Rigid Plastic Packaging Market Overview

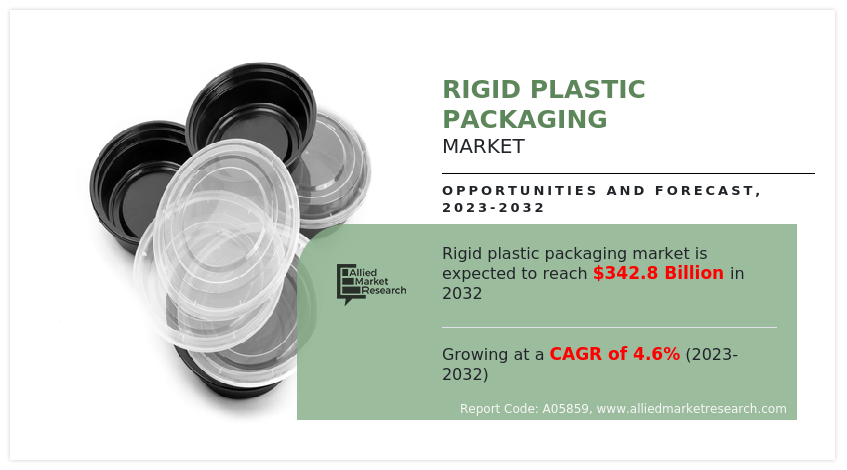

The Global Rigid Plastic Packaging Market size was valued at $218.6 billion in 2022, and is projected to reach $342.8 billion by 2032, growing at a CAGR of 4.6% from 2023 to 2032. The market has grown significantly due to increased consumer goods demand, better recycling rates, and low material costs. However, growth may be limited by preference for flexible packaging, strict environmental regulations, and raw material price volatility. Rising global e-commerce sales, however, present lucrative market opportunities.

Market Dynamics & Insights

- The rigid plastic packaging industry in Asia-Pacific held a significant share of over 37% in 2022.

- The rigid plastic packaging industry in Mexico is expected to grow significantly at a CAGR of 5.5% from 2023 to 2032

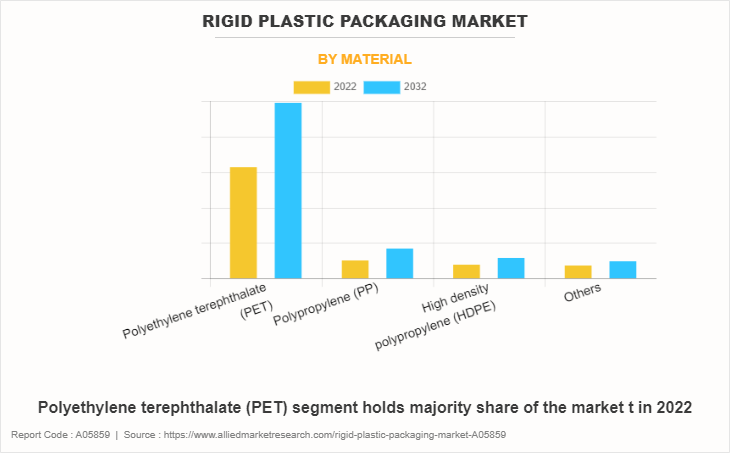

- By material, Polyethylene terephthalate (PET) is one of the dominating segments in the market and accounted for the revenue share of over 71.5% in 2022.

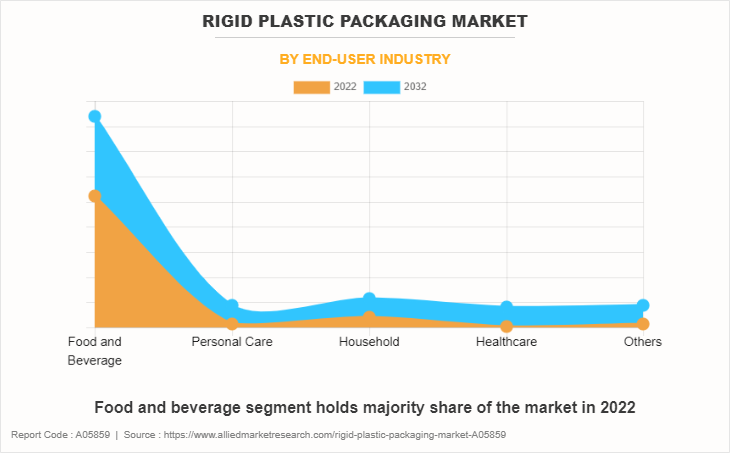

- By end-user, healthcare segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2022 Market Size: $218.6 Billion

- 2032 Projected Market Size: $342.8 Billion

- CAGR (2023-2032): 4.6%

- Asia Pacific: Largest market in 2022

- Asia Pacific: Fastest growing market

What is Meant by Rigid Plastic Packaging

Rigid plastic packaging involves utilization of plastic materials such as polypropylene (PP), high-density polyethylene (HDPE), and polyethylene (PET) for packaging of new bottles and containers. These materials are durable and lightweight. Polyethylene and polypropylene packaging solutions are applicable across various industries such as food & beverages, agriculture, aerospace, automotive, and medical.

Rigid Plastic Packaging Market Dynamics

The rise in global consumption of consumer goods acts as a significant driver for this market. As consumer demand for various products increases globally, there is a subsequent need for efficient and durable packaging solutions. Rigid plastic packaging fulfills this requirement by offering secure, versatile, and cost-effective packaging options, aligning with the escalating demand for packaged consumer goods.

The increased recycling rates of packaging serve as a crucial driving force for the rigid plastic packaging market. With growing environmental concerns, there's an increased emphasis on sustainability and recycling. Advances in recycling technologies and increase in awareness among consumers & industries have led to enhanced recycling rates for rigid plastic packaging. This aspect significantly boosts the market by addressing sustainability concerns and aligning with consumer preferences for eco-friendly packaging options. The growth of the rigid plastic packaging market is majorly driven by rapid expansion of the food & beverage industry, which, in turn, fuels the demand for bottles, jars, fruit juice containers, food package containers, and foodie bags. Rise in demand for cycle wheel, containers, and electronics switches further fuels the rigid plastic packaging market growth.

In addition, rigid plastic packaging solutions are used in various industry verticals such as agriculture, medical, personal care, and pharmaceuticals, owing to rise in demand for plastic packaging systems. The healthcare industry in various countries such as the UK, the U.S., and India is growing at a significant pace, due to increase in investments in this sector by government. For instance, in 2021, the UK Government and non-government spent approximately $330 billion on the healthcare industry. This is expected to rise in demand for containers, bottles, and tubes to store medicines.

Major players, such as ALPLA Werke Alwin Lehner GmbH & Co KG and Amcor Plc., are engaged in offering plastic packaging solutions. For instance, in May 2021, ALPLA Werke Alwin Lehner GmbH & Co KG launched a cap made up of polypropylene (PP) for viscous liquids such as mayonnaise and ketchup. Polypropylene serves as an ideal packaging solution and is cost-effective.

However, stringent government regulations toward the use of plastic and fluctuation in raw material prices are anticipated to restrain the growth of the global rigid plastic packaging market. On the contrary, rise in e-commerce sales presents a promising avenue for the robust expansion of the rigid plastic packaging market share. As online retail continues to flourish, the demand for secure, durable, and cost-effective packaging solutions rises significantly. Rigid plastic packaging offers versatility, ensures product safety during transit while being lightweight and customizable. This trend aligns with consumer preferences for sustainable, recyclable materials, driving the market's growth. Moreover, convergence of e-commerce's upward trajectory and adaptability of rigid plastic packaging sets the stage for lucrative opportunities and substantial market expansion in the foreseeable future.

Rigid Plastic Packaging Market Segmental Overview

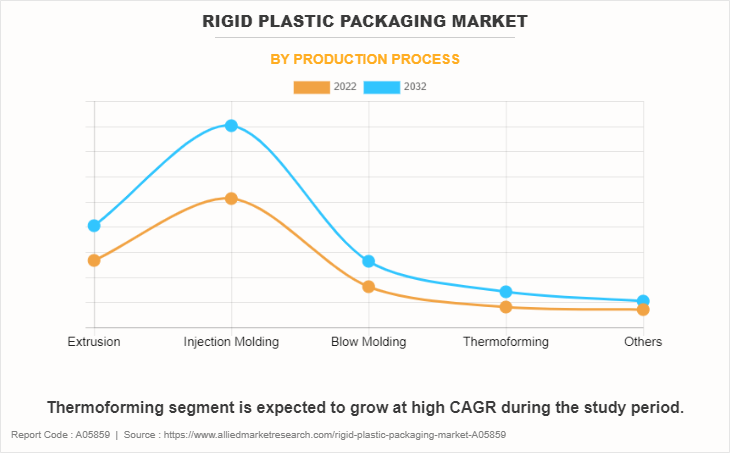

The rigid plastic packaging market is segmented into material, production process, end-user industry, and region. Depending on material, the market is segregated into polyethylene (PET), polypropylene (PP), high-density polyethylene (HDPE), and others. On the basis of production process, it is fragmented into extrusion, injection molding, blow molding, thermoforming, and others. By end-user industry, the market is categorized into food & beverages, personal care, household, healthcare, and others.

By Material:

The rigid plastic packaging market is divided into polyethylene (PET), polypropylene (PP), high-density polyethylene (HDPE), and others. Polyethylene terephthalate (PET) is a thermoplastic polymer resin, which is used in combination with glass fiber for engineering resins, fibers for clothing, thermoforming for manufacturing, and containers for foods & beverages. Polypropylene (PP) is a thermoplastic polymer, which is manufactured via chain growth polymerization from the monomer propylene. High-density polyethylene (HDPE) is a thermoplastic polymer manufactured from the monomer ethylene. Others include low-density polyethylene (LDPE), polylactide (PLA), polystyrene (PS), and polyvinyl chloride (PVC). The polyethylene (PET) segment dominated the market in 2022, owing to associated benefits of polyethylene such as low cost, robustness, and enhanced chemical resistance. The polypropylene (PP) segment is expected to exhibit the highest CAGR share in the product type segment in the rigid plastic packaging market during the forecast period.

By Production Process:

The rigid plastic packaging market is divided into extrusion, injection molding, blow molding, thermoforming, and others. The extrusion process is used for mass production of extruded plastic parts such as piping/tubing, weather stripping, deck railings, wire insulation, fencing, plastic films & sheeting, and thermoplastic coatings with high precision and negligible wastage. The injection molding process is used for mass production of injection molded plastic parts. Blow molding is a manufacturing process used to construct hollow plastic parts by inflating heated plastic tube and form the bottle in attractive shape. Blow molded parts use materials such as polystyrene, polyethylene, polypropylene, and polyvinyl chloride. The other segment includes rotational molding, compression molding, vacuum casting, and polymer casting. The injection molding segment led the global rigid plastic packaging market forecast in 2022, as injection molding exhibits features such as high efficiency, enhanced strength, and low labor costs. The thermoforming segment is expected to exhibit the highest CAGR share in the application segment in the rigid plastic packaging market during the forecast period.

By End-User Industry:

The rigid plastic packaging market is divided into food & beverages, personal care, household, healthcare, and others. The food & beverages segment is expected to be the largest revenue contributor during the forecast period, owing to rise in demand for jars, bottles, and containers from the industry. The healthcare segment is expected to exhibit the highest CAGR share in the payload segment in the rigid plastic packaging market during the forecast period.

By Region:

Region wise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific is expected to govern the market during the forecast period, owing to rise in industrialization and rapid urbanization.

Competition Analysis

Key market players profiled in the report include ALPLA-Werke Alwin Lehner GmbH & Co KG, Amcor Limited, DS Smith Plc, Berry Plastics Corporation, Klöckner Pentaplast, Plastipak Holdings, Inc., Pactiv Evergreen Inc, Sealed Air Corporation, Silgan Holdings, Inc., and Sonoco Products Company.

Major companies in the market have adopted product launch, business expansion, and other strategies as their key developmental strategies to offer better products and services to customers in the rigid plastic packaging market.

What are the examples of expansion product launch and other strategies on the market

- In January 2022, Plastipak has successfully completed the expansion of its manufacturing facility in Bascharage, Luxembourg. This expansion empowers the plant to elevate its annual production capacity of recycled polyethylene terephthalate (PET) by an impressive 136%.

- In July 2023, DS Smith has officially announced a $36.57 million investment aimed at enhancing and modernizing its trio of packaging facilities situated in Greece. The locations encompass a packaging plant located in Ancient Corinth, Greece, a 'Box Plant' situated in the town of Ierapetra, Crete, and a box storage facility in Thessaloniki, Greece. This substantial investment initiative is scheduled to unfold across the span of the next two years.

- In August 2023, DS Smith, a prominent provider of sustainable packaging solutions, has revealed its recent agreement to purchase Bosis doo, an esteemed packaging company located in Serbia. This acquisition harmonizes with the company's current packaging endeavors in Eastern Europe and is poised to bolster its expansion efforts within the region.

- In June 2023, ALPLA Group acquired iTEC Packaging situated in Mansfield, UK. iTEC Packaging specializes in producing closures tailored for the dairy, food, and beverage sectors. This acquisition aims to expedite the integration of post-consumer recycled materials into their closures, while also enriching their product range with a wider selection featuring heightened recycled content.

- In January 2021, ALPLA Werke Alwin Lehner GmbH & Co KG opened a new plastic extrusion facility in Anagni, Italy. It has a capacity of 15,000 tons per year. The business expansion was done by approximately $6.02 million on implement food grade made by PET bottles.

- In July 2023, Amcor Rigid Packaging introduces 100% recycled PET (rPET) bottles for Ron Rubin Winery's BLUE BIN wine series in 750ml sizes. This eco-friendly packaging minimizes greenhouse gas emissions, offering a shatterproof, lightweight option for consumers on-the-go. The initiative follows a two-year assessment by Ron Rubin to deliver premium, sustainable wines for environmentally conscious customers.

- In August 2023, Amcor has entered an agreement to purchase Phoenix Flexibles, aiming to expand its offerings of environmentally friendly packaging within India's rapidly growing market. This acquisition is anticipated to enable Amcor to provide a wider array of sustainable packaging solutions.

- In September 2023, Pactiv Evergreen, a top North American fresh food and beverage packaging manufacturer, collaborates with ExxonMobil, a pioneer in recycling tech. Together, they'll deliver certified-circular polypropylene (PP) packaging using ExxonMobil’s Exxtend tech. This innovative solution meets stringent food contact regulations, benefitting major food brands and service providers.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the rigid plastic packaging market analysis from 2022 to 2032 to identify the prevailing rigid plastic packaging market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the rigid plastic packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global rigid plastic packaging market trends, key players, market segments, application areas, and market growth strategies.

Rigid Plastic Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 342.8 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 220 |

| By Material |

|

| By Production Process |

|

| By End-user Industry |

|

| By Region |

|

| Key Market Players | Sonoco Products Company, PLASTIPAK HOLDINGS, INC., Berry Global Inc., Klockner Pentaplast Group GmbH & Co. KG, Amcor PLC, Pactiv Evergreen Inc., DS Smith Plc, ALPLA Werke Alwin Lehner GmbH & Co KG, Sealed Air Corporation., Silgan Holdings Inc. |

Analyst Review

The rigid plastic packaging market has created significant value for consumer companies through innovations that reduce production & shipping costs and design advances that enable brand differentiation & boost their sales. Rigid plastic is used to manufacture jars, bottles, soft drink containers, cosmetics, personal care, and pharmaceutical products. Materials such as high-density polyethylene (HDPE), polypropylene (PP), polyethylene terephthalate (PET), and polyvinyl chloride (PVC) are used, owing to their associated benefits such as prolonged durability, robust & economic nature, easy availability.

Emerging countries witness market growth due to increased consumer demand, whereas mature consumer markets experience growth propelled by demographic shifts. In addition, increase in disposable income and rapid urbanization creates a new customer base for companies producing consumer goods. There exists a strong connection between per capita income and packaging consumption, leading emerging markets to lag behind developed ones in rigid plastics packaging consumption.

The rapid growth of online retail significantly impacts the global rigid plastics packaging market by necessitating sturdy packaging for product protection during delivery. The trend toward smaller and single-person households drives the demand for smaller pack sizes and single-portion packaging, resulting in increased packaging per unit of consumed products.

Looking at different regions, the Asia-Pacific region is anticipated to generate the highest revenue during the forecast period owing to its dense population and rise in demand in the packaging industry. Following this region, Europe, North America, and LAMEA (Latin America, Middle East, and Africa) are expected to follow in terms of revenue generation.

The global rigid plastic packaging market was valued at $218,621.3 million in 2022, and is projected to reach $342,772.5 million by 2032, registering a CAGR of 4.6% from 2023 to 2032.

The forecast period considered for the global rigid plastic packaging market is 2022 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

The latest version of global rigid plastic packaging market report can be obtained on demand from the website.

The base year considered in the global rigid plastic packaging market report is 2022.

The major players profiled in the rigid plastic packaging market include ALPLA-Werke Alwin Lehner GmbH & Co KG, Amcor Limited, DS Smith Plc, Berry Plastics Corporation, Klöckner Pentaplast, Plastipak Holdings, Inc., Pactiv Evergreen Inc, Sealed Air Corporation, Silgan Holdings, Inc., and Sonoco Products Company.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Based on material, the polyethylene terephthalate (PET) segment was the largest revenue generator in 2022.

Loading Table Of Content...

Loading Research Methodology...