Roadside Drug Testing Devices Market Research, 2031

The global roadside drug testing devices market size was valued at $421.8 million in 2021, and is projected to reach $707.3 million by 2031, growing at a CAGR of 5.3% from 2022 to 2031. Roadside drug testing is screening of presence of drugs & alcohol in the blood while driving motor vehicles. It includes different devices such as breathalyzers and oral fluid testing kit. Oral fluid test kits are the ones where saliva sample is taken from the driver and is used to test the presence of traces of alcohol in blood. These tests are carried out as it is strictly prohibited to be under the influence of drugs while driving.

Market Dynamics

Increase in prevalence of drink and drive all over the globe, propel the growth of the market during the roadside drug testing devices market forecast. For instance, according to a report by the National Institute on Alcohol Abuse and Alcoholism in 2019, 10,142 people lost their lives as a result of drunk driving. Alarming rise in prevalence of death due to drink & drive is a primary factor fueling the growth of the global market. Further, advances in drug testing devices used for screening contribute to the market expansion. In addition, it is projected that new norms & regulations by drug enforcement management is projected to propel the growth of the roadside drug testing devices market. However, wrong result displayed by the devices and high cost of the devices restrain the expansion of the market.

Alcohol and drugs are detected with the help of breathalyzers, drug wipes, and oral fluids. Breathalyzers are compact, portable devices with a mouthpiece and two liquid-filled chambers, which determine the amount of alcohol in the system of persons suspected of being intoxicated. The subject exhales into a test container that is filled with a liquid potassium dichromate solution that is orange-red. Surfaces are examined for any indications of drug residue using a technique known as the drug wipe. Sweat or saliva tests may also be used on people. Law enforcement authorities may quickly screen drivers they suspect of being under the influence of narcotics using the drug wipe at the roadside.

World Health Organization (WHO) states that the risk of road accidents is increased due to increase in dependence on the psychoactive drug used. For instance, the risk of a fatal crash occurring among those who have used amphetamines is about 5 times the risk of someone who has not used it. Further, in high-income countries, around 20% of the injured drivers have excess alcohol content in their blood. As a result, there is a in demand for breath analyzers, driving the growth of the roadside drug testing devices market. Furthermore, remarkable government funding for deployment of breath analyzers to control alcohol & drug abuse is expected to drive the demand for the breath analyzers. In addition to this, adoption of breath analyzers by police & other law enforcement authorities around the globe will accelerate the market growth in the forecast period.

Although the growth of the market is driven by many factors, there are few concerns that may hinder the growth of the market. Inaccurate results associated with roadside drug testing devices is one such factor that hampers the roadside drug testing devices market growth. The device shows false results or negative results in some cases which is mainly due to technical errors associated with the device and malfunctioning due to cold weather conditions. In case of cold weather, batteries of devices are mainly affected and may get discharged early and frequently which may affect the results accuracy. Moreover, sometimes the results shown may be false due to the minor errors associated with the devices. In addition, sample contamination is also one of the main factors leading to the inaccurate results, thus causing hindrance to the growth of the market.

Impact of COVID-19 on Roadside Drug Testing Devices Market

Severe Acute Respiratory Syndrome Corona Virus-2 (SARS-CoV-2) is an infectious disease caused by the novel coronavirus (COVID-19), which originated in the Wuhan district in China in the late 2019, and since has spread to 212 countries. The virus was initially referred to as “novel coronavirus 2019” (2019-nCoV) by the WHO, However, on February 11, 2020, it was given the official name of SARS-CoV-2 by the International Committee on Taxonomy of Viruses. The WHO declared COVID-19 as pandemic on March 11, 2020, and by September 1, 2020, over 28.1 million people have been infected globally with over 909,000 deaths.

Nearly all industries have been impacted by the outbreak of COVID-19. Coronavirus crises forced healthcare organizations to devote the majority of their funds to fighting COVID-19. In addition, according to the National Highway Traffic Safety Administration, since the beginning of 2021, the percentage of people staying home per day has dropped from a high of 26% in January to approximately 23% in May and June. This suggests that while more people are traveling outside the home in 2021, the rates have not returned to pre-pandemic levels. However, these rates were normalized since second half of 2021 which is boosting the roadside drug testing devices market growth, owing to increasing in consumption of drugs & alcohol while driving among the major younger population.

The roadside drug testing devices Industry is segmented into sample type, substance type, and end users. By sample type, the roadside drug testing devices market is categorized into saliva, breath, and others. On the basis of substance type, the market is segregated into drugs and alcohol. End-user wise, the market is segmented into highway police and drug enforcement management. As per region, the roadside drug testing devices market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

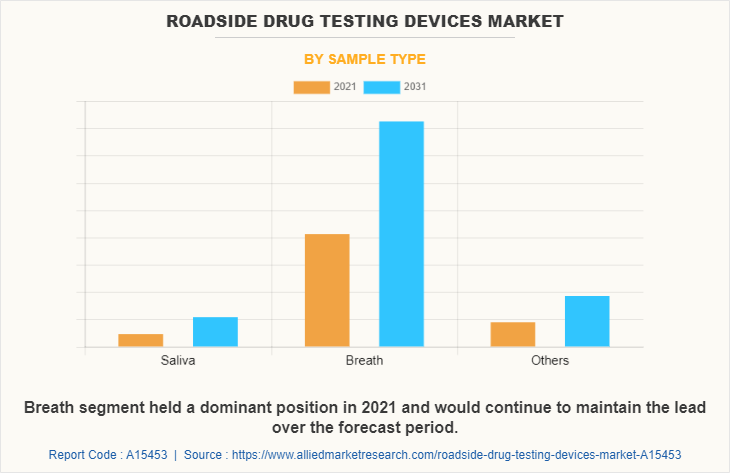

By Sample Type

On the basis of sample type, the breath segment dominated the roadside drug testing devices market and is expected to register the highest CAGR, owing to wide availability and new product launches & approval in this category.

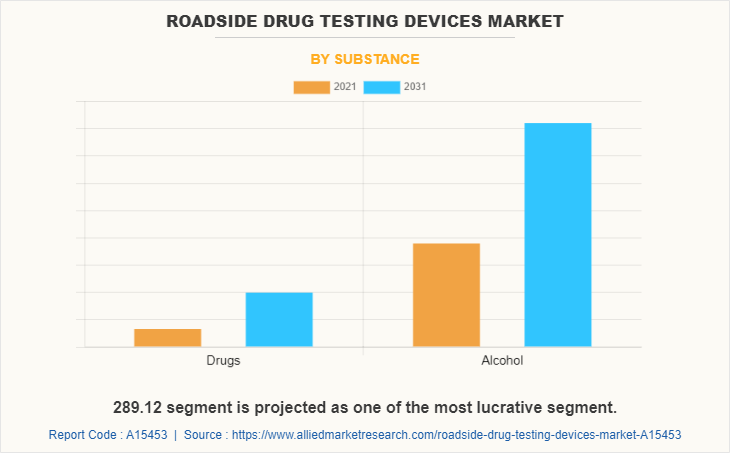

By Substance Type

On the basis of substance type, the alcohol segment was the major revenue contributor in 2021 and is expected to register the highest CAGR, owing to surge in the incidence of deaths due to drink & drive.

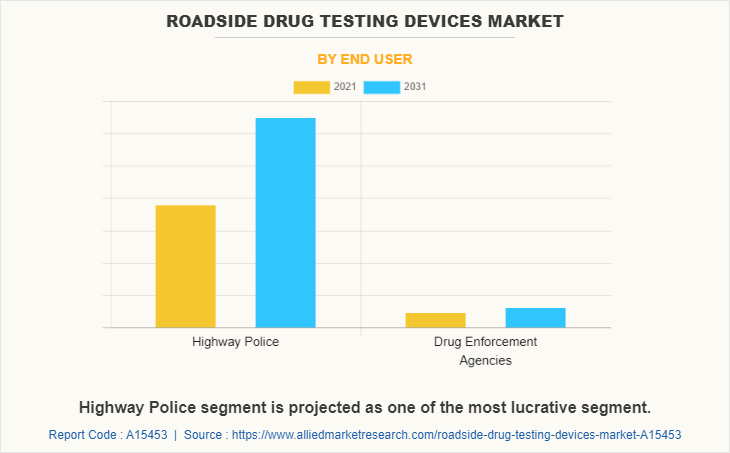

By End User

On the basis of end user, the highway police segment dominated the roadside drug testing devices market in 2021 and is expected to register the highest CAGR, owing to surge in the number of driving motor vehicles under the influence of alcohol & drugs.

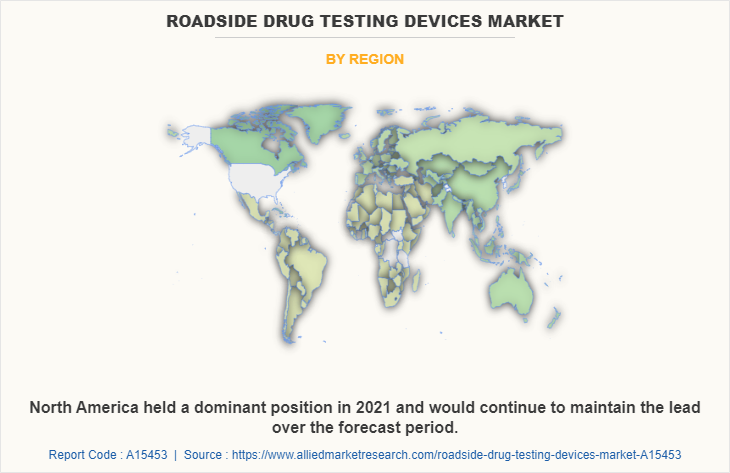

By Region

Region wise, North America had the highest roadside drug testing devices market share in 2021, and is expected to maintain its lead during the forecast period, owing to high prevalence rate of the alcoholism in this region. However, Asia-Pacific is expected to register the highest CAGR, due to the presence of high population base and untapped roadside drug testing devices market opportunities.

Some of the major companies that operate in the market include Abbott Laboratories., AK GlobalTech Corporation, Alcohol Countermeasure Systems Corp., Cannabix Technologies, Dräger, Intelligent fingerprinting, Lifeloc Technologies, Inc., Oranoxis Inc., Thermo Fisher Scientific, Inc., and UriTox LLC.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the roadside drug testing devices market analysis from 2021 to 2031 to identify the prevailing roadside drug testing devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the roadside drug testing devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global roadside drug testing devices market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the roadside drug testing devices market players.

- The report includes the analysis of the regional as well as global roadside drug testing devices market trends, key players, market segments, application areas, and roadside drug testing devices market growth strategies.

Roadside Drug Testing Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 707.3 million |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 203 |

| By Sample Type |

|

| By Substance |

|

| By End User |

|

| By Region |

|

| Key Market Players | Dräger, Alcohol Countermeasure Systems Corp., Oranoxis Inc., AK GlobalTech Corporation, UriTox LLC., Cannabix Technologies Inc., Intelligent Fingerprinting, Lifeloc Technologies, Inc., Thermo Fisher Scientific, Inc., Abbott Laboratories |

Analyst Review

This section provides the opinions of the top level CXOs on the roadside drug testing devices market. Roadside drug testing is a process of screening of traces of illegal drugs or alcohol by using sample such as blood, saliva, sweat, or by allowing the subject to exhale into the portable breathalyzer. The exhaled gas inside the breathalyzer is screened by the technique of gas chromatography and mass spectrometry.

The roadside drug testing devices include devices where samples such as blood, saliva, sweat, and breath are used. The breathalyzers are devices which analyzes exhaled breath of the subjects. Driving while intoxicated (DWI), sometimes known as driving under the influence (DUI), is when a person operates a vehicle while having a blood alcohol content (BAC) level of at least 0.08%. Overconsumption of alcohol slows down the driver's respiration rate and reaction time. Moreover, rise in the number of alcohol consumers further boosts the growth of the market.

North America is expected to witness the highest growth in terms of revenue, owing to rise in the prevalence of roadside accidents and presence of key players that manufacture & develop roadside drug testing devices. However, inaccurate results from roadside drug testing can hamper the market growth.

Increase in consumption of drink and drive all over the globe, propel the growth of the roadside drug testing devices market.

Drug detection is the leading application of Roadside Drug Testing Devices Market.

North America is the largest regional market for Roadside Drug Testing Devices.

The global roadside drug testing devices market is projected to reach $707.28 million by 2031, with a CAGR of 5.3% from 2022 to 2031.

Some of the major companies that operate in the market include Abbott Laboratories., AK GlobalTech Corporation, Alcohol Countermeasure Systems Corp., Cannabix Technologies, Dräger, Intelligent fingerprinting, Lifeloc Technologies, Inc., Oranoxis Inc., Thermo Fisher Scientific, Inc., and UriTox LLC.

The base year is 2021 in Roadside Drug Testing Devices market.

Yes, the Roadside Drug Testing Devices market report provides PORTER Analysis.

Loading Table Of Content...