Safety Needles Market Outlook - 2026

The safety needles market accounted for $1,609 million in 2018, and is expected to reach $3,009 million by 2026, registering a CAGR of 8.1% from 2019 to 2026.

A needle is solid and slender instrument, which is pointed at the end and is employed for puncturing of tissues. They are used for various purposes such as to draw blood from the body for sample collection, administration of drug in the body, and others. However, healthcare workers are at higher risk of accidentally puncturing the skin leading to needlestick injuries. Therefore, safety needles are devices which are equipped with features such as a sheath that covers the needle to prevent needlestick injuries. Various types of safety needles are available in the market that work on different mechanisms. For instance, active safety needles require manual activation of the safety feature, whereas passive safety needles are automatic. The safety features of these needles have led to surge in their adoption among various end users such as hospitals & ambulatory surgery centers, diabetic patients, and others.

Rise in cases of needlestick injuries worldwide and surge in prevalence of chronic & infectious disease are the key factors that drive the growth of the global safety needles market. In addition, surge in adoption of safety needles across the globe and implementation of favorable government initiatives related with the use of safety needles are the prime factors that boost the growth of the market. However, availability of alternative modes of drug delivery and high cost of needles hamper the market growth.

Safety Needles Market Segmentation

The safety needles market is segmented based on product, end user, and region to provide a detailed assessment of the market. Depending on product, the market is divided into active safety needles and passive safety needles. On the basis of end user, it is classified into hospitals & ambulatory surgery centers, diabetic patients, family practices, psychiatry, and others. Region wise, the safety needles market size is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, UK, Italy, Spain, France, Czech Republic, Republic of Moldova, Poland, Hungary, Romania, Russia, Slovakia, Ukraine, Greece, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, Taiwan, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, UAE, Qatar, Lebanon, Jordan, and rest of LAMEA).

Segment review

By product

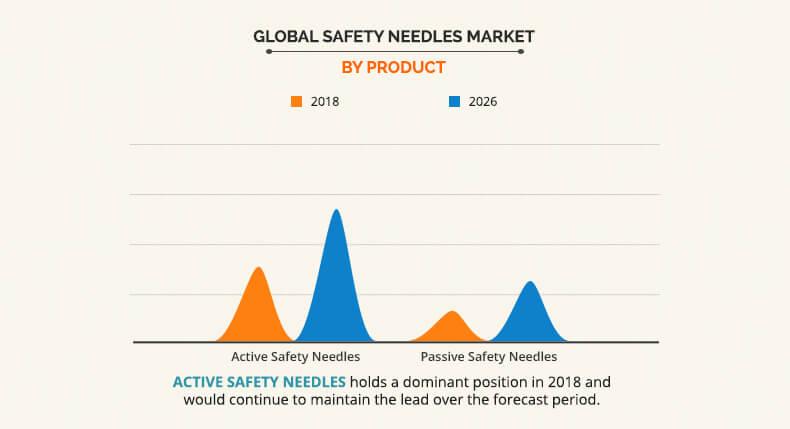

In 2018, the active safety needles segment acquired the major share in the safety needles market, owing to their widespread adoption and rise in cases of needlestick injuries. Active safety needles are low priced as compared to passive safety needles, which is another factor that boosts the safety needles market growth. However, the passive safety needles segment is expected to grow at the fastest rate during the forecast period, as they are automatic, which eliminates the need for manual activation of safety feature. In addition, they do not have extra assembly parts and hence can be easily disposed and require lesser space in packaging, which is beneficial for pharmaceutical companies. Therefore, the aforementioned factors significantly contribute toward the growth of the market.

By end user

Based on end user, the hospitals & ambulatory surgery centers segment acquired the major share in the safety needles market, as these devices are used in drug administration and blood sample collection, which are majorly performed by highly trained medical staff in hospitals and surgery centers. However, the psychiatry segment is expected to grow at a significant rate during the forecast period, due to rise in awareness related to need of safety needles in psychiatry. This is attributed to the elevated risk of needlestick injuries among healthcare workers.

By region

In 2018, North America accounted for the major share, and is expected to continue this trend in the near future, owing to rise in prevalence of needlestick injuries in the region. Moreover, other factors such as easy availability of safety needles, presence of majority of key players, and surge in adoption of safety needles boost the growth of the market in North America. However, Asia-Pacific is expected to exhibit fastest growth rate in the near future, owing to surge in awareness related harmful outcomes of needlestick injuries. The other factors that boost the growth of the market include presence of huge patient base suffering from chronic & infectious diseases and rise in healthcare expenditure in the region. Furthermore, the constantly evolving life science industry is anticipated to offer lucrative opportunities for market expansion in the developing economies such as India, China, and Malaysia.

Major players operating in the market include B. Braun Melsungen AG, Becton, Dickinson and Company, Cardinal Health, Johnson & Johnson (Ethicon Inc.), Nipro Corporation, Novo Nordisk A/S, Retractable Technologies, Inc., Smiths Group Plc., Terumo Corporation, and Vygon SA.

Key Benefits for Safety Needles Market:

- This report entails a detailed quantitative analysis along with the current global safety needles market trends from 2019 to 2026 to identify the prevailing opportunities along with the strategic assessment.

- The safety needles market forecast is studied from 2019 to 2026.

- The market size and estimations are based on a comprehensive analysis of key developments in the safety needles industry.

- A qualitative analysis based on innovative products facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the market

Safety Needles Market Report Highlights

| Aspects | Details |

| By Product |

|

| By End User |

|

| By Region |

|

| Key Market Players | B. BRAUN MELSUNGEN AG, BECTON, DICKINSON AND COMPANY, VYGON SA, TERUMO CORPORATION, CARDINAL HEALTH, RETRACTABLE TECHNOLOGIES, INC., JOHNSON & JOHNSON (ETHICON INC.), NOVO NORDISK A/S, NIPRO CORPORATION, SMITHS GROUP PLC. |

Analyst Review

Safety needles are expected to witness high adoption in the near future, owing to increase in number of needlestick- and sharps-related injuries. In addition, the market is exhibiting high growth rate, due to increase in usage of injectable drugs & vaccines and active initiatives undertaken both by governments & non-governmental organizations toward the use of safety needles to prevent hospital staff from infections. Moreover, surge in applications of injection & infusion therapies significantly contribute toward the growth of the market.

In addition, technological advancements such as improved retractable & passive safety hypodermic needles boost the market growth. Asia-Pacific and LAMEA are expected to offer lucrative growth opportunities to the key players. This is majorly attributed to factors such as improvement in healthcare facilities, rise in disposable income, and rapid improvement in economic conditions. However, availability of alternative modes of drug delivery and high costs associated with safety needles restrain the market growth. On the contrary, safety needle manufacturers and distributors have focused on expanding their presence in the emerging economies to strengthen their foothold in the market.

Loading Table Of Content...