Safety Laser Scanner Market Statistics - 2031

The Global Safety Laser Scanner Market size was valued at $436.7 million in 2021 and is projected to reach $849.6 million by 2031, growing at a CAGR of 6.9% from 2022 to 2031. A safety laser scanner is a device that detects the presence of persons or objects in a specific area and provides safety measures to avoid accidents. The scanner emits a rotating laser beam that forms a protective zone around the region being scanned. When an object or a person enters the protected field, the scanner identifies the interruption and sends a signal to the control system, which causes the machinery or equipment in the area to halt or slow down.

Safety laser scanners are widely employed in a variety of industries, including manufacturing, logistics, and automotive, to ensure worker safety and avoid accidents.

The research provides a complete analysis of the global safety laser scanner market, including market dynamics, essential segments, major regions, key players, and competitive landscape. Based on the influence of numerous industry dynamics and important variables driving the market, the research gives a detailed picture of the present market condition and future trends of the global safety laser scanner market.

The market dynamics identify the market drivers and opportunities that contribute to market growth. Furthermore, difficulties and barriers that have the potential to stymie market progress are outlined in the global safety laser scanner market. Porter's five forces analysis is delivered through the report, which precisely highlights the effects of key forces on the global safety laser scanner market. The report offers market size and estimation, analyzing the global safety laser scanner market through various segments.

The global safety laser scanner market is expected to witness notable growth during the forecast period, owing to technological advancements in the machine safety system. Moreover, the rise in emphasis on the workplace is one of the major drivers of the safety laser scanner market outlook. Furthermore, the growth in industrial automation is projected to shape the future of the safety laser scanner market.

However, the high cost associated with safety laser scanners is one of the prime factors that restrain the safety laser scanner market growth. In contrast, the growing demand for industrial safety solutions in emerging economies the projected to provide a lucrative opportunity to expand the safety laser scanner market during the forecast period.

Segment Overview

The safety laser scanner market is segmented into Type, End Use, and Region.

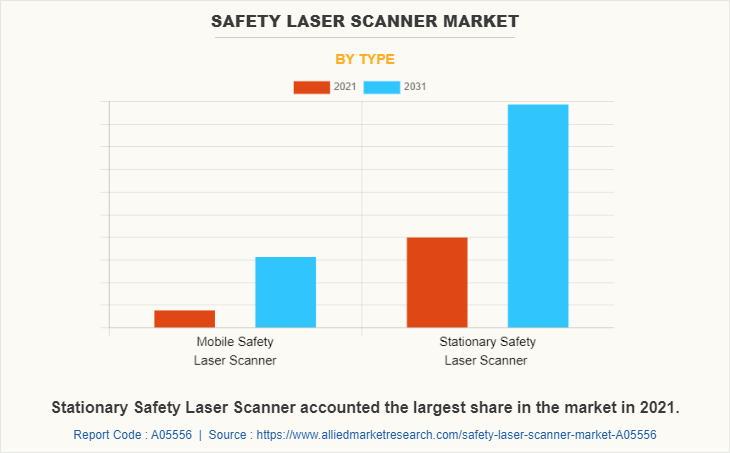

By type, the market is divided into mobile safety laser scanners and stationary safety laser scanners. In 2021, the stationary safety laser scanners segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period. However, the mobile safety laser scanners segment is expected to grow at a steady rate during the forecast period.

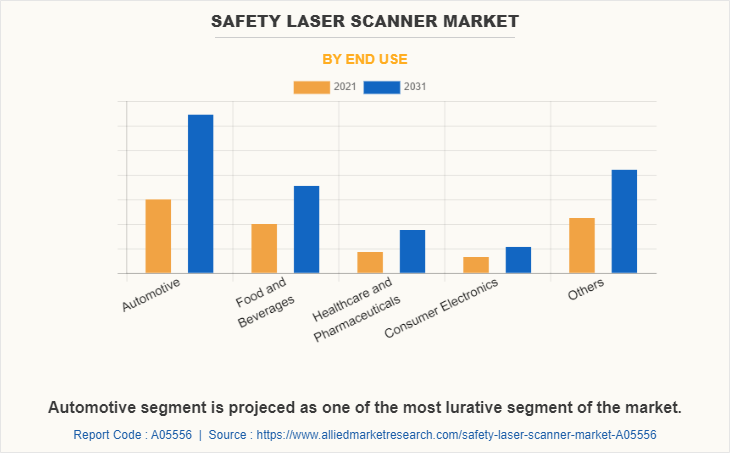

By end use, the market is classified into automotive, food & beverage, healthcare & pharmaceuticals, consumer electronics, and others. The automotive segment acquired a major share of the safety laser scanner market forecast in 2021 and is expected to grow at a high CAGR from 2022 to 2031.

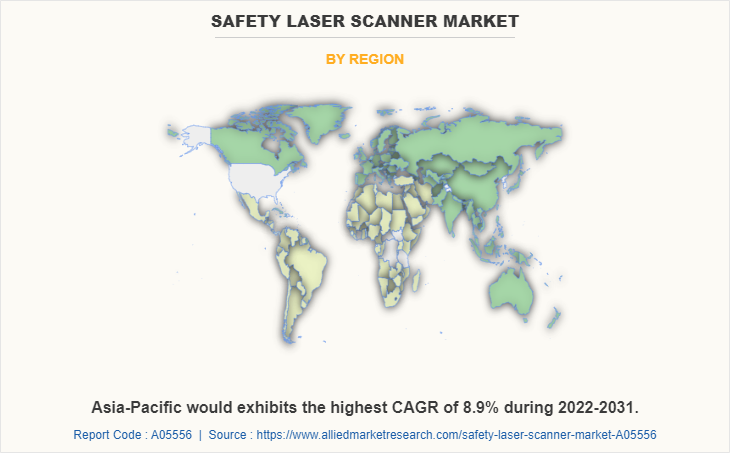

Region-wise, the safety laser scanner market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, and the Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). North America, specifically the U.S., remains a significant participant in the safety laser scanner market. Major organizations and government institutions in the North American region have significantly put resources into action to develop enhanced labor safety solutions for various sectors, including automotive, consumer electronics, and others are driving the growth of the safety laser scanner industry.

Competitive Analysis

Competitive analysis and profiles of the major global safety laser scanner market players that have been provided in the report include OMRON Corporation, Panasonic Corporation, SICK AG, Keyence Corporation, Hans Turck GmbH & Co. KG, Hokuyo Automatic Co., Ltd, Arcus, Banner Engineering, Leuze electronic GmbH Co. KG, IDEC Corporation, Pepper+Fuchs SE, and Rockwell Automation Inc.

Country Analysis

North America-wise, the U.S. acquired a prime share in the safety laser scanner market in the North America region and is expected to grow at a high CAGR of 4.7% during the forecast period of 2022-2031. The U.S. holds a dominant position in the safety laser scanner market, owing to the presence of prime players such as SACK AG, AMRON Corporation, Rockwell Automation, Inc., Leuze Electronics, and others that have significant investments in next-generation machine safety systems.

In Europe, Germany dominated the Europe safety laser scanner market share in terms of revenue in 2021 and is expected to follow the same trend during the forecast period. Furthermore, the UK is expected to emerge as one of the fastest-growing countries in Europe's safety laser scanner industry with a CAGR of 6.5%, owing to significant development in the Internet of Things, machine learning, Industry 4.0, and consumer electronics solutions.

In Asia-Pacific, China holds a dominant market share in the Asia-Pacific region and is expected to follow the same trend during the forecast period, owing to a significant rise in investment by prime players in next-generation machine safety systems to boost the safety laser scanner market. However, Japan is expected to emerge as a dominant country in the safety laser scanner market in the Asia-Pacific region.

In LAMEA, Latin America garnered a significant Safety laser scanner market outlook in 2021, owing to increasing demand for safety equipment such as safety laser scanners to assure worker safety and avoid accidents. In addition, automation is becoming more prevalent in industries such as automotive, manufacturing, and logistics in the Middle East region. As a result, there is an increasing demand for safety technology, such as safety laser scanners, to ensure worker safety in automated workplaces.

Top Impacting Factors

Significant factors that impact the growth of the global safety laser scanner industry include the growing industrial automation, paired with the rise in technological advancement in advanced machine safety systems. Moreover, the surge in emphasis on the workplace is expected to drive the safety laser scanner market opportunity. However, the high cost associated with the safety laser scanners is acting as a prime barrier to early adoption, which hampers the growth of the market. On the contrary, the rise in demand for safety laser scanner systems in emerging economies is expected to offer potential growth opportunities for the safety laser scanner market during the forecast period.

Historical Data & Information

The safety laser scanner market is highly competitive, owing to the strong presence of existing vendors. Vendors of safety laser scanner machines with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

OMRON Corporation, SICK AG, Keyence Corporation, Leuze Electronic GmbH Co. KG, and IDEC Corporation are the top 5 companies holding a prime share in the Safety laser scanner market. Top market players have adopted various strategies, such as product launches, partnerships, acquisitions, product upgrades, and product development, to expand their foothold in the Safety laser scanner market.

- In December 2020, OMRON Corporation announced the release of its 1S Series AC Servo System with Safety Functionality. A new model joined the 1S Series, helping achieve safer manufacturing environments and higher productivity in digital, food, pharmaceutical, cosmetics, and other industries.

- In April 2021, SICK AG launched the scanGrid2 safe multi-beam scanner. The compact sensor uses a novel and in-house developed solid-state LiDAR technology to increase the productivity of small autonomous and line-guided transport vehicles. It is certified as a Type 2/SIL 1 safety sensor according to IEC 61496-3. The scanGrid2 can protect hazardous areas up to performance level C and works well for collision avoidance.

- In June 2021, Maxim Integrated Products, Inc., announced its collaboration with Sick AG. This allowed Maxim's software-configurable digital IO products to enable a 50 percent size reduction for the microScan3 Core I/O LiDAR-based safety laser scanner from SICK AG. It also allowed SICK to expand the versatility of the new nanoScan3 Safety Laser Scanner for machines and vehicles that require high performance but have minimal mounting space.

- In June 2020, IDEC Corporation upgraded the SE2L Safety Laser Scanner. A laser scanner is a safety device that uses the reflection of laser beams to detect the presence of objects or people. The upgrade allowed the SE2L scanner to act as master and communicate with up to three other scanners. The safety controller only needs to communicate with the master, reducing the required number of input and communication channels on the controller.

- In August 2022, Leuze Electronic Group aimed to double the production for the sensor people. It constructed its new Leuze production site in Malacca (Malaysia) represents a key element in its global growth strategy.

- In April 2022, Leuze developed the new 36-sensor series, including a safety sensor. These sensors are suitable for the demanding requirements in intralogistics, packaging systems, and the automotive industry. They detect objects with different optical properties – even at a great distance, with vibration, ambient lighting, or soiling.

- In October 2021, Ambi Robotics Partnered with Keyence to increase the scanning speed for AI-powered parcel sorting robots. This partnership with Keyence Corp. enabled high-speed data collection at the pace of Ambi’s parcel sorting robots, increasing throughput for global delivery brands

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis from 2021 to 2031 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global safety laser scanner market trends, key players, market segments, application areas, and market growth strategies.

Safety Laser Scanner Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 849.6 million |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 302 |

| By Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Rockwell Automation Inc., SICK AG, Arcus, KEYENCE CORPORATION, Hans Turck GmbH & Co. KG, HOKUYO AUTOMATIC CO.LTD, IDEC Corporation, OMRON Corporation, Leuze electronic GmbH Co. KG, Panasonic Corporation, Banner Engineering, PepperlFuchs SE |

Analyst Review

The safety laser scanner system has witnessed significant growth in automotive, healthcare, Pharmaceutical, and manufacturing sectors, owing to a surge in industrial automation and workers' safety regulations by various governments globally. Moreover, the implementation of Industry 4.0 technologies such as the Internet of Things (IoT) and artificial intelligence (AI) is likely to propel the growth of the safety laser scanner market. These technologies allow safety laser scanners to interface with other equipment and systems, enhancing overall workplace safety and productivity.

The global safety laser scanner market is highly competitive, owing to the strong presence of existing vendors. Safety laser scanner vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in the market is expected to further intensify with an increase in technological innovations, product extensions, and different strategies adopted by key vendors.

The rise in demand for machine safety systems across the industrial, automotive, and healthcare sectors globally is driving the need for next generation to enhance the growth of the safety laser scanner market. Moreover, prime economics, such as the U.S., China, Germany, and Japan, has significantly invested in next-generation 3D safety laser scanner systems to offer enhanced safety for workers. Moreover, emerging economies, such as India, South Korea, Brazil, and others are imposing various safety standards for industrial automation and manufacturing solution, which is anticipated to provide lucrative opportunities for the safety laser scanner market.

Among the analyzed geographical regions, North America exhibits the highest adoption of safety laser scanners and has been experiencing a massive expansion of the market. On the other hand, Asia-Pacific is expected to grow at a faster pace, predicting lucrative growth due to emerging countries such as China, Japan, and India investing in these technologies. Regions such as the Middle East and Africa are expected to offer new opportunities for the growth of the safety laser scanner market in the future.

North America is the largest region for the safety laser scanner market.

Significant factors that impact the growth of the global safety laser scanner industry include the growing industrial automation paired with the rise in technological advancement in advanced machine safety systems.

OMRON Corporation, SICK AG, Keyence Corporation, Leuze electronic GmbH Co. KG, and IDEC Corporation are the top 5 companies holding a prime share in the Safety laser scanner market.

The Automotive segment acquired a major share of the safety laser scanner market in 2021.

The global safety laser scanner market was valued at $436.7 billion in 2021 and is projected to reach $849.6 billion by 2031, registering a CAGR of 6.9% from 2022 to 2031

Loading Table Of Content...