Respiratory Care Devices Market Research, 2033

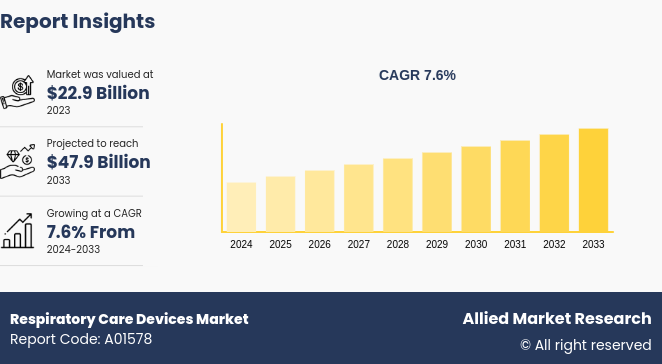

The global respiratory care devices market size was valued at $22.9 billion in 2023, and is projected to reach $47.9 billion by 2033, growing at a CAGR of 7.6% from 2024 to 2033. Driving factors for the respiratory care devices market growth nclude the increasing prevalence of chronic respiratory diseases such as COPD and asthma, rising geriatric population prone to respiratory conditions, advancements in respiratory care technology, and the growing demand for home healthcare solutions

Market Introduction and Definition

Respiratory care devices encompass a diverse range of medical equipment designed to aid in the management and treatment of respiratory conditions and disorders. These devices serve various functions, including oxygen therapy, ventilation support, airway clearance, and monitoring of respiratory parameters. From simple devices such as oxygen masks and nasal cannulas to advanced ventilators and continuous positive airway pressure (CPAP) machines, respiratory care devices play a crucial role in delivering respiratory support to patients in clinical settings, home care environments, and during emergencies. By assisting in breathing, maintaining oxygen levels, and improving lung function, these devices help alleviate symptoms, enhance patient comfort, and optimize respiratory health outcomes.

Key Takeaways

- The respiratory care devices market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major respiratory care devices industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The increasing prevalence of respiratory diseases globally, such as chronic obstructive pulmonary disease (COPD) , asthma, and sleep apnea, serves as a primary driver for the respiratory care devices market size. As respiratory diseases continue to rise due to factors such as air pollution, smoking, aging populations, and lifestyle changes, there is a growing need for effective treatment and management options, leading to heightened demand for respiratory care devices.

In addition, advancements in technology play a crucial role in driving innovation during the respiratory care devices market forecast period. Continuous technological developments have led to the creation of more efficient, user-friendly, and portable devices that offer improved therapeutic outcomes and patient comfort. For instance, the integration of digital health technologies, such as telemedicine platforms and wearable sensors, allows for remote monitoring and personalized treatment approaches, enhancing patient care and compliance.

Another driving factor for the respiratory care devices market is the growing awareness of respiratory health and the importance of preventive care. Healthcare initiatives, educational campaigns, and public health efforts aimed at raising awareness about respiratory diseases, their risk factors, and available treatment options contribute to early diagnosis and intervention, thereby driving the demand for respiratory care devices.

However, the stringent regulatory requirements for product approval, which increase the time and cost of bringing new devices, is expected to limit the market growth. In addition, limited healthcare infrastructure and resources in certain regions, coupled with budget constraints in developing countries, is expected to hamper the adoption of advanced respiratory care technologies. Moreover, advancements in technology such as portable and home-based respiratory care devices provide respiratory care devices market opportunity.

Prevalence Statistics of Respiratory Devices in Global Respiratory Care Devices Market

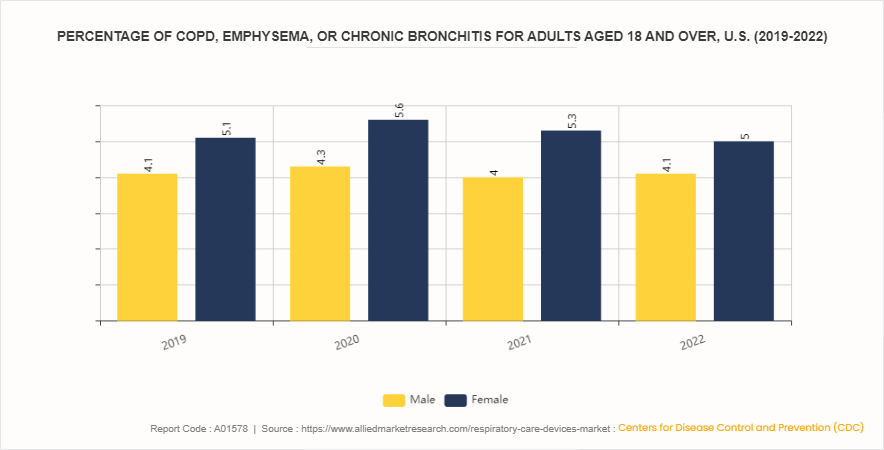

According to Centers for Disease Control and Prevention (CDC) , the prevalence of COPD, emphysema, or chronic bronchitis among adults aged 18 and over in the U.S. fluctuated marginally from 2019 to 2022. In 2019, 4.1% of men and 5.1% of women were affected by COPD, emphysema, or chronic bronchitis. These figures slightly increased in 2020, with 4.3% of men and 5.6% of women diagnosed with these respiratory conditions. The year 2021 saw a slight decline for men to 4%, while the percentage for women was 5.3%. In 2022, the prevalence returned to 4.1% for men and decreased to 5% for women. Thus, the demand for respiratory care devices remains significant, as these conditions often require ongoing management and treatment. Factors such as aging populations, rise in air pollution, and lifestyle changes contribute to the growing need for respiratory care solutions. As the prevalence of respiratory conditions rises, the market for these devices is projected to expand steadily.

Market Segmentation

The respiratory care devices market analysis is segmented into product, end user, and region. On the basis of product, the market is categorized into therapeutic devices, monitoring devices, diagnostic devices, and consumables and accessories. The therapeutic devices segment is further categorized into positive airway pressure (PAP) devices, mask, ventilators nebulizers, humidifiers, oxygen concentrators, inhalers, reusable resuscitators, nitric oxide delivery units, capnographs, gas analyzers, and oxygen hoods. The monitoring devices segment is further classified into pulse oximeters. The pulse oximeters segment is further classified into pediatric pulse oximeters, wrist-worn pulse oximeters, hand-held pulse oximeters, fingertip pulse oximeters, and table-top/bedside pulse oximeters. The diagnostic devices segment is further divided into spirometers, polysomnography (PSG) devices, and peak flow meters. The consumables and accessories segment further classified into disposable masks, disposable resuscitators, tracheostomy tubes, nasal cannulas, and others. On the basis of end user, the market is segregated into hospitals and home care. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA .

Regional/Country Market Outlook

In developed regions such as North America has significant respiratory care devices market share owing to well-established healthcare systems, high patient awareness, and rise in elderly population susceptible to respiratory ailments. In addition, investments in R&D, leading to technological advancements and the adoption of innovative respiratory care solutions, further drive the market growth.

In July 2022, the Journal of Asthma and Allergy reported that asthma is one of Germany's most common chronic diseases, affecting almost 4-5% of all adults and 10% of children each year.

In emerging markets such as Asia-Pacific and LAMEA, the respiratory care devices market is experiencing rapid growth owing to improving healthcare infrastructure and rise in awareness of respiratory health. Countries such as China and India, with large populations and growing healthcare expenditures, represent significant opportunities for market expansion.

Competitive Landscape

The major players operating in the respiratory care devices market include Masimo, Fisher & Paykel Healthcare Limited, Koninklijke Philips N.V., Drägerwerk AG & Co. KGaA, Becton, Dickinson and Company, Medtronic, ResMed, Hamilton Medical, Chart Industries, and Invacare Corporation. Other players in the respiratory care devices market include GE Healthcare, Rotech Healthcare Inc., 3B Medical Inc., and others.

Recent Key Strategies and Developments in Respiratory Care Devices Industry

- In June 2023, Royal Philips, a global leader in health technology, and Masimo, a global medical technology company announced FDA clearance for SedLine Brain Function Monitoring, Regional Oximetry (O3), and CO measurements in Philips Patient Monitors IntelliVue MX750 and MX850. The latest extension of Masimo and Philips’ ongoing collaboration is expected to help clinicians make quick and informed decisions without the need for additional monitoring equipment.

Key Sources Referred

- National Center for Biotechnology and Information (NCBI)

- Centers for Medicare & Medicaid Services (CMS)

- National Health Service (NHS)

- Australian Government Department of Health and Aged Care

- Government of Canada's Health and Wellness

- Ministry of Health and Family Welfare (MoHFW)

- National Health Mission (NHM)

- Ayushman Bharat - Health and Wellness Centres (AB-HWCs)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

- World Health Organization (WHO)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the respiratory care devices market analysis from 2023 to 2033 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the oncology/cancer drugs market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the Global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global respiratory care devices market trends, key players, market segments, application areas, and market growth strategies.

Respiratory Care Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 47.9 Billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 350 |

| By Product |

|

| By End User |

|

| By Region |

|

| Key Market Players | Koninklijke Philips N.V., ResMed, Becton, Dickinson and Company, Chart Industries, Fisher & Paykel Healthcare Limited., Masimo, Invacare Corporation, Drägerwerk AG & Co. KGaA, Medtronic, Hamilton Medical |

Analyst Review

The global respiratory care devices market is expected to witness significant growth in the near future, owing to the high prevalence rate of respiratory diseases across all age groups, especially the geriatric population. Presently, the market experiences steady growth, owing to the sluggish rate of product innovation. North America is expected to account for the major share in the market, on account of the high prevalence rate of respiratory diseases in this region. Asia-Pacific and LAMEA are expected to offer lucrative opportunities to market players in the near future, as the markets in the developed economies are nearing saturation due to large number of respiratory device providers. In addition, the market has experienced a paradigm shift in the recent years, because major players have focused on distributing portable products in the emerging markets, including China, India, and Brazil. LAMEA has witnessed rapid adoption of portable respiratory care devices, owing to improving reimbursement scenario for home oxygen and ventilation devices.

The growth of the global respiratory care devices market is attributed to factors such as increase in incidence of various respiratory diseases among the population, rapid urbanization, increase in pollution level, growth in geriatric population, and rise in tobacco consumption. However, large pool of undiagnosed population and risks associated with certain therapeutic devices for neonates hamper the market growth.

In the present scenario, the therapeutic devices segment accounted for the majority of the revenue share of the global market, and is expected to grow at a remarkable rate during the forecast period. This is attributed to the increased burden of chronic respiratory diseases such as chronic obstructive pulmonary disease (COPD) and asthma, worldwide. In addition, automatic positive airway pressure (APAP) devices are preferred to continuous positive airway pressure (CPAP) devices, as the former are technologically advanced and quieter than the latter. Furthermore, the bilevel positive airway pressure (BPAP) devices segment is in the nascent phase of development as compared to the existing CPAP and APAP devices. Thus, technological advancements would lead to the launch of innovative products; thereby, propelling the growth of the global market.

The total market value of respiratory care devices market is $22.9 billion in 2023.

The market value of respiratory care devices market in 2033 is $47.9 billion.

North America has largest market share in 2023, owing to rise in prevalence of respiratory diseases, advanced healthcare infrastructure, and significant investments in healthcare technology.

The upcoming trends in the global respiratory care devices market include the increased adoption of home-based respiratory care due to the rise in chronic respiratory diseases, advancements in portable and smart respiratory devices, the integration of AI and telemedicine for remote monitoring and management, and growing demand in emerging markets

The base year is 2023 in respiratory care devices market .

The forecast period for respiratory care devices market is 2024 to 2033.

The growth of the respiratory care devices market is fueled by increasing prevalence of respiratory diseases worldwide, technological advancements in device capabilities, rising geriatric population prone to respiratory ailments, and expanding healthcare infrastructure supporting better access to advanced respiratory treatments and devices.

Respiratory care devices are medical tools used to assist in the treatment and management of respiratory disorders.

Loading Table Of Content...