Robo Advisory Market Research, 2032

The global robo advisory market size was valued at $7.9 billion in 2022, and is projected to reach $129.5 billion by 2032, growing at a CAGR of 32.5% from 2023 to 2032.

Robo advisory refers to the provision of automated, algorithm-driven financial advice and investment services. It combines technology and financial expertise to offer investment recommendations and portfolio management without the need for human intervention. Robo-advisors utilize advanced algorithms to analyze an investor's financial situation, goals, risk tolerance, and other relevant factors to provide personalized investment strategies.

Robo advisory services witnessed significant adoption in recent years, owing to the increase in penetration of smartphones and rise in the number of netizens across the globe. Furthermore, robo advisory services serve as convenient and widely used options for investors, as they provide instant affordability options to clients for investing into funds, which notably contributes toward robo advisory market growth. In addition, robo-advisors leverage advanced technologies such as artificial intelligence (AI), machine learning (ML), and data analytics to offer automated investment advice, accelerated the robo advisory market. These technologies enable robo-advisors to process vast amounts of data, assess market trends, and provide personalized investment recommendations to clients. The increase in sophistication of these technologies has improved the accuracy and efficiency of robo advisory platforms, attracting more investors. Therefore, these factors notably promote the growth of the robo advisory market.

However, the increase in security concerns are significant barriers toward robo advisory market growth. Further, older investors, who may have greater wealth and assets, have been slower to adopt robo advisory platforms. This can be attributed to factors such as lack of familiarity with digital platforms, preference for face-to-face interactions, and concerns about the security of online financial transactions. Therefore, the growth potential of the robo advisory market may be limited by the slower adoption rate among older investors.

On the contrary, an increase in demand for automated investment solutions, and advancements in artificial intelligence (AI) and machine learning (ML) are expected to provide lucrative growth opportunity for the robo advisory market.

Investors are increasingly seeking automated investment solutions due to their convenience, cost-effectiveness, and accessibility. Robo advisors provide automated portfolio management services, offering personalized investment recommendations based on an individual's financial goals and risk tolerance. The demand for these services has grown as these cater to a wider range of investors, including millennials and tech-savvy individuals who prefer digital solutions.

The report focuses on growth prospects, restraints, and trends of the robo advisory market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the robo advisory market outlook.

Technology Insights

The robo-advisory market is anticipated to witness significant growth during the forecast period. This is attributed to the advancements in AI and automated investment strategies. Robo-investing platforms offer a convenient, cost-effective way for individuals to manage their investments without the need for traditional financial advisors. These platforms use algorithms to assess an investor’s financial goals, risk tolerance, and preferences, and then recommend personalized investment portfolios. By integrating smart asset allocation management, these platforms ensure that investments are diversified, balanced, and optimized to meet long-term objectives.

AI-powered wealth management leverages machine learning and data analytics to continuously optimize portfolios, adapting to market trends and individual performance. This ongoing asset reallocation ensures that investments stay in tune with evolving market circumstances, with the goal of increasing returns while minimizing risk. In addition, there is growing trend toward robo-advisory services whih are gaining popularity among a wide array of investors, from beginners to seasoned professionals, offering intelligent, automated solutions at a lower expense than conventional advisory services.

Furthermore, robo-advisors provide accessibility, transparency, and real-time monitoring, allowing users to track their portfolio's performance and adjust as needed. As AI and technology continue to evolve, the robo-advisory market is poised to transform the way people approach wealth management, offering an innovative and efficient alternative to traditional investment methods. This innovation is expected to offer significant robo advisory market opportunity for both investors and financial institutions for the growth of robo advisory market.

Segment Review

The robo advisory market is segmented into business model, provider, service type, end user, and region. By business model, the robo advisory market is fragmented into pure robo advisors and hybrid robo advisors. By service provider, the market is divided into fintech robo advisors, banks, traditional wealth managers and others. By service type, the robo advisory market is categorized into direct plan-based/goal-based and comprehensive wealth advisory. By end user, the robo advisory market is bifurcated into retail investor and high net worth individuals (HNIs). Region wise, the robo advisory market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

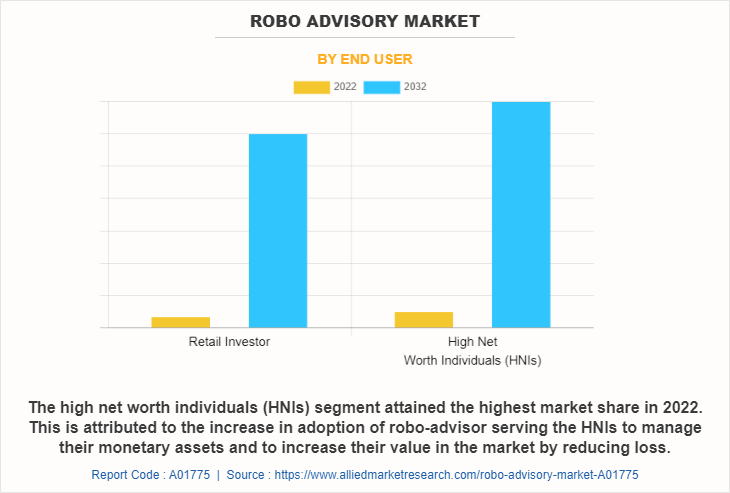

By end user, the robo advisory market share was led by the high-net-worth individuals (HNIs) segment in 2022 and is projected to maintain its dominance during the forecast period. Surge in adoption of robo-advisor serving the HNIs to manage their monetary assets and to increase their value in the market by reducing loss drives the growth of the segment. However, the retail investor segment is expected to grow at the highest rate during the forecast period, owing to growing adoption of these services among the retail investors to manage and control their portfolio.

Region wise, the robo advisory services market size was dominated by North America in 2022, and is expected to retain its position during the forecast period. The major factor that drives the growth of the robo advisory market in this region includes rise in adoption of robo advisory services among the investor and presence of major players such as Betterment and Vanguard. However, Asia-Pacific is expected to witness significant growth rate during the forecast period, owing to increase in adoption of digital technologies across emerging countries and rapid increase in disposable income of the middle-class population.

Type Insights

In the robo-advisory market, two main types of platforms gaining popularity: algorithm-driven platforms offer scalability and efficiency, while hybrid models balance automation with human expertise.

Algorithm-driven robo-advisors rely entirely on automated algorithms to analyze an investor’s financial profile and recommend investment strategies. These platforms are fully digital, cost-effective, and involve minimal human interaction, making them ideal for those seeking a hands-off, affordable approach to wealth management.

Hybrid robo-advisors combine the efficiency of automation with the personal touch of human financial advisors. While they use algorithms for portfolio construction and management, they also provide access to human experts for personalized consultations. This allows investors to receive tailored financial advice, appealing to those who want the convenience and cost benefits of robo-advisory services but also value professional guidance.

Competitive Analysis

The key players operating in the robo advisory market include Fincite Gmbh, Betterment, Charles Schwab & Co., Inc., SigFig Wealth Management, LLC, Social Finance, Inc., Wealthfront Corporation, Wealthify Limited, The Vanguard Group, Inc., Ginmon Vermögensverwaltung GmbH, and Axos Financial, Inc. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the robo advisory industry.

Key Industry Developments

On February 7, 2025, Robinhood launched a "plain vanilla" robo-advisor, allocating investments using algorithms without relying on AI. Instead, human teams selected the investments. This move was part of Robinhood's broader strategy to expand into the wealth management space, offering a low-cost, automated investing service. This development was related to the growing robo advisory market, as more companies integrated digital solutions for accessible and cost-effective investment management.

On May 7, 2024, Abyan Capital, the first robo-advisory company in Saudi Arabia, secured $18 million in a Series A funding round1. The round was led by STV, with participation from Wa’ed Ventures and RZM Investment1. Since its launch in 2022, Abyan Capital has aimed to revolutionize financial advisory in Saudi Arabia by providing automated, Shariah-compliant investment and savings solutions.

On February 4, 2025, Frec has launched a new Portfolio Allocation feature, giving investors full control over rebalancing their portfolios1. Unlike traditional robo-advisors that enforce automatic rebalancing, Frec allows investors to decide how and when to rebalance, offering more flexibility and tax-efficient alternatives1. This development is part of the broader trend in the robo advisory market, where personalized and adaptable investment solutions are becoming increasingly important.

Country-specific Statistics & Information

Investors seek convenient and cost-effective investment options that align with their financial goals. Robo-advisors offer automated investment platforms that provide personalized recommendations on the basis of factors such as risk tolerance, investment horizon, and financial objectives. These platforms use algorithms and data analysis to create diversified portfolios suited to individual investors. The ability to access such tailored investment advice easily and at lower costs has led to a surge in the popularity of robo advisory services. For instance, in the U.S., robo-advisors such as Betterment and Wealthfront have gained significant market share by offering automated and personalized investment services. In Europe, the introduction of the Markets in Financial Instruments Directive II (MiFID II) has enhanced transparency and investor protection, creating favorable conditions for robo advisory growth. Moreover, established financial institutions such as Vanguard and Charles Schwab launched their robo advisory platforms or acquired existing robo advisory firms, further fueling robo advisory industry growth.

In addition, robo-advisors heavily rely on advanced technologies such as artificial intelligence (AI), machine learning (ML), and natural language processing (NLP). These technologies enable robo-advisors to analyze vast amounts of data, identify investment patterns, and generate insights quickly. Robo-advisors can improve their recommendations over time by continuously learning from user behavior and market trends. AI-driven robo advisory platforms can also automate various investment tasks, such as rebalancing portfolios and tax optimization, ensuring efficient and accurate investment management.

The COVID-19 pandemic prompted lockdowns and social distancing measures, leading to a surge in demand for digital financial services. The safety measures issued by government authorities turned individuals to online platforms for managing their finances, including robo advisory services. This increased demand provides an opportunity for robo-advisors to attract new clients and expand their market reach. In addition, the pandemic caused significant volatility in financial markets that highlighted the importance of risk management and asset allocation. Robo-advisors, known for their algorithm-driven portfolio rebalancing and risk management capabilities, provide timely adjustments to investors' portfolios, which help mitigate losses and reduce risk during volatile market conditions. These factors, in turn, boost the growth of the robo advisory market.

Top Impacting Factors

Shift in Preference from Traditional Investment Services to Robo Advisory Services

The robo advisory market is expected to witness significant adoption in recent years, owing to the increase in penetration of smartphones and rise in the number of netizens across the globe. Furthermore, robo advisory services serve as convenient and widely used options for investors, as they provide instant affordability options to clients for investing into funds, which notably contributes toward market growth. Moreover, a large number of businesses and individuals started filling out applications online for investing rather than getting into the time-consuming investing process.

In addition, regulatory bodies, such as the Securities and Exchange Commission (SEC) in the U.S. and the Financial Conduct Authority (FCA) in the UK, introduced guidelines and regulations specifically addressing the operations of robo advisors. These regulations provide a clear framework for robo advisory platforms, ensuring investor protection and fostering the robo advisory market growth.

Rapid Digitalization in Financial Services

Digitization has been one of the most widely adopted strategies in financial services to improve core processing capabilities and offer better consumer services and insights. In addition, various organizations such as the Vanguard Group, Inc. and Betterment have reportedly increased their sales percentage by focusing on the digitalization of their financial services. In addition, more than half of these financial services have been associated with investments. Most of the investments are made through digital advisory platforms, as they offer high returns and evaluate portfolios according to economic and market conditions.

All these factors reduce the chances of uncertainty and provide instant convenient options to the investors. Thus, an increase in the focus of organizations on digitalizing their financial services to achieve business efficiency and better outcomes drives the growth of the robo advisory market.

Technological Innovations in Digital Investment Platforms

Digital investment platforms have experienced a drastic change over centuries, owing to the emergence of disruptive technologies. Innovations in robo advisory services have revolutionized businesses in the financial sector in recent years and helped banks and other investors to streamline the processes and improve the quality of their services. These innovations are constantly being developed, thereby providing potential opportunities for the growth of the robo advisory market. For instance, AI in digital investment solutions exhibit capabilities to reduce investment processing time and operational costs. In addition, cognitive computing possesses capabilities to analyze massive volume of data, which is anticipated to create remunerative opportunities for investors in risk analysis and management sector. In addition, integration of advanced technologies such as AI and ML are expected to create significant opportunities for the expansion of the global robo advisory market during the forecast period.

Surge in Adoption of Digital Platforms and Mobile Devices

The widespread use of digital platforms and mobile devices has transformed the way individuals access financial services in the robo advisory market. Investors now expect seamless and user-friendly interfaces that allow them to manage their investments. Robo-advisors leverage digital platforms and mobile apps to provide intuitive interfaces, enabling investors to monitor their portfolios, make adjustments, and execute transactions easily.

In addition, traditional financial institutions have recognized the potential of robo advisory services and have started collaborating with or acquiring robo advisory firms. These partnerships leverage the strengths of both sides, with robo-advisors benefiting from the established brand reputation, customer base, and distribution networks of traditional financial institutions. For instance, in March 2022, Goldman Sachs acquired NextCapital, a robo-adviser that specializes in workplace pensions. Chicago-based NextCapital directly advises retirement plans as well as supplying its underlying technology to other financial institutions under a “white label”. Sponsors of defined contribution retirement plans use NextCapital’s digital advice to help employees customize their savings and investment options.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the robo advisory market segments, current trends, estimations, and dynamics of the robo advisory market analysis from 2022 to 2032 to identify the prevailing market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the robo advisory market segmentation assists to determine the prevailing robo advisory market opportunity.

Major countries in each region are mapped according to their revenue contribution to the market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the robo advisorymarket players.

The report includes the analysis of the regional as well as robo advisory market trends, key players, market segments, application areas, and market growth strategies.

Robo Advisory Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 129.5 billion |

| Growth Rate | CAGR of 32.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 273 |

| By Service Type |

|

| By Business Model |

|

| By Provider |

|

| By End User |

|

| By Region |

|

| Key Market Players | Ginmon Vermögensverwaltung GmbH, SigFig Wealth Management, LLC, Charles Schwab & Co., Inc., The Vanguard Group, Inc., Betterment, Wealthify Limited, Social Finance, Inc., Axos Financial, Inc., Wealthfront Corporation., Fincite Gmbh |

Analyst Review

Robo-advisors heavily rely on advanced technologies such as artificial intelligence (AI), machine learning (ML), and natural language processing (NLP). These technologies enable robo-advisors to analyze vast amounts of data, identify investment patterns, and generate insights quickly. By continuously learning from user behavior and market trends, robo-advisors can improve their recommendations over time. AI-driven robo advisory platforms can also automate various investment tasks, such as rebalancing portfolios and tax optimization, ensuring efficient and accurate investment management.

Initially, robo advisors primarily focused on providing automated investment services for individual retail investors. However, the market has expanded its offerings including high-net-worth individuals, institutional investors, and retirement plans, to incorporate robo advisory platforms into their services. This expansion increases the market potential and creates lucrative growth opportunities for robo advisory providers.

Robo advisors have evolved to offer increasingly personalized investment recommendations. They consider an investor's financial situation, risk appetite, investment goals, and time horizon to construct a customized portfolio. By leveraging data analytics and algorithms, robo advisors can provide tailored investment strategies compared to traditional one-size-fits-all approaches. This personalization appeals to investors who desire customized solutions aligned with their specific financial objectives. Moreover, robo advisory services are not limited to specific geographical regions. Many robo advisory platforms operate internationally, enabling investors worldwide to access their services. This global reach allows robo advisory providers to tap into diverse markets and leverage different investment opportunities across countries, thereby expanding their customer base and revenue potential.

The key players in the robo advisory market are Fincite GmbH, Betterment, Charles Schwab & Co., Inc., SigFig Wealth Management, LLC, Social Finance, Inc., Wealthfront Corporation, Wealthify Limited, The Vanguard Group, Inc., Ginmon Vermögensverwaltung GmbH, and Axos Financial, Inc. Major players operating in the robo advisory market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. Major players are collaborating their product portfolio to provide differentiated and innovative products with the increase in awareness and demand for robo advisory across the globe.

At a CAGR of 32.5% , the Robo Advisory Market will expand from 2023 - 2032.

By the end of 2032, the market value of Robo Advisory Market will be $129,462.3 million.

Shift in preference from traditional investment services to robo advisory services Rapid digitalization in financial services Personalized investment solutions

The robo advisory market is segmented into business model, provider, service type, end user, and region. By business model, the market is fragmented into pure robo advisors and hybrid robo advisors. By service provider, the market is divided into fintech robo advisors, banks, traditional wealth managers and others. By service type, the market is categorized into direct plan-based/goal-based and comprehensive wealth advisory. By end user, the market is bifurcated into retail investor and high net worth individuals (HNIs). Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the robo advisory market include Fincite Gmbh, Betterment, Charles Schwab & Co., Inc., SigFig Wealth Management, LLC, Social Finance, Inc., Wealthfront Corporation, Wealthify Limited, The Vanguard Group, Inc., Ginmon Vermögensverwaltung GmbH, and Axos Financial, Inc.

Loading Table Of Content...

Loading Research Methodology...