Retail and Warehouse Logistics Market Research, 2034

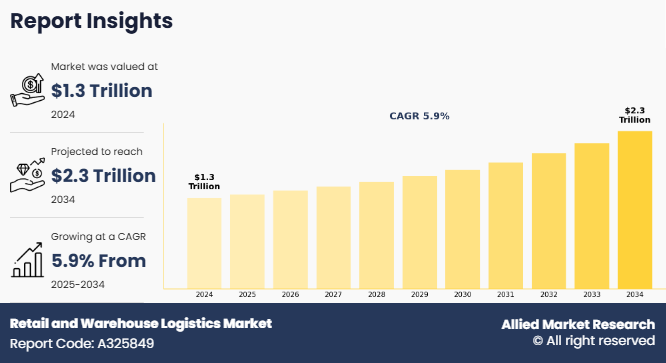

The global retail and warehouse logistics market size was valued at $1.3 trillion in 2024, and is projected to reach $2.3 trillion by 2034, growing at a CAGR of 5.9% from 2025 to 2034.

Report Key Highlighters

- The retail and warehouse logistics market size study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2025-2034.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The retail and warehouse logistics market share is highly fragmented, into several players including DHL Group, XPO Logistics, Kuehne + Nagel, DB Schenker, FedEx, UPS Supply Chain Solutions, C.H. Robinson Worldwide, Inc., Geodis, CEVA Logistics, and DSV. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Retail and warehousing logistics includes infrastructure, services, and systems that support the storage, handling, and distribution of retail goods across various channels. It includes physical warehousing facilities, transportation fleets, inventory control technologies, and software platforms used for order tracking and supply chain optimization. Retail and logistics serves a wide range of industries such as FMCG, electronics, fashion, healthcare, and automotive by enabling efficient movement and storage of products at larger scale. As retailers are shifting toward omnichannel strategies, the demand for real-time visibility, scalable warehouse space, and flexible logistics operations continues to grow.

The retail and warehouse logistics market growth is driven by growth in the E-commerce sector, increase in omnichannel retail logistics, and growing demand for FMCG products. However, factors such as lack of control of manufacturers on reverse logistics service, and poor infrastructure and higher logistics costs hinders the growth of the market to some extent. On the contrary, growing adoption of automation and artificial intelligence, and expansion of third-party logistics (3PL) and fourth-party logistics (4PL) services offers lucrative market growth opportunities in the retail and warehouse logistics industry.

In recent years, there has been a rapid expansion of the e-commerce sector, driven by rising internet penetration, increased smartphone usage, and changing consumer shopping behavior. This growth has significantly transformed the retail landscape, creating high demand for efficient and scalable logistics and warehousing solutions. Moreover, modern consumers now expect faster delivery, real-time tracking, and flexible return policies, pushing e-commerce businesses to strengthen their supply chain and invest in advanced logistics infrastructure. In addition, the growth in online shopping during festival seasons and other events has led to the need for robust warehousing systems capable of handling large order volumes and quick turnaround times.

Moreover, the increasing adoption of technologies such as AI-driven inventory management, automated picking systems, and data analytics is enabling e-commerce companies to streamline operations and improve delivery performance. Logistics providers are also expanding their last-mile delivery capabilities to meet the growing demand in both urban and rural areas. For instance, in October 2023, Amazon India announced the opening of five new fulfillment centers ahead of the festive season, aiming to increase storage capacity and shorten delivery timelines. Such strategic expansions and technological advancements are expected to drive the growth retail and warehouse logistics market forecast during the forecast period.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On June 2025, GEODIS announced the launch of two specialized, cloud-native software modules aimed at streamlining the returns management process for retail and e-commerce clients in North and South America. These modules are designed to automate label generation and customer communication during the returns initiation process and digitize in-warehouse disposition workflows, enabling warehouse staff to more efficiently sort, inspect, restock, recycle, or discard returned items. These tools are integrated seamlessly with major e-commerce platforms like Shopify, Magento, and Salesforce Commerce Cloud, thus offering greater real-time visibility into returns inventory.

- On July 2025, UPS Supply Chain Solutions (SCS) announced a major expansion of its cold chain logistics network across Europe. The new cold chain facility is majorly developed for the pharmaceutical and healthcare logistics sector. As part of the expansion, the company it added over 500,000 square feet of GDP-compliant (Good Distribution Practice) warehouse space across key European markets, including Germany, the Netherlands, and Belgium. These state-of-the-art facilities are equipped with temperature-controlled zones, real-time thermal monitoring, and validated handling protocols for products that require strict storage conditions, such as vaccines, biologics, specialty drugs, and medical devices. The infrastructure supports ambient, cold 2°C–8°C, and frozen -20°C and below storage environments, making it suitable for a broad range of critical therapies and retail healthcare products.

Segmental Analysis

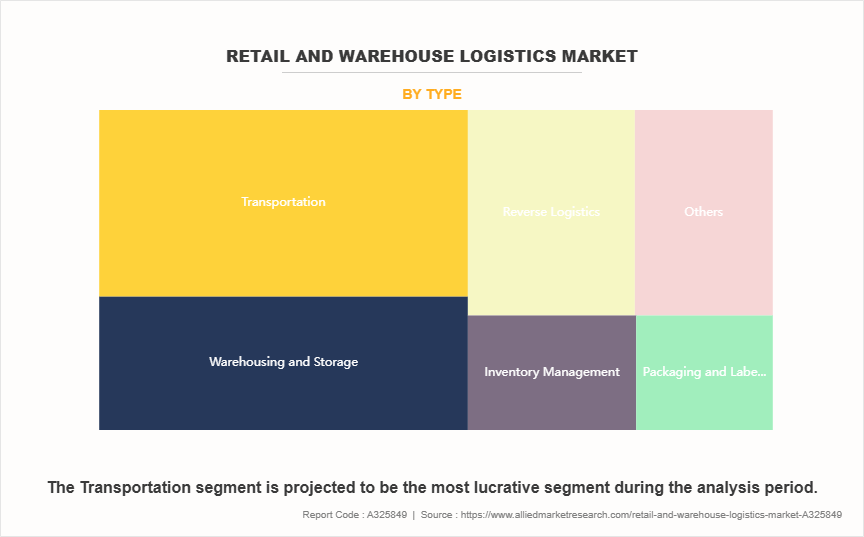

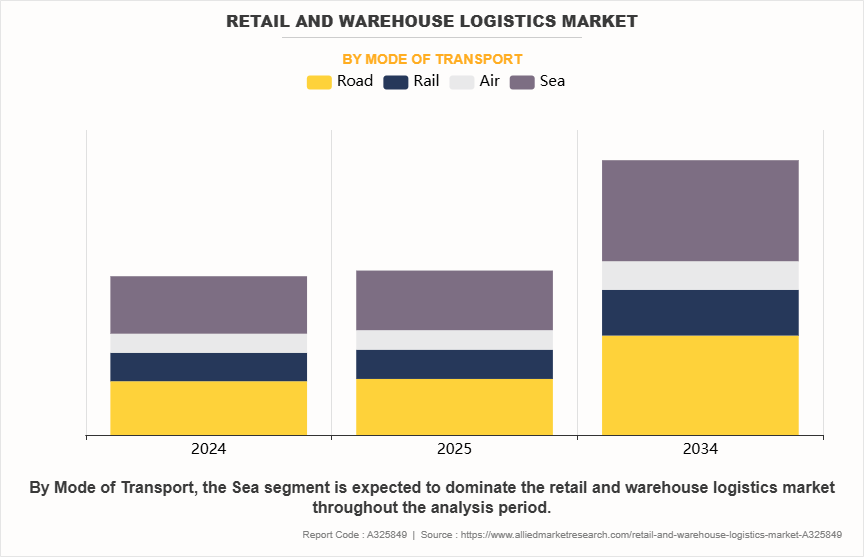

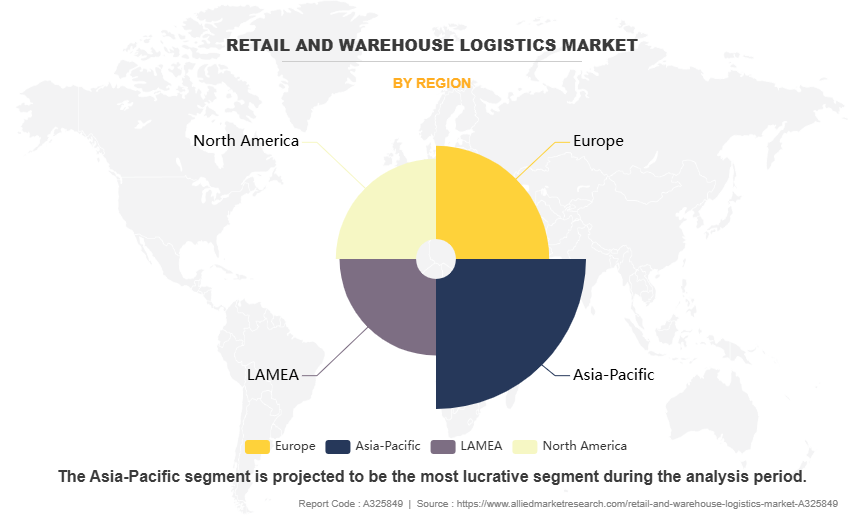

The global retail and warehouse logistics market demand is segregated into type, mode of transport, end user and region. Based on type the global market is segregated into transportation, warehousing and storage, inventory management, packaging and labelling, reverser logistics and others. On the basis of mode of transport the market is segregated into road, rail, air and sea. Based on end user the global market is studied across healthcare, manufacturing, aerospace, automotive, FMCG, electronics, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Type

Based on type the global retail and warehouse logistics industry is segregated into transportation, warehousing and storage, inventory management, packaging and labelling, reverse logistics, and others. The transportation segmented dominated the global market share in 2024, owing to growing surge in e-commerce and omnichannel retailing. Modern, consumers expect faster and more flexible delivery options, including same-day and next-day shipping. Hence, retailers are expanding their geographic reach, and integrating more robust and efficient transport networks. Additionally, the rise in cross-border trade and supply chain diversification is increasing the need for reliable transportation solutions.

Mode of Transport

Based on mode of transportation, the market is categorized into road, rail, air and sea. The sea segment dominated the global market share in 2024, owing to sea transportation is used for moving large volumes of goods such as apparel, electronics, and home goods from countries like China, Vietnam, and Bangladesh to global markets. For instance, large retail chains import container loads of merchandise by sea to stock their regional distribution centers in advance of major sales seasons like Black Friday or Diwali.

End User

On the basis of end user, the global market is segmented into healthcare, manufacturing, aerospace, automotive, FMCG, electronics and others. The FMCG segment dominated the global market share in 2024, owing to FMCG products are transported in high volume and thus require fast, frequent, and wide-reaching distribution network. Products in this segments are typically stored in regional distribution centers and then sent to retail outlets or directly to consumers. Retail and warehousing logistics in this segment involves managing expiration dates, temperature-controlled storage for perishables, and quick response systems to meet daily retail demand.

By Region

Region wise, the global market is analyzed into North America, Europe, Asia-Pacific and LAMEA. The Asia-Pacific region dominated the global market share in 2024, owing to countries in the region are witnessing strong demand for retail and warehousing logistics due to high population density, growing digital adoption, and a surge in online retail activity. Moreover, Asia-Pacific is home to some of the world’s largest E-commerce markets, which has led to large-scale investments in smart warehouses, automation technologies, and fulfillment centres, thus driving the retail and warehouse market demand.

Increase In Omnichannel Retail Logistics

In recent years, there has been a significant rise in omnichannel retail logistics operation, driven by the increasing integration of online and offline retail platforms to meet the demand for growing consumer expectations. This shift is encouraging retailers to offer seamless shopping experiences across multiple channels such as in-store, mobile apps, and e-commerce websites. Moreover, the demand for faster delivery, real-time inventory visibility, and flexible return options is pushing companies to invest in faster and responsive logistics networks. In addition, retailers are increasingly relying on regional warehouses and fulfillment centers to optimize last-mile delivery and reduce shipping times.

Moreover, advancements in warehouse management systems, automation technologies, and data analytics are further supporting the growth of omnichannel logistics. Retailers are also collaboratively working with third-party logistics providers to improve scalability and efficiency. For instance, in January 2024, Walmart expanded its automated fulfillment centers across North America to support both in-store and online operations. The company announced that these facilities will enhance its capacity to handle high-volume orders and improve delivery speed. Such developments are expected to drive the growth of the retail and warehousing logistics market during the forecast period.

Growing Adoption of Automation and Artificial Intelligence

The adoption of automation and artificial intelligence has gained significant momentum across the retail and warehousing logistics industry, as companies are seeking ways to improve speed, accuracy, and efficiency in their operations. Automation technologies such as robotic picking systems, automated guided vehicles, and conveyor-based sorting are being increasingly used to streamline warehouse functions and reduce dependency on manual labor. Moreover, these systems allow for faster order processing, reduced error rates, and can operate around the clock, which is becoming critical in meeting the demands of rapid e-commerce growth.

In addition, the use of AI is allowing companies to optimize their logistics processes by enabling real-time decision-making, demand forecasting, and smarter inventory management. AI-powered software can analyze large sets of data to predict consumer buying trends, recommend restocking schedules, and optimize delivery routes to reduce fuel and time costs.

Moreover, the growing focus on digital transformation and the need to manage rising operational costs is encouraging logistics providers to invest in AI and automation. For instance, in August 2024, Flipkart announced the deployment of AI-enabled robotic arms at its Bengaluru fulfillment center to speed up the sorting and packing process. Such developments are expected to drive the growth of the retail and warehousing logistics market during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the retail and warehouse logistics market analysis from 2024 to 2034 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global retail and warehouse logistics market trends, key players, market segments, application areas, and market growth strategies.

Retail and Warehouse Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 2.3 trillion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2024 - 2034 |

| Report Pages | 280 |

| By Type |

|

| By Mode of Transport |

|

| By End User |

|

| By Region |

|

| Key Market Players | DSV, UPS Supply Chain Solutions Inc., GEODIS, FedEx, DHL GROUP, DB Schenker, C.H. Robinson Worldwide, Inc., XPO Logistics Inc., KUEHNE + NAGEL, CEVA Logistics |

Integration of automation, AI-driven inventory management, robotics, and sustainable supply chain solutions are the upcoming trends in the retail and warehouse logistics.

The FMCG segment is the leading segment of the retail and warehouse logistics market.

Asia-Pacific is the largest regional market for retail and warehouse logistics market.

The retail and warehouse logistics market was valued at $1,301.4 billion in 2024 and is estimated to reach $2,252.5 billion by 2034, exhibiting a CAGR of 5.9% from 2025 to 2034.

DHL Group, XPO Logistics, Kuehne + Nagel, DB Schenker, FedEx, UPS Supply Chain Solutions, C.H. Robinson Worldwide, Inc. are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...