Retail Fuel Station Market Research, 2032

The global retail fuel station market was valued at $1.8 trillion in 2022, and is projected to reach $2.4 trillion by 2032, growing at a CAGR of 2.8% from 2023 to 2032.

A fuel station, also known as a petrol station, gas station, service station, or filling station, is a retail outlet that sells motor vehicle fuel to vehicle owners. Fuel stations provide various fuels including diesel, petrol, gasoline, kerosene, and ethanol. The main components of a fuel station include gas pumps, pipelines, metal barriers, and drainage systems.

Rise in upcoming trends such as electric vehicle charging infrastructure alternative fuels, enhanced customer experience, digital transformation & connectivity, partnerships & collaborations, adoption of autonomous vehicles & technologies, and focus on sustainability practices drive retail fuel stations industry. Furthermore, adoption of digital technologies for seamless customer interactions, efficient operations, and personalized services enhances the overall customer experience.

It includes mobile apps for payments, ordering, and loyalty rewards. Expansion of retail fuel stations is attributed to a convergence of factors such as influencing consumer habits and market demands. Surge in vehicle ownership propelled by rise in incomes and population growth, the necessity for fuel stations naturally escalates to meet this growth in demand.

The prevalent reliance on fossil fuels for internal combustion engines continues the need for retail fuel stations despite the rise awareness of environmental concerns. Moreover, fuel providers now offer diversified services such as convenience stores, vehicle maintenance, and emerging features such as electric vehicle charging stations.

This multifaceted landscape, change in consumer behaviors, technological advancements, and economic drivers, collectively propels the retail fuel stations market trends within the transportation and energy sectors. According to the Organization of Petroleum Exporting Countries (OPEC), in 2022, global natural gas production remained fairly stable at 4.09 trillion cubic meters.

U.S. is largest producer of natural gas representing nearly a quarter of global natural gas production. Its output has increased by more than 350 billion cubic meters owing to the increasing cost of coal, and advancements in extraction technology such as horizontal drilling and hydraulic fracturing. In addition, U.S. became the world’s largest exporter of liquefied natural gas (LNG) as the country increased shipments to Europe due to Russia-Ukraine war.

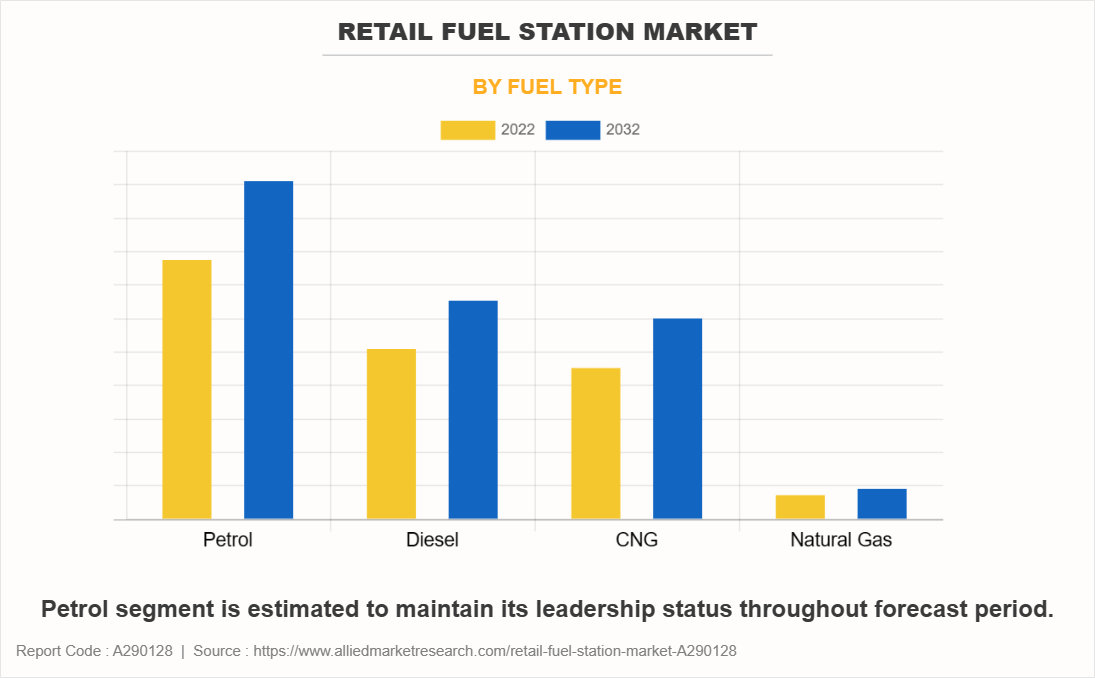

Petrol is one of the most widely used fuels globally for transportation due to its energy density, ease of use, and suitability for internal combustion engines. Its availability and usage vary across regions, with different fuel standards and regulations governing its composition and sale. Furthermore, rise in consumers preference for contactless payment methods due to their ease of use and perceived security drive the retail fuel stations market. Petrol, as a primary fuel source plays a pivotal role in driving the retail fuel station market. The high dependency on petrol for transportation fuels and industrial purposes positions it as a key determinant in the growth and dynamics of retail fuel stations market. The widespread use of petrol-powered vehicles and machinery across globe underscores the critical importance of petrol availability, pricing, and distribution networks established through retail fuel stations.

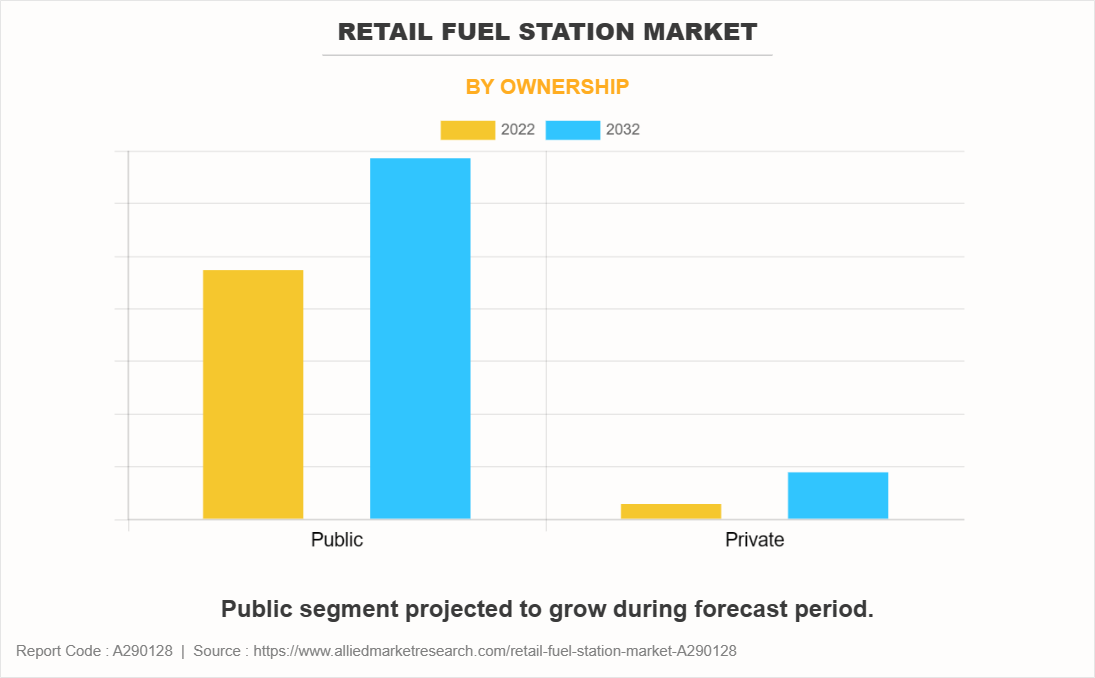

Publicly owned fuel stations, often managed by government entities or state-controlled organizations, play a significant role in driving the retail fuel station market through their influence on market dynamics, regulations, and infrastructure. Government often set benchmarks for industry standards in terms of fuel quality, pricing, and service, acting as a reference point for private stations. Their regulatory oversight drive industry-wide compliance, ensuring safety, environmental standards, and fair competition.

Additionally, public stations, due to their government backing, might invest in innovative technologies or alternative fuel sources. Furthermore, public stations strategically locate outlets to ensure broader geographic coverage, filling gaps that private entities may overlook. Overall, public ownership within the fuel station market sets benchmarks, ensures standards compliance, fosters innovation, and contributes to market stability, shaping the broader landscape for both public and private players.

The future of the retail fuel stations market is poised to undergo substantial transformations driven by several prominent trends. The rise of electric vehicles (EVs) will significantly shape the retail fuel station industry landscape. Fuel stations are expected to evolve into comprehensive energy hubs, offering not only traditional fuels but also an array of charging solutions for electric vehicles, such as fast-charging stations and battery swapping facilities. This shift necessitates a reconstruction of the retail fuel station infrastructure and business models to cater to the growing EV market.

Moreover, technological advancements will further revolutionize the retail fuel station market owing to the enhanced digital interfaces, AI-driven analytics, and IoT integration will optimize operations, enabling predictive maintenance, inventory management, and personalized customer experiences. Furthermore, retail fuel station offers amenities, such as premium coffee shops, high-quality food outlets, convenience stores, and working spaces, aiming to create more engaging and multi-functional spaces that cater to various consumer needs beyond fuelling vehicles.

In summary, the future trends in the retail fuel station market forecast encompass the integration of EV infrastructure, technological advancements to enhance operations and customer experiences, and the evolution of stations into comprehensive lifestyle hubs, all of which will redefine the traditional retail fuel station model.

Increase in R&D aims toward improving the quality of retail fuel stations, coupled with favorable policies by various governments toward pushing the growth of government-owned fuel stations are some of the crucial market-propelling factors. As per the Minister of Petroleum and Mineral Resources, Tarek al-Mulla, Egypt has planned to rise gas natural vehicle (GNV) of the country filling infrastructure from 306 to 1,300 stations by the end of 2023.

In September 2023, ADNOC Distribution announced the inauguration of the first three service stations in Egypt located in key areas across Greater Cairo, this expansion is the result of acquisition of the company, a 50% stake in Total Energies Egypt. The joint venture includes a diversified downstream portfolio of 240 fuel retail stations, 100 convenience stores, 250 lube changing stations, car washes, lubricants, wholesale, and aviation fuel operations. However, Egypt retail fuel station market conditions and dynamics change rapidly, influenced by various factors such as government policies, economic changes, and Egypt energy trends.

In North America, several key trends are shaping the retail fuel station market and influencing its evolution. With growing environmental concerns, fuel stations are offering alternative fuels such as ethanol blends, biodiesel, and investing in infrastructure to support electric vehicle charging. This aligns with governmental policies incentivizing the adoption of cleaner energy options, driving the market towards a more sustainable future.

Moreover, technological advancements play a pivotal role in transforming the retail fuel station market. Contactless payment systems, mobile apps for fuel purchases, and integration of IoT devices to optimize operations and improve customer service enhances convenience for consumers while streamlining backend processes for fuel station management. Overall, the convergence of sustainability initiatives, technological innovation, enhanced convenience, and data-driven personalization are key trends in the North America retail fuel station market.

As per European Environment Agency, transport sector is among the largest contributors to EU greenhouse gas emissions. Henceforth, reducing transport emissions vital to meeting the EU’s climate neutrality objectives. Transport represents almost a quarter of Europe's greenhouse gas emissions. EU legislation sets mandatory emission targets for new cars and for new vans. This has resulted in the gradual improvement of the fuel-efficiency of vehicles, as well as a higher share of zero- and low-emissions vehicles, such as electric vehicles.

Electric cars, which include battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), are gradually penetrating the EU market further create retail fuel stations market opportunities. There has been a steady increase in the number of new electric car registrations about 1,74 million in 2021, accounting for 18% of new registrations. These figures continued to grow in 2022, when almost 22% of newly registered passenger cars were electric. BEVs accounted for 12.2% of total new car registrations in 2022, while PHEVs represented 9.4%.

In 2022, the share of electric vehicles in new car registrations increased in almost all countries (EU-27, Iceland, Norway) compared with 2021. The highest shares were found in Norway (89%), Sweden (58%) and Iceland (56%). Germany, France and Norway together accounted for about 64% of all new BEV registrations among the EU-27 and non-EU EEA countries. Norway had the highest number of new BEVs registered in 2022, accounting for 79% of new car sales. PHEV percentage sales were highest in Iceland, Sweden (both 23%) and Finland (20%). In four European countries, the percentage of EV registrations remained lower than 5% of the total fleet (Cyprus, Poland, Czechia and Slovakia).

Furthermore, to support electric mobility, several measures have been deployed across Europe. These include financial support to the electric vehicle industry; public investments in charging infrastructure or subsidies for home chargers; public procurement of electric vehicles (e.g., for municipal vehicle fleets); indirect consumer incentives such as preferential access to bus lanes; free or preferential parking; access to low-emission zones; free charging at public stations; and road toll exemptions.

The government scheme offers regulatory support and assistance to petrol pump owners, ensuring compliance with relevant laws, regulations, and quality standards. This includes guidance on licensing procedures, adherence to safety and environmental norms, and periodic inspections to maintain operational compliance. The government’s regulatory support helps streamline the licensing process and ensures that petrol pumps operate safely and responsibly.

To stay abreast of advancements in the fuel retail industry, the government scheme emphasizes technology adoption and infrastructure development. This includes the promotion of digital payment systems, smart fuel management solutions, and the establishment of fuel stations at strategic locations. By embracing technology and improving infrastructure, the government aims to enhance customer convenience, operational efficiency, and the overall consumer experience.

The retail fuel stations market is dominated by state-owned companies, which account for over 70% of the market share. The private sector plays an important role in the retail fuel stations market. There are a number of private companies operating in the retail fuel stations market, such as TotalEnergies SE., Shell plc, and TAQA. Private companies invest heavily in new fuel stations and expanding its networks across the country. The retail fuel stations market size is expected to grow at a CAGR of 25% from 2023 to 2040, driven by a number of factors, which include population growth, rise in incomes, increase in popularity of electric vehicles, and the growth in demand for sustainable fuels.

The retail fuel stations market is competitive, with companies competing on price, location, and customer service. Furthermore, companies have invested in new technologies, such as mobile payment systems to improve the customer experience. The government has played a major role in the development of the retail fuel stations market by investing in the development of new infrastructure, such as roads and highways, which make it easier for people to access fuel stations. In addition, the government has implemented policies to encourage the use of natural gas, which is a cleaner and more sustainable fuel than gasoline and diesel.

There has been rapid development of fuel stations across rural and semi-urban areas with an increase in number of vehicles plying the roads, both private and commercial. Furthermore, the increase in investments in modern fuel stations including automated pumping, brighter lighting systems, flexible payment modes, and innovative advertising, are some of the factors augmenting the retail fuel stations market growth. The government intends to increase the use of alternative fuels to reduce reliance on conventional fuels such as gasoline and diesel by introducing electric and hybrid vehicles in both public and private transportation, with a greater emphasis on converting more vehicles to run on natural gas.

In addition, rise of electric vehicles and other alternative fuels, the rise of advanced mobility modes, and rapidly changing customer habits created huge challenges for the traditional fuel retail business. The retail fuel stations market is segmented on the basis of fuel type, ownership and region. On the basis of fuel type, it is classified into petrol, diesel, CNG, and natural gas. On the basis of ownership, it is bifurcated into public and private. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. The major companies profiled in this report include Exxon Mobil Corporation, Reliance Industries Limited, BP p.l.c., TotalEnergies SE, Shell plc, Indian Oil Corporation Limited, Phillips 66, TAQA, ENOC Company and Gulf Oil International.

The report provides a detailed retail fuel stations market analysis of these key players. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their retail fuel stations market share and maintain dominant shares in different regions. Further, key strategies adopted by potential market leaders to facilitate effective planning have been discussed under retail fuel stations market scope in this report.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the retail fuel station market analysis from 2022 to 2032 to identify the prevailing retail fuel station market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the retail fuel station market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global retail fuel station market trends, key players, market segments, application areas, and market growth strategies.

Retail Fuel Station Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.4 trillion |

| Growth Rate | CAGR of 2.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 563 |

| By Fuel Type |

|

| By Ownership |

|

| By Region |

|

| Key Market Players | BP p.l.c., TAQA, Indian Oil Corporation Limited, Phillips 66 Company, Shell plc, Exxon Mobil Corporation, ENOC Company, Gulf Oil International Ltd, TotalEnergies SE., Reliance Industries Limited. |

Analyst Review

According to CXO perspective, the retail fuel stations market is expected to witness increased demand during the forecast period due to a rise in transportation sector.

Fuel retailing industry comprises companies that operate by selling automotive fuel or lubricating oils at retail stores such as service stations, fuel stations, and similar others. Contactless payment methods have a significant impact on the retail fuel station market. Its adoption enhances the customer experience and contributes to the overall competitiveness and operational efficiency at fuel stations. The market is impacted by a number of trends, such as the increase in popularity of electric vehicles and the growth in demand for sustainable fuels.

On 14 July 2021, the European commission presented a package of proposals to make the EU's climate, energy, land use, transport and taxation policies fit for reducing net greenhouse gas emissions by at least 55% by 2030, known as the Fit for 55 packages. The package included the proposal to revise the 2014 directive on alternative fuels infrastructure. The commission proposed to repeal the directive and replace it with a regulation, suggesting that the change of instrument is needed to ensure “swift and coherent development” of the infrastructure network across the EU.

Furthermore, political, and regional instability sometimes disrupt oil production and exploration activities further hamper the growth of retail fuel stations market. Fuel retailers adopt digitization to enhance operational efficiency and improve customer experience. For instance, ExxonMobil developed Speedpass+ to facilitate payment processes for customers. In addition, Shell heavily innovates in retail fuel stations through a mix of partnerships and internal capability building, to address market developments and fulfil customer needs.

Upcoming trends in the retail fuel station market include a shift towards diversified energy offerings, integrating electric vehicle charging points, hydrogen refueling stations, and renewable fuel options. Stations are evolving into comprehensive energy hubs, providing varied services and sustainable fuel choices to cater to evolving consumer preferences and environmental concerns.

The lack of infrastructure development poses significant constraints on the growth and efficiency of the retail fuel station industry. The infrastructure required for dispensing alternative fuels differs significantly from traditional fuels. Establishing charging stations for EVs, hydrogen refueling stations, or biofuel dispensers require different technologies, space, and investments compared to standard fuel pumps. This presents a financial barrier and operational challenge for traditional fuel stations looking to diversify into offering alternative fuels. In addition, the existing stations require significant modifications or new construction. In conclusion, the retail fuel station industry heavily relies on robust infrastructure for optimal operations, expansion, and adaptation to evolving consumer needs and technological advancements. The absence of infrastructure development presents substantial obstacles, limiting growth opportunities, operational efficiency, and the ability to provide innovative services within the fuel station sector.

North America is the largest regional market for Retail Fuel Station.

The global retail fuel station market was valued at $1.8 trillion in 2022, and is projected to reach $2.4 trillion by 2032, growing at a CAGR of 2.8% from 2023 to 2032.

Exxon Mobil Corporation, Reliance Industries Limited, BP p.l.c., TotalEnergies SE, Shell plc, Indian Oil Corporation Limited, Phillips 66, TAQA, ENOC Company and Gulf Oil International are the top companies to hold the market share in Retail Fuel Station.

Loading Table Of Content...

Loading Research Methodology...