Rideshare Insurance Market Research, 2032

The global rideshare insurance market was valued at $2.2 billion in 2022, and is projected to reach $6.1 billion by 2032, growing at a CAGR of 11.1% from 2023 to 2032.

Rideshare insurance is a type of insurance coverage that is designed for people who drive for companies like Uber or Lyft. These companies provide some insurance coverage to their drivers, but it may not be enough to fully protect them in case of an accident. Rideshare insurance provides additional coverage to fill in the gaps and ensures that drivers are fully protected while they are working. Further, it can also help protect drivers from high deductibles or coverage limits that may be imposed by the ride-sharing company's insurance policy.

The increasing number of accidents involving rideshare drivers has led to a higher demand for insurance coverage for rideshare services. In addition, the government's increasing focus on rideshare insurance regulations is driving the growth of the rideshare insurance market. However, the lack of awareness among rideshare drivers about the need for insurance coverage and the complexity of insurance policies for rideshare drivers is the major restraint for the rideshare insurance market growth. On the contrary, the development of personalized insurance products for rideshare drivers is expected to provide significant opportunities for the growth of the rideshare insurance market in upcoming years.

Furthermore, the collaborations and partnerships between ridesharing companies and insurance providers is anticipated to provide lucrative opportunities for the growth of the rideshare insurance market.

The report focuses on growth prospects, restraints, and trends of the rideshare insurance market. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the rideshare insurance market outlook.

The rideshare insurance market is segmented into and Coverage.

Segment Review

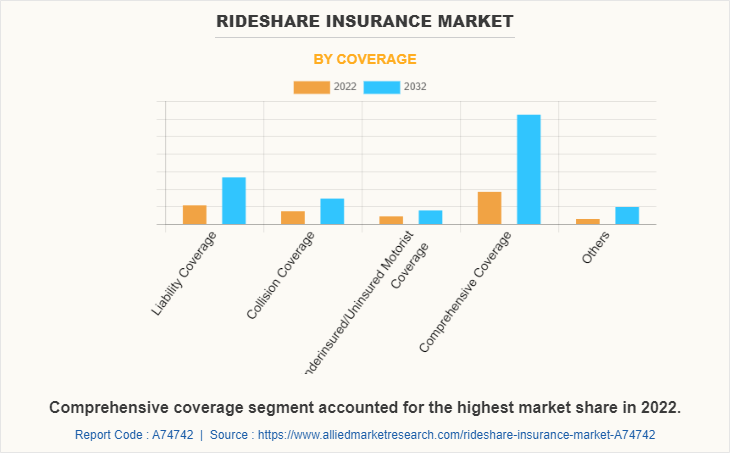

The rideshare insurance market is segmented into coverage and region. By coverage, the market is divided into liability coverage, collision coverage, underinsured/uninsured motorist coverage, comprehensive coverage, and others. Region wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By coverage, the comprehensive coverage segment acquired a major rideshare insurance market size in 2021 and is expected to grow with the fastest CAGR. The growth of this segment is attributed to the fact that this policy generally will protect the car in the event that it is crushed by a collapsing garage, dented by a collision with a deer, spray-painted by a vandal, or destroyed by a tornado. Further, rideshare companies are increasingly providing their own insurance policies that provide comprehensive coverage for their drivers. These policies generally cover damage and losses to the driver’s vehicle caused by events other than collisions.

Region wise, North America dominated the rideshare insurance market share in 2021. This is attributed to the increasing popularity of ridesharing services, the growth of the gig economy, and the need for specialized insurance coverage for rideshare drivers.

The key players operating in the global rideshare insurance market include Allstate Insurance Company, Progressive Casualty Insurance Company, State Farm Mutual Automobile Insurance Company, AXA, Allianz, Bingle Insurance, USAA, NerdWallet, Inc., Farmers, and Erie Indemnity Co. These players have adopted various business strategies to increase their market penetration and strengthen their position in the rideshare insurance industry.

Country Specific Statistics & Information

Rise in product launches to develop better insurance plans and adoption of advanced technologies are some of the trends that have helped to augment the rideshare insurance market growth. For instance, in September 2019, US-based ridesharing company Uber announced that it will offer free insurance to its riders in case of accidents while on trip across categories such as cars, autos and motorcycles. Riders would be insured for up to USD $6,093.84 (Rs 5 lakh) in case of accidental death or disability and up to USD $2,437.54 (Rs 2 lakh) for hospitalization, including an OPD benefit of up to USD $609.38 (Rs 50,000).

Furthermore, in August 2022, Uber announced the launch and expansion of the WhatsApp to Ride (WA2R) product feature for users in Delhi NCR which would help riders across Delhi-NCR book an Uber ride via its official WhatsApp chatbot. The partnership would expand access to Uber’s mobility services to a new segment of consumers through integration in two languages (Hindi and English).

COVID-19 pandemic had a negative impact on the rideshare insurance industry, owing to decrease in demand for rideshare services, as people have been staying at home and avoiding unnecessary travel. This has resulted in a decrease in the number of drivers on the road and a corresponding decrease in the need for rideshare insurance. Further, drivers who have continued to provide rideshare services during the pandemic have had to adjust their behavior to minimize the risk of contracting or spreading the virus. This has included measures such as wearing masks, frequently sanitizing their vehicles, and limiting the number of passengers they carry. These changes have impacted the risk profile of rideshare drivers and have likely influenced the insurance rates offered by providers. Thus, the pandemic had a negative effect on the rideshare insurance industry.

Top Impacting Factors

Increase in Demand for Ridesharing Services

As the use of ridesharing services such as Uber and Lyft continue to grow, there is a corresponding increase in demand for insurance products that cater specifically to these services. Rideshare insurance provides coverage for drivers and passengers during rideshare trips, which is not typically covered by traditional personal auto insurance policies. In addition, as more people have become aware of the risks associated with ridesharing, the demand for insurance products that address these risks has increased. Insurers are taking advantage of this trend by developing and marketing specialized insurance products that provide coverage specifically for ridesharing services. For instance, in July 2022, Stable, a new insurtech company built specifically for rideshare drivers and fleets, announced that it has launched its first insurance product for owner operators – drivers who own vehicles that they drive on rideshare networks like Uber and Lyft. This will help the drivers to fully protect themselves and their businesses with commercial-grade insurance coverage and technology tools that enable them to run their businesses more efficiently and profitably.

Rise in Awareness about Rideshare Insurance

The demand for insurance products to address the risks has increased as more people have become aware of the risks associated with ridesharing. Insurers can take advantage of this trend by developing and marketing specialized insurance products that provide coverage specifically for ridesharing services. Further, growing awareness of the need for specialized insurance coverage is fostering the growth of the market. Furthermore, many states and local governments have implemented regulations requiring rideshare drivers to carry commercial insurance coverage. This has created a need for specialized insurance products that meet these regulatory requirements. Thus, the increasing awareness about rideshare insurance is fueling the growth of rideshare insurance market.

Innovation in Products

Insurers are increasingly developing innovative products that cater specifically to the unique risks and needs of rideshare drivers. In addition, the ridesharing industry is expected to continue to grow in the coming years, with more people turning to ridesharing services for transportation. This creates a significant growth opportunity for insurers offering specialized insurance products for rideshare drivers. Insurers are partnering with ridesharing companies to offer insurance products directly to drivers through the ridesharing platform. This can provide a direct marketing channel and potentially increase customer loyalty. For instance, in December 2021, Allianz Partners and Uber partnered to provide benefits and protection insurance for independent drivers and couriers in Europe. The coverage included on-trip benefits in cases of accidents, injury or hospitalizations, as well as off-trip benefits such as sick pay and maternity/paternity payments. Thus, the innovation in products is expected to fuel the market growth in upcoming years.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the rideshare insurance market analysis from 2021 to 2031 to identify the prevailing rideshare insurance market forecast.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the rideshare insurance market size segmentation assists to determine the prevailing rideshare insurance market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global rideshare insurance market trends, key players, market segments, application areas, and market growth strategies.

Rideshare Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.1 billion |

| Growth Rate | CAGR of 11.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 230 |

| By Coverage |

|

| By Region |

|

| Key Market Players | Progressive Casualty Insurance Company, Allstate Insurance Company, USAA, State Farm Mutual Automobile Insurance Company, Bingle Insurance, NerdWallet, Inc., Farmers, Erie Indemnity Co., AXA, Allianz |

Analyst Review

Hybrid insurance policies that provide coverage for both personal and commercial use of a vehicle are becoming more popular among rideshare drivers. These policies can be more cost-effective than separate policies for personal and commercial use. Further, as more drivers enter the rideshare market, the demand for specialized insurance coverage tailored to their unique needs is growing. In addition, insurance companies are increasingly leveraging technology to improve their offerings for rideshare drivers. For example, some companies are using telematics data to develop usage-based insurance policies that provide coverage based on how much a driver uses their car for ridesharing.

The COVID-19 outbreak had a negative impact on the rideshare insurance market owing to lockdowns and social distancing measures. As the pandemic has disrupted the rideshare industry, insurance companies have had to adjust their policies to reflect changes in demand and usage patterns. For example, some providers have offered temporary policy adjustments to reduce premiums for drivers who were not actively using their vehicles for rideshare services. This, in turn, fostered the growth of the market during the pandemic.

Moreover, in June 2020, Buckle, a technology-driven financial services company, acquired Gateway Insurance Company (Gateway), including its 47 state insurance licenses. Gateway was formerly an indirect subsidiary of Atlas Financial Holdings, Inc. (Atlas), which provided auto insurance to the light commercial automobiles market in the U.S. With this acquisition, Buckle was able to provide comprehensive, affordable auto insurance to the commercial auto market, providing protection to part-time rideshare and delivery drivers, full-time taxicab and limousine drivers, non-emergency para-transit drivers, and transportation network companies (TNCs).

The key players in the rideshare insurance market are Allstate Insurance Company, Progressive Casualty Insurance Company, State Farm Mutual Automobile Insurance Company, AXA, Allianz, Bingle Insurance, USAA, NerdWallet, Inc., Farmers, and Erie Indemnity Co. Major players that operate in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for rideshare insurance across the globe, major players are collaborating to provide differentiated and innovative products.

The rideshare insurance market is estimated to grow at a CAGR of 11.1% from 2023 to 2032.

The rideshare insurance market is projected to reach $6.05 billion by 2032.

Increase in demand for ridesharing services and rise in awareness about rideshare insurance majorly contribute toward the growth of the market.

The key players profiled in the report include rideshare insurance market analysis includes top companies operating in the market such as Allstate Insurance Company, Progressive Casualty Insurance Company, State Farm Mutual Automobile Insurance Company, AXA, Allianz, Bingle Insurance, USAA, NerdWallet, Inc., Farmers, and Erie Indemnity Co.

The key growth strategies of rideshare insurance players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...