Rubber Coated Fabrics Market Research, 2033

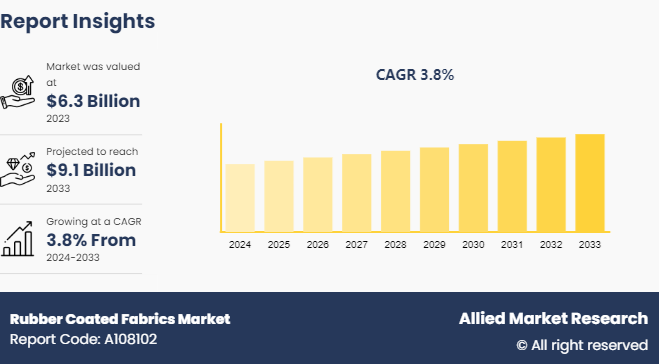

The global rubber coated fabrics market was valued at $6.3 billion in 2023, and is projected to reach $9.1 billion by 2033, growing at a CAGR of 3.8% from 2024 to 2033.

Market Introduction and Definition

Rubber-coated fabric refers to material that consists of a base fabric or substrate that has been coated or laminated with a layer of rubber or a rubber-like material. The coating process involves applying a thin layer of rubber compound onto the surface of the fabric, creating a composite material with enhanced properties such as flexibility, durability, weather resistance, and impermeability. These coated fabrics offer advantages such as increased strength, abrasion resistance, and the ability to withstand environmental factors such as water, chemicals, and UV radiation.

Key Takeaways

The rubber coated fabrics market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major rubber coated fabrics industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

Rubber coated fabrics exhibit low permeation and diffusion. This coating provides several desirable characteristics such as durability, weather resistance, waterproofing, and flexibility. Rubber-coated fabrics are utilized in various components to improve performance and longevity. They are commonly used in car seats, door panels, and interior trims to enhance durability, provide water resistance, and improve aesthetics. In addition, rubber-coated fabrics are employed in the manufacturing of automotive covers such as car covers and truck tarps that offer protection against weather elements and environmental damage. As the automotive industry embraces technological advancements and stringent performance standards, the demand for durable and high-performance rubber-coated fabrics for belts and seats is expected to drive the growth of the rubber coated fabrics market.

However, challenges such as difficulty in recycling these materials effectively restrain the rubber-coated fabrics market. As compared to certain textile or polymer-based materials that are easily recycled, the complex composition of rubber-coated fabrics involves a combination of rubber polymers and various textiles that makes recycling a technically demanding and economically less viable process. In addition, as regulations and standards related to environmental impact become more stringent, industries are seeking materials that align with circular economy principles. The restricted recyclability of rubber-coated fabrics leads to regulatory challenges and limits their acceptance in markets where sustainable and recyclable materials are preferred or mandated. All these factors are expected to hamper the rubber coated fabrics market growth.

Rubber-coated fabrics are versatile materials that offer durability and flexibility of textiles with the protective and weather-resistant properties of rubber coatings. These fabrics are created by applying a layer of rubber or rubber like material onto a base textile substrate through various coating processes such as calendaring, dipping, or spraying. The growing demand for waterproof and weatherproof materials has driven the popularity of rubber-coated fabrics across a wide range of industries. With their unique combination of properties, such as water resistance, durability, flexibility, and chemical resistance, rubber-coated fabrics have become indispensable in applications where protection against the elements is essential. This demand creates significant opportunities for manufacturers to innovate and advance the technology of rubber-coated fabrics.

Market Segmentation

The rubber coated fabrics market is segmented by raw material, application, end-use industry, and region. By raw material, the market is classified as natural rubber and synthetic rubber. By application, the market is divided into protective clothing, accessories, home decor, and others. By end-use industry, the market is divided into aerospace and defense, marine, pharmaceuticals, sports, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The automotive industry in the Asia-Pacific region is a significant consumer of rubber coated fabrics. These materials are used in the production of car interiors such as seat covers, dashboards, and door panels where durability and resistance to wear and tear are highly valued. In addition, rubber coated fabrics provide excellent noise and vibration dampening properties, contributing to a quieter and more comfortable ride. Moreover, in commercial vehicles and public transportation these fabrics are employed in flooring due to their ease of cleaning and maintenance. As the automotive sector grows, driven by increasing consumer demand and manufacturing capabilities, the use of rubber coated fabrics is expanding. According to India Brand Equity Foundation (IBEF) , Mr. Piyush Goyal discussed the roadmap to achieve the target of $250 billion in textiles production and $100 billion in exports by 2030.

Competitive Landscape

The major players operating in the rubber coated fabrics market include W. KÖPP GmbH & Co. KG, Trelleborg Group, Saint-Gobain S.A, Nolato AB, White Cross Rubber Products Limited, Caodetex S.A, Auburn Manufacturing, Inc, Fothergill Group, Arville, Zenith Rubber, and Bobet Company.

Recent Key Strategies and Developments

- In July 2022, BASF SE announced a collaboration with Permionics Membranes, a membrane manufacturer based in Vadodara, to expand the application of BASF’s Ultrason E polyethersulphone (PESU) polymer. This collaboration aims to utilize the properties of Ultrason E in creating coated fabrics designed to serve as particulate and bacterial filters for face masks.

- In January 2022, Trelleborg Industrial Solutions acquired an operation from Alpha Engineered Composites, specializing in polymer-coated fabrics for niche applications. With an annual sales volume of around $10 million, this acquisition grants Trelleborg access to advanced heat-resistant silicone coated fabric technologies. This move enables Trelleborg to enter new markets within the coated fabrics sector while offering innovative solutions to existing clients and expanding its customer base into adjacent applications.

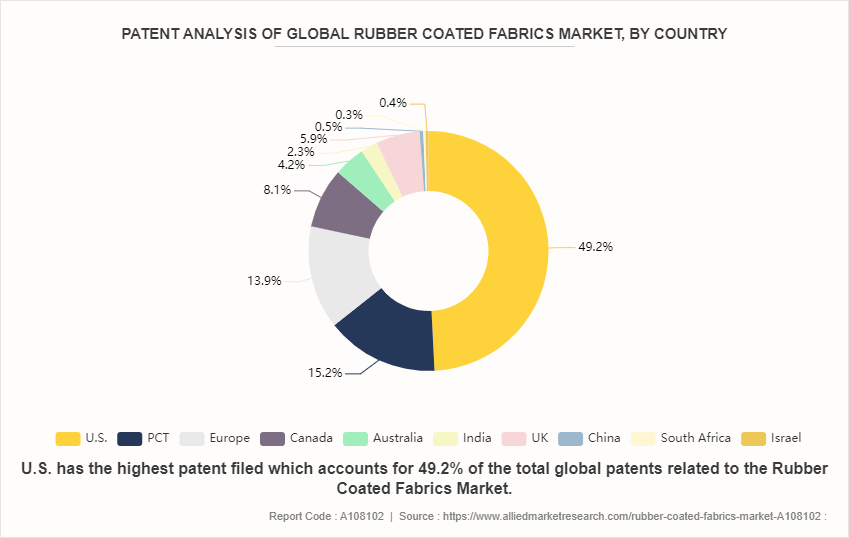

Global Rubber Coated Fabrics Market- Patent Outlook, by Country

The U.S. collectively hold half of the total rubber coated fabrics patents that indicate strong innovation and investment in this technology in U.S. countries. This suggests fierce competition and a significant focus on rubber coated fabrics R&D in these leading economies. U.S. has the highest patent filed those accounts for 49.2% of the total global patents related to the rubber coated fabrics market. Europe and PCT, although holding smaller percentages of rubber coated fabrics patents individually, collectively contribute to the overall Asian dominance in rubber coated fabrics innovation. This reflects the region's strong presence in materials science and engineering R&D.

Key Regulations

- Volatile Organic Compounds (VOCs) : VOC emissions occur during the manufacturing process of rubber coatings and fabrics, particularly during solvent-based coating applications. While specific emission standards for VOCs in the rubber coated fabric industry are universally mandated, manufacturers are still subject to regulations governing air quality and emissions in area. Compliance with VOC emission limits is required to mitigate environmental impact and ensure workplace safety.

- Particulate Matter (PM) : Depending on the production processes involved, particulate matter emissions are also a concern in the rubber coated fabric industry. These particles arise from activities such as grinding, cutting, or curing of rubber materials. While standardized emission limits for PM are specific to this industry, manufacturers implement control measures and best practices to minimize particulate emissions and maintain air quality standards in facilities.

- Other Air Pollutants: In addition to VOCs and particulate matter, emissions of other air pollutants such as nitrogen oxides (NOx) , carbon monoxide (CO) , and sulfur dioxide (SO2) occur during energy-intensive manufacturing processes or combustion activities. While emission standards for these pollutants explicitly tailored to the rubber coated fabric market, manufacturers need to comply with general air quality regulations and emission limits set by environmental agencies to mitigate potential impacts on human health and the environment.

Industry Trends

According to the China Association of Automobile Manufacturers, the production of New Energy Vehicles (NEVs) in the country experienced a remarkable year-on-year increase of 96.9% in December 2022 since 2021. This substantial growth has significantly boosted the rubber coating fabrics market, reflecting the rising demand and production capacity for NEVs in China.

According to India Brand Equity Foundation (IBEF) , India’s textile and apparel exports (including handicrafts) stood at $ 44.4 billion in 2022, with a 41% increase YoY.

In 2022, China solidified its position as the world's leading automotive production hub, boasting a total output of 27 million vehicles, as reported by the China Association of Automobile Manufacturers (CAAM) . This marked a 3.4% increase from the previous year's production of 26 million units.

Key Sources Referred

SAE International

International Organization for Standardization

International Energy Agency (IEA)

International Renewable Energy Agency (IREA)

Invest India

United Nations Development Programme (UNDP)

India Brand Equity Foundation (IBEF)

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the rubber coated fabrics market analysis from 2024 to 2033 to identify the prevailing rubber coated fabrics market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the rubber coated fabrics market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global rubber coated fabrics market trends, key players, market segments, application areas, and market growth strategies.

Rubber Coated Fabrics Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 9.1 Billion |

| Growth Rate | CAGR of 3.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 340 |

| By Raw Material |

|

| By End-Use Industry |

|

| By Application |

|

| By Region |

|

| Key Market Players | Zenith Rubber, W. KÖPP GmbH & Co. KG, Fothergill Group, Nolato AB, Trelleborg Group, Auburn Manufacturing, Inc, White Cross Rubber Products Limited, Caodetex S.A, Arville Textiles Limited, Saint-Gobain S.A. |

Increasing demand for lightweight and durable materials, rising demand for protective clothing and equipment are the upcoming trends of Rubber Coated Fabrics Market.

Asia-Pacific is the largest regional market for Rubber Coated Fabrics.

Protective clothing is the leading application of Rubber Coated Fabrics Market.

$9.1 billion is the estimated industry size of Rubber Coated Fabrics by 2033

W. KÖPP GmbH & Co. KG, Trelleborg Group, Saint-Gobain S.A, Nolato AB, White Cross Rubber Products Limited, Caodetex S.A, Auburn Manufacturing, Inc., Fothergill Group, Arville, Zenith Rubber, Bobet Company are the top companies to hold the market share in Rubber Coated Fabrics

Loading Table Of Content...