Rotary Blade UAV Drones Market Research, 2033

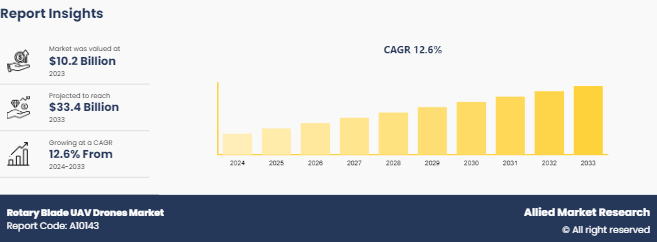

The global Rotary Blade UAV Drones Market Size was valued at $10.2 billion in 2023, and is projected to reach $33.4 billion by 2033, growing at a CAGR of 12.6% from 2024 to 2033.

Market Introduction and Definition

The rotary blade UAV drones market focuses on unmanned aerial vehicles (UAVs) equipped with rotary blades, which allow for vertical takeoff, landing, and hovering capabilities. These drones are highly versatile and used in various applications, including aerial photography, agriculture, surveillance, and delivery services. The Rotary Blade UAV Drones Industry exists due to the increasing demand for efficient and flexible aerial solutions that can operate in confined spaces and perform tasks that are difficult or dangerous for humans. Key benefits include improved precision in operations, reduced operational costs, and enhanced safety. The rise of automation and advancements in drone technology further propel this Rotary Blade UAV Drones Market Growth, making rotary blade UAVs indispensable in both commercial and military sectors.

Key Takeaways

- The Rotary Blade UAV Drones Market Size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2034.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major rotary blade UAV drones industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

- In January 2024, DJI, a leading player in the drone industry, launched the DJI Mavic 3 Enterprise drone, targeting commercial applications such as infrastructure inspection and public safety. The Mavic 3 Enterprise features advanced obstacle avoidance technology and improved camera capabilities, enhancing its utility for critical missions.

- In March 2024, Boeing announced the acquisition of SkyGrid, a software company specializing in airspace management solutions for drones. This strategic acquisition aims to integrate SkyGrid’s software capabilities into Boeing's existing portfolio, enabling enhanced operational efficiency and safety management for unmanned aerial systems.

- Also in March 2024, Parrot, another major player in the drone market, expanded its presence in the Asia-Pacific region by opening a new office in Singapore. This expansion allows Parrot to strengthen its customer support, sales, and distribution network in Southeast Asia, catering to the growing demand for drones in sectors like agriculture and infrastructure monitoring.

- Lastly, in April 2024, a consortium of European drone manufacturers, including Airbus and Leonardo, launched a joint initiative to develop next-generation rotary blade UAVs with enhanced sustainability features. This collaborative effort, supported by European Union funding, aims to advance drone technology while promoting environment-friendly practices in drone manufacturing and operations.

Key Market Dynamics

The rotary blade UAV drones market is experiencing dynamic shifts driven by a combination of drivers, restraints, and emerging opportunities. One of the primary drivers is the increasing adoption of UAVs across various sectors such as agriculture, infrastructure inspection, and defense. These drones offer cost-effective solutions for aerial surveillance and data collection, fueling their demand globally. However, regulatory challenges and airspace restrictions pose significant restraints. The complexity of integrating UAVs into existing airspace regulations limits their deployment in urban areas and commercial sectors, hindering market growth.

Despite these challenges, technological advancements in drone capabilities, such as improved battery life and enhanced payload capacities, present substantial opportunities. These advancements enable UAVs to perform longer and more complex missions, thereby expanding their applications in delivery services and disaster response. Moreover, the growing investments in research and development by key players are expected to drive innovation and reduce operational costs, further boosting market growth.

Furthermore, the market benefits from increasing government initiatives and funding for UAV development, particularly in defense and security applications. For instance, the integration of UAVs in military operations for surveillance and reconnaissance purposes continues to bolster market expansion. Additionally, the expansion of commercial UAV operations in industries such as oil and gas exploration and environmental monitoring highlights the diverse opportunities available in the rotary blade UAV drone’s market.

Market Segmentation

The rotary blade UAV drones market is segmented into product type, application, and region. On the basis of product type, the market is divided into less Than 8, and more Than 8. By application, the market is segregated into law enforcement delivery, disaster management, agriculture monitoring, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The U.S. leads the global rotary blade UAV drones market, driven by significant investments in both military and commercial drone applications. The U.S. Department of Defense has heavily invested in drone technology for intelligence, surveillance, and reconnaissance missions, contributing to the robust growth of the military segment. According to the Department of Defense's Unmanned Systems Integrated Roadmap, the military's investment in drones is projected to continue rising, with the budget allocation for unmanned aerial systems expected to reach $7.5 billion by 2025.

On the commercial front, the Federal Aviation Administration (FAA) has established comprehensive regulations and streamlined processes for drone operations, fostering a conducive environment for commercial drone adoption. The FAA's "Part 107" rules, which came into effect in 2016, have significantly lowered barriers to entry, allowing businesses to integrate drones into their operations legally and safely. As a result, industries such as agriculture, construction, real estate, and media have increasingly adopted rotary blade UAVs for tasks such as crop monitoring, infrastructure inspection, aerial photography, and videography.

China also plays a dominant role in the rotary blade UAV market, primarily due to the presence of major manufacturers such as DJI, which controls a substantial Rotary Blade UAV Drones Market Share of the global consumer and commercial drone markets. The Chinese government’s supportive policies and investments in drone technology have bolstered domestic production and innovation. China's "Made in China 2025" initiative aims to advance technological capabilities in high-tech sectors, including unmanned systems, further propelling the country's leadership in the UAV market.

Europe is also emerging as a significant market for rotary blade UAV drones, driven by the European Union's regulatory framework that harmonizes drone regulations across member states. The European Union Aviation Safety Agency (EASA) has implemented regulations to ensure safe and secure drone operations within Europe, which has facilitated market growth and encouraged innovation. The European Commission’s funding initiatives for drone research and development further support this market, aiming to integrate drones into the European airspace seamlessly.

Competitive Landscape

The major players operating in the rotary blade UAV drones market include DJI, Parrot SA, Yuneec International, AeroVironment, Inc., Boeing, Lockheed Martin Corporation, Northrop Grumman Corporation, Textron Inc., Thales Group, and Israel Aerospace Industries.

Other players in the rotary blade UAV drones market include PrecisionHawk, 3D Robotics, Inc., Draganfly Innovations Inc., Kespry Inc., Insitu Inc., Autel Robotics, GoPro Inc., Guangzhou Walkera Technology Co., Ltd., Aeryon Labs Inc., BAE Systems, Elbit Systems Ltd., FLIR Systems Inc., General Atomics Aeronautical Systems, Inc., Kratos Defense & Security Solutions, Inc., and Raytheon Company.

Industry Trends

- In April 2024, the U.S. saw a significant integration of rotary blade UAV drones into commercial operations, particularly in agriculture and logistics. This integration has led to increased efficiency in crop monitoring and delivery services, driving economic growth in these sectors by reducing labor costs and increasing productivity.

- In June 2024, China implemented new regulations to streamline the certification and operation of UAVs. This policy aimed to support the burgeoning drone industry, fostering innovation and expansion. As a result, the UAV market saw rapid growth, with more companies entering the sector and contributing to economic development.

- In March 2024, Australia expanded the use of rotary blade UAV drones in the mining industry. These drones have enhanced safety and efficiency in mine inspections and monitoring, reducing the need for human intervention in hazardous areas. This technological advancement has significantly boosted the mining sector's productivity and safety standards.

- In May 2024, the UK increased its investment in research and development for rotary blade UAV drones. This investment has led to the creation of advanced drone technologies, positioning the UK as a leader in the UAV market. The economic impact includes job creation and the establishment of new businesses in the tech sector.

- In February 2024, India deployed rotary blade UAV drones for disaster management and relief operations. The use of drones has improved the efficiency and speed of response in natural disaster scenarios, such as floods and earthquakes, thereby minimizing the impact on affected communities and aiding in faster recovery.

Key Sources Referred

DJI

Parrot

Yuneec

3D Robotics

Autel Robotics

AeroVironment

PrecisionHawk

Walkera

Hubsan

CyPhy Works

FLIR Systems

Lockheed Martin

Northrop Grumman

Boeing

Airbus

Aeryon Labs

Aibotix

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the rotary blade uav drones market analysis from 2024 to 2033 to identify the prevailing Rotary Blade UAV Drones Market Opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the rotary blade uav drones market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global rotary blade uav drones market trends, key players, market segments, application areas, and market growth strategies and Rotary Blade UAV Drones Market Forecast.

Rotary Blade UAV Drones Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 33.4 Billion |

| Growth Rate | CAGR of 12.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | DJI, Boeing, Israel Aerospace Industries, Textron Inc., Parrot SA, Northrop Grumman Corporation, Lockheed Martin Corporation, Yuneec International, Thales Group, Aerovironment Inc. |

Analyst Review

The Rotary Blade UAV Drones Market is experiencing significant growth driven by advancements in technology, expanding applications, and increasing investments across various sectors. These drones are characterized by their vertical take-off and landing capabilities, making them highly versatile for both military and commercial applications. In the defense sector, rotary blade UAVs are increasingly utilized for surveillance, reconnaissance, and tactical operations due to their ability to hover and maneuver in tight spaces. The commercial sector is witnessing a surge in demand for these drones in agriculture, construction, and logistics. Precision agriculture benefits from UAVs through efficient crop monitoring and pesticide application, while construction industries leverage them for site surveying and inspection. The logistics sector employs rotary blade drones for last-mile delivery, improving efficiency and reducing delivery times.

Regionally, North America dominates the market, attributed to substantial government investments in drone technology and a robust presence of key manufacturers. Asia-Pacific is emerging as a lucrative market, driven by increasing adoption in countries like China and India, where the agricultural and e-commerce sectors are rapidly integrating drone technology. Europe is also a significant player, with regulations being streamlined to facilitate drone operations and innovation. Technological advancements such as enhanced battery life, autonomous flying capabilities, and integration with artificial intelligence and machine learning are further propelling market growth. Challenges such as regulatory hurdles and concerns over privacy and safety continue to persist, but ongoing efforts to address these issues are expected to support the market's expansion. The competitive landscape is marked by continuous product innovation and strategic partnerships aimed at enhancing capabilities and expanding application areas, positioning the rotary blade UAV drones market on a trajectory of robust growth.

The global rotary blade UAV drones market was valued at $10.2 billion in 2023, and is projected to reach $33.4 billion by 2033, growing at a CAGR of 12.6% from 2024 to 2033.

The Rotary Blade UAV Drones Market is product type, and region. 2024-2033 would be the forecast period in the market report.

The agriculture monitoring segment held the largest market share in 2023 and is expected to grow at the fastest rate during the forecast period. The global Rotary Blade UAV Drones Market were valued at $10.2 billion in 2023.

The Rotary Blade UAV Drones Market is analyzed across North America, Europe, Asia-Pacific, LAMEA. 2023 is the base year calculated in the Rotary Blade UAV Drones Market report.

The top companies that hold the market share are DJI, Parrot SA, Yuneec International, AeroVironment, Inc., and Boeing, Lockheed Martin Corporation.

Loading Table Of Content...