Road Assistance Insurance Market Research, 2031

The global road assistance insurance market was valued at $5.9 billion in 2021, and is projected to reach $13.9 billion by 2031, growing at a CAGR of 9.4% from 2022 to 2031.

Automakers and other service companies provide state farm roadside assistance for vehicles. This service offers help if the car malfunctions or crashes. Car roadside assistance advantages on-site assistance, including mechanical and electrical repairs as well as other typical roadside issues like flat tires, and dead batteries. The market for automobile roadside assistance progressive cover is undergoing a significant growth because of the increasing number of aging vehicles that face several electrical & mechanical issues.

The rise in the number of older vehicles with numerous electrical and mechanical problems is the major factor driving the growth of the road assistance insurance market. In addition, the road assistance insurance industry is growing since app-based services have sped up roadside help response times. Extreme weather conditions have an influence on many drivers throughout the world, especially in cold weather when battery power drains and battery jump starts are necessary. Further, icy and snowy driving conditions in some areas enhance the likelihood of deadly traffic collisions, necessitating roadside vehicle assistance.

However, the pay per use service of the roadside vehicle assistance insurance services is likely to restrain the market growth. On the contrary, several governments have taken steps to encourage the use of hybrid and electric vehicles, such as granting subsidies and tax rebates, in order to reduce carbon emissions. As a result, hybrid and electric vehicle sales have increased, necessitating the expansion of vehicle roadside help services. Thus, this factor is expected to provide lucrative opportunities for road assistance insurance market to grow in upcoming years.

The report focuses on growth prospects, restraints, and trends of the road assistance insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the road assistance insurance market outlook.

The road assistance insurance market is segmented into Vehicle Type, Coverage and Distribution Channel.

Segment Review

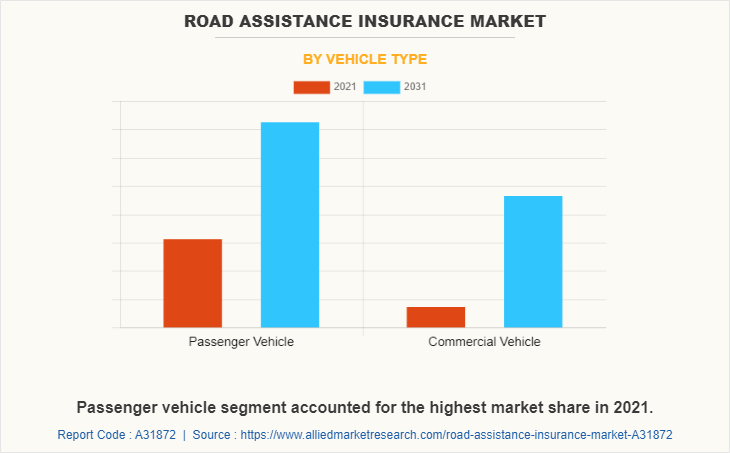

The road assistance insurance market is segmented into vehicle type, coverage, distribution channel, and region. By vehicle type, the market is differentiated into passenger vehicle and commercial vehicle. Depending on coverage, it is fragmented into towing, jump start/pull start, lockout/replacement key service, flat tire, fuel delivery, and others. The distribution channel segmented into insurance agents/brokers, direct response, banks, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By vehicle type, the passenger vehicle segment attained the highest road assistance insurance market share in road assistance insurance market in 2021. This is attributed to the fact that roadside assistance insurance for passenger vehicle offers an additional layer of protection against specific scenarios.

Region wise, Europe dominated the road assistance insurance market size in 2021. This was attributed to the escalated per capita income, consumer preference for lavishness, high standard of living, and rise in the sale of premium vehicles.

The key players that operate in the global road assistance insurance market include as Agero, Inc., Allstate Insurance Company, American Express Company, Erie Indemnity Co., GEICO, IFFCO-Tokio General Insurance Company Limited, Nationwide Mutual Insurance Company, Progressive Casualty Insurance Company, USAA, and Viking Assistance Group. These players have adopted various strategies to increase their market penetration and strengthen their position in the road assistance insurance industry.

The COVID-19 pandemic has had a negative effect on the market for roadside car assistance since production facilities had to temporarily shut down due to lockdowns, there was a shortage of labor, and there was less of a demand for their products. However, this market is expected to grow steadily over the next few years, despite the new coronavirus posing some minor restrictions. Further, rising quantity of vehicle issues, such as worn tires, drained batteries, and worn brake lines owing to lockdown imposed by government has propelled the growth of road assistance insurance market during pandemic.

Top Impacting Factors

Rise in need for Safety and Security of Supplying Activities

Road assistance insurance services are vital to ensure the safety and security of motorists and vehicle drivers, and these can be offered 24/7 throughout the year for consumers. In case a vehicle experiences a breakdown or is involved in a road crash, road assistance insurance can fix the issue on the spot most of the time and covers the costs. Furthermore, in case of critical accidents where the issue cannot be resolved on the spot, road assistance insurance services assure that the vehicle reaches its requested destination, such as a vehicle repair shop, by means of towing and other such services. These benefits boost the demand for road assistance insurance.

Surge in Adoption of Road Assistance Insurance by SMEs in Developing Countries

An increase in investments in road assistance insurance tools for monitoring pre-trade, post-trade, and examination of cross-asset and cross-market trades among the small number of organizations drives the growth of the market. In addition, various fintech organizations are adopting road assistance insurance systems to drive their revenue growth opportunity and to improve service efficiencies, which fuels the adoption of road assistance insurance.

For instance, in August 2022, USAA introduced an auto crash detection technology, implemented into its SafePilot app, to detect possible accidents and assist drivers in case of a collision. As one of the first auto insurance carriers to do so, USAA launches innovative technology to accelerate the claims process and simplify the customer's experience in handling an auto accident and boost its road assistance insurance product’s growth. SafePilot is a behavior-based insurance plan that rewards drivers for safe driving behaviors with policy discounts. Embedded into the SafePilot app, the crash detection technology uses sensors to detect a potential crash and notifies the user to verify whether or not a collision has occurred. These are the major factors propelling the road assistance insurance market growth.

Growing Adoption of Connected and Autonomous Vehicles

The growing adoption of connected and autonomous vehicles is expected to create lucrative opportunities for the growth of the market. Connected cars generate a large amount of data that provide insights such as current vehicle location, real-time running status, and other crucial vehicle usage information. This enables the company to find the breakdown cause and assure the provision of quick vehicle roadside assistance. Furthermore, the connected car-generated data assist the company in solving the vehicle breakdown problem in a short time. In addition, several governments have taken steps to encourage the use of hybrid and electric vehicles, such as granting subsidies and tax rebates, in order to reduce carbon emissions. As a result, hybrid and electric vehicle sales have increased, necessitating the expansion of vehicle roadside help services. Thus, this factor is expected to provide lucrative opportunities for road assistance insurance market to grow in upcoming years.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the data analytics in banking market analysis from 2021 to 2031 to identify the prevailing road assistance insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities in the road assistance insurance market forecast.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the road assistance insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global road assistance insurance market trends, key players, market segments, application areas, and market growth strategies.

Road Assistance Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 13.9 billion |

| Growth Rate | CAGR of 9.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 230 |

| By Vehicle Type |

|

| By Coverage |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Agero, Inc., GEICO, American Express Company, Nationwide Mutual Insurance Company, Viking Assistance Group, Erie Indemnity Co., Progressive Casualty Insurance Company, IFFCO-Tokio General Insurance Company Limited, USAA, Allstate Insurance Company |

Analyst Review

Roadside assistance is an extra protection that enables to get aid in an emergency. It is a supplement to the owner's automobile insurance. In addition, roadside assistance can grant the right to aid in an emergency. It is especially useful if the owner finds it difficult to imagine having small repairs made somewhere new. Moreover, a few well-known automakers, including Hyundai, offer temporary support free of charge. It is also a choice that one may make when purchasing auto insurance; this is especially sensible if the vehicle has logged enough kilometers and has a higher likelihood of breaking down.

The COVID-19 outbreak had a negative impact on the road assistance insurance market owing to drop in demand due to lockdown implemented by the authorities. However, digital transformation in road assistance insurance market has helped the market demand to grow during the pandemic. This, as a result, promoted the demand for road assistance insurance, thereby accelerating the revenue growth.

The road assistance insurance market is fragmented with the presence of regional vendors such as Agero, Inc., Allstate Insurance Company, American Express Company, Erie Indemnity Co., GEICO, IFFCO-Tokio General Insurance Company Limited, Nationwide Mutual Insurance Company, Progressive Casualty Insurance Company, USAA, and Viking Assistance Group. Major players operating in this market are adopting various strategies that include product launch and acquisitions to reduce supply and demand gaps. With increase in awareness and demand for road assistance insurance across the globe, major players are collaborating on their product portfolio to provide differentiated and innovative products.

The road assistance insurance market is estimated to grow at a CAGR of 9.4% from 2022 to 2031.

The road assistance insurance market is projected to reach $13.87 billion by 2031.

Rise in need for safety and security of supplying activities, and surge in the adoption of road assistance insurance by SMEs in developing majorly contribute toward the growth of the market.

The key players profiled in the report include Agero, Inc., Allstate Insurance Company, American Express Company, Erie Indemnity Co., GEICO, IFFCO-Tokio General Insurance Company Limited, Nationwide Mutual Insurance Company, Progressive Casualty Insurance Company, USAA, and Viking Assistance Group.

The key growth strategies of road assistance insurance market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...