Rock Drilling Equipment Market Research, 2032

The global rock drilling equipment market was valued at $2.3 billion in 2022, and is projected to reach $3.4 billion by 2032, growing at a CAGR of 3.9% from 2023 to 2032. Rock drilling equipment includes a wide range of technology that is specifically designed to penetrate rock formations. These devices are required for a range of industrial applications that need the handling of hard, abrasive materials, where traditional excavation methods are ineffective. The primary function of rock drilling equipment is to create holes in rock surfaces that allow exploration, mining, and construction operations to take place. Mining, construction, and tunnelling are all applications for rock drilling equipment. Rock drilling equipment is used in mining operations to collect minerals and ores from the earth's crust. It is used in open-pit and underground mining operations.

Sophisticated rock drilling equipment have strong engines, accurate control systems, and long-lasting drill bits that enable for rapid penetration into varied rock forms. This leads to shorter project schedules and lower operational expenses. Modern rock drilling equipment is built to tackle a wide range of tasks. These devices can adapt to a variety of geological conditions, whether surface drilling, underground mining, tunnelling, or geotechnical investigation. The ability to utilize a single equipment for many jobs is a significant benefit. Drilling precision is critical, particularly in applications such as geotechnical exploration and mining. Advanced rock drilling equipment includes cutting-edge technology such as GPS guiding and laser positioning to ensure precise and accurate drilling. This accuracy reduces waste, improves resource recovery, and contributes to the project's overall success. Many current rock drilling equipment come with remote monitoring and automation functions. This enables workers to manage and monitor drilling operations remotely, improving safety and efficiency. The demand for drilling machinery is closely tied to the level of mining and exploration activities globally. As the demand for minerals and resources increases, so does the need for efficient rock drilling equipment. Automation also helps to ensure consistent drilling performance by decreasing the need for manual intervention. Safety features on sophisticated equipment include collision avoidance systems, emergency shut-off mechanisms, and enhanced warning systems. These features not only protect operators but also prevent equipment damage.

The geological complexity of the rock formations is a considerable impediment. During drilling operations, different kinds of rocks, such as sedimentary, igneous, and metamorphic, present various obstacles. Hard and abrasive rocks, for example, can accelerate wear and tear on drilling bits, shortening their lifespan, and requiring frequent replacements. This not only raises operational expenses but also causes downtime when equipment is serviced or replaced. Furthermore, the unpredictability of subsurface conditions might compromise the effectiveness of rock drilling equipment. Uneven drilling performance can be caused by variations in rock hardness, density, and composition. Drilling rates that are inconsistent may result in inefficiencies and delays in project schedules, lowering overall productivity. Another aspect influencing the effectiveness of rock drilling equipment is the depth of drilling. The pressure and temperature conditions beneath are becoming increasingly difficult as drilling depth increases. This can result in greater wear on machine components, decreased drilling efficiency, and increased safety hazards. Deep drilling also necessitates the use of specialized equipment and technology, which raises the entire cost of the drilling process.

The global construction industry is continually expanding, driven by urbanization and infrastructure development projects. The global push for infrastructure development, including roads, bridges, dams, and tunnels, creates a significant demand for rock drilling equipment. These projects often require precise and efficient rock drilling technology to facilitate construction activities. Rapid urbanization is leading to the expansion of cities and the development of new urban areas. Rock drilling equipment is essential for various construction tasks in urban environments, such as foundation drilling for high-rise buildings and tunneling for underground transportation systems. The mining sector relies heavily on rock drilling equipment for activities like exploration, extraction, and tunneling. The demand for rock drilling equipment is closely tied to construction and infrastructure development projects. As urbanization continues and new infrastructure projects are undertaken, the need for rock excavation equipment increases. As the demand for minerals and resources continues to rise, the mining industry contributes to the sustained growth of the rock drilling equipment market.

The key players profiled in this report include Atlas Copco, Hitachi Zosen, Sandvik Construction, Sanyhe International Holdings, Herrenknecht, Furukawa Rock Drill, Kawasaki Heavy, Komatsu, Sunward Equipment Group, China Railway Engineering, and XCMG Group. Product innovation and development of rock drilling equipment are common strategies followed by major market players. For instance, on January 11, 2023, Epiroc, a manufacturer of drill rigs, launched the new Epiroc DTH drill bits. These drill bits are likely to last up to 20% longer compared to an older version of the company's drill bits.

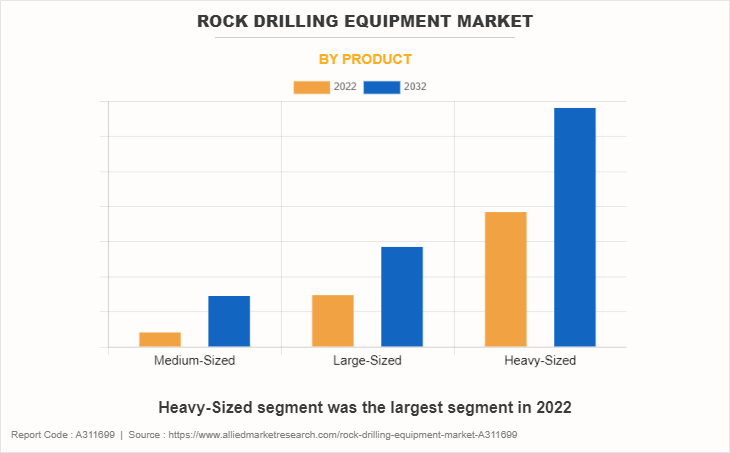

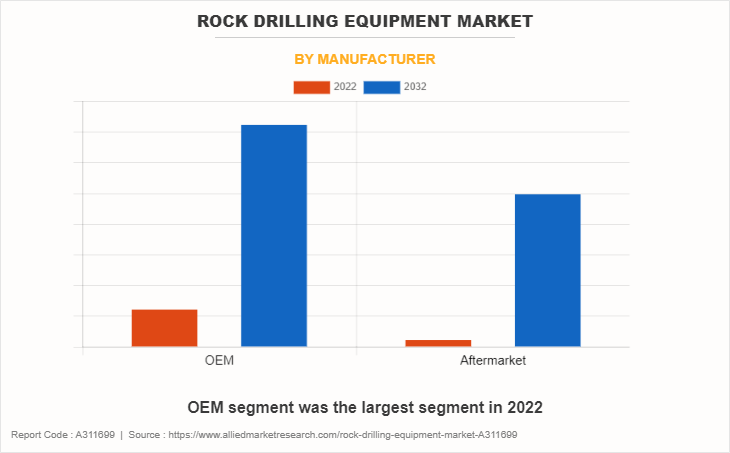

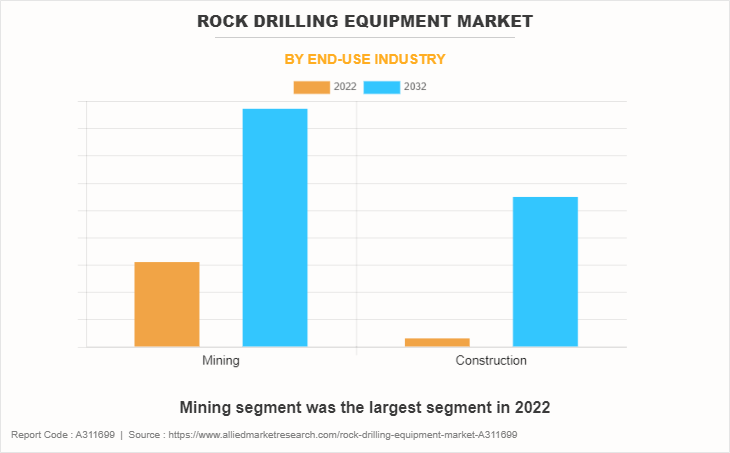

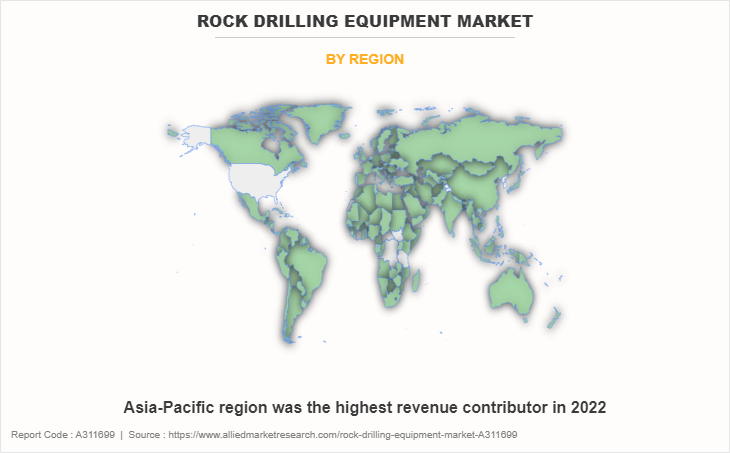

The rock drilling equipment market growth is segmented on the basis of product, end-use industry, business, and region. By product, the market is classified into medium-sized, large-sized, and heavy-sized . By end-use industry, the market is classified into mining and construction. By manufacturer, the market is classified into OEM and aftermarket. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The rock drilling equipment market is segmented into Product, Manufacturer and End-use Industry.

By product, the heavy-sized sub-segment dominated the global rock drilling equipment market share in 2022. One of the most notable advantages of large-scale rock drilling equipment is its capacity to drill to great depths. These machines excel in penetrating hard rock formations at significant depths, whether for mining operations that need reaching ore deposits deep underground or construction projects that require creating deep foundation piles. Heavy-duty rock drills provide high penetration rates, allowing for faster drilling progress. This benefit is especially useful in time-sensitive tasks when fulfilling deadlines is important. The combination of strong engines and efficient drilling mechanisms denotes that these machines can break through difficult rock formations fast and effectively. Heavy-duty rock drilling equipment is built with durability and lifespan in mind. Heavy-duty rock drilling equipment is adaptable to difficult terrain, which adds to its flexibility. These robots are intended to travel and function in different and tough situations, such as rocky mountain sides, uneven terrain, and difficult-to-reach spots. This versatility guarantees that projects continue to move forward efficiently, regardless of the topographical obstacles they face.

By manufacturer, the OEM sub-segment dominated the global rock drilling equipment market share in 2022. Various safety and environmental restrictions are applicable to rock drilling activities. Compliance with these requirements is prioritized by OEMs during the design and production processes. This dedication not only assures worker and environmental safety, but also assists operators in avoiding any legal challenges related with noncompliance. OEM equipment is created with a thorough awareness regarding the unique problems faced by rock drilling. As a result, performance, efficiency, and dependability are improved. OEMs employ sophisticated technologies and materials to improve the functionality of their equipment, resulting in higher productivity for end users. OEMs are on the front edge of technical breakthroughs in the rock drilling equipment industry. OEMs use cutting-edge technology into their products, from automated drilling equipment to data analytics for predictive maintenance. While the initial investment in OEM equipment is larger, the long-term cost benefits are frequently substantial. OEM equipment's quality assurance, durability, and dependability result in lower maintenance costs and downtime. The use of high-quality materials and components also helps to the equipment's lifetime, resulting in a great return on investment over time.

By end-use industry, the mining sub-segment dominated the global rock drilling equipment market opportunity in 2022. Modern rock drilling equipment is built to optimize drilling operations, resulting in higher operating efficiency. Automation, real-time monitoring, and data analytics all contribute to quicker drilling, less downtime, and shorter project timeframes. Mining operations are moving into increasingly distant and difficult terrains, such as deep-sea mining and polar research. Accessing previously undiscovered mineral deposits requires rock drilling equipment that can survive harsh temperatures and perform efficiently in these locations. Precision drilling is essential in mining to enable precise mineral extraction. To attain exceptional precision and accuracy in resource extraction, advanced rock drilling equipment utilizes technology such as GPS-guided drilling and automated drilling systems. Advancements in drilling techniques are essential to access resources in deeper and more challenging geological formations. Environmental sustainability is becoming increasingly important in the mining business. Increasing emphasis on environmental sustainability and safety regulations in drilling operations necessitate the use of equipment that is designed with a deep understanding of rock mechanics. Innovative rock drilling equipment integrates characteristics such as low emissions, energy efficiency, and little environmental impact, answering the requirement for responsible mining operations.

By region, Asia-Pacific dominated the global rock drilling equipment market size in 2022. Asia-Pacific is rich in mineral resources, and the growing mining activities, particularly in countries like Australia, Indonesia, and Mongolia, contribute to the demand for rock drilling equipment market overview in exploration and extraction processes. Rapid urbanization in several countries leads to increased construction of residential and commercial buildings, creating a demand for rock drilling equipment for foundation and excavation work. Asia-Pacific contains a wide variety of geological features, ranging from hilly terrain to coastal locations. Because of this variety, adaptable rock drilling equipment capable of solving a variety of issues is required. Several Asian nations, notably in Southeast Asia, have established themselves as low-cost manufacturing hubs. Because of this cost advantage, manufacturers can make rock drilling equipment at cheap costs without affecting quality. Therefore, the region has emerged as a favored sourcing location for both local and foreign customers, strengthening its position in the global market.

Impact of COVID-19 on the Global Rock Drilling Equipment Industry

- The interruption in the supply chain was one of the pandemic's direct impacts on various industries. Economic uncertainties during the pandemic led to a decrease in construction and infrastructure projects, impacting the demand for rock drilling equipment. Many industries slowed down or temporarily halted operations, affecting capital expenditure on such equipment. Many rock drilling equipment manufacturers rely on a complicated network of domestic and foreign suppliers for crucial components.

- Obstacles and limited manufacturing capacity resulted from delays in the production and supply of certain components. Therefore, the timely supply of drilling equipment to end-users was hampered, resulting in project delays and financial setbacks. Furthermore, Lockdowns, social distancing measures, and health and safety concerns impacted the operations of companies involved in the production and use of rock drilling equipment. Worksite restrictions and labor shortages also led to project delays.

- Labor shortages and interruptions in industrial plants were caused by social distancing measures, lockdowns, and health concerns. Implementing remote labor and reducing on-site workforce numbers hindered manufacturing processes. Furthermore, the requirement for strong worker safety measures raised operational expenses for firms, hampering profit margins.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the rock drilling equipment market analysis from 2022 to 2032 to identify the prevailing rock drilling equipment market forecast opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the rock drilling equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global rock drilling equipment market trends, key players, market segments, application areas, and market growth strategies.

Rock Drilling Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.4 billion |

| Growth Rate | CAGR of 3.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 320 |

| By Product |

|

| By Manufacturer |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | Drill KIng International.L.P, Mincon Group Plc, Rockmore International,Inc., Rock- Tech International, Numa Tool Company, Sandvik AB, Epiroc AB, Furukawa Rock Drill, Global Mining Equipments, Holte Manufacturing |

The rock drilling equipment market size is expected to grow due to an increase in demand from the mining industry globally. In addition, the market is driven by growth in infrastructure development activities.

The major growth strategies adopted by the rock drilling equipment market players are development of rock drilling equipment and product innovation.

Asia-Pacific will provide more business opportunities for the global rock drilling equipment market in the future.

Atlas Copco, Hitachi Zosen, Sandvik Construction, Sanyhe International Holdings, Herrenknecht, Furukawa Rock Drill, Kawasaki Heavy, Komatsu, Sunward Equipment Group, China Railway Engineering, and XCMG Group are the major players in the rock drilling equipment market.

The heavy-sized rock drilling equipment sub-segment of the product segment acquired the maximum share of the global rock drilling equipment market in 2022.

Mining companies are the major customers in the global rock drilling equipment market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global rock drilling equipment market from 2022 to 2032 to determine the prevailing opportunities.

The growth of the mining sector, driven by the increasing demand for minerals and metals, contributes significantly to the demand for rock drilling equipment. These machines are essential for exploration, extraction, and processing of mineral resources.

Remote and autonomous drilling, rise in electric and hybrid drilling equipment, and surge in demand from the construction and infrastructure development industries to drive the global rock drilling equipment market.

Loading Table Of Content...

Loading Research Methodology...