Revenue Assurance Market Insights:

The global revenue assurance market was valued at USD 507 million in 2021 and is projected to reach USD 1.3 billion by 2031, growing at a CAGR of 10% from 2022 to 2031.

Revenue assurance has been defined as the use of high-quality data and workflow improvement approaches to increase profitability, income, and cash flows through proper revenue collection for all given services. A significant portion of revenue assurance strategies involves correcting data before it enters the billing system and finding and repairing leakage points in the system's network and customer-facing systems.

Revenue assurance is the process of ensuring that a company issues accurate bills in accordance with the contracts it has with its customers. If the terms of a contract are complex, billing errors may result in clients being undercharged. Even slight errors can add up over time and result in revenue leakage. Revenue assurance can help prevent revenue leakage and maximize both cash flow and revenue by routinely looking for discrepancies between contract wording and billing history. Revenue assurance includes manual inspections by a company's sales or account management teams, recurrent audits by dedicated revenue assurance teams, and automated procedures carried out by Artificial Intelligence (AI) software platforms to discover problems.

Revenue assurance is a complex and manual process that requires teams to meticulously review contracts and compare them with billing data to identify any errors in invoicing. This process can be time-consuming, especially since revenue assurance requires immediate attention. Delayed detection of errors may result in contractual obligations preventing the re-issuance of un-invoiced charges, ultimately leading to financial losses for businesses. These are the major factors projected to hamper the revenue assurance market growth in the upcoming years.

New technologies including cloud computing, the Internet of Things (IoT), software-defined networking (SDN), network functions virtualization (NFV), 4G/5G networks, and others have offered telecom operators the chance to introduce fresh services and business models. Telecom companies will be able to provide cutting-edge services like connected autos, smart cities, and remote healthcare owing to these techniques. Real-time revenue assurance is essential to guaranteeing that operator can monetize these services, which need a dependable and secure network architecture. The ability to monitor network traffic in real-time, spot irregularities and potential income leaks, and take corrective action before a problem arises is known as real-time revenue assurance. Therefore, operators' revenue streams are optimized, customer satisfaction is raised, and profitability is also raised.

The key players revenue assurance market forecast in this report include Amdocs, Araxxe, Cartesian, Itron Inc, Hewlett Packard Enterprise Development LP, Subex Ltd, Wedo Technologies, Sandvine, Sigos, and Tata Consultancy Services Limited (India).

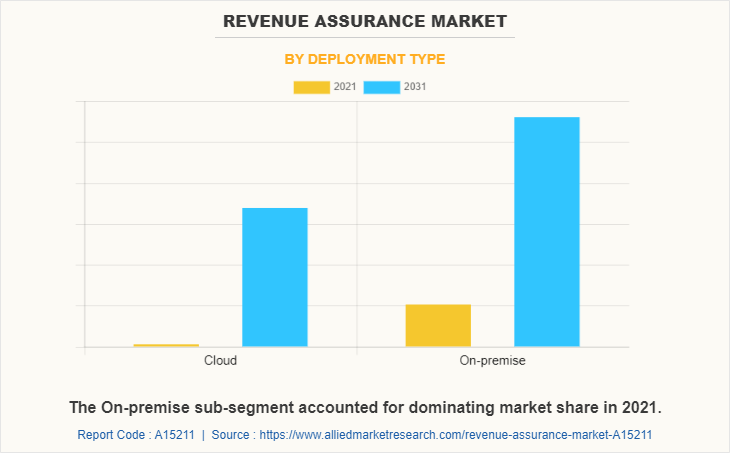

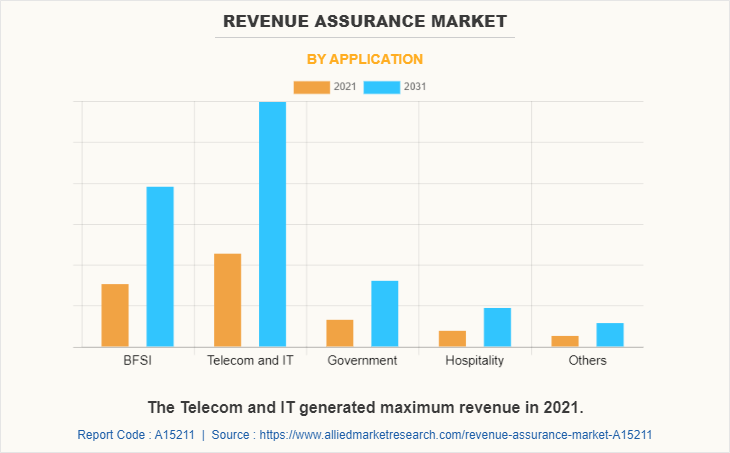

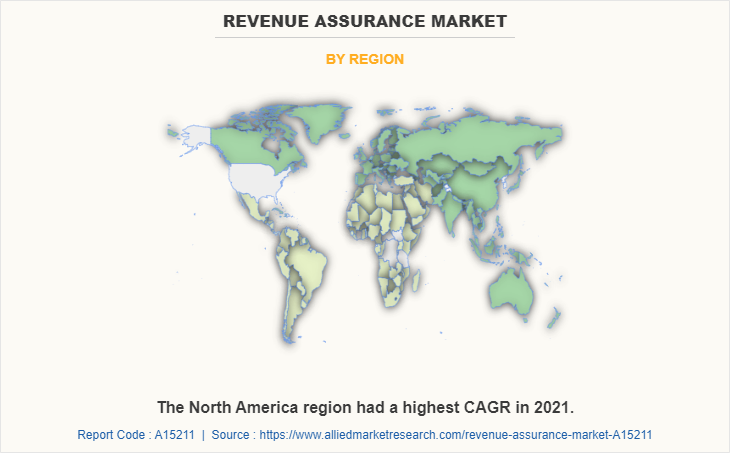

The revenue assurance market share is segmented on the basis of component, deployment type, application, and region. By component, it is classified into solutions and services. By deployment type, it is divided into cloud and on-premise. By application, it is classified into BFSI, telecom & IT, government, hospitality, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By component, the solutions sub-segment dominated the revenue assurance market in 2021. Revenue assurance tools assist in various revenue assurance solutions such as risk management, fraud management, and revenue recovery. In addition, these options help organizations to strengthen their revenue management and maintain regulatory compliance. In the telecommunication sector, revenue assurance solutions help to identify revenue leakage, identify anomalies, and take corrective actions to prevent revenue leakage. Revenue assurance solutions help in the detection and prevention of fraudulent actions in the banking & financial services industries. These technologies assist in guaranteeing proper invoicing and preventing revenue leakage due to errors in the healthcare industry.

By deployment type, the on-premise sub-segment dominated the global revenue assurance market share in 2021. The on-premises deployment segment currently holds the most market share as it has various advantages that are particularly appealing to enterprises in industries such as telecommunications, banking, healthcare, and retail. The on-premise implementation provides stronger security because the software and data are within the company's own infrastructure, limiting the danger of external breaches.

By application, the telecom and IT sub-segment dominated the market in 2021. One of the primary factors driving the demand for revenue assurance solutions in the telecom sector is the increase in prevalence of telecom fraud. Telecom providers face significant income loss due to several issues such as network problems, billing errors, and fraud. Revenue assurance solutions assist operators in determining the fundamental causes of revenue leakage and taking corrective action to avoid further losses. These are predicted to be the major factors driving the market size during the forecast period.

By region, North America accounted for a dominant market share in 2021 and is projected to remain the fastest-growing during the forecast period. North America is anticipated to experience significant growth due to the increasing popularity of cloud computing and the rising need to increase operational efficiency in large companies and SMEs. The market is developing in North America owing to the region's cutting-edge IT and telecom infrastructure and high level of digital maturity. This is driving demand for revenue assurance solutions that can help to reduce revenue leakages. Also, the North America revenue assurance market is dominated by reputable rivals such as TEOCO, Subex, and Hewlett Packard Enterprise. The widespread implementation of modern technologies such as AI and cloud-based solutions, as well as the rising need for revenue assurance solutions in the healthcare and retail sectors, are factors boosting the demand for the market in North America.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis from 2021 to 2031 to identify the prevailing revenue assurance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities in demand for revenue assurance solutions.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The revenue assurance report scope includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Revenue Assurance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.3 billion |

| Growth Rate | CAGR of 10% |

| Forecast period | 2021 - 2031 |

| Report Pages | 280 |

| By Application |

|

| By Component |

|

| By Deployment Type |

|

| By Region |

|

| Key Market Players | wedo technologies, Amdocs, Cartesian, Sigos, Sandvine, Tata Consultancy Services Limited (India), Hewlett Packard Enterprise Development LP, araxxe, Subex Ltd, Itron Inc |

Analyst Review

Revenue Assurance is a software solution that enables a telecommunications provider (CSP) to inspect and plug dozens of actual or possible leakage points throughout the network and customer-facing systems, as well as correct data before it reaches the billing system. revenue Assurance market share has increased due to leakages that occur whenever revenue that has been generated by the company and when services are delivered to the customer is lost on its route to the billing systems and the consumer is never debited, which is driving the market's growth. Data privacy is anticipated to restrict market expansion during the forecast period. The majority of companies use open-source software that includes a variety of techniques and algorithms to manage data. If the data is not sufficiently protected, hackers can readily obtain the source code as the majority of processes and algorithms are run through open sources. Due to the advent of new technologies, the arrival of over-the-top (OTT) services enhances competition from players with extremely disruptive business models, even in national markets, giving operators the opportunity to introduce new business models and services. Many communication service providers use revenue assurance in service models of operation for system integration, which has boosted the growth of the Revenue Assurance market. These factors are anticipated to drive the expansion of the electronic data management market.

Among the analyzed regions, North America is expected to account for the highest revenue in the market by the end of 2031, followed by Asia-Pacific, Europe, and LAMEA. Rapid growth in the telecommunication sector, BFSI, and retail industries is the key factor responsible for the leading position of North America and Asia-Pacific in the global revenue assurance market.

Revenue assurance is a method used by enterprises to discover, analyze, reduce, and prevent revenue loss through a variety of measures. Its goal is to limit the likelihood of losses due to mistakes, negligence, or fraud. The revenue assurance market growth is anticipated to expand in the upcoming years as companies across all sectors continue to look for strategies to minimize revenue loss and maximize profitability.

The major growth strategies adopted by the revenue assurance market players are investment and agreement.

Asia-Pacific will provide more business opportunities for the global revenue assurance market in the future.

Amdocs, Araxxe, Cartesian, Itron Inc, Hewlett Packard Enterprise Development LP, Subex Ltd, Wedo Technologies, Sandvine, Sigos, and Tata Consultancy Services Limited are the major players in the revenue assurance market.

The telecom & IT sub-segment of the application segment acquired the maximum share of the global revenue assurance market in 2021.

BFSI, telecommunications, government, and hospitality are the major customers of the global revenue assurance market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global revenue assurance market from 2021 to 2031 to determine the prevailing opportunities.

Revenue assurance is essential to any successful business model since it helps to secure long-term growth while mitigating revenue growth risks. Revenue assurance benefits firms in a variety of ways, including reducing profit loss and enhancing operational efficiency, which is expected to drive its adoption.

Loading Table Of Content...

Loading Research Methodology...