Retirement Home Service Market Research, 2032

The global retirement home service market size was valued at $9.5 billion in 2022, and retirement home service market forecast to reach $14.2 billion by 2032, growing at a CAGR of 4.2% from 2023 to 2032.

Home retirement services offer a comprehensive range of care and support tailored to the needs of elderly individuals who opt to live in place within the comfort of their own homes during their retirement years. These services include in-home caregiving, skilled medical assistance, transportation facilitation, meal delivery, housekeeping, companionship, and remote monitoring solutions.

The expansion of the retirement home service market is closely tied to the growing geriatric demographic globally. A significant portion of the retired population wants to enjoy their life after retirement worry free. This demographic shift has been significant over the past decade, with older adults comprising a significantly larger portion of the global population. According to data provided by the World Health Organization (WHO), the estimation indicates that by 2030, one in six individuals worldwide will be 60 years of age or older, with 1.4 billion people ranging up from 1 billion in 2020. During this period, the global population of individuals aged 60 or older is set to double by 2050, which is expected to reach 2.1 billion. Moreover, the number of individuals aged 80 or older is expected to triple, reaching 426 million globally. This demographic transformation signifies a shift away from high fertility, birth rates, and mortality rates towards a population characterized by low fertility, low birth, and death rates, leading to an overall increase in life expectancy.

As a result of this demographic transition, senior group of population are actively seeking integrated solutions that address their social, physical, and emotional requirements, which thereby promotes a comfortable and better quality of life. It is essential to recognize that the preferences and requirements of this aging demographic can significantly diverge as they advance through various life phases. This signifies the need for service adaptation to align with evolving needs and preferences of consumers. For instance, the provision of housing alternatives that prioritize physical accessibility and safety is crucial; some seniors may opt for aging in place with necessary modifications, while others may require the amenities provided by nursing homes or assisted living facilities. The challenges related to elderly isolation and loneliness should not be underestimated, as their capacity for social engagement, participation in community events, and maintenance of critical family and friend connections directly influences their mental and emotional health. Thus, these factors are poised to increase the demand for retirement home service market that are well-equipped to meet the requirements of this expanding demographic.

Many individuals and families seriously consider the high cost associated with retirement home services, which may act as a barrier for the growth of the market. Retirement communities offer various types of accommodations, including independent living apartments, assisted living residences, and memory care facilities, with pricing varying based on factors such as unit size, privacy level, and available amenities. Location plays a significant role in the cost, with metropolitan or high-demand areas charging higher prices due to increased living expenses and real estate costs. Furthermore, the range of services provided by retirement homes, such as meals, housekeeping, transportation, recreational activities, and medical care, influences the overall expense of retirement homes. Costs tend to escalate for higher-level care, such as skilled nursing or memory care.

Individuals and families considering retirement home services have to carefully assess their financial situation and thoroughly explore all available options owing to the huge expenses involved. It is crucial to gain a comprehensive understanding of the fee structure, services included, and contract terms before making a decision. In addition, some retirement homes impose upfront admission fees, which can create a significant financial hurdle. Thus, high cost associated with retirement home services is expected to hamper the expansion of the retirement home service market in the coming years.

Integration of cutting-edge technology into retirement home services holds huge potential for improving the overall quality of life for elderly residents, which thus streamlines care provision, and instills a sense of confidence among both seniors and their families. The adoption of telehealth and telemedicine platforms is increasingly prevalent within retirement communities, affording a convenient means of accessing healthcare expertise remotely. This innovation enables individuals to engage in consultations with healthcare professionals, including physicians, nurses, and specialists, without the need to travel, thereby reducing transportation expenses and ensuring swift medical attention. Moreover, the implementation of smartwatches and a range of health monitoring devices, whether wearable or non-wearable, facilitates the continuous tracking of vital signs, activity levels, and sleep patterns. This information empowers caregivers and healthcare professionals to closely track health and respond promptly to any changes or emergencies. Thus, the integration of technological innovations in retirement home services has the potential to increase the overall standard of care, enhance safety measures, and promote greater independence and fulfillment among the elderly population. Furthermore, adoption of these technological advancements as a preferred choice for comfortable retirement living can play a pivotal role in augmenting the broader market.

Segmental Overview

The retirement home service market is segmented on the basis of type, age group, gender, and region. On the basis of type, the retirement home service industry is categorized into independent living, assisted living, and others. On the basis of age group, it retirement home service industry is categorized into 55 to 64, 65 to 74, and 75 and above. On the basis of gender, the retirement home service market is bifurcated into men and women. On the basis of region, the retirement home service market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Italy, Spain, Netherlands, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

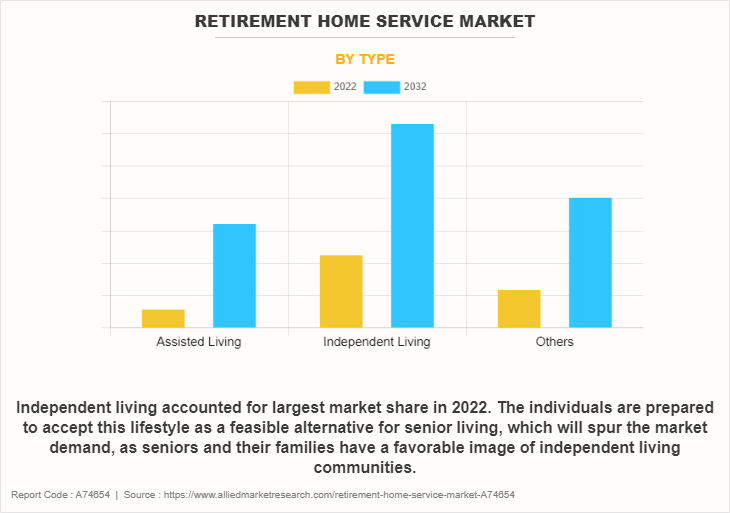

By type

On the basis of type, the independent living segment garnered highest retirement home service market share in 2022 with a CAGR of 38.2%. The development of independent living services is influenced by various socioeconomic, cultural, sociological, and economic factors. Seniors who wish to maintain an independent and active lifestyle while reducing the responsibilities of homeownership can benefit from independent living services. Many seniors aspire to lead fulfilling, social lives, and independent living facilities offer a range of services and activities that cater to these preferences. In addition, some elderly individuals find independent living communities to be a more cost-effective option as compared to single-family homes, particularly when factoring in home maintenance and property taxes. Furthermore, increasing number of individuals are viewing this lifestyle as a viable senior living option, which is expected to drive retirement home service market demand, as seniors and their families hold a positive perception of independent living communities.

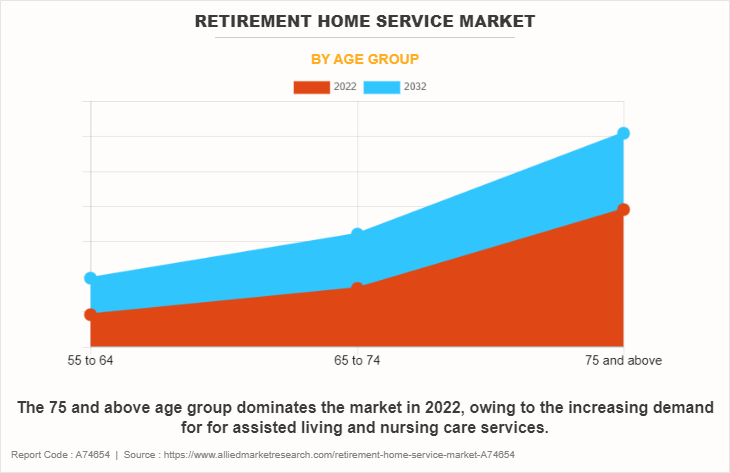

By age group

On the basis of age group, the 75 and above segment was the highest revenue contributor in 2022 and is expected to reach $7,076.7 million by 2032 at a CAGR of 3.8%. This age group is more prone to chronic diseases such as coronary heart disease, myocardial infarction, angina, cancer, COPD, emphysema, or chronic bronchitis, stroke, hypertension, and diabetes. As the risk of most chronic diseases rises with age, older people are more vulnerable to such diseases. As older population have physical and mental health demands, chronic illness care in the elderly should be a priority. The population in this age group opts majorly for assisted living and nursing care. Increase in demand for such services in this age group is estimated to propel retirement home service market growth.

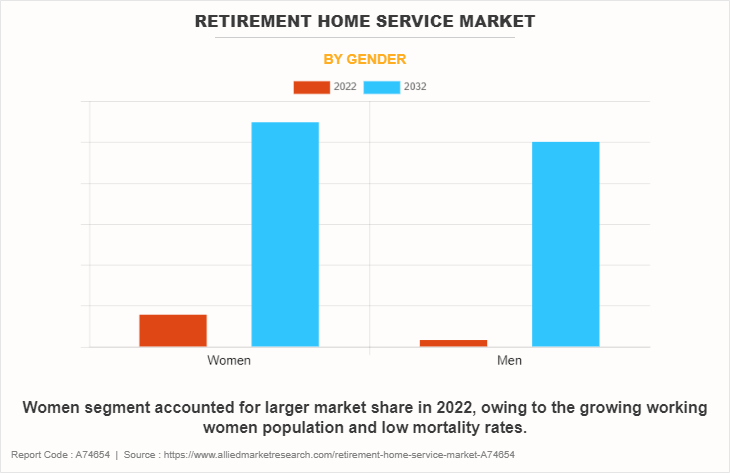

By gender

On the basis of gender, the women segment was the highest revenue contributor in 2022 and is expected to reach $7,243.2 million by 2032 at a CAGR of 4.1%. Single older women, including those who are unmarried, divorced, or widowed, have increase need for independent living options. Women in the 55+ age category are increasingly considering retirement homes as a potential residence choice as these facilities offer integrated healthcare and security services within a single community. Data from the Economic and Social Commission for Asia and the Pacific (ESCAP) reveals significant gender disparities in life expectancy and demographics. In the Asia-Pacific region, women's life expectancy at birth in 2020 stood at 76.1 years, outstripping the 71.5 years for males. In addition, a substantial majority of the global elderly population comprises women; in 2020, women accounted for 53.2% of individuals aged 60 or older and 61.2% of those aged 80 or above. These factors are expected to drive the demand for retirement home services catered to women during the forecast period.

By region

On the basis of region, North America held the largest share of $3,771.4 million in 2022, and is expected to reach $5,417.8 million by 2032 at a CAGR of 3.8%. The American Health Care Association/National Center for Assisted Living (AHCA/NCAL) estimated that there are approximately 30,600 assisted living establishments in the U.S. These communities collectively provide 1.2 million licensed beds, with the average assisted living facility accommodating 39 licensed beds. Licensing of these communities is overseen by regulatory bodies in each state. The Western and Southern regions have a higher concentration of assisted living facilities due to their appeal to retirees. Assisted living facilities come in various sizes, ownership structures, including individual ownership, for-profit, and not-for-profit. Approximately 56% of these communities, as estimated by NCAL, are part of chains, comprising two or more such communities. The remaining 42% of assisted living facilities are privately owned. The demand for retirement home services in North America is bolstered by the increasing interest of individuals in independent living options. Furthermore, the retired population seeks lifestyle alternatives that offer comfort, companionship, and a range of amenities. Retirement homes often provide these benefits, including communal dining, exercise facilities, and organized activities. Thus, North America has high potential for driving the market growth of home retirement home services throughout the forecast period.

Competitive Analysis

The market is being driven by factors such as rapid growth in infrastructural development as well as various advancements in developing countries. The major players operating in the global retirement home service market are ABM INDUSTRIES INCORPORATED, AlerisLife, American Retirement Homes, British United Provident Association Ltd., Brookdale Senior Living Inc., Columbia Pacific Management, Erickson Senior Living, LLC., Genesis HealthCare, Senior Lifestyle, and Life Care Services.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the retirement home service market analysis from 2022 to 2032 to identify the prevailing retirement home service market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the retirement home service market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global retirement home service market trends, key players, market segments, application areas, and market growth strategies.

Retirement Home Service Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 14.2 billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 378 |

| By Age Group |

|

| By Type |

|

| By Gender |

|

| By Region |

|

| Key Market Players | American Retirement Homes, Inc., Brookdale Senior Living Inc., Columbia Pacific Management, Inc., Genesis HealthCare, Inc., AlerisLife Inc., British United Provident Association Limited, Erickson Senior Living Management, LLC, ABM Industries Incorporated, Senior Lifestyle, Life Care Companies, LLC |

Analyst Review

As per the perspective of top-level CXOs, the global retirement home service market is expected to offer attractive business opportunities in developing economies; however, it deals with challenges simultaneously. Developing economies are further expected to emerge as major markets for retirement home service in a decade with increase in the geriatric population.

Residents now have fast access to daily meals, activity opt-ins, and program scheduling all in one location owing to smart devices such as tablets and apps. With technological advancements, the old age population can look at choices for integrated wearables that track important statistics or can make one-touch calls for help if they are worried about your health and safety. Despite the fact that many seniors are just as tech-savvy as anybody else, communities are concentrating on developing user-friendly platforms to guarantee that the new technology enhances the resident experience. With the use of this innovative digital healthcare technology, elder care may be provided at lower prices with higher-quality care.

Also, to help the ageing population, some assisted living and retirement care facilities are becoming smart homes. Seniors are finding it easier to remember their daily schedules, such as when to eat, take their medications, or see their physicians thanks to voice assistants like the Google Home and Amazon Echo (also known as Alexa). Smart pillboxes assist with medication scheduling and dose management. Even some smart gear is already assisting physicians in tracking the movements of their patients to look for abnormal gaits or to notify the care team if a fall happens. Beyond that, personal robots, smart beds, and even motion detectors can improve the quality of assisted living. Advancements in technology and the adoption of these technologies for the retirement home services are driving up the overall market growth.

The global Retirement Home Service market size was valued at $9,464.1 million in 2022.

Growing geriatric population, increase in life expectancy rate, growing popularity of retirement homes, and technological advancements are some of the upcoming trends of the Retirement Home Service Market in the world

North America is the largest regional market for Retirement Home Service

Independent living is the leading type of Retirement Home Service Market

The major players operating in the global retirement home service market are ABM INDUSTRIES INCORPORATED, AlerisLife, American Retirement Homes, British United Provident Association Ltd., Brookdale Senior Living Inc., Columbia Pacific Management, Erickson Senior Living, LLC., Genesis HealthCare, Senior Lifestyle, and Life Care Services.

The global retirement home service market is expected to grow at a CAGR of 4.2%.

Loading Table Of Content...

Loading Research Methodology...