Reverse Factoring Market Research, 2032

The global reverse factoring market was valued at $0.5 trillion in 2023, and is projected to reach $1.3 trillion by 2032, growing at a CAGR of 11.2% from 2024 to 2032.

The market's growth is propelled by the increasing demand for working capital optimization, particularly among companies looking to enhance their liquidity and maintain healthy supplier relationships. The market continues to evolve, driven by technological advancements, the integration of digital platforms, and the expansion of supply chain networks, catering to the financial needs of businesses across various industries and sectors.

Key Takeaways

The reverse factorings market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literature, industry releases, annual reports, and other such documents of major reverse factoring industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Market Introduction and Definition

The global reverse factoring market plays a pivotal role in facilitating supply chain finance, offering a financial solution that enables businesses to optimize working capital by extending payment terms to suppliers while providing early payment options through a financial institution. This market has seen significant growth due to its ability to improve cash flow for both buyers and suppliers within supply chains. Reverse factoring, also known as supply chain finance, allows large corporations or buyers to leverage their creditworthiness to secure lower-cost financing for their suppliers. This arrangement provides suppliers with the option to receive payments earlier than the agreed-upon terms, helping them manage cash flow effectively.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis to identify the prevailing reverse factoring market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global reverse factoring market trends, key players, market segments, application areas, and market growth strategies.

Industry Trends

In October 2022, HSBC Hongkong, a wholly owned subsidiary of HSBC Group, launched Trade Platform, a one-stop e-platform that provides a flexible, safe, and secure offering for managing global transactions of trade loans for sellers and buyers, guarantees, import Bills, and import documents for credit. With reduced paperwork, time-saving, and real-time status tracking. The company aims to offer all trade services with this digital platform to the customers.

In December 2022, Endesa along with Banco Bilbao Vizcaya Argentaria, Caixabank, and Santander launched the circular reverse factoring solution, which provides bonuses, and rewarding sustainable practices. This launch helped them to increase their competitiveness in the economy.

The EU introduced a directive aimed at combating late payments in commercial transactions. While not specific to reverse factoring, it has implications for financing arrangements within supply chains, emphasizing prompt payment practices.

In October 2019, the U.S. Securities and Exchange Commission (SEC) initiated scrutiny of companies' use of reverse factoring, especially concerning its impact on financial reporting and transparency. This increased scrutiny followed concerns raised by certain high-profile accounting scandals.

Key Market Dynamics

The global reverse factorings market is growing due to several factors such as increasing investments by micro, small medium manufacturing enterprises (MSMEs) in reverse factoring tools for pre-trade, post-trade, and examination of cross-asset and cross-market goods are driving the growth of the reverse factoring industry. However, lack of standardization and perception of risk restrains the development of the market. In addition, the advancements in emerging technologies such as natural language processing (NLP) , cloud computing, artificial intelligence (AI) , big data analytics, the Internet of Things (IoT) , and Blockchain are creating robust market opportunities for the reverse factoring industry.

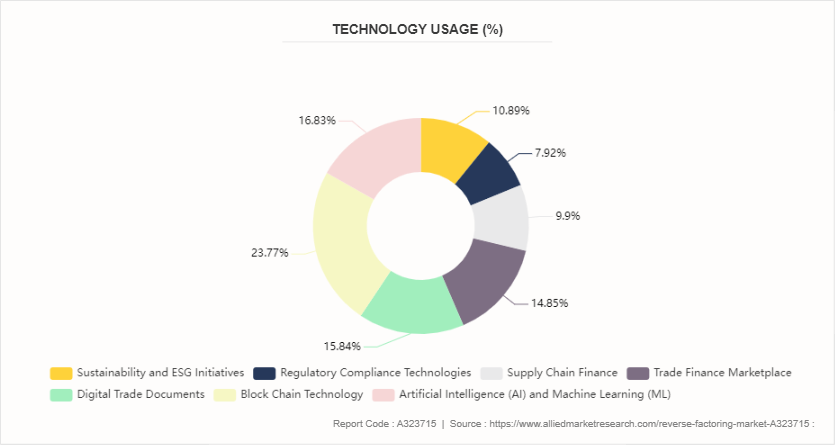

Technology Usage in the Global Reverse Factoring Market

The global reverse factoring market reveals significant technological advancements and innovations that are shaping the industry. Key trends include the integration of automation and artificial intelligence (AI) , which enhance efficiency and accuracy in processing invoices, performing risk assessments, and forecasting cash flows. Additionally, blockchain and distributed ledger technology (DLT) have emerged as pivotal innovations, providing secure, transparent, and tamper-proof platforms that reduce fraud risks and streamline transactions. Smart contracts further automate payments and enforce terms, thus increasing transaction speed and reliability. Risk management solutions are also a focus, with sophisticated algorithms and real-time monitoring systems minimizing default risks and ensuring financial stability. Leading this innovation are major financial institutions and fintech companies, actively filing patents related to new technologies and process improvements. These include global banks, fintech startups, and specialized supply chain finance providers. Technology companies specializing in AI, blockchain, and data analytics also contribute significantly to the patent landscape. Collaborative efforts between financial institutions and technology providers result in joint patents and shared innovations, leveraging the strengths of both sectors to create advanced reverse factoring solutions.

Market Segmentation

The reverse factoring market is segmented into category, financial institution, end-user, and region. On the basis of category, the market is divided into domestic and international. As per financial institution, the market is segregated banks, and NBFC’s. By end-user, the market is classified into manufacturing, transport & logistics, information technology, healthcare, construction, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The significant growth of the Europe reverse factoring market can be attributed to increasing business activity levels, availability of quick expert advice for financial management from a majority of the firms, and significant penetration of the market leaders in the region. Supportive government initiatives to assist start-ups in raising public & private funding and focus on established reverse factoring service providers on offering alternative financial assistance by buying SMEs’ pending invoices are creating a positive market outlook in Europe. Moreover, the growth of Latin America's reverse factoring industry can be attributed to the shift in focus of companies from various sectors on bad debt evasion and business growth with better financial stability. Several Latin American countries, such as Argentina, Peru, Chile, Mexico, and Brazil, are witnessing rising demand for reverse factoring services in most sectors.

In January 2024, Ford Motor Company initiated a reverse factoring program with its suppliers, providing them with early payment options to ensure stability in the supply chain while optimizing working capital.

In March 2023, Walmart partnered with financial institutions to offer early payment options to its suppliers through reverse factoring, enabling them to access cash faster and improve financial liquidity.

The UK government announced reforms to the Prompt Payment Code, encouraging fairer payment practices within supply chains. These reforms aim to address the broader issue of late payments while not specifically targeting reverse factoring.

In October 2022, Apple implemented a supply chain finance program, offering early payment options at discounted rates to its suppliers, enhancing supplier relationships and cash flow management.

Competitive Landscape

The major players operating in the reverse factoring market include Accion International, Banco Bilbao Vizcaya Argentaria, S.A., Barclays Plc, Credit Suisse Group AG, Deutsche Factoring Bank, Drip Capital Inc., eFactor Network, The Hongkong and Shanghai Banking Corporation Limited,, and JP Morgan Chase & Co.

Other players in the reverse factoring market include PrimeRevenue, Inc., Societe Generale, Trade Finance Global, TRADEWIND GMBH, and Viva Capital Funding, LLC.

Recent Key Strategies and Developments

- In September 2023, Bank of America introduced the CashPro Supply Chain Solutions, the first of a multi-year project. Through this initiative, the bank will be able to better serve its clients who are involved in supply chain management and financing by giving creative and effective solutions.

In October 2022, HSBC Hongkong, a wholly-owned subsidiary of HSBC Group, launched Trade Platform, a one-stop e-platform that provides a flexible, safe, and secure offering for managing global transactions of trade loans for sellers and buyers, guarantees, import Bills, and import documents for credit. With reduced paperwork, time-saving, and real-time status tracking. The company aims to offer all trade services with this digital platform to the customers.

In December 2022, Endesa along with Banco Bilbao Vizcaya Argentaria, Caixabank, and Santander launched the circular reverse factoring solution which provides bonuses, and rewarding sustainable practices. This launch helped them to increase their competitiveness in the economy.

Key Sources Referred

- Bloomberg

- Harvard Business Review

- International Journal of Production Economics

- Journal of Financial Economics

- U.S. Securities and Exchange Commission (SEC)

- Trade Finance Global

- European Banking Authority (EBA)

Key Benefits For Stakeholders

This report provides a quantitative analysis of the Reverse factoring Market segments, current trends, estimations, and dynamics of the reverse factoring market analysis from 2024 to 2032 to identify the prevailing reverse factoring market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the Reverse factoring Market segmentation assists to determine the prevailing reverse factoring market size, reverse factoring market share, reverse factoring market growth, and reverse factoring market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global Reverse factoring Market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players, and reverse factoring market forecast.

The report includes an analysis of the regional as well as global reverse factoring market outlook, key players, market segments, application areas, and market growth strategies.

Reverse Factoring Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.3 Trillion |

| Growth Rate | CAGR of 11.2% |

| Forecast period | 2024 - 2032 |

| Report Pages | 234 |

| By Category |

|

| By Financial Institution |

|

| By End-User |

|

| By Region |

|

| Key Market Players | JP Morgan Chase & Co., Banco Bilbao Vizcaya Argentaria, S.A., PrimeRevenue, Inc, Accion International, eFactor Network, Drip Capital Inc, Barclays PLC, Credit Suisse Group AG, The Hongkong and Shanghai Banking Corporation Limited, Deutsche Factoring Bank GmbH & Co. |

The reverse factoring market is estimated to reach $1.3 Trillion by 2032.The global reverse factoring market was valued at $0.5 trillion in 2023, is projected to hit $1.3 trillion by 2032, growing at a CAGR of 11.2% from 2024 to 2032.

Upcoming trends in the reverse factoring market include increased adoption of digital platforms and blockchain technology for enhanced transparency and efficiency, greater focus on sustainability and ESG (Environmental, Social, and Governance) factors, and expanding access for small and medium-sized enterprises (SMEs) to improve their cash flow management.

The leading application of the reverse factoring market is providing improved cash flow and liquidity management for suppliers by allowing them to receive early payments on invoices through financial institutions.

North America is the largest regional market for Reverse Factoring in 2023.

The major players operating in the reverse factoring market include Accion International, Banco Bilbao Vizcaya Argentaria, S.A., Barclays Plc, Credit Suisse Group AG, Deutsche Factoring Bank, Drip Capital Inc., eFactor Network, HSBC Group, and JP Morgan Chase & Co. Other players in the reverse factoring market include PrimeRevenue, Inc., Societe Generale, Trade Finance Global, TRADEWIND GMBH, and Viva Capital Funding, LLC.

Loading Table Of Content...