Road Transport Logistics Market Research, 2034

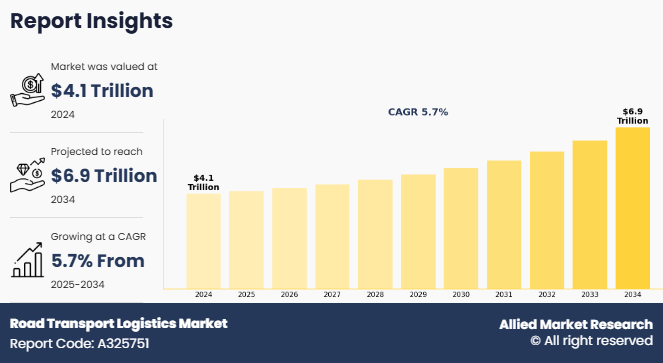

The global road transport logistics market size was valued at $4.1 trillion in 2024, and is projected to reach $6.9 trillion by 2034, growing at a CAGR of 5.7% from 2025 to 2034.

Road transport logistics refers to the planning, execution, and management of freight and passenger transportation via road networks. It plays a crucial role in supply chain operations, ensuring the efficient movement of goods between manufacturers, warehouses, retailers, and consumers. This sector includes various services such as freight forwarding, fleet management, last-mile delivery, and cross-border transportation. Furthermore, key components of road transport logistics industry include vehicle routing, load optimization, real-time tracking, and regulatory compliance. The industry is evolving with advancements in digital logistics solutions, automation, and the integration of sustainable transport options such as electric and hydrogen-powered vehicles.

Key Takeaways

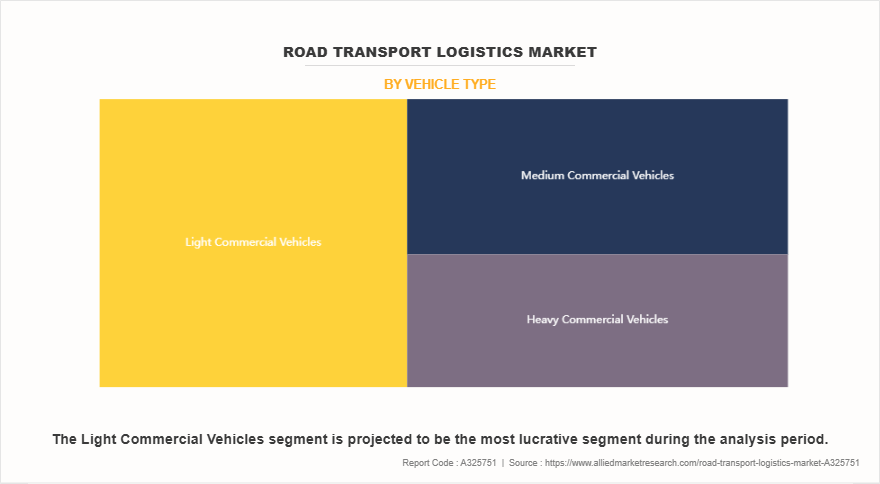

- On the basis of vehicle type, the light commercial vehicle segment held the largest share in the road transport logistics market in 2024.

- By end use, the agriculture segment was the major shareholder in 2024.

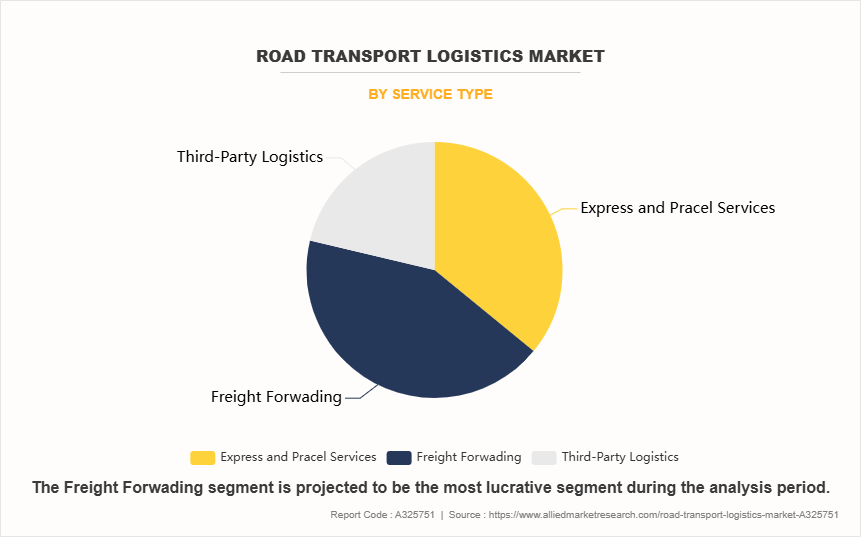

- By service type, the freight forwarding segment dominated the market, in terms of share, in 2024.

- By destination, the international segment dominated the market, in terms of share, in 2024.

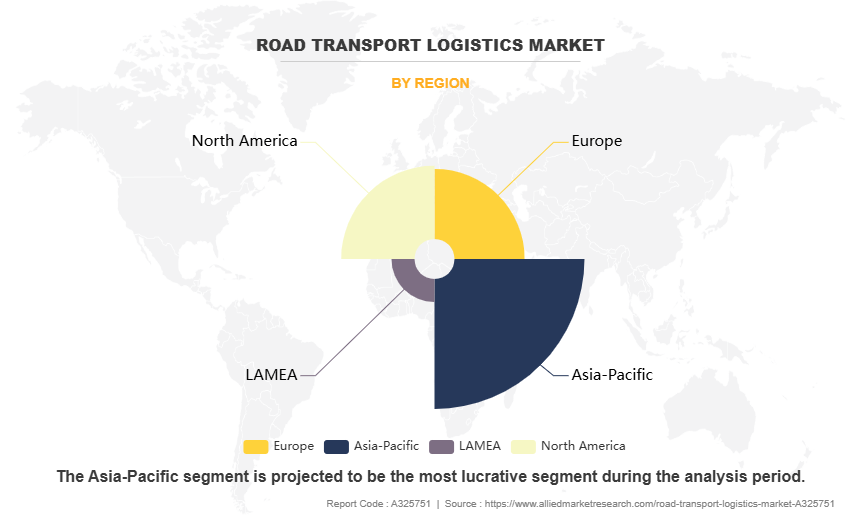

- Region wise, Asia-Pacific region held the largest market share in 2023.

Growing e-commerce demand, expanding infrastructure, and the adoption of smart technologies are driving the sector's growth. Challenges such as fuel price fluctuations, traffic congestion, and environmental concerns are shaping industry strategies. Road transport logistics industry remains a vital component of global trade, supporting economic development and ensuring the seamless flow of goods across regions.

For instance, in March 2024, DHL Express inaugurated its first Automated Shipment Sorting Hub in New Delhi, significantly expanding the capacity of the DHL Express Delhi Gateway. This development increased capacity nearly sixfold compared to its initial setup two decades ago. Spanning 34,256 square feet, the hub features automated sorting machines capable of processing 2,000 shipments per hour, resulting in a 30% boost in productivity. Equipped with 18 sorting chutes, 11 truck docks, and eight telescopic conveyors, the facility streamlines inbound shipment processing, improving transit times and enhancing overall customer service.

Moreover, in May 2023, FedEx Express, a subsidiary of FedEx Corp. and a global leader in express transportation, launched a comprehensive Road Transport Logistics solution for shipping dangerous goods in Cebu. Local businesses can now ship over 2,200 types of regulated items, including paints, perfumes, bleaches, and lithium battery-powered devices, to international markets with ease. Dangerous goods, which pose potential health, safety, or environmental risks, are meticulously packed, labeled, documented, and handled by FedEx-trained personnel to ensure safe and compliant delivery to their destinations.

The rise of e-commerce and increasing demand for last-mile delivery services are driving growth in the road transport logistics market size. As online shopping expands, businesses require faster and more efficient transportation networks to meet customer expectations. This has led to greater investments in fleet management, route optimization, and real-time tracking solutions. The demand for same-day and express deliveries is accelerating the need for advanced logistics infrastructure and technology-driven transport solutions. Furthermore, advancements in digital logistics and real-time tracking solutions and an increasing adoption of sustainable and electric vehicles in logistics have driven the demand for road transport logistics. However, high fuel costs and fluctuating oil prices are hampering the growth of the road transport logistics market by increasing operational expenses for transportation companies. Rising fuel prices lead to higher freight charges, affecting profitability and supply chain efficiency. This volatility forces businesses to adopt cost-cutting measures and explore alternative fuel options. Moreover, stringent government regulations and compliance costs are major factors that hamper the growth of the road transport logistics market share. On the contrary, the expansion of cross-border trade and free trade agreements presents a lucrative opportunity for the road transport logistics market. Reduced trade barriers and streamlined regulations enhance the movement of goods, increasing demand for efficient logistics services. This fosters investment in infrastructure, advanced fleet management, and digital solutions to optimize cross-border transportation.

Segment Review

The global road transport logistics market is segmented on the basis of vehicle type, end user, service type, destination, and region. On the basis of vehicle type, the market is divided into light commercial vehicles, medium commercial vehicles, and heavy commercial vehicles. By end user, it is classified into agriculture, fishing & forestry, manufacturing, oil and gas, wholesale & retail trade, and others. On the basis of service type, it is categorized into express and parcel services, freight forwarding, and third-party logistics. By Destination, the market is bifurcated into domestics, and international. Region-wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Vehicles Type

On the basis of mode of vehicles type, the light commercial vehicles segment attained the highest market share in 2023 in the road transport logistics market. This is due to their flexibility, cost-efficiency, and suitability for urban and regional deliveries. LCVs are ideal for short-haul transportation and last-mile delivery services, which are increasingly in demand due to the growth of e-commerce and retail distribution. Their ability to navigate congested city routes and deliver goods directly to consumers or retail outlets makes them a preferred choice for logistics providers. In addition, lower fuel consumption and maintenance costs contribute to their widespread adoption across various industries.

By Service Type

On the basis of service type, the freight forwarding segment acquired the highest market share in 2023 in in the road transport logistics market. This is due to the increase in need for efficient coordination of cargo movement across domestic and international routes. Freight forwarders play a crucial role in managing transportation, documentation, and customs clearance, offering end-to-end logistics solutions. Their ability to consolidate shipments, optimize routes, and reduce transit times appeals to businesses seeking reliable and cost-effective delivery options. The rise in global trade, e-commerce, and just-in-time delivery models has further boosted demand for freight forwarding services, making them a key component of modern road logistics operations.

By Region

Region wise, Asia-Pacific attained the highest market share in 2023 and emerged as the leading region in the road transport logistics market. This growth was driven by rapid industrialization, expansion of e-commerce, and significant infrastructure development across countries such as China, India, and Southeast Asian nations. High demand for goods movement within densely populated areas and between manufacturing hubs boosted the need for efficient road transport services. Government initiatives to improve road connectivity and trade corridors supported market expansion. The region’s growing middle-class population and rising consumption further contributed to increased logistics activity, solidifying Asia-Pacific’s dominant position in the market.

The report focuses on growth prospects, restraints, and trends of the road transport logistics market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the road transport logistics market insights.

Competitive Analysis

The report analyses the profiles of key players operating in the road transport logistics market such as DHL Group, United Parcel Service of America, Inc., FedEx, Kuehne+Nagel, DSV, CEVA Logistics, DB Schenker, C.H. Robinson Worldwide, Inc., GEODIS SA and J.B. Hunt Transport Services. These players have adopted various strategies to increase their market penetration and strengthen their position in the Road Transport Logistics market.

Rise in E-Commerce and Demand for Last-Mile Delivery Services

The rise in e-commerce and increase in demand for last-mile delivery services are significantly driving the expansion of the road transport logistics market growth. With the surge in online shopping, businesses require efficient logistics solutions to ensure timely and seamless deliveries. Consumers expect faster shipping, pushing companies to optimize their supply chains and invest in advanced transportation networks. Road transport logistics plays a crucial role in facilitating last-mile deliveries, enabling goods to reach customers in urban and rural areas efficiently. For instance, in November 2023, Amazon has introduced its Global Last Mile Fleet Program in India, deploying 100% electric vehicles (EVs) to enhance sustainability in road transport logistics. This initiative, a global first for Amazon, allows Delivery Service Partners (DSPs) to lease custom-designed three-wheeler EVs through a fleet management company. By providing access to zero-emission, safe, and efficient delivery vehicles, Amazon is reinforcing its commitment to eco-friendly last-mile logistics.

Moreover, the rise of same-day and next-day delivery services has increased the demand for light and medium commercial vehicles to enhance delivery speed and flexibility. The integration of digital tracking systems, route optimization software, and electric delivery vehicles is further transforming the industry. In addition, the expansion of retail and e-commerce giants into new markets has fueled cross-border road transport logistics, making it an essential component of global trade and supply chain networks.

Advancements in Digital Logistics and Real-Time Tracking Solutions

Advancements in digital logistics and real-time tracking solutions are boosting the demand for the road transport logistics market by enhancing efficiency, visibility, and decision-making. Companies are integrating IoT, AI-driven route optimization, and cloud-based logistics management to improve fleet tracking, reduce delays, and optimize delivery schedules. For instance, in December 2023, Fujitsu launched a cloud-based logistics data standardization and visualization service to enhance efficiency in road transport logistics. This solution enables shippers, logistics companies, and vendors to streamline data integration, improve real-time shipment tracking, and optimize fleet management. By enhancing supply chain visibility, it supports faster, more reliable, and cost-effective road transport operations.

Moreover, with the rise of e-commerce, just-in-time inventory, and cross-border trade, businesses require real-time shipment tracking to ensure transparency and meet customer expectations for faster deliveries. GPS-enabled tracking systems and predictive analytics help logistics providers anticipate demand fluctuations, optimize fleet utilization, and enhance supply chain resilience.

In addition, automated freight management and smart warehouses streamline operations, reducing costs and environmental impact. As businesses shift towards digital transformation, the adoption of data-driven logistics solutions continues to reshape the road transport logistics market share, making it more responsive, cost-effective, and sustainable while improving overall supply chain performance.

High Fuel Costs and Fluctuating Oil Prices

High fuel costs and fluctuating oil prices are hampering the demand for the road transport logistics market. The volatility in global crude oil prices directly impacts transportation costs, making freight and logistics operations more expensive. As fuel expenses account for a significant portion of total logistics costs, rising prices force logistics providers to either absorb the costs, reducing profitability, or pass them on to customers, increasing transportation rates. This leads to a decline in demand for road transport services, as businesses seek cost-effective alternatives such as rail or multimodal transportation.

In addition, fluctuating fuel prices create uncertainty in financial planning for logistics companies, affecting investment in fleet expansion and operational efficiency. The high operational costs also put pressure on small and medium-sized logistics providers, limiting their ability to compete with larger firms. Consequently, companies are increasingly exploring fuel-efficient technologies, electric vehicles, and alternative fuels to mitigate the impact of rising fuel costs in the road transport logistics market demand.

Expansion of Cross-Border Trade and Free Trade Agreements

The expansion of cross-border trade and free trade agreements presents a the road transport logistics market opportunity. As global trade continues to grow, the demand for efficient and seamless cross-border transportation solutions is increasing. For instance, in February 2025, Hong Kong Pharma Digital Technology Holdings Limited has partnered with a leading Chinese e-commerce platform to enhance cross-border logistics services, aiming to streamline pharmaceutical supply chains, improve delivery efficiency, and expand market accessibility for international trade. Free trade agreements (FTAs) between countries eliminate tariffs, reduce trade barriers, and simplify customs procedures, facilitating the smooth movement of goods across borders. This creates a strong demand for road transport logistics services to support supply chains and enhance trade efficiency.

In addition, the integration of regional economies through trade agreements, such as the U.S., Mexico, Canada Agreement (USMCA) and the Regional Comprehensive Economic Partnership (RCEP), further boosts cross-border freight transportation. Businesses benefit from reduced costs, faster deliveries, and expanded market access, driving investments in logistics infrastructure and fleet expansion.

With the rise in international trade and economic cooperation, logistics providers have a significant opportunity to optimize operations, expand networks, and improve last-mile delivery efficiency in cross-border trade routes.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the road transport logistics market analysis from 2023 to 2032 to identify the prevailing road transport logistics market forecast.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the road transport logistics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global road transport logistics market trends, key players, market segments, application areas, and market growth strategies.

Road Transport Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 6.9 trillion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2024 - 2034 |

| Report Pages | 345 |

| By Service Type |

|

| By Destination |

|

| By Vehicle Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | DB Schenker, United Parcel Service of America, Inc., FedEx, Geodis SA, CEVA Logistics, J.B. Hunt Transport Services, Inc., C.H. Robinson Worldwide, Inc., DSV, Kuehne+Nagel, DHL GROUP |

The global road transport logistics market is undergoing significant transformation, driven by technological advancements, sustainability initiatives, and evolving trade dynamics.

The leading application of the road transport logistics market is in the manufacturing sector. This industry heavily relies on efficient and timely transportation of raw materials and finished goods across supply chains.

Asia-Pacific is the largest regional market for Road Transport Logistics

$6865.9 billion is the estimated industry size of Road Transport Logistics

DHL Group, United Parcel Service of America, Inc., FedEx, Kuehne+Nagel, DSV, CEVA Logistics, DB Schenker, C.H. Robinson Worldwide, Inc., and J.B. Hunt Transport Services.

Loading Table Of Content...

Loading Research Methodology...