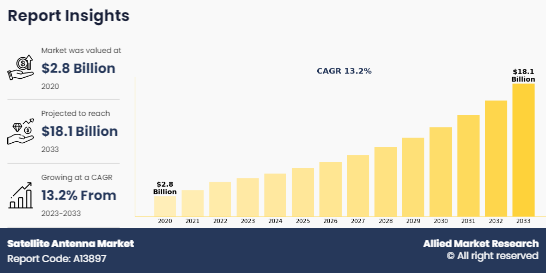

The global satellite antenna market was valued at $2.8 billion in 2020, and is projected to reach $18.1 billion by 2033, growing at a CAGR of 13.2% from 2023 to 2033.

An antenna is a specialized device that transforms electric currents into electromagnetic (EM) waves, or conversely, converts EM waves into electric currents. The satellite antenna functions as a crucial apparatus for either receiving or transmitting high-frequency electromagnetic waves between the Earth and satellites in orbit. It adjusts these frequencies to enable their distribution across coaxial cable networks. The components of parabolic satellite antenna include reflector/dish, feed horn, antenna, and low-noise block converter.

Key Takeaways

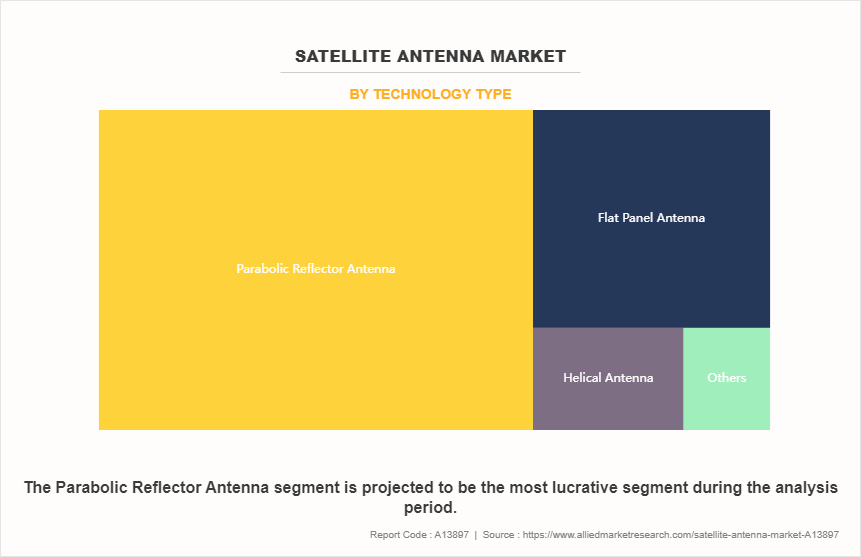

- On the basis of type, the parabolic reflector antenna segment held the largest share in the satellite antenna market in 2022.

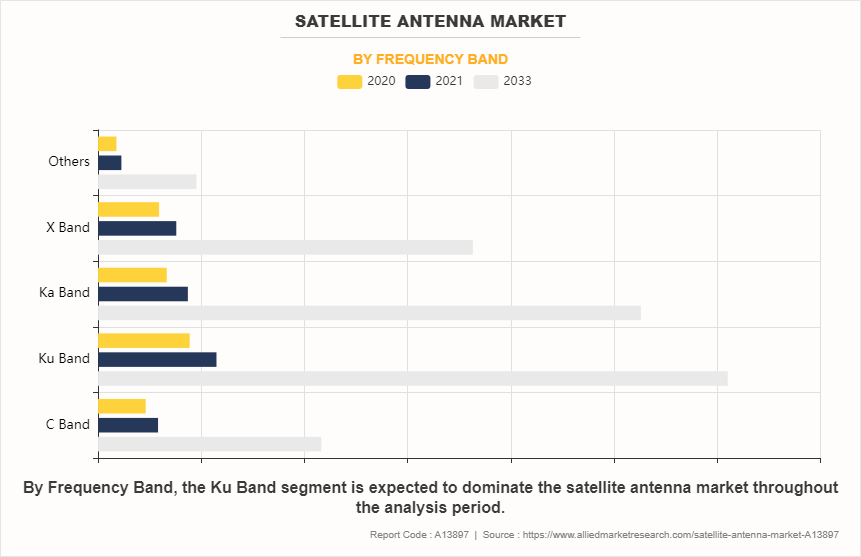

- By frequency band, the Ku band segment held the largest share in the market in 2022.

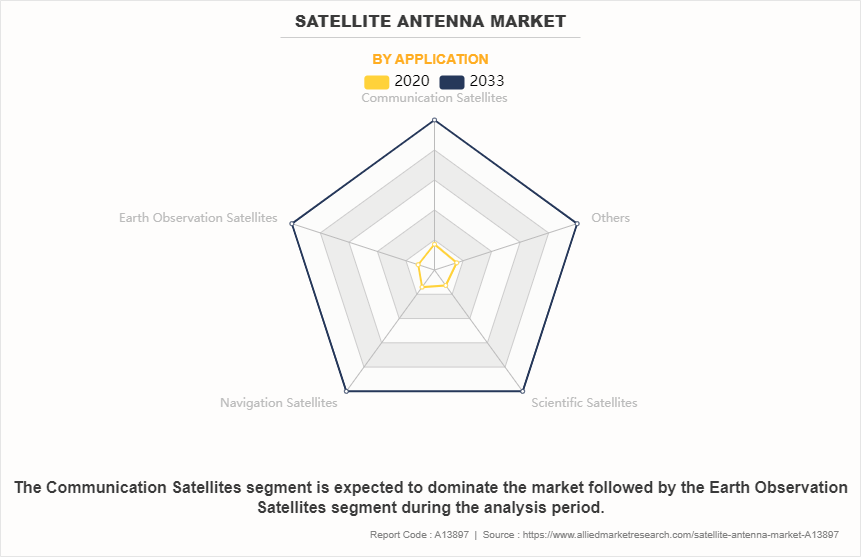

- On the basis of application, the communication satellites segment held the largest market share in 2022.

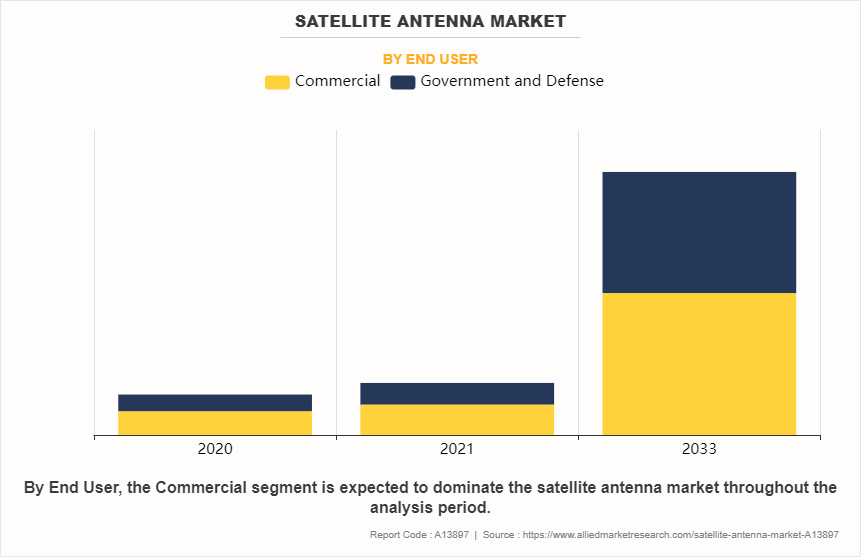

- On the basis of end user, the commercial segment held the largest market share in 2022.

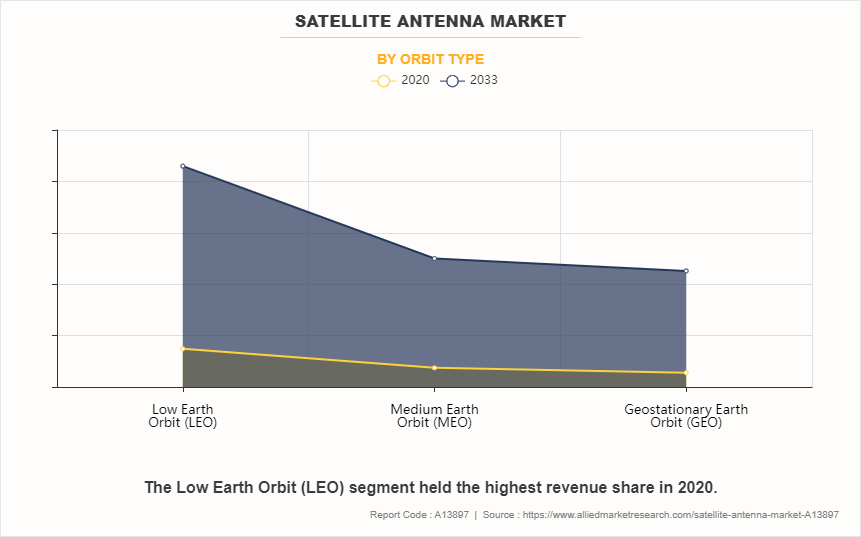

- On the basis of orbit type, the low earth orbit (LEO) segment held the largest market share in 2022.

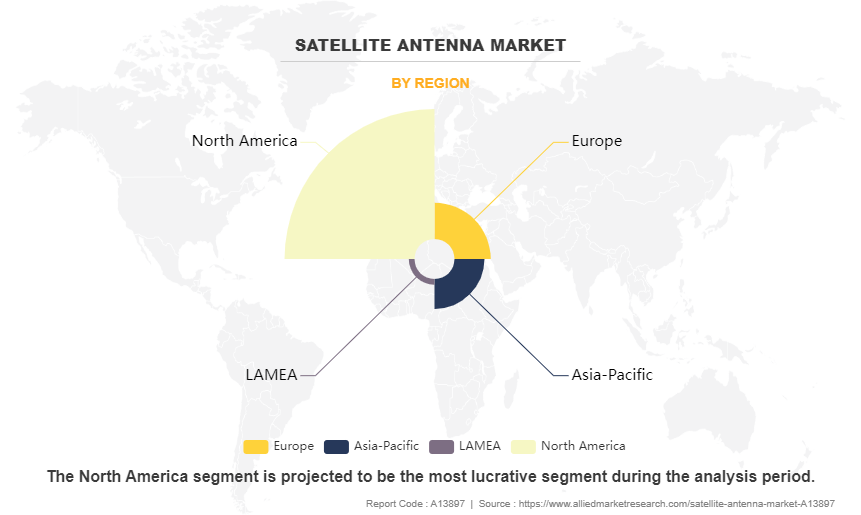

- On the basis of region, North America held the largest market share in 2022.

Satellite Antenna Market in United States

The U.S. accounts for major market share, with high demand from defense and intelligence agencies deploying satellite communications for tactical needs. Consumer broadband has also propelled antenna demand, as SpaceX Starlink scales users in the U.S. and Canada. SpaceX has expanded production for dish antennas to meet orders. Major satellite companies are engaged in the development of sophisticated antenna technologies to strengthen the capabilities of satellite services in this region, boosting the growth of the satellite antenna market across U.S. Moreover, apart from SpaceX, there are other players such as Amazon, which adopted new antenna systems to increase market presence in the U.S. For instance, in March 2023, Amazon unveiled three satellite antennas in anticipation of competing with Starlink of SpaceX with its own Project Kuiper internet network. Amazon stated that it anticipates paying less than $400 per unit to produce the "standard" model of the satellite antenna, also referred to as a customer terminal. Such developments are expected to propel the satellite antenna market growth.

Global satellite companies have expanded the adoption of advanced antenna in Canada. For instance, in February 2022, Telesat, a global satellite communications company partnered with Cobham Limited, a terminal solutions provider, to equip its upcoming low-orbit satellite network. Cobham Limited is expected to supply tracking antennas and install them at landing stations globally. This enables the satellite operator to build out ground infrastructure for its next-gen broadband constellation. The companies intend to set up the initial 30 global landing stations in Canada. The government of Mexico partnerships with companies, such as Hughes and Viasat, Inc., have expanded satellite broadband and TV access for rural areas, creating a steady antenna sales opportunity. For instance, in February 2023, Viasat, Inc., a global satellite company, and a Mexican telecom company collaborated to provide internet access to 850 under connected communities across Mexico. The partnership is expected to use satellite technology to bring broadband to rural areas without reliable connectivity. This is anticipated to help more people get online and access key resources such as healthcare, education, and government services.

Satellite antennas are expected to gain high traction in the coming years owing to digital expansion and the emergence of Low Earth Orbit (LEO) satellite constellations, alongside advancements in technology that cater to the rise in data needs in various industries. The necessity for mobile internet solutions and the advent of LEO satellite constellations boost demand for advanced satellite antenna systems. In December 2022, Leslie Klein, the CEO of C-COM Satellite Systems Inc., highlights the substantial and growing demand for satellite antenna systems, which is fueled by the rapid global increase in the need for internet services. Klein points out that there was a significant gap in the market for transportable high-speed Internet solutions, especially in locations lacking terrestrial infrastructure. This gap led to the development and success of C-COM's iNetVu Mobile Satellite Antenna Systems, which have been widely adopted across various industries and regions.

Increase in demand for internet connectivity, rise of in-flight, maritime & land mobile connectivity, and investments in SATCOM infrastructure and ground stations are factors driving the satellite antenna market. However, high costs associated with phased array and electronically steered antennas, and regulatory barriers and restrictions on placement/installation of antennas hinders the growth of the market. Furthermore, development of flat panel, interoperable, & multi-orbit antennas, and adoption of electronically steered antennas (ESA) in aerospace, defense provide growth opportunities for the players operating in the market.

Segment Review

The satellite antenna market is segmented into technology type, frequency band, application, orbit type, end user, and region. By type, the market is divided into parabolic reflector antenna, flat panel antenna, helical antenna, and others. On the basis of frequency, it is classified into C Band, Ku Band, Ka Band, X Band, and Others. Depending on application, it is fragmented into communication satellites, earth observation satellites, navigation satellites, scientific satellites, and others. As per orbit type, it is categorized into low earth orbit (LEO), medium earth orbit (MEO), and geostationary earth orbit (GEO). By end user, it is segregated into commercial and government & defense. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Technology Type

On the basis of type, the parabolic reflector antenna segment generated maximum revenue in 2022, owing to increasing need for effective and dependable methods of transmitting and receiving signals by parabolic antennas over extended distances. The surge in satellite communication usage for television broadcasting, internet access, and worldwide connectivity has led to a substantial rise in the demand for parabolic antennas.

By Frequency Band

On the basis of frequency band, the Ku band segment generated maximum revenue in 2022, owing to rise in collaboration between companies to develop satellite antenna systems for communication in various industries such as aviation sector. Ku-band satellites provide global coverage, allowing for seamless communication and connectivity across vast geographical regions. This global reach makes Ku-band satellite services attractive for international telecommunications and broadcasting.

By Application

On the basis of application, the communication satellites segment was the highest revenue contributor to the market in 2022 owing to surge in demand for communication satellites particularly in remote or underserved regions lacking terrestrial infrastructure to deliver broadband internet access, telecommunication services, and connectivity solutions to users. Moreover, governments and military organizations across the globe rely on communication satellites for secure and reliable communication services, including command and control, intelligence gathering, surveillance, and reconnaissance.

By End User

On the basis of end user, the commercial segment was the highest revenue contributor to the market in 2022 owing to the ongoing expansion in telecommunications network and broadcasting and media sector. The broadcasting and media sector is witnessing notable growth, fueled by the surge in digital content consumption and the expansion of Direct-to-Home (DTH) television and satellite radio services.

By Orbit Type

On the basis of orbit type, the low earth orbit (LEO) segment was the highest revenue contributor to the market in 2022 owing to the investment in the LEO satellite constellations to offer a diverse range of services, such as broadband internet, IoT connectivity, remote sensing, and earth observation. Notable examples include SpaceX's Starlink constellation, OneWeb, and Amazon's Project Kuiper, all deploying extensive fleets of LEO satellites. The establishment of these constellations necessitates a broad network of ground stations equipped with high-performance antennas to establish communication links with the satellites, further propelling the demand for LEO satellite antennas.

By Region

Based on region, North America dominated the satellite antenna market in 2022 owing to high demand from defense and intelligence agencies deploying satellite communications for tactical needs. Moreover, apart from SpaceX, there are other players such as Amazon, which adopted new antenna systems to increase market presence in the U.S. For instance, in March 2023, Amazon unveiled three satellite antennas in anticipation of competing with Starlink of SpaceX with its own Project Kuiper internet network. Amazon stated that it anticipates paying less than $400 per unit to produce the "standard" model of the satellite antenna, also referred to as a customer terminal

Competitive Analysis

Some of the major companies that operate in the global satellite antenna market are Kymeta Corporation, L3Harris Technologies, Inc., Viasat, Inc., Honeywell International Inc., CPI International Inc., Thales, Intellian Technologies, Inc., GILAT SATELLITE NETWORKS, Hughes Network Systems, LLC, Cobham Limited, and Airbus DS Government Solutions Inc. Companies are implementing strategies such as investing in research and development to innovate new antenna technologies, expanding their product portfolios to increase the satellite antenna market share.

Rising Demand for Internet Connectivity

Internet connectivity has evolved into an essential need for individuals, businesses, governments, and organizations globally. In 2022, according to the Global System for Mobile Communications (GSMA), mobile internet use has reached 55% of the world's population. By the end of 2021, 4.3 billion people were using mobile internet, an increase of almost 300 million since the end of 2020. The need for internet access has increased dramatically due to the widespread use of smartphones, IoT devices, and other technological breakthroughs. With the surge in dependence on digital communication, online services, and data exchange across diverse sectors, there is an increasing demand for broad access to high-speed internet.

The conventional land-based networks struggle to efficiently cover remote or underserved areas. In such scenarios, satellite antennas present a viable solution, offering dependable internet connectivity to regions where establishing terrestrial infrastructure is either absent or economically impractical. Overall, the rise in demand for internet connectivity; is driven by the need for global connectivity, bridging the digital divide, disaster recovery, maritime & aviation connectivity, IoT applications, and business continuity; which underscores the importance of satellite antennas in meeting these evolving connectivity needs. As the demand for internet access continues to grow, the demand for satellite antennas as a reliable and accessible means of connectivity increases.

Rise of in-flight, Maritime and Land Mobile Connectivity

The satellite antenna market size is increasing due to the escalating demand for satellite connectivity services across the mobility sector, including aviation, maritime, and land transport This has created strong demand for specialized satellite antenna systems and terminals optimized for mobility usage. In aviation, more airlines have equipped their aircraft with satellite antenna systems to provide inflight Wi-Fi for passengers. For instance, in February 2023, Intelsat, a company known for its extensive satellite and ground networks as well as in-flight connectivity services, finished in-flight testing of its advanced electronically steered array (ESA) antenna. This innovative antenna allows airlines globally to offer high-speed global Wi-Fi services to passengers. The maritime industry is another industry vertical, with passenger ferries, cruise liners, and freight carriers that have adopted satellite links for onboard communications and operations via compact maritime satellite antennas.

For instance, in April 2023, Intellian Technologies, a prominent global provider of advanced satellite user terminals and communication solutions, revealed a significant investment of $100 million dedicated to the R&D of satellite communication technologies at the official inauguration of its Advanced Development Center (ADC) located in Maryland. The investment is anticipated to expand and enhance its product portfolio, particularly for enterprise, government, and maritime customers in phased array antennas. Land mobile sectors such as coaches, trains, emergency services, and logistics firms present opportunities for mobile satellite antennas for internet access and communications on the move. Therefore, the rise of in-flight, maritime, and land mobile demand for broadband connectivity propels the adoption of advanced satellite antenna technologies and provides growth opportunities in the industry.

Investments in SATCOM Infrastructure and Ground Stations

The satellite industry has actively invested in next-generation satellite communications infrastructure and ground systems to meet rise in bandwidth demands. This involves launching new high-throughput satellites and upgrading ground stations with advanced antenna systems, which benefit the satellite antenna market. Moreover, ViaSat-3 fleet of Viasat, Inc. also requires significant ground network investments, including large gateway antennas capable of terabit-level capacities. In 2022, the company partnered with antenna providers such as General Dynamics and Cobham for ground infrastructure. Moreover, maritime armed forces invested in advanced antenna systems to modernize the navy system.

For instance, in February 2023, the U.S. Navy made an investment in satellite communications technology. Inmarsat and Cobham Satcom secured a contract worth $578 million from the U.S. Navy. This contract involves the provision of global satellite communications services and new antenna hardware. In addition, government space agencies have contracted large, high-performance tracking antennas for their deep space networks, scientific missions, and satellite control operations. Therefore, the satellite antenna industry stands to benefit significantly from order flow for advanced ground station antennas and faster antenna replacement cycles with SATCOM players prioritizing ground network investments to meet explosive bandwidth demand..

High Costs Associated with Phased Array and Electronically Steered Antennas

The costs are currently higher compared to conventional mechanically steered dishes While phased array antennas provide advantages such as electronic beam steering, rapid switching, and interference nulling. The thousands of RF modules, phase shifters, amplifiers, and solidstate components required make phased arrays complex to manufacture. This results in high procurement and maintenance costs. Emerging methodologies leveraging 3D printing, photonic integrated circuits, and meta-materials are under development to mitigate the costs associated with phased array antennas.

However, their comprehensive integration into widespread operational contexts is anticipated to be a multi-year endeavor. The operational challenges such as DC power requirements, heat dissipation, system calibration, and integration on platforms drive up lifecycle costs currently. As a result, commercial adoption of phased arrays remains limited outside of government and enterprise markets. Lower cost mechanicsbased antennas dominate consumer broadband. Thus, the high price point of electronically steered and phased array antennas continues to be a restraint for mass commercial adoption and remains an impediment to realizing the full addressable market potential despite the advantages.

Regulatory Barriers and Restrictions on Placement/Installation of Antennas

Satellite dish and antenna deployments face zoning restrictions and other regulations that pose challenges for consumer broadband adoption and limit market growth. Some municipalities impose constraints on antenna sizes and visibility to maintain aesthetic standards. This makes installation of large dishes problematic in residential areas. Homeowner associations (HOAs) and landlords frequently prohibit mounting antennas on balconies or rooftops. This prevents renters and apartment dwellers from installing individual antenna systems. Acquiring building permits for commercial antenna installations is burdensome.

Aviation and maritime regulators impose safety rules, such as antenna radiation power limits, aircraft mounting placement away from fuselage, stringent testing/certification - increase in costs. Efforts within the satellite industry have aimed to advocate for standardized and minimally invasive regulatory frameworks. However, the challenging task of lobbying poses a hurdle for various municipal bodies. Disparate rules across regions continue hindering rapid scale-up of consumer antenna deployments. Therefore, navigating through local, state, and national regulatory frameworks on antenna installations remains an obstacle for consumer satcom players. Simplifying and aligning rules reduces costs and speeds up ground system deployment.

Development of Flat Panel, Interoperable, Multi-orbit Antennas

Flat panel antennas are known for their lightweight, compact design, and easy installation, making them suitable for a variety of applications such as maritime, land-mobile, and airborne communications. Their interoperability allows seamless switching between different frequency bands (such as C-, Ku-, and Ka-band) and orbits (including GEO, MEO, and LEO), providing flexibility and compatibility with diverse satellite networks and communication systems. Numerous companies are increasingly launching satellite antennas with multi-orbit capability that allows the antennas to maintain connectivity and communication with satellites regardless of their orbital positions. For instance, in January 2023, Intellian expanded its XEO Series of VSAT antennas by introducing the X100D and X150D models.

These antennas are part of a dual-band multi-orbit system that electronically switches between Ku-band and Ka-band frequencies. The XEO Series has gained significant traction in both commercial and military markets since the launch of the X130D and X130D PM models in March 2022. The satellite antenna market forecast indicates a promising trajectory, with sustained growth anticipated in the foreseeable future. Moreover, multi-orbit antennas enhance performance by leveraging satellites in various orbits. For instance, LEO satellites offer lower latency and higher data speeds, ideal for real-time communication needs such as IoT, autonomous vehicles, and remote sensing. Incorporating multi-orbit capabilities into flat panel antennas expands the range of satellite services available to users, enhancing connectivity, reliability, and bandwidth. This development creates new market opportunities for satellite communication providers, equipment manufacturers, and service integrators.

Recent Developments in the Satellite Antenna Industry

- In October 2023, Kymeta Corporation launched Osprey u8 HGL Multi-Orbit, On-the-Move Flat-Panel Antennafor military users. It is hybrid geostationary/low Earth orbit (GEO/LEO) terminal specially design for defense services. The Osprey u8 HGL is a customizable solution that can mounted on a wide array of military vehicles & vessels, providing connectivity on-the-move.

- In February 2022, Kymeta Corporation partnered with Kratos Defense & Security Solutions, Inc. to develop products and solutions that enable modern, virtualized ground systems to leverage the capabilities of next generation mobile satellite antennas. This technology focus on joint development of a software-defined remote terminal that support a variety of dynamic satellite connectivity applications, including support for multi-orbit use cases where connectivity to LEO, MEO, and GEO satellites through the same antenna are desirable.

- In August 2022, Cobham Limited launched ka-band antenna systems for Telenor Satellite THOR 7 VSAT services. The one-meter SAILOR 1000 XTR Ka and 65-centimetre SAILOR 600 XTR Ka leverage advanced VSAT technology platform to secure high availability of broadband service on the THOR 7 satellite. It is used for a full range of network applications including big data management in the cloud architecture.

- In March 2022, Hughes Network Systems, LLC revealed technology for electronically steerable, flat-panel antennas, including a prototype for delivering OneWeb Low Earth Orbit (LEO) connectivity services. The antenna seamlessly hands off signals from one satellite beam to another every 11 seconds, and from one satellite to the next every three minutes.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the satellite antenna market analysis from 2020 to 2033 to identify the prevailing satellite antenna market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the satellite antenna market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global satellite antenna market trends, key players, market segments, application areas, and market growth strategies.

Satellite Antenna Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 18.1 billion |

| Growth Rate | CAGR of 13.2% |

| Forecast period | 2020 - 2033 |

| Report Pages | 376 |

| By Technology Type |

|

| By End User |

|

| By Frequency Band |

|

| By Orbit Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Kymeta Corporation, Intellian Technologies, Inc., Viasat, Inc., GILAT SATELLITE NETWORKS, Cobham Limited, Hughes Network Systems, LLC, L3Harris Technologies, Inc., CPI International Inc., Airbus DS Government Solutions Inc., Honeywell International Inc., Thales |

The global satellite antenna market was valued at $2,784.8 million in 2020, and is projected to reach $18,111.9 million by 2033, registering a CAGR of 13.2% from 2023 to 2033.

The top companies to hold the market share in satellite antenna are Kymeta Corporation, L3Harris Technologies, Inc., Viasat, Inc., Honeywell International Inc., CPI International Inc., Thales, Intellian Technologies, Inc., GILAT SATELLITE NETWORKS, Hughes Network Systems, LLC, Cobham Limited, and Airbus DS Government Solutions Inc.

The largest regional market for satellite antenna is North America.

The leading application of satellite antenna market is communication satellite.

The upcoming trends of satellite antenna market in the world are development of flat panel, interoperable, multi-orbit antennas, and adoption of electronically steered antennas (ESA) in aerospace, defense.

Loading Table Of Content...

Loading Research Methodology...