The global Retail cash management market size was valued at $3.2 billion in 2021 and is projected to reach $12.1 billion by 2031, growing at a CAGR of 14.5% from 2022 to 2031.

Retail cash management can automate the entire cash handling process, from the point of sale to bank deposit, this is enabling businesses to switch from manual cash handling to automated cash management solutions owing to its time saving and operational efficiency improvement capabilities.

The unavailability of a proper in-store workforce during the period of the COVID-19 pandemic aided in propelling the growth of the global retail cash management market. Moreover, the social distancing and sanitization policies implemented across various parts of the world further supported the growth of the retail cash management solutions market. However, implementation and maintenance costs of cash management solutions can hamper the retail cash management market outlook. On the contrary, advancements in technologies like big data and machine learning are expected to offer remunerative opportunities for the expansion of the retail cash management industry during the forecast period.

The report focuses on growth prospects, restraints, and analysis of the global retail cash management market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global retail cash management market share.

The retail cash management market is segmented into Component, Application, Deployment Mode and Enterprise Size.

Segment review

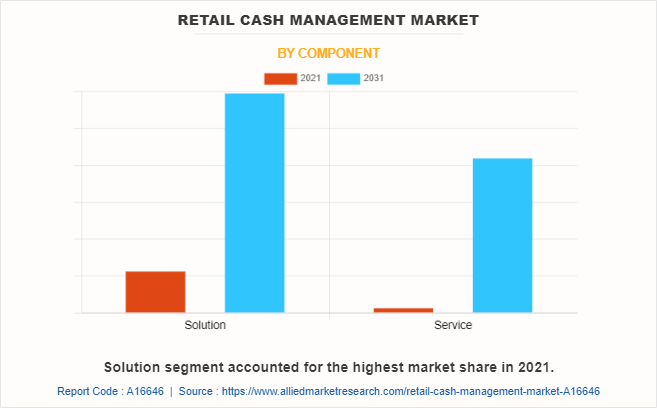

The retail cash management market is segmented on the basis of component, application, deployment mode, enterprise size, and region. On the basis of component, the industry is divided into solution and service. Depending on the application, the market is classified into balance & transaction reporting, cash flow forecasting, corporate liquidity management, payables & receivables, and others. On the basis of deployment mode, the industry is segmented into on-premise and cloud. Depending on enterprise size the industry is bifurcated into large enterprises and small and medium sized enterprises. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on component, the solution segment dominated the retail cash management market share in 2021, and is expected to continue this trend during the forecast period owing to the growing demand for cash management solutions in smaller retail stores post the period of the pandemic. However, the service segment is expected to witness the highest growth in the upcoming years, owing to large-scale and cash cycle automation applications of retail cash management solutions, which is expected to aid the retail cash management industry.

Region wise, the retail cash management market was dominated by North America in 2020, and is expected to retain its position during the forecast period, owing to its high concentration of retail cash management solutions and services vendors such as Oracle Corporation and Brink's Incorporated which is expected to drive the market for retail cash management technology within the region during the forecast period. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the growing consumer and retail industry, which is expected to fuel the growth of retail cash management market opportunities in the region in the coming few years.

The global retail cash management market is dominated by key players such as ALVARA Digital Solutions GmbH, Aurionpro Solutions Limited, Giesecke+Devrient GmbH, Glory Global Solutions, NTT DATA Corporation, Nucleus Software Exports Ltd., Oracle Corporation, Sopra Banking Software SA, The Sage Group plc, and Tietoevry. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

COVID-19 Impact Analysis

The impact of the COVID-19 pandemic on the retail sector has been significant, as many brick and mortar stores were being forced to shut down their regular operations during the period. Moreover, the unavailability of in-store employees during the period of lockdowns caused many retail sector businesses to invest in automated cash management solutions, which aided in the retail cash management market growth.

The COVID-19 pandemic is expected to positively impact the overall economy of technology related sectors globally. In addition, retail cash management is the latest buzzword that has been capturing the imagination of the tech industry and holds significant potential in creating tremendous growth opportunities for marketers by allowing retail sector businesses to efficiently manage their cash flow, aiding the retail cash management market analysis in the near future.

Top Impacting Factors

Rise in demand for efficient cash management

In the past few years, there has been a rise in demand for more efficient cash management solutions owing to the fact that many companies are facing challenges in managing their cash resources during the pandemic, as customers and suppliers were facing unprecedented disruptions, which in turn highlights the importance of effective process management through the entire cash-conversion cycle. This factor is expected to drive the growth of the retail cash management industry. Furthermore, optimizing the cash outflow will also play a vital role in managing the cash flow more efficiently. Moreover, one of the key outflows of cash is towards suppliers and supply chain entities. Such instances allow the organization on taking full advantage of the credit period and delaying the payment as far as possible within the credit terms will help organizations to balance the cash outflow and inflow. Such factors are expected to boost retail cash management market size growth.

Growing demand for automation and optimization of working capital among various retailers

Despite the growth of cashless payment methods, banknotes and coins remain the most used payment method in the world. Moreover, the largest number of cash transactions occur at points of sales. Retailers are required to accept, process, and store cash payments as well as the required amount for change. Keeping and managing cash, increases the need for working capital, and cash handling processes can require a higher degree of effort from human resources and employees. Such factors are supporting the growth of the retail cash management across the globe. In addition, order automation for the cash collection and exchange delivery and cash distribution within the organization is driving the growth of the market. Furthermore, cash flow visualization from cashier systems and electronic cashiers and instant deposits using automated deposit machines (ADM) among other similar solutions are being adopted by various retail businesses and organizations. These are some of the factors that are driving the market towards growth during the period of forecast.

KEY BENEFITS FOR STAKEHOLDERS

- The study provides an in-depth analysis of the global retail cash management market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global retail cash management trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market from 2021 to 2031 is provided to determine the retail cash management market opportunity.

Retail Cash Management Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 12.1 billion |

| Growth Rate | CAGR of 14.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 219 |

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | Tietoevry, ALVARA Digital Solutions GmbH, Oracle Corporation, Sopra Banking Software SA, Aurionpro Solutions Limited, Nucleus Software Exports Ltd., Giesecke+Devrient GmbH, The Sage Group PLC, Glory Global Solutions |

Analyst Review

Cash management systems in retail sector enterprises can assist businesses to increase the efficiency of their operations. Cash management systems that are integrated with POS and back-office allow staff to monitor cash flow from the cash drawer and store safely all the way to the bank. Moreover, features like counting by denominations is also an excellent technique to keep track of the coins and smaller notes required for delivering change, which aids with change ordering optimization. By automating labor-intensive operations, cash counting machines can minimize labor time, helping in saving costs and time.

Key providers of the retail cash management market such as Oracle Corporation, Sopra Banking Software SA, and The Sage Group plc account for a significant share of the market. With larger requirements from retail cash management, various companies are establishing partnerships to increase retail cash management capabilities. For instance, in June 2021, Wipro Limited, a leading global information technology, consulting and business process services company, and Finastra, the largest pure-play software vendor that serves the entire financial services industry, today announced a partnership to help corporate banks across Asia-Pacific accelerate their digital transformation. The companies will create a unique offering that combines Wipro’s comprehensive services catalog with Finastra’s front-to-back trade finance and cash-management solutions.

In addition, with the increase in demand for retail cash management, various companies are expanding their current product portfolio with increasing diversification among customers. For instance, in July 2021, Infosys Finacle, a subsidiary of Indian technology solutions provider Infosys announced the launch of Santander Global Connect. Santander Global Connect will be powered by Infosys’s Finacle Cash Management Suite which includes the Finacle Digital Engagement Hub, Finacle Online Banking, Finacle Payments, and Finacle Liquidity Management solutions.

Moreover, market players are expanding their business operations and customers by increasing their acquisitions. For instance, in April 2021, the American total cash management solutions vendor announced the acquisition of PAI, Inc., the largest privately-held provider of ATM services in the U.S. With this acquisition Brink is expected to widen its cash management offerings portfolio.

The Retail Cash Management Market is estimated to grow at a CAGR of 14.5% from 2022 to 2031.

The Retail Cash Management Market is projected to reach $12.1 billion by 2031.

The unavailability of a proper in-store workforce during the period of the COVID-19 pandemic aided in propelling the growth of the global retail cash management market. Moreover, the social distancing and sanitization policies implemented across various parts of the world further supported the growth of the retail cash management solutions market.

The global retail cash management market is dominated by key players such as ALVARA Digital Solutions GmbH, Aurionpro Solutions Limited, Giesecke+Devrient GmbH, Glory Global Solutions, NTT DATA Corporation, Nucleus Software Exports Ltd., Oracle Corporation, Sopra Banking Software SA, The Sage Group plc, and Tietoevry.

The key growth strategies of Retail Cash Management market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...