The global satellite-based earth observation market was valued at $3.5 billion in 2022, and is projected to reach $6.4 billion by 2032, growing at a CAGR of 6.6% from 2023 to 2032.

Satellite-based earth observation involves utilization of satellites orbiting the earth to collect data pertaining to different facets of the earth's surface, atmosphere, and oceans. Satellite-based earth observation process utilizes remote sensing technique to collect information on chemical, physical, and biological aspects of earth. The information collected through remote sensing is used for several applications such as weather & terrain mapping, reconnaissance & intelligence missions, agricultural monitoring & management, synthetic aperture radar imagery, and others. In addition, collected information is used by the defense sector for border monitoring, disaster management, and other military missions.

Key Takeaways

- On the basis of product type, the value-added services segment held the largest share in the satellite-based earth observation market in 2022.

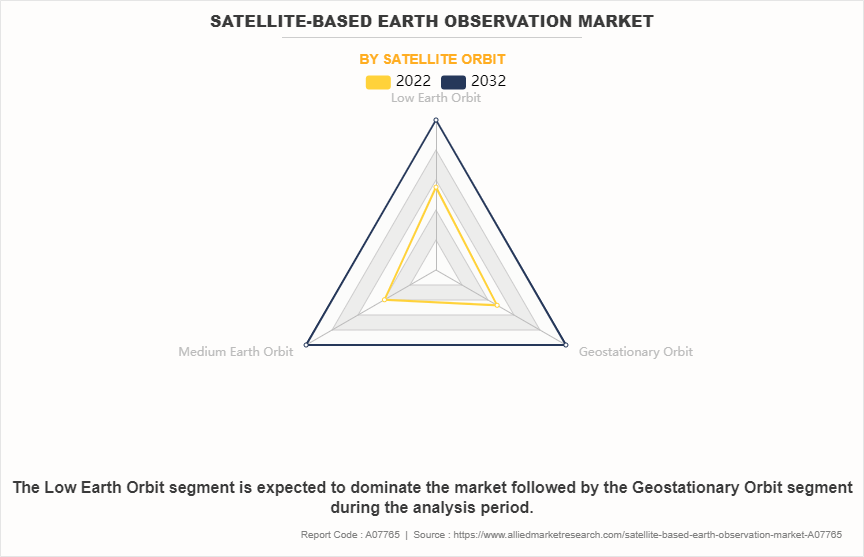

- By satellite orbit, the low earth orbit segment held the largest share in the market in 2022.

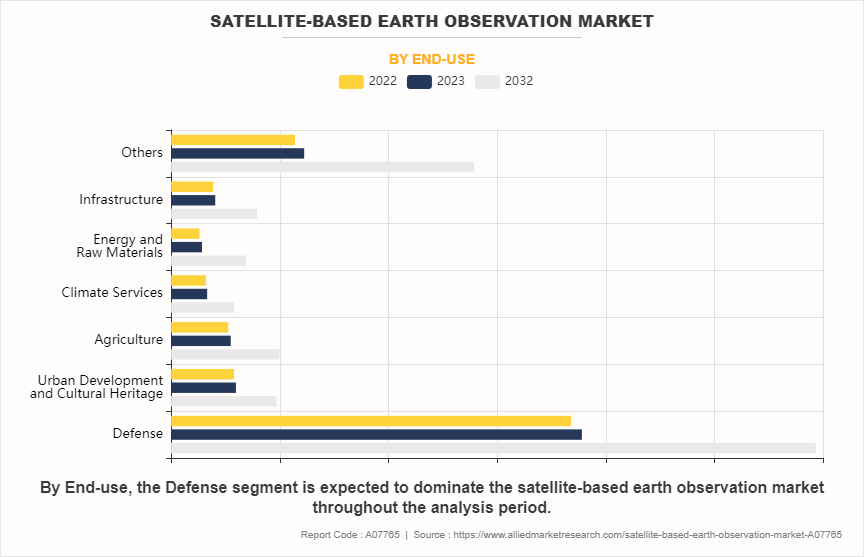

- On the basis of end use, the defense segment held the largest market share in 2022.

- On the basis of region, North America held the largest market share in 2022.

The satellite-based earth observation market size is expanding significantly, driven by advancements in satellite technology, increased demand for data analytics. North America, especially the U.S., hosts some of the premier space agencies, satellite manufacturers, and earth observation service providers, which notably contributes toward the growth of the market. In addition, the continual progress in satellite technology, sensor capabilities, and data processing methods fosters market expansion. Moreover, space agencies in the country are collaborating with commercial satellite providers to enhance their earth observation capabilities. For instance, in October 2023, National Aeronautics and Space Administration (NASA) significantly expanded its Commercial Smallsat Data Acquisition Program by awarding contracts to seven companies for the provision of earth observation data and services. The contracts have a maximum value of $476 million over five years and include an option to extend services for an additional six months.Moreover, the integration of artificial intelligence and machine learning with Earth observation techniques is expected to increase the satellite-based earth observation market size.

Government bodies such as NASA and National Oceanic and Atmospheric Administration (NOAA) play pivotal roles in promoting satellite-based earth observation endeavors by investing in research, development, and the launch of satellite missions. These missions focus on monitoring various environmental aspects, weather conditions, natural calamities, and climate variations. For instance, in August 2023, Spire Global—a provider of space-based data, analytics, and services—was awarded a $6.5 million, 12-month contract renewal to continue its participation in NASA's Commercial Smallsat Data Acquisition (CSDA) Program. This represents a $500,000 increase from the previous award of $6 million received in June 2022.

The surge in demand for big data technology to generate accurate insights on earth observation data, advancements in earth observation satellite technologies, and high-demand for high-resolution imaging services are factors driving the satellite-based earth observation market. However, the rise in utilization of alternative earth observation technologies such as aerial drones and high-altitude balloons and lack of skilled & trained personnel hinders the growth of the market. Furthermore, increase in investments by several governments in space technology provides growth opportunities for the players operating in the market.

Segment Review

The global satellite-based earth observation market is segmented into product type, satellite orbit, end-user, and region. By product type, the market is divided into EO data and value-added services. On the basis of satellite orbit, it is classified into low earth orbit, medium earth orbit, and geostationary orbit. Depending on end use, it is fragmented into defense, urban development & cultural heritage, agriculture, climate services, energy & raw materials, infrastructure, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Product Type

On the basis of product type, the value-added services segment generated maximum revenue in 2022, owing to the increasing demand for advanced data analytics and customized solutions. This trend highlights the growing need for tailored services that enhance the value of raw Earth observation data.There is a rise in demand for satellite value added services wiith deeper insights to enhance the usability of the data and addressing the specific requirements of customers across diverse industries

By Satellite Orbit

On the basis of satellite orbit, the low earth orbit segment generated maximum revenue in 2022, owing to rise in demand for satellite-based earth observation services, particularly those provided by LEO satellites equipped with synthetic aperture radar (SAR) technology. LEO satellites can capture high-resolution imagery of the earth's surface, allowing for detailed observation of various features such as infrastructure, natural resources, land use, and environmental changes

By End-use

On the basis of end-use, the defense segment was the highest revenue contributor to the market in 2022 owing to surge in use of satellite data in the defense sector to enhance situational awareness and operational planning. In maritime sector, earth observation technologies can provide data for quality meteorology over oceans (offshore weather and sea state monitoring) complemented near-real-time data collection of variables such as wave height and frequency, wind speed & direction, and ocean current velocity on global and regional scales.

By Region

Based on region, North America dominated the satellite-based earth observation market in 2022 owing to strong presence of key players and high adoption of satellite data among government and military agencies in the region. Moreover, space agencies in the country are collaborating with commercial satellite providers to enhance their earth observation capabilities. For instance, in October 2023, National Aeronautics and Space Administration (NASA) significantly expanded its Commercial Smallsat Data Acquisition Program by awarding contracts to seven companies for the provision of earth observation data and services. The contracts have a maximum value of $476 million over five years and include an option to extend services for an additional six months.

Competitive Analysis

Some of the major companies that operate in the global satellite-based earth observation market are Airbus SE, Boeing, Israel Aerospace Industries Ltd., Lockheed Martin Corporation, Mitsubishi Electric Corporation, Planet Labs PBC, L3Harris Technologies, Inc., SkyWatch Space Applications Inc., Raytheon Technologies Corporation, Thales Group, Maxar Technologies, BlackSky, Capella Space, and ICEYE.

Rising Demand for Internet Connectivity

In recent years, there has been an exponential increase in earth observation data volume, which, in turn, is proliferating the demand for big data technologies to infer actionable insights on numerous global challenges such as climate change and others. With advanced big data analytics, satellite imagery can be processed at higher resolutions and with greater accuracy. This enables users to detect subtle changes in the earth's surface or atmosphere, leading to more precise monitoring and forecasting of environmental changes, natural disasters, and other phenomena. Earth observation satellites produce massive volumes of data on a daily basis that is required to be stored, processed, and analyzed regularly. The satellite-based earth observation market share is rapidly increasing as more industries adopt this technology for various applications.

The data generated in heterogeneous format, semantics, modalities, and resolutions is propelling the need for big data technologies to process and analyze complex data in a faster way. It results in high complexity of data set that requires pre-processing, multi-level fusion, and analytics. Thus, variety, veracity and volume apply to this kind of dataset, driving the need to deploy big data analytics to generate accurate insights. The satellite-based Earth observation market forecast suggests promising growth opportunities, driven by the rising demand for satellite data across diverse sectors such as agriculture, environmental monitoring, and urban planning.

Moreover, big data technologies gauge customer requirements and analyze the complexity of data to provide actionable insights in a faster and better decision-making way. The demand for big data analytics in earth observation drives innovation and investment in satellite technology and data services. Therefore, the surge in demand for big data technology to generate accurate insights on earth observation data is expected to drive the growth of the market during the forecast period.

Advancements in Earth Observation Satellite Technologies

Technological progress in earth observation satellites leads to the development of advanced sensors and instruments, enabling satellites to gather a wider range of data with greater accuracy and precision. These enhancements enable satellites to capture detailed information about diverse earth phenomena, including land use, vegetation health, climate patterns, and natural disasters. Consequently, the increased availability of comprehensive and high-quality data appeals to a broader array of users and applications, stimulating market growth. Leading players across the globe have made many advancements in satellite technology (such as hyperspectral and multispectral imaging and additive manufacturing) to further expand the capabilities of satellites, decrease the cost, and improve the customizability of satellites.

Hyper-spectral and multi-spectral imaging enhance the capabilities of satellites in collecting precise data about the changes in the environment. Hyperspectral sensors produce images comprising highly detailed spectral data that allow the detection of micro-level changes in the environment such as in soil, crops, and water. Multispectral sensors, on the other hand, provide a clear perception of details on the ground, such as spotting pest-infested trees. For instance, the NASA-ISRO Synthetic Aperture Radar (NISAR) satellite, set to launch in 2024, is a joint effort between NASA and the Indian Space Research Organization (ISRO). It will utilize radar technology to continually scan earth's surface, aiming to monitor changes in landscapes over time. The NISAR satellite contains two different synthetic aperture radar (SAR) systems, the L-band SAR, developed by NASA and the S-band SAR, developed by ISRO.The satellite-based earth observation market opportunity is vast, offering immense potential for businesses to capitalize on the increasing demand for satellite imagery and data analytics solutions.

Moreover, advancements in satellite imaging technology result in improved spatial, spectral, and temporal resolutions, allowing satellites to capture finer details and distinguish between various land features and environmental changes. The higher resolution imagery facilitates more precise analysis and monitoring of earth's surface, supporting applications such as urban planning, agriculture management, environmental monitoring, and disaster response. This availability of high-resolution data attracts industries and organizations seeking accurate and actionable insights, thereby fueling the expansion of the satellite-based earth observation industry.The satellite-based earth observation market growth is driven by increasing demand across diverse industries for high-resolution satellite imagery and data analytics solutions.

Rise in Utilization of Alternative Earth Observation Technologies

Alternative technologies, such as aerial drones, ground-based sensors, and high-altitude balloons, are becoming increasingly capable of capturing detailed earth observation data. This increased competition can lead to a decline in market share for satellite-based earth observation services. Competitors from alternative technologies is one of the key deterrent factors of the global satellite-based earth observation market.

The major enterprises such Google and World View Enterprises and several start-ups such as Zero 2 infinity are investing in R&D of high-altitude balloons, which, in turn, is expected to affect the demand for satellite-based earth observation. In addition, unmanned aerial vehicles (UAVs), such as drones, have been utilized for earth observation applications such as archeological surveying, climate studies, and traffic monitoring. Such applications of alternative technologies are expected to restrain the growth of the market during the forecast period.

Lack of Skilled & Trained Personnel

The analysis and interpretation of earth observation data demand specialized expertise in remote sensing, geographic information systems (GIS), and data analysis techniques. Proficient professionals are indispensable for deriving meaningful insights from the extensive satellite imagery collected, crucial for applications like environmental monitoring, urban planning, agriculture, and disaster management. The operation and maintenance of earth observation satellites necessitates proficiency in spacecraft engineering, orbital dynamics, and mission control.

Competent personnel ensure the optimal functioning of satellite systems, including monitoring spacecraft health, executing orbital maneuvers, and resolving technical issues. Skilled individuals are essential for crafting innovative applications and solutions that harness satellite earth observation data to address specific user requirements and challenges. This entails the development of tailored algorithms, software tools, and analytical models to extract actionable insights from satellite imagery. Thus, dearth of skilled and trained personnel presents a notable hurdle to the market.

Increase in Investments by Several Governments in Space Technology

The overall space economy consists of revenue-generating commercial space activities and government investments in space. Government investments shaped the space industry in the 20th century, whereas commercial activities are now setting the pace. The private spaceflight industry has evolved at a fast pace with new entrants and private funding creating opportunities for innovations in products, services, and processes. Increase in investments by governments across the globe for improvement of infrastructure and rise in need to deliver high-quality telecommunication services to consumers are expected to provide remunerative opportunities for the growth of the satellite-based earth observation market during the forecast period market. Furthermore, high demand for satellite imagery in the government sectors, including federal agencies, local, and state governments for various purposes such as urban planning, border mapping, infrastructure security, homeland security is significantly contributing to the growth of the market. Another factor positively influencing the growth of the market is the large number of satellites that have been launched by various agencies such as NASA, European Space Imaging, and Japan Aerospace Exploration Agency. The European public funding landscape includes programs such as Horizon Europe, InvestEU, and European Fund for Strategic Investments (EFSI), for product development, research, and innovation. The European Space Agency (ESA) Business Incubator and Acceleration Centers and the Copernicus Start-Up Program encourage early-stage investments. In addition, governments of various countries aim to expand the space sector with various infinitives in the space and technology industry.

Recent Developments in the Satellite-based earth Observation Industry

- In May 2023, Airbus SE obtained a geospatial commission pilot project to deliver high-resolution satellite imagery to the public sector in the UK. In addition, more than 100 users in up to 35 public sector organizations within the UK Government will get access to Airbus Earth observation, which includes full mosaic coverage of the entire country with excellent pixel quality and very less cloud cover.

- In July 2023, Israel Aerospace Industries (IAI) launched Singapore's DS-SAR radar satellite. The satellite consists of synthetic aperture radar sensor payload, which is designed for the collection of a wide range of data in terms of both coverage and resolution, day and night, and under all weather conditions. The satellite will be utilized for maritime surveillance with Singapore's Ministry of Defense Sand Technology Agency. The satellite provides commercial services through ST electronics with TELEOS 1 earth observation.

- In February 2024, Lockheed Martin Corporation collaborated with NVIDIA to form a prototype of an AI-driven earth and space observing digital twin. The twin can process live streams of incoming weather data, apply artificial intelligence and machine learning to analyze the data, and display current global environmental conditions from satellite and ground-based observations and output from weather forecasting models.

- In September 2022, Mitsubishi Electric Corporation launched new Daichi 3 earth observation satellite at Kamakura work facility. The new facility will provide an upgrade of the resolution of images taken from space. Daichi-3 will produce images at a resolution three times higher than Daichi and has the detail to identify individual automobiles on the ground from space.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the satellite-based earth observation market analysis from 2022 to 2032 to identify the prevailing satellite-based earth observation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the satellite-based earth observation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global satellite-based earth observation market trends, key players, market segments, application areas, and market growth strategies.

Satellite-Based Earth Observation Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.4 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 391 |

| By Product Type |

|

| By Satellite Orbit |

|

| By End-use |

|

| By Region |

|

| Key Market Players | Lockheed Martin Corporation, Israel Aerospace Industries Ltd., Maxar Technologies, Raytheon Technologies Corporation, Airbus SE, L3Harris Technologies, Inc., BlackSky, ICEYE, Planet Labs PBC, Boeing, Mitsubishi Electric Corporation, SkyWatch Space Applications Inc., Thales Group, Capella Space |

The global satellite-based earth observation market was valued at $3,445.1 million in 2022, and is projected to reach $6,370.9 million by 2032, registering a CAGR of 6.6% from 2023 to 2032

The top companies to hold the market share in satellite-based earth observation are Airbus SE, Boeing, Lockheed Martin Corporation, Mitsubishi Electric Corporation, Planet Labs PBC, Raytheon Technologies Corporation, Israel Aerospace Industries Ltd., L3HARRIS TECHNOLOGIES, INC., Thales Group, Maxar Technologies, BlackSky, Capella Space, SkyWatch Space Applications Inc., and ICEYE.

The largest regional market for satellite-based earth observation is North America.

The leading application of satellite-based earth observation market is defense.

The upcoming trends of satellite-based earth observation market in the world are increase in investments by several governments in space technology.

Loading Table Of Content...

Loading Research Methodology...