Satellite Bus Market Research, 2033

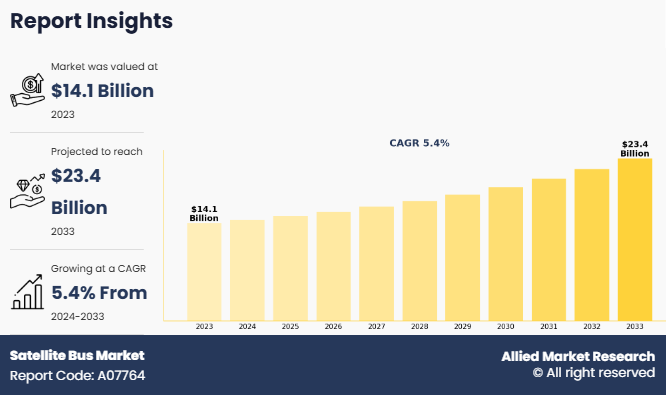

The global satellite bus market size was valued at $14.1 billion in 2023, and is projected to reach $23.4 billion by 2033, growing at a CAGR of 5.4% from 2024 to 2033.

Report Key Highlighters:

- The Satellite Bus industry study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The satellite bus market share is highly fragmented, into several players including Airbus S.A.S, Ball Corporation, Israel Aerospace Industries Ltd. (IAI), ISRO, Lockheed Martin Corporation, Mitsubishi Electric Corporation, Northrop Grumman Corporation, Sierra Nevada Corporation, Thales Group, and The Boeing Corporation. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

A satellite bus refers to a standardized, modular framework or platform that provides essential support systems for the operation of a satellite. It serves as the foundation for a satellite's subsystems, including power, propulsion, thermal control, communication, and attitude control, allowing the payload such as scientific instruments, cameras, or communication transponders to function effectively.

The global satellite bus industry is driven by an Increase in investment by governments & space agencies, new product launches in the satellite manufacturing market, and an increase in the number of satellite launches. However, factors such as lack of clarity in government policies, and stringent government regulations for implementation and use of satellite restrain the growth of the market to some extent. On the contrary, incorporation of new technologies, and advancements in satellite mission technologies offer lucrative growth opportunities for the market.

Satellite & launch missions have seen tremendous growth globally in recent years owing to growing collaborations of space companies with governments. Organizations such as Northrop Grumman Corporation, ArianeGroup, Boeing, and Airbus are manufacturing advanced satellites & related components, which have created a wider impact on gthe rowth of the market. In addition, developments carried out between companies such as Ariane Group (an endeavour among Airbus and Safran), Thales Alenia Space (a Thales/Lenardo Group), and United Launch Alliance (JV of Boeing and Lockheed Martin Corporation) are driving the growth of the market.

In recent years, research around orbital launch has seen major growth as many companies are competing for stakes globally. Similarly, the demand for small satellites for commercial applications has increased significantly, owing to which companies are coming up with new satellite system models, which is expected to further drive the growth of the satellite bus market across the globe.

For instance, according to data published by the World Economic Forum on February 28, 2024, India will allow full foreign ownership in satellite and its related component manufacturing industry. This strategy will help in increasing foreign investment for manufacturing of satellites and related components in India. According to the data, the government in the region aims to increase the share of space sector and reach a valuation of $47.3 billion by the year 2032. Also, according to the data, the country is planning to allow 100% of foreign direct investment and is expected to receive significant investment from companies such as SpaceX and Blue Origin.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In January 2023 Ball Corporation developed spacecraft bus for the Weather System Follow-on-Microwave (WSF-M) satellite. It is the U.S. Space Force's next-generation operational environmental satellite system. Through this strategy, WSF-M provides mission data to the Department of Defense's (DoD) environmental prediction systems that support all warfighter domains.

- In November 2024 Lockheed Martin Corporation launched LM 400, a common, mid-sized satellite bus. The satellite bus is also customizable to support different missions including remote sensing, communications, imagery and radar as well as orbits and launch configurations.

- In April 2023, Airbus through its subsidiary Airbus OneWeb Satellites, signed an agreement to supply 15 satellite buses known as Longbow to Loft Orbital. The Longbow bus is based on the design of the bus used for OneWeb satellites.

Segmental analysis

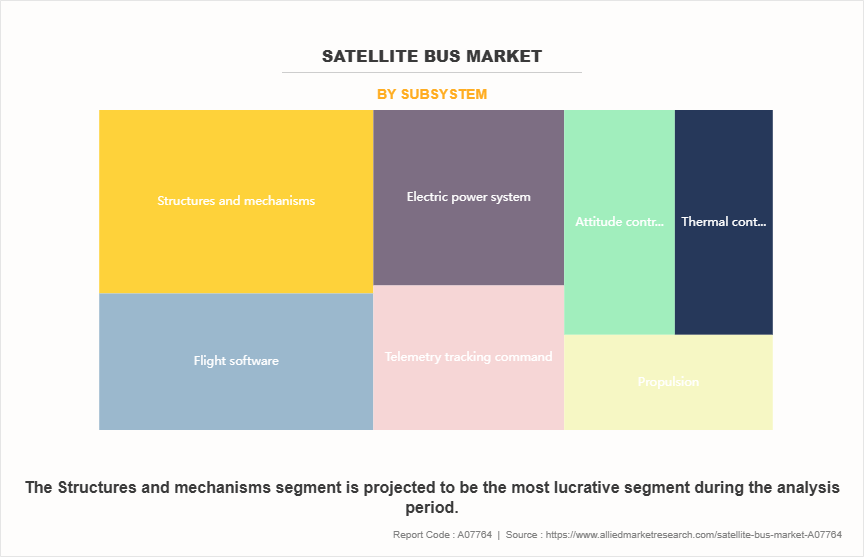

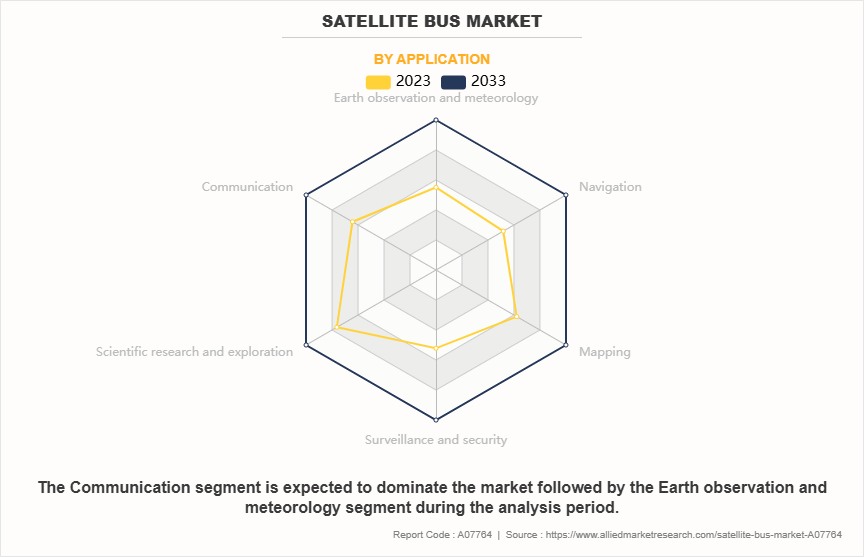

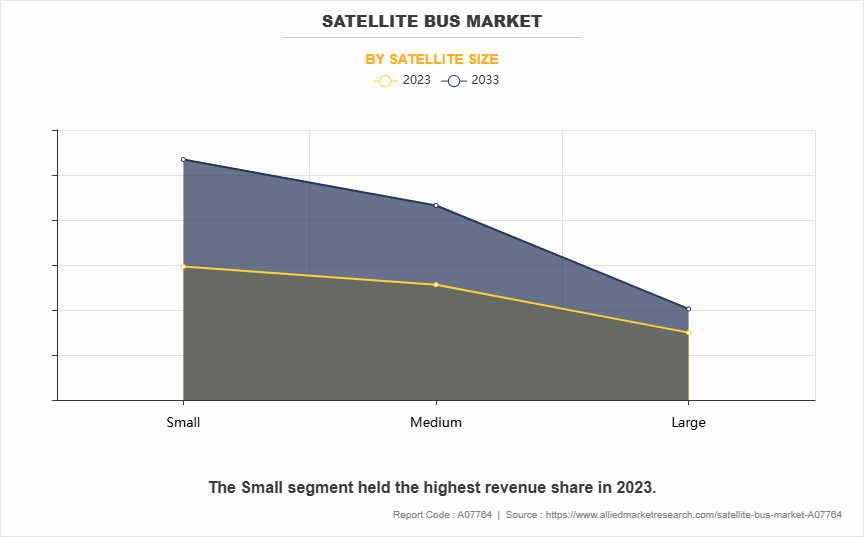

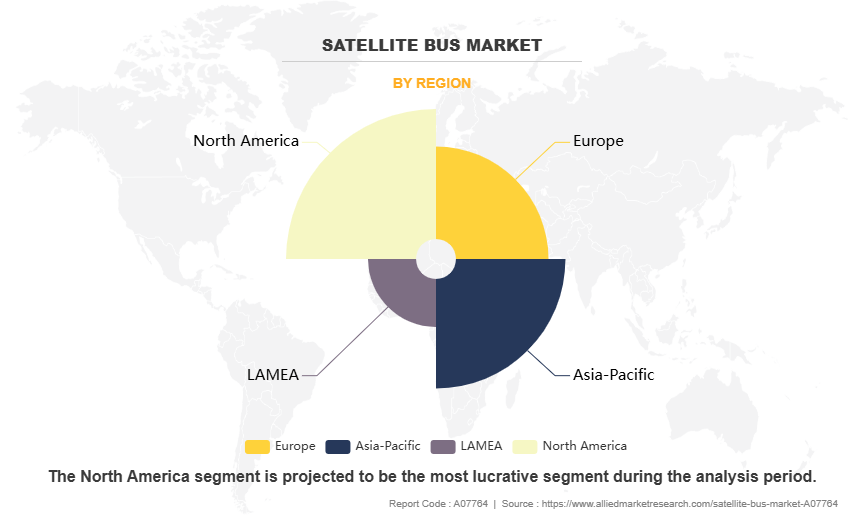

The satellite bus market growth is segmented into subsystem, application, satellite size, and region. By subsystem, the market is segregated into structures & mechanisms, thermal control, electric power system, attitude control system, propulsion, telemetry tracking command, and flight software. By application, it is segregated into Earth observation & meteorology, communication, scientific research & exploration, surveillance & security, mapping, and navigation. By satellite size, it is segregated into small, medium, and large. Region-wise, the global satellite bus market has been studied across North America, Europe, Asia-Pacific, and LAMEA.

By Subsystem

By subsystem, the satellite bus market is categorized into structures and mechanisms, thermal control, electric power system, attitude control system, propulsion, telemetry tracking command and flight software. The structures and mechanisms segment dominated the satellite bus market in 2023. owing to increase in demand for strong structure for use in rugged environment. Numerous types of designs such as monocoque as well as modular frame designs have been introduced by different manufacturers. Introduction of such system maximizes internal volume, and provides more thermal mass, which allows for more mounting points to the structure of the satellite bus.

By Application

By application, the satellite bus market is categorized into earth observation and meteorology, communication, scientific research and exploration, surveillance and security, mapping and navigation. The communication segment dominated the satellite bus market in 2023. owing to its vital role in global communication systems, drives the growth of the satellite bus market. In addition, communication satellites are used for wireless, radio, internet, television, mobile communication, and military applications, which also drives the growth of the satellite bus market demand..

By Satellite Size

By satellite size, the satellite bus market forecast is categorized into small, medium and large. The small segment dominated the satellite bus market in 2023. Small satellites are popular and they are cheaper to build and launch as compared to larger ones. In some cases, like scientific research and radio communication, using many small satellites is more effective than relying on a few big ones. They are increasingly used for a variety of missions, including scientific research, remote sensing, and communication services. The use of small satellites is widely growing around the world especially for smaller countries and companies to participate in space activities and support their sustainable development goals.

By Region

Region wise the global market is analyzed into North America, Europe, Asia-Pacific, and LAMEA. The North America region dominated the satellite bus market in 2023 owing to the presence of companies such as Lockheed Martin Corporation, The Boeing Company, Northrop Grumman Corporation, Sierra Nevada Corporation, and Ball Corporation creates ample opportunities for the growth of the market in North America. Additionally, The North America satellite bus market is gaining traction due to numerous developments carried out by key companies operating in the satellite and related components manufacturing industry. Companies involved in the production and manufacturing of essential components have carried out numerous developments, which has supplemented the growth of the market in North America.

For instance, on June 12, 2024, Los Angeles-based space tech startup company, Apex received around $95 million of investment for Series B from XYZ Venture Capital and CRV to increase its production of satellite buses. According to Apex, they will utilize this investment to tackle the growing demand for satellites from customers like the U.S. Department of Defense.

New Product Launches in the Satellite Manufacturing and Launch System

Satellites are being used extensively for numerous purposes such as establishing a communication network, surveillance, military applications & navigation, and TV broadcasting. Moreover, satellites are being used to tackle 21st century challenges such as climate change, resource management, and disaster mitigation. Hence, owing to wide applications of satellites, countries across the globe have been frequently launching satellites.

Moreover, growth of private space companies such as SpaceX, which has launched numerous satellites in recent years for intended use in communication and other applications, creates ample opportunities for growth of the market across the globe.

For instance, in October 2024, SpaceX announced that they have received new contracts worth $733.5 million for national security space missions. According to the agreement, SpaceX received contracts for nine launches under the National Security Space Launch Phase 3 Lane 1 program. The Space Development Agency will be utilizing SpaceX’s Falcon 9 rocket to launch small satellites into a low-Earth orbit constellation, to install a network of satellites specifically designated to enhance military communications and intelligence capabilities. Thus, emergence of private players in recent years is anticipated to positively drive the growth of the satellite bus market.

Increase in Number of Satellite Launches

There is growth in satellite launches in recent years due to a rise in technological advancements, rise in demand for connectivity, and the emergence of private aerospace and defence companies. Furthermore, the rise of smaller, cost-effective satellites such as CubeSats has made it easier for startups, universities, and emerging countries to join space exploration projects, which is further driving the market for satellite buses. In addition, rise of mega-constellations projects, such as SpaceX's Starlink, Amazon's Project Kuiper, and OneWeb, aims to provide high-speed internet access globally. These projects require frequent launch of thousands of satellites, further driving the demand for satellite launches. In addition, governments globally are deploying more satellites for defence and surveillance operations.

For instance, the U.S. government agencies have used commercial sensor satellites to identify the illegal activities in maritime. For instance, in August 2023, the U.S. Space Force imagery unit utilized commercial sensor satellites to detect illegal fishing boats and monitor other activities during a military exercise in South America. In addition, commercial satellite imaging is increasingly used in various sectors, including defense, construction, transportation, and others, which acts as a key driver for the global market. Increase in security concerns and introduction of new technologies such as GPS satellites, advanced remote sensing technology, high-resolution cameras, light detection & ranging (LIDAR) technology, and electric propulsion technology further contribute toward the growth of the market. Thus, development of satellite technology is anticipated to drive the growth of the satellite bus market during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the satellite bus market analysis from 2023 to 2033 to identify the satellite bus market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global satellite bus market trends, key players, market segments, application areas, and market growth strategies.

Satellite Bus Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 23.4 billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 280 |

| By Subsystem |

|

| By Application |

|

| By Satellite Size |

|

| By Region |

|

| Key Market Players | Northrop Grumman, Boeing, Lockheed Martin Corporation, Ball Corporation, Airbus, Mitsubishi Electric Corporation, ISRO, Thales, IAI, Sierra Nevada Corporation |

Integration of lightweight components are the upcoming trends in the industry.

Communication is the leading application of satellite bus market.

North America is the largest market for the satellite bus market.

The global satellite bus market was valued at $14,046.7 million in 2023 and is estimated to reach $23,383.0 million by 2033, exhibiting a CAGR of 5.4% from 2024 to 2033.

Airbus S.A.S, Ball Corporation, Israel Aerospace Industries Ltd. (IAI), ISRO, Lockheed Martin Corporation are the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...