RPA And Hyperautomation In Banking Market Research, 2031

The global RPA and hyperautomation in banking market was valued at $745.4 million in 2021, and is projected to reach $7.1 billion by 2031, growing at a CAGR of 25.7% from 2022 to 2031.

RPA and Hyperautomation is a digital transformation strategy that involves automating as many business processes as possible while digitally augmenting the processes that require human input. RPA and hyperautomation in banking market trends allows for easy automation of various tasks crucial to the mortgage lending process, including loan initiation, document processing, financial comparisons, and quality control. As a result, the loans can be approved quickly, leading to enhanced customer satisfaction. Moreover, adopting RPA and hyperautomation brings valuable benefits and competitive advantages for the banks operating in the digital economy.

The demand for RPA and hyperautomation in banking market is increasing due to rapid development in the automation of banking industry. By eliminating repetitive and laborious tasks, banking institutions allow their employees to work more efficiently and focus on other core tasks with the help of automation. In addition, another benefit of hyperautomation is that it can save both time and money and rapid growth in digital banking services are driving the growth of the market. However, process standardization and organizational difficulties for implementing RPA and security and privacy concerns have emerged as key industry problems in RPA and hyperautomation in banking market. On the contrary, technological advancement in the field of banking will further give major opportunity for the RPA and hyperautomation in banking market growth.

The report focuses on growth prospects, restraints, and trends of the RPA and hyperautomation in banking market analysis. The study provides Porters five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the RPA and hyperautomation in banking market size.

Segment Review

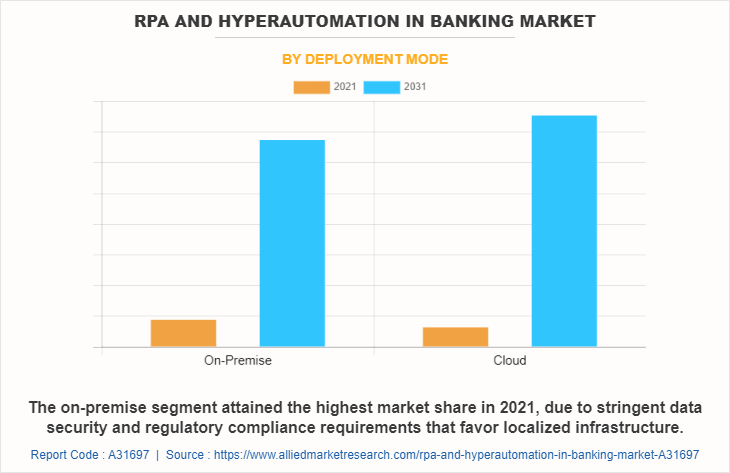

The RPA and hyperautomation in banking market is segmented on the basis of component, deployment mode and application. By component, it is classified into solution and services. By deployment mode, it is bifurcated into on-premise and cloud. By organization size, it is segregated into large enterprises and small and medium-sized enterprises. By application, it is segmented into customer account management, fraud prevention, report and invoice automation, account opening and KYC, auditing and compliance chatbots and others. By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

Based on deployment mode, the on-premise segment attained the highest growth in 2021. This is attributed to the fact that the on-premise deployment mode is considered widely useful in large banks and institutions, as it involves a significant investment to implement, and organizations need to purchase interconnected servers as well as software to manage the system.

Based on region, North America attained the highest growth in 2021. This is attributed to the fact that RPA and hyperautomation banking has been adopted by the majority of banks and financial institutions in the U.S. as a result of increased financial services efficacy, decreased costs & complexity, and consumer acceptance.

The report analyzes the profiles of key players operating in the RPA and hyperautomation in banking market such as AntWorks, Aspire Systems, Atos SE, Automation Anywhere, Inc., Blue Prism Limited, eccenca GmbH, IBM, Itrex Group, Protiviti Inc. and UiPath. These players have adopted various strategies to increase their market penetration and strengthen their position in the RPA and hyperautomation in banking market share.

COVID-19 Impact Analysis

COVID-19 has increased the demand for the RPA and hyperautomation in banking market opportunity as the pandemic forced the global human workforce remote working under lockdown, RPA allowed financial companies to remain operational. One of the key challenges that financial firms faced during COVID-19 is the extreme shift in workload pressures on certain processes such as accounts receivables and the delays caused by remote working. Therefore, financial firms increasingly invested in RPA and hyperautomation, which allows companies to overcome the burden of manual processes, shift their workforce to more value-added tasks, and be ready to rebound fast. Thus, COVID-19 pandemic had a positive impact on RPA and hyperautomation in banking industry.

Top Impacting Factors

Rapid Development in the Automation of Banking Industry

Through automation, banks can perform countless processes that could otherwise be labor intensive and time consuming. Moreover, errors due to human factors are heavily mitigated with the help of automation in banking services. In addition, highly efficient transactions increase customer satisfaction and streamline numerous procedures. By eliminating repetitive and laborious tasks, banking institutions allow their employees to work more efficiently and focus on other core tasks with the help of automation. Furthermore, the primary aim of RPA in the banking industry is to assist in processing the banking work that is repetitive in nature. Robotic process automation (RPA) helps banks & financial institutions increase their productivity by engaging customers in real-time and leveraging the immense benefits of robots. This is one of the major factors boosting the growth of the market.

Process Sstandardization and Organizational Difficulties for Implementing RPA

Process standardization and organizational misalignment are among the top hindering factors in implementing RPA and hyperautomation in banking. To integrate RPA solutions in an organization, a new distribution of roles and responsibilities is required to create an alignment between the teams involved. This hurdle, in turn, implies the challenge of process standardization related to unstructured data and non-standardized processes that require human input. In addition, resistance to adoption of RPA by banks is one of the major factors stopping them from embracing RPA and hyperautomation in the banking industry. The automation strategy cannot be properly and effectively executed without implementing organizational change management as part of the holistic approach towards technology acceptance. This factor hampers the growth of RPA and hyperautomation in banking market.

Technological Advancement in the Field of Banking

An increase in demand for a digital banking experience from millennials and Gen Z is transforming how the entire banking industry operates. Moreover, consumers growing desire to access financial services from digital channels has led to a surge in new banking technologies that are conceptualizing the banking industry. In addition, digitalization is changing how people interact and do business on a day-to-day basis, and advancements in banking technology are continuing to influence the future of financial services around the world. Furthermore, banking industry is undergoing a technological churn right now due to rising competition from fintech startups and increasing concern for cyber-security. Surge in adoption of blockchain and artificial intelligence in banking industry is propelling the growth of the market. These factors provide major lucrative opportunities in the growth of the market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the RPA and hyperautomation in banking market forecast from 2021 to 2031 to identify the prevailing RPA and hyperautomation in banking market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the RPA and hyperautomation in banking market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global RPA and hyperautomation in banking market outlook, key players, market segments, application areas, and market growth strategies.

RPA and Hyperautomation in Banking Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 7.1 billion |

| Growth Rate | CAGR of 25.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 252 |

| By Component |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | Antworks, Atos SE, Automation Anywhere, Inc., Blue Prism Limited, Protiviti Inc., Aspire Systems, UiPath, itrex group, IBM, eccenca GmbH |

Analyst Review

The volume of everyday customer queries in banks ranging from balance query to general account information is enormous, making it difficult for the staff to respond to them with low turnaround time. RPA and hyperautomation tools allow banks to automate such mundane, rule-based processes to effectively respond to queries in real-time, thereby reducing the turnaround time substantially. Moreover, the fact that robots are highly scalable allows to manage high volumes during peak business hours by adding more robots and responding to any situation in record time. In addition, hyperautomation implementation allows banks to put more focus on innovative strategies to grow their business by freeing employees from doing mundane tasks. Furthermore, with further growth in investments across the globe and rise in demand for RPA and hyperautomation in banking service, various companies have expanded their current product portfolio with increased diversification among customers.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, on In April 2020, Automation Anywhere, a global leader in Robotic Process Automation (RPA), launched new AI-powered bots to help lending institutions automate thousands of loan applications for small businesses under the $2.2 trillion U.S. coronavirus stimulus package. The new Payroll Protection Program (PPP) Bots streamline loan processing by automatically extracting application data and entering the information into the small business administration’s (SBA) loan origination portal quickly, efficiently and accurately. This strategy boosts the growth of the SAS’s RPA and hyperautomation in banking business.

Some of the key players profiled in the report include AntWorks, Aspire Systems, Atos SE, Automation Anywhere, Inc., Blue Prism Limited, eccenca GmbH, IBM, Itrex Group, Protiviti Inc. and UiPath. These players have adopted various strategies to increase their market penetration and strengthen their position in the RPA and hyperautomation in banking market.

The demand for RPA and hyperautomation in banking market is increasing due to rapid development in the automation of banking industry. By eliminating repetitive and laborious tasks, banking institutions allow their employees to work more efficiently and focus on other core tasks with the help of automation.

North America is the largest regional market for RPA and Hyperautomation in Banking market

The estimated industry size of RPA and Hyperautomation in Banking is projected to reach $7,127.15 million by 2031, growing at a CAGR of 25.7% from 2022 to 2031.

AntWorks, Aspire Systems, Atos SE, Automation Anywhere, Inc., Blue Prism Limited, eccenca GmbH, IBM, Itrex Group, Protiviti Inc. and UiPath.

Loading Table Of Content...

Loading Research Methodology...