers to Harness the Greenfield Potential From 2021-2023

- Understanding Supply Chain Security, Sustainability, and Subsidies in Developing Economies

- Subsidies and Incentives for Greenfield Semiconductor Ventures

- The Impact of Subsidies

- Fostering a Collaborative Ecosystem

- Winding up

Onkar Sumant

Koyel Ghosh

Exploring the Greenfield Potential in the Semiconductors Industry

A Thriving Sector that Encourages Expansion

The semiconductor industry holds promise for new opportunities, known as greenfield potential. Exploring this potential involves discovering untapped markets or technologies within the sector. By identifying these greenfield opportunities, companies are expected to innovate and expand their operations, leading to economic growth and technological advancement. This exploration is important, when it comes to staying competitive and meeting the evolving demands of industries like electronics, telecommunications, and renewable energy.

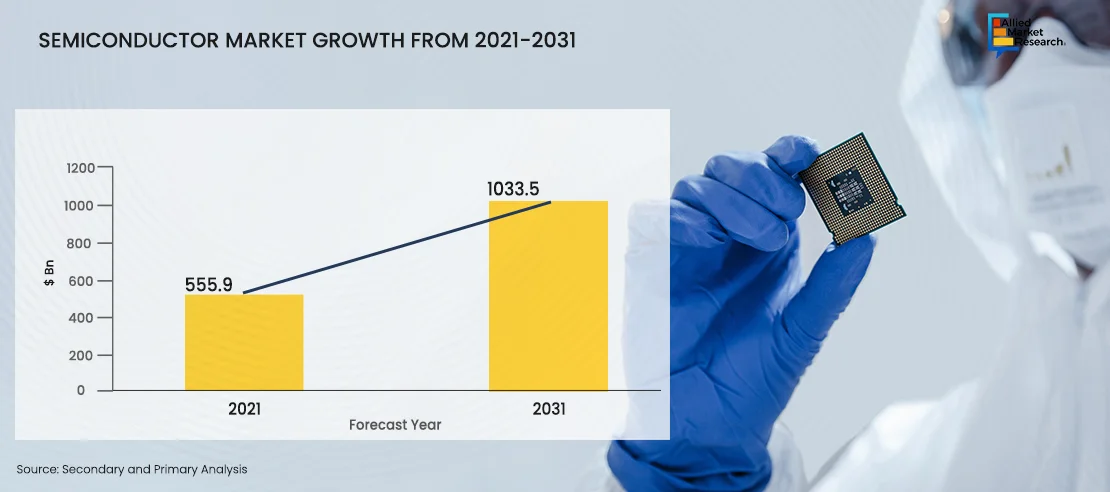

The Semiconductor Industry Will Witness an Impressive Growth of over 85.9% During 2021-2031

| Semiconductor industry | 2021 | 2031 | Growth (2021-2031) % |

| $ Bn | 555.9 | 1,033.5 | 85.9% |

Source: Secondary and Primary Analysis

To capture opportunities in the semiconductor sector, companies need tailored strategies for each market. Understanding market trends, rivals, and rules helps in offering suitable products and entering markets effectively. Collaborating with local partners such as governments and universities provides valuable resources and knowledge. This collaboration assists in overcoming regulatory challenges and building a strong foothold in the market. Investment in R&D is crucial for innovation and maintaining a competitive edge. Tailored solutions addressing regional needs can be developed through focused R&D initiatives. Investing in local manufacturing enhances efficiency, mitigates value chain risks, and bolsters market competitiveness.

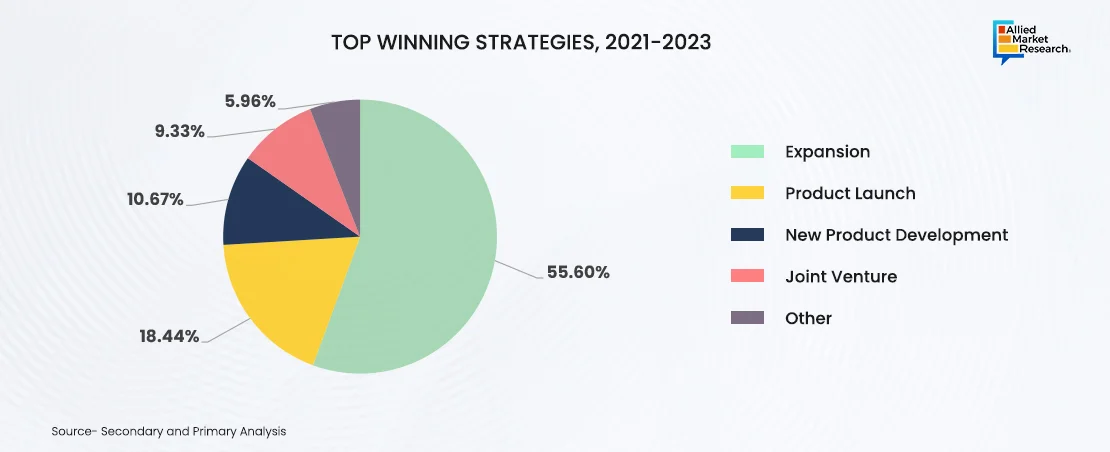

Strategies Implemented by Semiconductor Manufacturers to Harness the Greenfield Potential From 2021-2023

Semiconductor manufacturers are expected to witness substantial growth, driven by rising demand for consumer electronics and the proliferation of IoT technology. This expansion is further fueled by increased investments in semiconductor wafer fabrication equipment and materials. However, complexities in manufacturing pose challenges. Leveraging greenfield opportunities, companies are strategically launching new products, developing innovative solutions, forming joint ventures, and implementing various strategies to address market demands. By capitalizing on these initiatives, firms can streamline complexities and grab growth opportunities in the semiconductor sector amidst evolving industry dynamics.

At the same time, each segment of the value chain requires specialized capabilities, and no single region excels in all areas. Consequently, semiconductor production involves a distributed process across multiple countries. For instance, silicon ingots are cut into wafers in Japan and then transported to the United States for fabrication. Afterward, these semiconductors undergo further processing in Malaysia, which includes sorting, cutting, assembly, packaging, and testing. Ultimately, they are incorporated into finished products in Singapore. This interconnected global supply chain highlights the importance of international collaboration and coordination in the semiconductor industry.

Understanding Supply Chain Security, Sustainability, and Subsidies in Developing Economies

During the recent pandemic and amidst global economic instability, as well as geopolitical tensions like the conflict in Ukraine, corporate leaders rapidly reconsidered their risk assessments. According to a recent McKinsey survey of CEOs in advanced industries, many now consider geopolitical dynamics as their primary business challenge. Consequently, executives are intensifying their focus on monitoring supply chain vulnerabilities and devising strategies to mitigate disruptions. One prominent approach gaining traction involves the localization of semiconductor manufacturing to enhance resilience and prevent supply chain disruptions. Governments support these initiatives to guarantee a steady chip supply for local industries and critical security systems.

Industries are a major source of greenhouse gas emissions, which have a big impact on the environment. Carbon dioxide equivalent (CO2e) is an essential measure used to gauge the combined effect of different GHGs on global warming. A few years ago, overall industrial production activities contributed over 40% of the world's CO2e emissions stemming from fuel combustion, while commercial logistics accounted for more than 10% of this total. However, according to IEA, IPCC, Climatewatch, and BCG, overall CO2e emissions were reduced by 5% to 10% due to the impact of COVID-19. But post-pandemic, manufacturing operations resumed, and the semiconductor industry in emerging markets is likely to witness an increase in the number of new semiconductor companies in the coming years. These findings showcase the adverse impact of industrial and logistical processes on the environment, emphasizing the urgent need for sustainable practices and emissions reduction strategies within these sectors.

In the semiconductor industry, emissions originate from various sources, with fabs being a primary contributor due to the utilization of process gases with high global warming potential (GWP) during critical activities such as wafer etching and chamber cleaning. Additionally, emissions stem from high-GWP heat-transfer fluids, creating challenges when utilized in chillers and possibly leaking into the atmosphere. According to Mckinsey, such emissions from semiconductor fabs account for 35% of the total emissions in the semiconductor industry. Moreover, emissions arise from purchased electricity, steam, heating, and cooling equipment, with production tools and utilities being the primary contributors, holding 45% of overall emissions, as per the same source. Furthermore, the semiconductor industry deals with indirect emissions throughout its supply chain. Upstream emissions come from suppliers, while downstream emissions result from the use of products containing semiconductors, making up the remaining 20% of emissions. Solving these emission issues demands a holistic approach, focusing on innovation, collaboration, and a steadfast commitment to sustainable practices throughout the semiconductor ecosystem.

Subsidies and Incentives for Greenfield Semiconductor Ventures

Subsidies have evolved to be more comprehensive than in past years, frequently integrating innovative incentives. For example, in the U.S., traditional state and local subsidy programs, such as property or sales tax exemptions, have been augmented by policy adjustments, extending the scope of potential advantages. Recent governmental initiatives have focused on providing the relocation of high-tech manufacturing operations back to domestic shores. In addition, many developing countries are providing enticing subsidy packages to attract semiconductor companies.

- China: China offers various financial incentives, including tax breaks, land subsidies, and cheap loans, to attract chipmakers. The "Made in China 2025" initiative prioritizes domestic chip production.

- India: The Indian government launched the "Semiconductor Fab Scheme" that provides financial aid and land subsidies for setting up fabs in India. Additionally, tax breaks and import duty exemptions are offered.

- Vietnam: Vietnam offers competitive corporate income tax rates, land-use incentives, and streamlined permitting processes to attract chip manufacturers.

- Malaysia: Malaysia, with its extensive experience in semiconductor manufacturing, offers attractive tax breaks, infrastructure support, and a skilled workforce.

The Impact of Subsidies

Subsidies greatly decrease initial investment expenses for companies planning greenfield projects, making them more financially feasible. This leads to increased investment in developing regions, fostering the growth of a domestic semiconductor ecosystem and attracting technology transfer. However, concerns exist regarding potential subsidy wars between countries, causing market distortions and unsustainable practices.

Fostering a Collaborative Ecosystem

Successfully harnessing greenfield potential requires a collaborative effort between governments, private companies, and educational institutions. Here are some key strategies:

Developing a Skilled Workforce: Educational programs need to be tailored to meet the specific needs of the semiconductor industry, creating a pipeline of qualified engineers and technicians.

Building a Supportive Infrastructure: Reliable access to power, water, and high-speed communication infrastructure is essential for successful fab operations.

Protecting Intellectual Property: Robust IP protection frameworks should be established to provide a secure environment for companies willing to invest in new locations.

Creating a Sustainable Industry: Green technologies and energy-efficient practices should be integrated into the design and operation of new fabs.

Winding up

The rise of greenfield opportunities within the semiconductor sector offers a distinct opportunity to tackle present obstacles and construct a supply chain that is both resilient and sustainable. By considering current challenges and nurturing collaborative networks, these endeavors have the potential to set a fresh direction for the worldwide semiconductor industry. This will guarantee ongoing technological progress and economic prosperity in the future.

As the semiconductor industry continues to evolve, exploring untapped opportunities in developing countries drives innovation and growth in the sector. With advancements in technology and changing market dynamics, exploring new horizons requires adaptability. Embracing emerging opportunities, such as government subsidies and incentives, has the prospects to provide the required support for ventures seeking to establish or expand semiconductor manufacturing operations.

AMR offers valuable support in exploring greenfield potential. Through our comprehensive market research and tailored insights, we equip you with the knowledge needed to identify emerging opportunities. By utilizing AMR's expertise, you can make informed decisions, mitigate risks, and drive innovation within your business. Our partnership enables you to stay ahead of the competition, understand market shifts, and confidently pursue strategic initiatives that drive your business toward sustainable growth. For more insights in the semiconductor industry, feel free to contact us!