Ride-Hailing Service Market Overview :

The global ride-hailing service market was valued at $36,450.0 million in 2017, and is projected to reach $126,521.2 million by 2025, registering a CAGR of 16.5% from 2018 to 2025. North America was the highest contributor to the global market in 2017 garnering a CAGR of 12.7% during the forecast period.

Ride-hailing service enables passengers to hail a vehicle using online platforms such as Grab, Lyft, Uber, and Ola. It serves as one of the most comfortable means of transportation, as it provides door-to-door services. Moreover, while hailing a ride, information of the passenger and the driver is exchanged, making this service safer than traditional taxi services.

The growth of the global ride-hailing service market is driven by rise in trend of on-demand transportation services, creation of employment opportunities, and low rate of car ownership among millennials. In addition, advancements in connected & automatic vehicles to reduce CO2 emission and substantial increase in sales of these vehicles for the use of ride-hailing services propel the global market growth.

However, low rate of internet penetration in developing regions considerably hampers the growth of the market. Moreover, enforcement of stringent government policies toward ride-hailing service restrains the market growth. For instance, the Bombay High Court recently took action against ride-hailing service providers such as Uber and Ola in Kolkata, Bhopal, and Mumbai, due to unnecessary hike in their service pricing. On the contrary, rise in trend of mobility-as-a-service and increase in user base of ride sharing services across the globe are expected to create lucrative opportunities for the market players.

The key players operating in the global ride-hailing service market include Uber Technologies Inc., Lyft, Inc., Daimler AG., Grab, ANI Technologies Pvt. Ltd., Didi Chuxing Technology Co., nuTonomy, Denso Corporation, TomTom NV, and Gett, Inc.

The global ride-hailing service market is segmented based on service type, vehicle type, location, end user, and region. E-hailing, car rental, car sharing, and station-based mobility are studied under the service type segment. On the basis of vehicle type, the market is categorized into two-wheeler, three-wheeler, four-wheeler, and others. Depending on location type, it is bifurcated into urban and rural. According to end user, it is segregated into institutional and personal. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

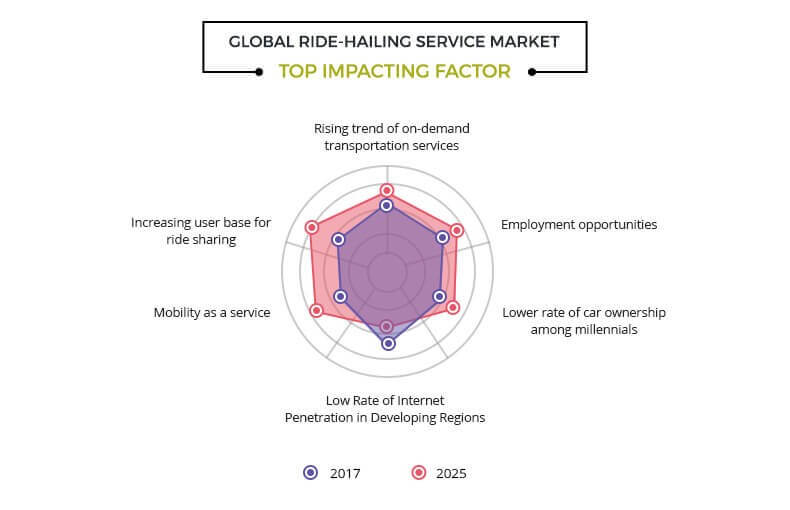

TOP IMPACTING FACTORS

The key factors that drive the growth of the global ride-hailing service industry are rise in trend of on-demand transportation services, creation of employment opportunities, and lower rate of car ownership among millennials. However, low rate of internet penetration in developing regions and stringent government policies for ride-hailing service are some of the major restraining factors of this market. On the contrary, the market is expected to witness significant growth in the near future, owing to increase in trend of mobility-as-a-service and upsurge in users for ride sharing across the globe. Each of these factors is anticipated to have a definite impact on the global ride-hailing service market during the forecast period.

Rise in trend of on-demand transportation services

On-demand service comprise taxis, passenger vehicles, and charter vehicles, which provide real-time feedback, tracking of vehicle, and rating for service experience provision to end customers. Ride-hailing services ensure that customers can accurately locate the vehicles and track their journey alongside offer safety to the occupants, which in turn is expected to significantly drive the market growth. Abundant availability of cars and comparison of fare with correspondents facilitated by many mobile applications further drive the growth of the market. For instance, in August 2017, the launch of Migo, a Seattle-based search engine for on-demand ride services mobile application, enabled users to compare the locations and prices of nearby taxis and car-sharing & ride-hailing companies at a single platform.

Increase in employment opportunities

Ride-hailing service allows driver to work full or part time. According to the U.S. Bureau of Labor Statistics, the enrollment of full-time drivers is 40% more as compared to part-time drivers. For instance, in September 2017, CEO of Uber agreed that the company is creating more than 50,000 new jobs for drivers around the world every month. Expansion of ride-hailing services across the globe by various companies such as Lyft, Uber, OLA, Careem Taxify, and others and huge investment of Daimler, Volkswagen, and Denso in the ride-hailing industry are anticipated to create remunerative employment opportunities globally.

Low rate of internet penetration in developing regions

Ride-hailing services require three parties for their operation that include driver, riders, and service providers. All the processes such as matching rider with drivers, fare estimation & calculation, ride payment, and reputation management are done by using smartphone with internet connectivity. Some countries such as Eritrea, Burundi, Chad, Somalia, and others have lower penetration of internet, which acts as a restraint of the ride-hailing service market. To hail a ride, the driver must have GPS-equipped smartphone that has active internet connection to identify exact pickup and drop locations of customers. Therefore, lower penetration of internet hampers the expansion of the market globally.

Increase in trend of mobility-as-a-service

People who are not capable of purchasing car can experience seamless travel through mobility services. According to the Bureau of Transportation Statistics, the average cost to own and operate a vehicle is around $8,858, assuming 15k miles traveled per year. Mobility-as-a-service decreases such costs for the user by providing improved utilization of transport services such as car sharing and ride hails. In addition, it reduces city congestion and overall vehicle emissions. Therefore, digitally enabled car sharing and ride-hailing manage travel needs in the smartest way, and provide a hassle-free and environmentally sound alternative to private car ownership. This sharing & ride-hailing activity that includes the entire process from travel planning to payments can be managed through a single mobile application, which is expected to create lucrative opportunity for the market in the near future.

Key Benefits for Ride-Hailing Service Market :

- This study comprises an analytical depiction of the global ride-hailing service market analysis along with current trends and future estimations to depict the imminent investment pockets.

- The overall market potential is determined to understand the profitable trends to gain a strong foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- Porters five forces analysis illustrates the potency of the buyers and suppliers in the industry.

- The report includes the market share of key vendors and ride-hailing service market trends.

Ride-Hailing Service Market Report Highlights

| Aspects | Details |

| By Service Type |

|

| By Vehicle Type |

|

| By Location |

|

| By End User |

|

| By Region |

|

| Key Market Players | DAIMLER AG, NUTONOMY (APTIV PLC), LYFT, INC., GETT,INC., DENSO CORPORATION, TOMTOM INTERNATIONAL N.V., ANI TECHNOLOGIES PVT. LTD.(OLA TAXIS), DIDI CHUXING TECHNOLOGY CO., LTD., UBER TECHNOLOGIES INC., GRAB |

Analyst Review

Ride-hailing service is a comfortable means of transportation, which offers door-to-door conveyance. The market for such ride-hailing services holds high potential in the transportation industry. The current business scenario has witnessed high demand for these services, especially in the developing regions, namely U.S., China, Germany, and others.

Rise in trend of on-demand transportation services, creation of employment opportunities, and low rate of car ownership among millennials are the key factors that propel the growth of the global ride-hailing service market. In addition, advancements in connected & automatic vehicles to reduce CO2 emission and burgeoning increase in the sales of these vehicles for use in ride-hailing services propel the global market growth. Moreover, the key players operating in the industry have adopted various techniques to provide customers with advanced and innovative product offerings, thereby fueling the growth of the market.

However, low rate of internet penetration in developing regions and implementation of stringent government policies toward unprecedented hike in service pricing are some of the major restraining factors of this market. On the contrary, rise in the trend of mobility-as-a-service and increase in users of ride sharing across the globe are projected to create remunerative opportunities for market expansion.

North America exhibits the highest adoption of ride-hailing services. On the other hand, Asia-Pacific is expected to grow at a faster pace in the near future.

The key players operating in the ride-hailing service market include Uber Technologies Inc., Lyft, Inc., Daimler AG., Grab, ANI Technologies Pvt. Ltd., Didi Chuxing Technology Co., nuTonomy, Denso Corporation, TomTom NV, and Gett, Inc.

Ola, one of the world’s largest ride-hailing platforms, has launched its first UK services across South Wales. This will offer customers the option of Private Hire Vehicles (PHVs) and Taxis on one user-friendly platform, which will include additional transportation options in the future to provide passengers with greater choice.

The global ride-hailing service market was valued at $36,450.0 million in 2017, and is projected to reach $126,521.2 million by 2025, registering a CAGR of 16.5% from 2018 to 2025.

The report sample for ride hailing service Market report can be obtained on demand from the website.

The current business scenario is witnessing an increase in the demand for global telematics solutions providers for the diffrent type of vehicle particularly in the developing regions, such as China, India, and others. Such countries are potential customers for market expansion.

key players operating in the ride hailing service market are Uber Technologies Inc., Lyft, Inc., Daimler AG., Grab, ANI Technologies Pvt. Ltd., Didi Chuxing Technology Co., nuTonomy, Denso Corporation, TomTom NV, Gett, Inc.

The company profiles of the top ten players of the ride hailing service Market can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the ride hailing service industry along with their last three year revenue, segmental revenue, product offerings, key strategies adopted, and geographical revenue generated.

Based on the global ride hailing services market analysis, North america is the major revenue contributor in 2018 and Asia-pacific region is expected to provide more business opportunities during the forecast period as well as is expected to see a lucrative growth during the forecast period.

The ride hailing service providers includes the companies which are having the platform which are relating to the car sharing, car rental, e hailing, and station based mobility via mobile at commerialand industrial areas.

The key growth strategies adopted by the ride hailing service industry players includes innovations and developments of better and efficient products. These strategies opted by various industry players is leading to the growth of the ride hailing service industry as well as the players.

The application of the ride haioling services inlcudes the institutional, industrial, commercial and personal use which can be avil such service through the mobile or others.

E-hailing services such as app-based ride-services, car sharing services, are hampered due to the COVID-19 crisis owing to the travel bans and social distancing measures to curb the spread of virus.

Loading Table Of Content...