SBAS Market - 2032

The global satellite based augmentation systems market size was valued at $559.1 million in 2022, and is projected to reach $906 million by 2032, growing at a CAGR of 5.1% from 2023 to 2032.

The satellite-based augmentation system (SBAS) is a navigation system that enhances the accuracy and integrity of global navigation satellite systems (GNSS) signals, such as GPS and global navigation satellite system (GLONASS). SBAS achieves this by broadcasting additional information from a network of ground-based reference stations, which is then transmitted to user receivers via geostationary satellites. This additional information enables the users to correct positioning errors caused by atmospheric disturbances, satellite clock & orbit errors, and other factors that affect GNSS signals.

The growth of the SBAS market is driven by increase in demand for precise positioning and navigation in various industries such as aviation, maritime, transportation, and surveying. This is attributed to the fact that SBAS technology provides reliable and accurate navigation solutions, which are essential for safety-critical applications such as aviation, where even small positioning errors can lead to disastrous consequences. Moreover, rise in adoption of unmanned aerial vehicles (UAVs) and autonomous vehicles is driving the demand for SBAS technology, as it provides a reliable and accurate positioning solution in GPS-denied environments. Advancements in satellite technology and increase in investments by governments and private companies in the development of SBAS infrastructure further propel the market growth. In addition, the SBAS market is expected to continue its growth trajectory in the coming years driven by surge in demand for accurate and reliable positioning and navigation solutions across various industries.

The growth of the SBAS market is driven by increase in demand for precise positioning and navigation in various industries such as aviation, maritime, transportation, and surveying. This is attributed to the fact that SBAS technology provides reliable and accurate navigation solutions, which are essential for safety-critical applications such as aviation, where even small positioning errors can lead to disastrous consequences. Moreover, rise in adoption of unmanned aerial vehicles (UAVs) and autonomous vehicles is driving the demand for SBAS technology, as it provides a reliable and accurate positioning solution in GPS-denied environments. Advancements in satellite technology and increase in investments by governments and private companies in the development of SBAS infrastructure further propel the market growth. In addition, the SBAS market is expected to continue its growth trajectory in the coming years driven by surge in demand for accurate and reliable positioning and navigation solutions across various industries.

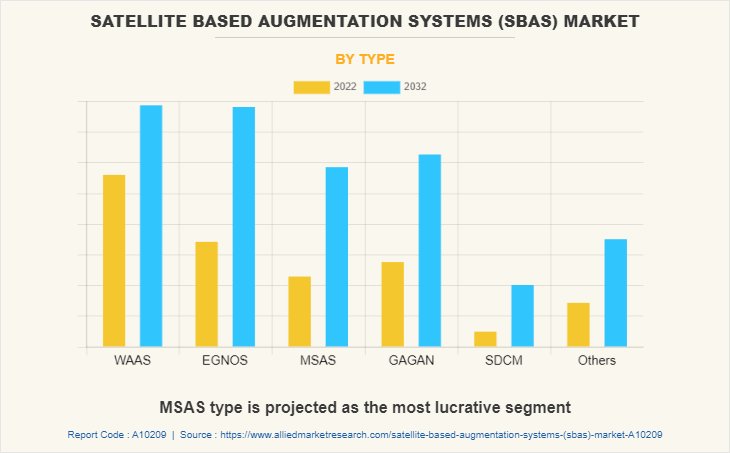

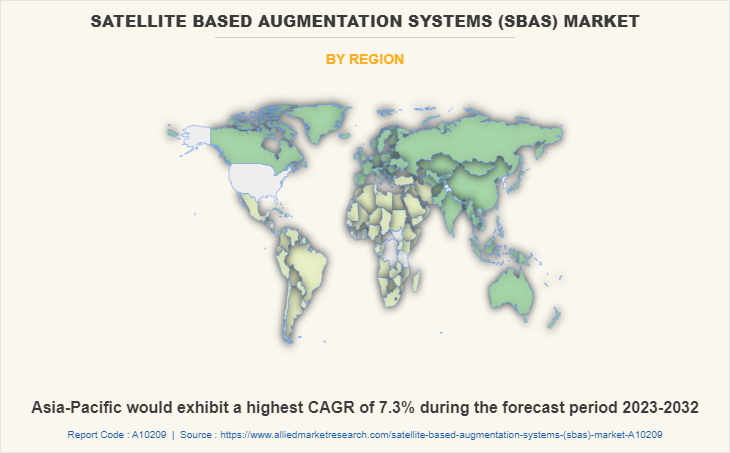

The satellite-based augmentation system market is segmented into business type, application, and region. By type, the market is divided into WAAS, EGNOS, MSAS, GAGAN, SDCM, and others. On the basis of application, it is segregated into aviation, maritime, road & rail, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the satellite-based augmentation system market include Honeywell International Inc., Broadcom, Federal Aviation Administration, Garmin Ltd., Airbus, Raytheon Technologies Corporation, GMV Innovating Solutions S.L., Hexagon AB, and SkyTraq Technology, Inc.

Increase in demand for precise and reliable positioning information

As the use of GPS technology has grown, so has the demand for more accurate and reliable positioning information. This is particularly true in industries such as aviation and maritime, where even small errors in positioning data can have serious consequences. According to the Federal Aviation Administration (FAA), runway incursions and unauthorized presence of aircraft, vehicle, or person on a runway have been a persistent problem in the aviation industry. In many cases, these incidents have been attributed to errors in positioning data. To address this, the FAA implemented the wide area augmentation system (WAAS), which provides improved accuracy and integrity of GPS signals for aviation. For instance, the Galileo system is a global navigation satellite system that includes SBAS technology. The system has been in development for over a decade and is intended to provide precise positioning and timing information to users around the world.

[APPLICATIONGRAPH]

Rise in use of SBAS in autonomous vehicles

The development of autonomous vehicles, including drones and self-driving cars, has increased the need for precise positioning information. SBAS technology can provide this information, helping to ensure safe and reliable operation of these vehicles. For instance, in February 2021, General Motors announced that it was partnering with the start-up company, Cruise to test self-driving cars in San Francisco. The vehicles will be equipped with SBAS technology to provide accurate positioning information, which is essential for safe and reliable autonomous driving. Furthermore, the European Space Agency launched a new SBAS system, called EGNOS, to provide precise positioning information for autonomous vehicles in Europe. The system is designed to improve the accuracy and reliability of navigation, particularly in areas where GPS signals may be weak or unavailable. This demonstrates how SBAS technology is becoming increasingly important for the safe and reliable operation of autonomous vehicles, including drones and self-driving cars.

High cost of implementation and maintenance

Building and operating an SBAS system requires a significant investment in infrastructure and personnel. In 2021, the Indian Government announced that it was planning to launch its own SBAS system to improve the accuracy of GPS signals across the country. The project is expected to cost around $1.5 billion and take several years to complete. While the system will provide significant benefits to Indian industries such as aviation and shipping, high cost of implementation may make it difficult for other countries to follow suit, thus hampering the growth of the market. For instance, the European Union's SBAS system, EGNOS (European Geostationary Navigation Overlay Service), has been undergoing upgrades to improve its performance and coverage. The system is being expanded to cover additional regions, including North Africa, and new capabilities are being added, such as support for safety-critical applications, including aviation.

Increased safety for various applications

SBAS can enhance safety in various industries, including aviation, by providing real-time information about the location and movements of aircraft. This information can be used to warn pilots and air traffic controllers about potential safety hazards, such as collisions or other incidents. For instance, in 2020, ISRO announced that it had successfully demonstrated the use of its GPS Aided Geo Augmented Navigation (GAGAN) system for real-time monitoring of aircraft movements. The system provides accurate and reliable information about the location and movements of aircraft, which can be used to improve safety and reduce the risk of incidents. SBAS has been used to enhance safety in aviation by providing real-time information about the location and movements of aircraft. This information is used by pilots and air traffic controllers to manage air traffic and reduce the risk of collisions or other incidents. By improving the accuracy and reliability of this information, SBAS has played an important role in enhancing safety in aviation and other industries. Thus, multiple benefits associated with SBAS boost its demand, globally, which is anticipated to offer remunerative opportunities for the expansion of the global market during the forecast period.

The satellite based augmentation systems (sbas) market is segmented into Type and Application.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the satellite based augmentation systems (SBAS) market analysis from 2022 to 2032 to identify the prevailing satellite based augmentation systems (SBAS) market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the satellite based augmentation systems (SBAS) market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global satellite based augmentation systems (SBAS) market trends, key players, market segments, application areas, and market growth strategies.

Satellite Based Augmentation Systems (SBAS) Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 906 million |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 241 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Raytheon Technologies Corporation, Broadcom, Federal Aviation Administration, GMV Innovating Solutions S.L., Honeywell International Inc., Garmin Ltd., SkyTraq Technology, Inc., Thales Group, Hexagon AB, Airbus |

Analyst Review

SBAS has been gaining high traction in the market due to surge in demand for precise positioning and navigation solutions from various industries. Several companies are investing in the development of SBAS infrastructure to cater to the growing demand for these services. For instance, Thales Group—a French multinational company that designs and builds electrical systems and provides services for the aerospace, defense, transportation, and security markets has been investing in the development of SBAS technology. In 2020, Thales signed a contract with the European Space Agency (ESA) to develop a new generation of SBAS that will be compatible with the Galileo satellite navigation system.

Similarly, Raytheon Technologies Corporation, an American multinational conglomerate that specializes in aerospace and defense technologies, has been investing in the development of SBAS technology. In 2020, Raytheon announced that it received a contract from the US Federal Aviation Administration (FAA) to develop a new SBAS for the Next Generation Air Transportation System (NextGen).

The CXOs further added that the SBAS market is expected to continue its growth trajectory during the forecast period owing to increase in investments in SBAS infrastructure and rise in demand for accurate and reliable positioning and navigation solutions across various industries.

The global satellite-based augmentation system market was valued at $559.07 million in 2022, and is projected to reach $905.86 million by 2032.

The key players profiled in the global satellite-based augmentation system market report include Honeywell International Inc., Broadcom, Federal Aviation Administration, Garmin Ltd., Airbus, Raytheon Technologies Corporation, GMV Innovating Solutions S.L., Hexagon AB, and SkyTraq Technology, Inc.

Aviation is the leading application of Satellite Based Augmentation System (SBAS) Market.

North America is the largest regional market for Satellite Based Augmentation Systems Market.

The key factors impacting the growth of the global SBAS market are increase in demand for precise positioning and navigation solutions across various industries, increase in adoption of unmanned aerial vehicles (UAVs) and autonomous vehicles, advancements in satellite technology, and rise in investments by governments and private companies in the development of SBAS infrastructure.

Loading Table Of Content...

Loading Research Methodology...