Robot Operating System Market Isights:

The global robot operating system market size was valued at USD 534.2 million in 2022, and is projected to reach USD 1.8 billion by 2032, growing at a CAGR of 12.9% from 2023 to 2032.

The rise in adoption of automation in the industrial sector, along with the increase in adoption of ROS by manufacturers, especially in developing economies, are some of the important factors that boost the global market across the globe. Furthermore, the surge in demand for collaborative modular robots is a significant factor anticipated to fuel the expansion of the robot operating system market during the forecast period. However, the high maintenance and installation costs of robots are expected to hamper the market growth. On the contrary, an increase in the adoption of robots as a service (RaaS) is expected to provide a lucrative opportunity to boost the growth of the market around the world.

The robot operating system (ROS) is a collection of tools and frameworks that are designed for the development and control of robotic systems. The future of robots in business, enterprise, and developers is being driven by ROS. The design of the embedded software in a robot was formerly the responsibility of robotic researchers and robot designers. Ubuntu serves as the main base for robotic operating systems due to its adaptability and user-friendliness attributes. Further, ROS is an open-source platform; thus, it helps researchers and programmers write and reuse code for robotics applications. A global open-source community of engineers and programmers known as the "robot operating system" works to advance and expand the usability of ROS and make robots available to the whole world.

The report focuses on growth prospects, restraints, and analysis of the global robot operating system market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global robot operating system market share.

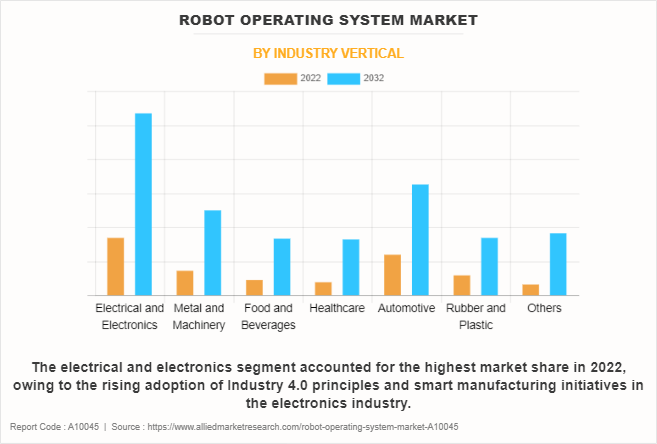

The robot operating system market is segmented on the basis of robot type, application, industry vertical, and region. By robot type, the market is classified into SCARA robots, articulated robots, parallel robots, collaborative robots, and others. By application, the market is segregated into plastic injection and blow molding, pick and place, testing and quality inspection, PCB handling and ICT, metal stamping and press tending, CNC machine tending, co-packing, and end-of-line packaging. As per industry vertical, the ROS market is divided into electrical and electronics, metal and machinery, food and beverages, healthcare, automotive, rubber and plastic, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on the industry vertical segment, the electrical and electronic segment dominated the robot operating system market share in 2022 and is expected to continue this trend during the forecast period, owing to the surge in demand for data-driven robotics in the electronic industry, along with the growing adoption of collaborative robots within this sector. However, the metal and machinery segment is expected to witness the highest growth in the upcoming years, owing to the surging demand for automation and operational efficiency, along with the ongoing technological advancements in robotics, including software capabilities provided by ROS.

Region-wise, the robot operating system market was dominated by Asia-Pacific in 2022 and is expected to retain its position during the forecast period, owing to the increase in consumer awareness about the benefits of robot operating systems, along with the presence of favorable government regulations, further contributing to the ROS market growth within the region. However, Asia-Pacific is expected to witness significant growth during the forecast period, due to the increased customer-centric robot operating systems solutions tailored to the diverse needs of the consumers in this region.

The global robot operating system industry is dominated by key players such as Kuka AG, Fanuc Corporation, Yaskawa Electric Corp., Microsoft Corporation, Omron Corporation, Clearpath Robotics, iRobot Corporation, ABB Ltd., Denso Corporation, and Universal Robotics. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Top Impacting Factors:

Increase in the Adoption of Automation in Various Industries

Industrial automation has become a key driving force behind the economic transformation, reshaping industries and economies worldwide. With continuous advancements in digital technologies and the adoption of automation solutions, industries across numerous sectors are experiencing increased productivity, efficiency, and competitiveness. Automated systems excel in speed, accuracy, and consistency, exceeding the capabilities of manual labor. This is particularly beneficial in manufacturing and logistics industries where routine processes are prevalent. These aforementioned benefits are likely to pave the adoption of industrial automation solutions, which in turn, drives the robot operating system market forecast.

Furthermore, ROS automation may appear to be an intimidating strategies to adopt in a manufacturing environment, but these solutions are arguably more feasible than ever and can deliver a powerful punch to boost a firm's competitive advantage. Since the 1990s, there has been a considerable increase in the manufacture of robots, which has led to a decrease in the cost of such machinery. Thus, the rise in adoption of automation across the manufacturing sector has proliferated the use of ROS, which in turn, provides a significant outlook for robot operating system market growth.

Moreover, the Industrial Internet of Things (IIoT) and e-commerce platforms provide SMEs with new abilities to use ROS platforms to deliver customized services and goods. This is projected to enable internationalization and growth into micro-multinational corporations, which will create new jobs and income, foster innovation, and boost productivity, thereby surging the adoption of ROS among various industry verticals.

Escalating Demand for Collaborative Robots

The demand for collaborative robots (Cobots) is escalating rapidly across various industries due to their unique capabilities and the rising need for human-robot collaboration in manufacturing and other workplaces. Cobots, unlike traditional robots that operate in isolation, are designed to work safely alongside human workers, sharing workspaces and adapting to human presence. This collaboration enables a more efficient and productive work environment. Thus, to remain competitive and participate in the anticipated ROS market expansion, numerous leading robotics companies in the world are releasing ROS collaborative robot models in addition to their industrial robot models.

For instance, in August 2023, Omron, a leading provider of end-to-end industrial automation solutions, successfully launched its new OMRON TM20 Cobot with a payload of 20 kg. The new cobot is well-equipped to automate palletizing, machine tending, and material handling whilst managing heavy payloads. Thus, these efforts by robotic technology vendors are likely to fuel the robot operating system market growth worldwide.

Further, collaborative robots are increasingly being used, and one of the key reasons for this is that they are becoming more affordable. These robots are starting to be useful outside of factories as well. The low price tag makes automation investments easier to justify in every situation, which strengthens the adoption of collaborative robots. For instance, the International Federation of Robotics (IFR) estimated that cobots accounted for almost 5% of total robot sales in 2018, and the contribution of cobot sales has grown significantly to about 13% in 2022. Thus, the rise in demand for cobots is expected to boost the demand for the ROS market.

Recent Product Launches in the Market:

- In March 2022, Fanuc Corporation introduced the new CRX-5iA, CRX-20iA/L, and CRX-25iA collaborative robots, the newest additions to its popular CRX series that include the CRX-10iA and CRX-10iA/L collaborative robots.

- In September 2022, KUKA AG launched two new cobot models, the LBR iisy 11 kg and the LBR iisy 15 kg. These models have extended payload capacities, significantly longer reach, and a higher IP protection class and are suitable for a wide range of tasks and applications.

Recent Partnerships in the Industry:

- In October 2022, ABB entered into a strategic partnership with U.S.-based Scalable Robotics to improve its portfolio of user-friendly robotic welding systems. This strategic investment is another milestone in ABB’s ecosystem strategy of partners who offer easy-to-use solutions for a range of applications and industries.

- In December 2021, Clearpath Robotics, a manufacturer of mobile robotic platforms for research and development, and Sygnal Technologies Inc., experts in drive-by-wire (DBW) control systems, have partnered to bring the Sygnal drive-by-wire conversion kit to the global autonomous vehicle developer community. Under the partnership agreement, Clearpath is authorized to sell and support the Sygnal DBW system worldwide via its component store.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the robot operating system market analysis from 2022 to 2032 to identify the prevailing robot operating systems industry opportunities.

- The ROS market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the robot operating system market growth assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global robot operating system market analysis.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global robot operating system market trends, key players, market segments, application areas, and market growth strategies.

Robot Operating System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.8 billion |

| Growth Rate | CAGR of 12.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 385 |

| By Robot Type |

|

| By Application |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Yaskawa Electric Corp., Microsoft Corporation, FANUC CORPORATION, Clearpath Robotics, DENSO CORPORATION, OMRON Corporation, Universal Robots, KUKA AG, iRobot Corporation, ABB Ltd. |

Analyst Review

Following several interviews conducted with top-level CXO executives, the growing economy in developing countries such as China, India, Indonesia, Thailand, and others is anticipated to offer profitable chances for market expansion. The adoption of robot operating systems has increased in the last few years, due to the rise in demand for automation in different industries, such as manufacturing and the healthcare sector. Moreover, the major players in the market are developing affordable, small as well as compact, and energy-efficient robots to reach a wider customer base. In addition, the growing entrepreneurial ecosystem has driven the adoption of robot operating systems among small and medium-sized enterprises (SMEs) and startups, which is expected to drive the growth of the market.

In addition to this, the supply side of the robot operating system market is driven by a range of factors, including the expansion of e-commerce, competitive pricing models, and the implementation of vendor support and integration services. Furthermore, industry developments around the world are anticipated to present considerable growth potential during the forecast period, due to the increased use of various types of robots and the adoption of high-end robots across diverse industries. The market for robot operating systems market is highly consolidated, and businesses are concentrating on employing new technologies to provide robotics software to fulfill the changing needs of the user.

Further, key players in the robot operating system market such as ABB Ltd., Microsoft Corporation, and Fanuc Corporation, account for a significant share of the market, followed by some other top vendors in the local and regional markets. With larger requirements for automation technologies, numerous companies introduced various strategies to strengthen their market position capabilities.

For instance, in March 2022, Japan-based Fanuc Corporation introduced the new CRX-5iA, CRX-20iA/L, and CRX-25iA collaborative robots, the newest additions to its popular CRX series that includes the CRX-10iA and CRX-10iA/L collaborative robots. Such strategic initiatives by the market players are expected to contribute to significant growth of the robot operating system market across the globe.

Moreover, market players have expanded their business operations and geographical footprint by making strategic collaborations and partnerships. For instance, in October 2022, ABB entered into a strategic partnership with U.S.-based Scalable Robotics to improve its portfolio of user-friendly robotic welding systems. This strategic investment is another milestone in ABB’s ecosystem strategy of partners who offer easy-to-use solutions for a range of applications and industries. These aforementioned strategic advancements propel the growth of the robot operating system market.

The global robot operating system market size was valued at USD 534.2 million in 2022, and is projected to reach USD 1.8 billion by 2032.

The global robot operating system market is projected to grow at a compound annual growth rate of 57.2% from 2021-2030 to reach USD 21,954 million by 2030

The global robot operating systems market is dominated by key players such as Kuka AG, Fanuc Corporation, Yaskawa Electric Corp., Microsoft Corporation, Omron Corporation, Clearpath Robotics, iRobot Corporation, ABB Ltd., Denso Corporation, and Universal Robotics.

North America is the largest regional market for the Robot Operating System (ROS).

Key factors driving the robot operating system market include rising industrial automation, growing ROS adoption in developing economies, and increasing demand for collaborative modular robots.

Loading Table Of Content...

Loading Research Methodology...