RPA In Insurance Market Research, 2031

The global rpa in insurance market was valued at $98.6 million in 2021, and is projected to reach $1.2 billion by 2031, growing at a CAGR of 28.3% from 2022 to 2031.

RPA (Robotic Process Automation) in insurance refers to the use of software robots or virtual assistants to automate repetitive and time-consuming tasks in the insurance industry. This technology is used to handle processes such as claims processing, policy administration, underwriting, customer service, and compliance. Moreover, the goal of RPA in insurance is to improve efficiency, accuracy, and customer experience, while reducing operational costs. These, software robots perform tasks 24/7, without the need for breaks or rest, and can handle large volumes of data quickly and accurately. This leads to improved productivity, faster processing times, and a more efficient and effective insurance industry.

RPA in insurance helps for better decision-making through data analysis by automating the collection, organization, and analysis of large amounts of data. This enables insurance companies to quickly identify patterns and trends, and make informed decisions based on the insights gained from the data. Moreover, the use of RPA can also improve the accuracy and consistency of data analysis, which can lead to more informed and effective business decisions.

Furthermore, use of RPA in insurance companies also helps to achieve cost savings and efficiency, by automating repetitive and manual tasks, such as data entry, claims handling, and customer service. Thus, such automation helps to frees up employees to focus on higher-value activities, while RPA manages the time-consuming and repetitive tasks. Thus, these are some of the factors that propel the growth of the RPA in insurance market. However, implementation of RPA is expensive and may require a significant investment in technology and resources.

Moreover, the costs of installation also include integrating RPA with existing systems and processes, as well as the ongoing maintenance and upgrades required to ensure the technology is functioning effectively. Therefore, such factors function as a restraint for the growth of the market. On the contrary, the reduced operational cost is an opportunity for RPA in the insurance market. By automating manual, repetitive tasks and reducing errors, RPA help insurance companies to save on labor and operational costs, freeing up resources for other value-adding activities. Thus, such factors are likely to propel the growth of the RPA in insurance market to new heights.

The report focuses on growth prospects, restraints, and trends of the RPA in insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the RPA in insurance market.

Segment Review

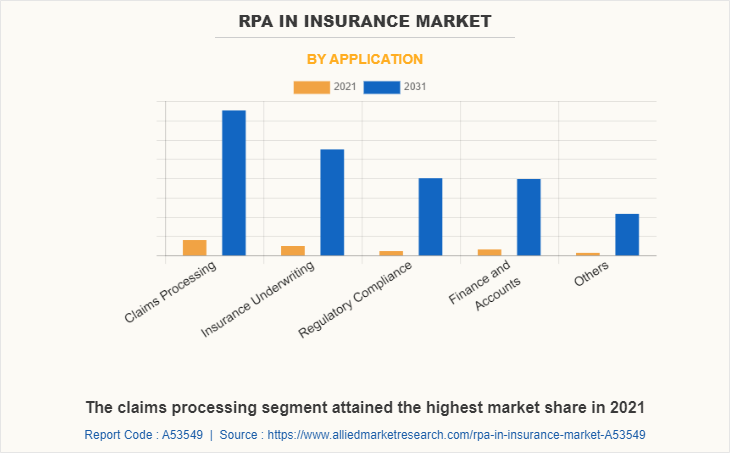

The RPA in insurance market is segmented on the basis of component, deployment mode, enterprise size, application and region. Based on component, it is segmented into solution and service. By deployment mode, it is segmented into on-premise and cloud. By enterprise size, it is segmented into large enterprise and small and medium-sized enterprises. By application, it is segmented into claims processing, insurance underwriting, regulatory compliance, finance and accounts, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on application, claim processing segment attained the highest growth in 2021. This is attributed to the fact that the use of RPA in claim processing segment helps to automate tasks such as data entry, document management, and communication with stakeholders. Additionally, it also helps to freeing up claims processing staff to focus on higher-value tasks that require human judgment and decision making. Thus, these leads to the growth of the segment in this market.

However, the regulatory compliance segment is considered to be the fastest growing segment during the forecast period. This is attributed to the fact that RPA in regulatory compliance helps to automate compliance tasks such as risk assessment, document management, and reporting thus leads to, improving the accuracy and efficiency of compliance processes. Moreover, it also enhances data security and privacy by automating processes and reducing human error. Overall, RPA helps organizations to meet regulatory requirements in a more streamlined and cost-effective manner, while improving transparency and accountability. Thus, all these factors collectively contribute toward the growth of the global RPA in insurance market outlook.

By region, North America attained the highest growth in 2021. This is attributed to the fact that in the North America, manual labor charges are high therefore, by adopting RPA software technology, it reduces the need for manual labor, decrease operational costs and improves efficiency, which lead to significant cost savings for insurance companies in North America region. However, the Asia-Pacific region is considered to be the fastest growing segment during the forecast period. This is attributed to the fact that, RPA in insurance is being driven by the rise in the occurrence of new technologies in Asia-Pacific. Moreover, integration with AI technologies, such as natural language processing and machine learning, will provide more advanced solutions in the insurance industry for the automation and efficiency of the work in this region.

The report analyzes the profiles of key players operating in the RPA in insurance market such as Aspire Systems, Automation Anywhere, Inc., Dynpro, Fidel Technologies, Infosys Limited, Opteamix, Pegasystems, Inc., Royal Cyber Inc., UiPath, and Vuram. These players have adopted various strategies to increase their market penetration and strengthen their position in the RPA in insurance market.

Market Landscape and Trends

The RPA in market has grown rapidly in recent years, with an increasing number of platforms and campaigns. RPA is rapidly gaining traction in the insurance industry as a means to streamline and automate manual and repetitive tasks, improve operational efficiency, and reduce costs. The market for RPA in the insurance sector is expected to grow significantly in the coming years, driven by factors such as the increasing demand for automation in insurance operations, the growing adoption of digital technologies, and the increasing pressure to reduce operational costs. Key trends in the RPA market for insurance include the use of RPA in claims processing, underwriting, policy administration, and customer service. Additionally, the integration of RPA with other technologies such as artificial intelligence, machine learning, and natural language processing is expected to drive further innovation and growth in the market.

Moreover, the market is characterized by the presence of a large number of established players offering RPA solutions and services, as well as new entrants looking to establish a foothold in the market. Additionally, collaboration between companies and new startups will give rise to the RPA in insurance market. Furthermore, digitalized workplaces, new innovative business and simplified operations along with accelerated performance are expected to drive the growth of the global RPA in insurance market over the forecasted period. Therefore, these are the major market trends of RPA in insurance market share.

Top Impacting Factors

Better Decision-making Through Data Analysis

RPA helps in insurance for better decision-making through data analysis by automating the collection, organization, and analysis of large amounts of data. This enables insurance companies to quickly identify patterns and trends, and make informed decisions based on the insights gained from the data. Moreover, the use of RPA can also improve the accuracy and consistency of data analysis, which leads to more informed and effective business decisions. In addition, the increasing amount of data generated by insurance companies and the need for more efficient and accurate analysis have driven this trend.

Furthermore, with RPA, insurance companies can automate data collection and analysis, and perform these tasks in a more consistent and efficient manner. This leads to faster and more accurate insights and enables companies to make better decisions based on data analysis. In addition, as technology continues to advance and the insurance industry becomes increasingly data-driven, it is likely that the trend of RPA in the insurance sector for better decision-making through data analysis will continue to grow. Thus, it helps to boost the market in upcoming years.

Cost Savings and Efficiency Improvement

The use of RPA in insurance companies helps to achieve cost savings and efficiency improvements by automating repetitive and manual tasks, such as data entry and processing, claims handling, and customer service. Therefore, such automation helps to free up employees to focus on higher-value activities, while RPA manages the time-consuming and repetitive tasks. Moreover, by automating these tasks, insurance companies can reduce costs, improve efficiency, and increase productivity. In addition, RPA eliminates the need for manual data entry and reduces the risk of errors, further improving the efficiency and accuracy of processes. Furthermore, it helps to deploy quickly and cost-effectively, and can easily scale to meet the changing needs of the business.

Moreover, in today's generation RPA offers an attractive solution for insurance companies who, are looking to achieve cost savings and efficiency improvements. For instance, Allianz has implemented RPA in its underwriting operations to automate tasks such as policy verification and premium calculation. This has led to improved speed and accuracy in the underwriting process, as well as cost savings. In addition, AXA has also implemented RPA in its customer service operations to automate tasks such as handling customer inquiries and providing quotes. This has led to improved customer satisfaction and reduced costs. Therefore, such factors are driving the growth of the RPA in insurance market size during the forecast period.

Improved Customer Experience

RPA (Robotic Process Automation) in the insurance industry can automate repetitive tasks, freeing up employees to focus on more complex and customer-facing tasks. Therefore, this can lead to improved customer service, faster processing times, and a more efficient and streamlined customer experience. Moreover, such advance technology can automate the claims processing process, reducing the time it takes for a customer's claim to be processed and approved.

Furthermore, automated processes are less prone to errors, which can lead to improved accuracy and reduced customer frustration. Thus, by automating the routine tasks, insurance companies can free up their employees to focus on more customer-facing activities, such as answering customer inquiries and resolving customer issues. In addition, with help of RPA a company can gather and analyze customer data to provide more personalized interactions and recommendations, enhancing the overall customer experience. For instance, AIG has implemented RPA in its claims handling operations to automate tasks such as data entry, claims assessment, and payment processing. This has led to improved speed, accuracy, and provides enhanced customer experience in the claims process. Thus, these factors are expected to boost the RPA in insurance market during the forecast period.

Implementation Cost is High

Implementing RPA can be expensive and may require a significant investment in technology and resources. Moreover, it requires investment in technology and resources, including software, hardware, and personnel. The costs can also include integrating RPA with existing systems and processes, as well as the ongoing maintenance and upgrades required to ensure the technology is functioning effectively. Therefore, such factors function as a retrain for the growth of the market.

Data Security and Privacy

Data security and privacy are major concerns in the implementation of RPA in the insurance market. The insurance industry deals with a significant amount of sensitive customer data, including personal information and financial details, which must be protected against unauthorized access and breaches.

Furthermore, to ensure data security and privacy, insurance companies should implement strict security protocols and procedures, such as encryption, secure data storage, and restricted access to sensitive information. In addition, the industry oversees sensitive information such as personal and financial data, which must be protected from unauthorized access, breaches, and theft. Therefore, to mitigate these risks, insurance companies should implement robust security measures, such as encryption, secure data storage, and restricted access controls. Therefore, this is one of the major factors that hampers the growth of RPA in insurance industry.

Auto Claim Processing

The reduced operational cost is an opportunity for RPA in insurance market growth. By automating manual, repetitive tasks and reducing errors, RPA can help insurance companies to save on labor and operational costs, freeing up resources for other value-adding activities. In addition, the improved efficiency and accuracy offered by RPA can also reduce costs associated with errors and inefficiencies. Moreover, auto claim processing in the insurance industry refers to the use of technology, such as RPA, to automate the handling and resolution of insurance claims. This process typically involves the use of software robots to perform tasks such as data entry, document handling, and claim adjudication.

Furthermore, this process can lead to a faster and more efficient claims process, improved accuracy, consistency, and enhanced customer experience. In addition, there are advantages of auto claim processing which include, faster processing times and improved accuracy. The use of RPA in insurance leads to more accurate and consistent claim processing. Therefore, these factors provide opportunities for the growth of RPA in insurance market in upcoming years.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the RPA in insurance market forecast from 2022 to 2031 to identify the prevailing RPA in insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the RPA in insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global RPA in insurance market trends, key players, market segments, application areas, and market growth strategies.

RPA in Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.2 billion |

| Growth Rate | CAGR of 28.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 418 |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | Vuram, Opteamix, Aspire Systems, Dynpro, Fidel Technologies, Infosys Limited, Royal Cyber Inc., Pegasystems, Inc., UiPath, Automation Anywhere, Inc. |

Analyst Review

Robotic Process Automation (RPA) is a technology that allows automating repetitive and manual tasks through software robots. In addition, it helps organizations to streamline their processes and improve efficiency. Moreover, insurance sector uses RPA for automating claims handling, reducing manual data entry, and speeding up the claims settlement process. The RPA software technology also helps for the automating the underwriting tasks, such as collecting and analyzing data from various sources, reducing manual errors and improving accuracy. Utilizing RPA also identify and detect the fraud patterns in real-time to prevent financial losses.

Furthermore, market players are adopting strategies like partnership for enhancing their services in the market and improving customer satisfaction. For instance, in 2022, Pegasystems Inc., the software company has announced partnership with QBE European Operations, one of the world's leading insurers and reinsurers, with this partnership Pegasystems Inc. will be using, Robotic Process Automation (RPA) to increase efficiency and improve customer experience. Therefore, such strategies are boosting the growth of the market in upcoming years.

Moreover, some of the key players profiled in the report include are Aspire Systems, Automation Anywhere, Inc., Dynpro, Fidel Technologies, Infosys Limited, Opteamix, Pegasystems, Inc., Royal Cyber Inc., UiPath, and Vuram. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The RPA in Insurance Market will expand at a CAGR of 28.3% from 2021 - 2031

the market value of RPA in Insurance Market by the end of 2031 will be $1.15 billion

Better decision-making through data analysis Cost savings and efficiency improvement Improved customer experience

Aspire Systems, Automation Anywhere, Inc., Dynpro, Fidel Technologies, Infosys Limited, Opteamix, Pegasystems, Inc., Royal Cyber Inc., UiPath, and Vuram

The RPA in insurance market is segmented on the basis of component, deployment mode, enterprise size, application and region. Based on component, it is segmented into solution and service. By deployment mode, it is segmented into on-premise and cloud. By enterprise size, it is segmented into large enterprise and small and medium-sized enterprises. By application, it is segmented into claims processing, insurance underwriting, regulatory compliance, finance and accounts, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA

Loading Table Of Content...