Satellite Ground Station Market Overview:

The global satellite ground station market size was valued at $58.7 billion in 2022, and is projected to reach $178.9 billion by 2032, growing at a CAGR of 11.9% from 2023 to 2032. Satellite ground station, also known as SGS, is designed to collect and transmit remote sensing satellite data to various users and applications. These stations play a crucial role in gathering weather and other data for organizations such as national weather centers and research centers. The main components of a satellite ground station include a reception antenna, a feed horn, waveguide, and receiver, which are typically mounted on a pedestal. To protect the antenna, a protective cover called a radome is often used.

Report Key Highlighters:

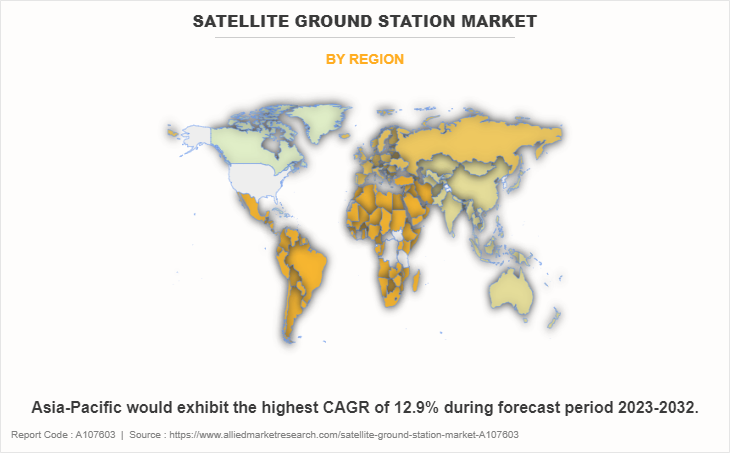

The satellite ground station market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The satellite ground station market share is moderately consolidated among several players including Viasat, Inc., SES S.A., Intelsat, Gilat Satellite Networks, Inmarsat Global Limited, Kratos Defense & Security Solutions, Inc., EchoStar Corporation, ST Engineering, Comtech Technologies Inc. and Satcom Technologies.

The rise in demand for satellite ground station system by the U.S. defense department is one of the major factors driving for the growth of the satellite ground station market in North America. For instance, in April 2023, Kratos and ALL.SPACE partnered to cooperatively create and deliver solutions to enable software-defined satellite ground systems to better harness the capabilities of next-generation smart terminals.

The integrated solutions are projected to improve dynamic operations from the gateway to the network's edge, giving end users more application power and substantially expanding flexibility beyond today's proprietary, purpose-built satellite terminals.

The presence of big satellite ground station providers namely EchoStar Corporation, Telesat, and Viasat, Inc. in the region is anticipated to propel the growth of the satellite ground station market in North America during the forecast period. Moreover, in April 2023, Intelsat and Public Broadcasting Services (PBS) signed an agreement. According to the agreement Intelsat started delivering Public Broadcasting Service (PBS) educational, music and arts content across the continental U.S., as part of an exclusive satellite distribution agreement. The agreement is expected to increase the geographical outreach of the company.

The Chinese and Indian governments have increased satellite launches to increase the satellite communication capability of the region. For instance, in March 2021, China launched Yaogan 31-series satellites through the Long March-4C rocket. The Yaogan satellites is expected to augment the territory monitoring capability of China. The increase in technological development in the region acts as the factor that supports the growth of the satellite ground station market.

In addition, an increase in deployment of satellites for commercial applications is anticipated to boost the growth of the market across the commercial area. For instance, in December 2021, Inmarsat, the world leader in global mobile satellite communications successfully launched its first Inmarsat-6 satellite, I-6 F1, by Mitsubishi Heavy Industries (MHI) from the JAXA Tanegashima Space Center in Japan.

Factors such as the increase in use of Internet of Things (IoT) & autonomous systems and rise in demand for military & defense satellite ground station solutions drive the growth of satellite ground station market. In addition, the surge in adoption of satellite ground station equipment in online streaming services, radio, and TV broadcast propels market growth. However, cybersecurity threats to satellite ground station hinders growth of the market. Furthermore, the technological advancements in satellite missions provide remarkable growth opportunities for players operating in the market.

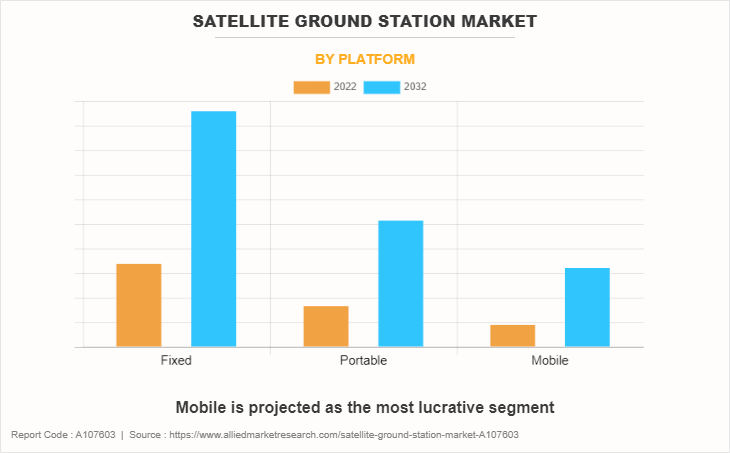

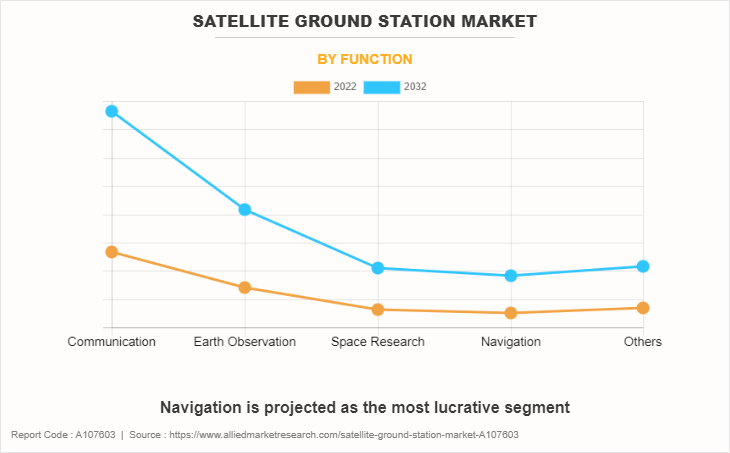

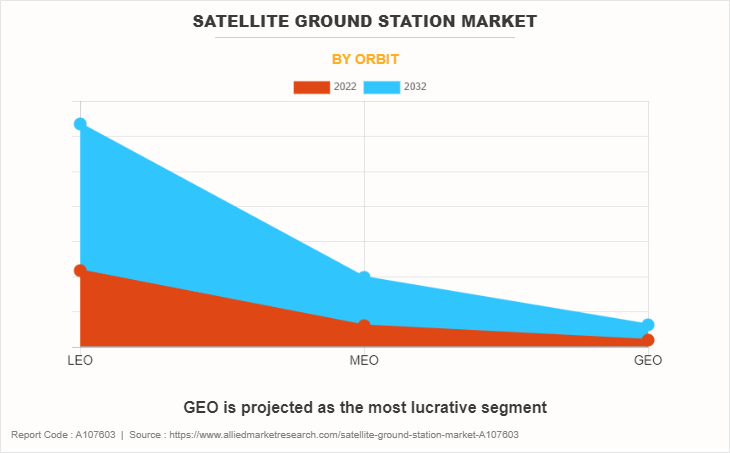

The satellite ground station market is segmented into platform, function, orbit, end user, and region. On the basis of platform, it is segregated into fixed, portable, and mobile. On the basis of function, it is fragmented into communication, earth observation, space research, navigation, and others. On the basis of orbit, the market is categorized into low earth orbit (LEO), medium earth orbit (MEO), and geostationary earth orbit (GEO). Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

North America holds a prominent share in the satellite ground station market, comprising the U.S., Canada, and Mexico. The satellite ground station industry in North America is expected to expand due to increased demand for military satellite systems and equipment in the U.S. market.

The rise in threat to national security has raised North American defense spending to develop new technologies to relay critical information and counter the threat. In addition, a satellite ground station is developed to give connectivity to commercial North American users such as Satellite Industry Association (SIA), and U.S. Geological Survey (USGS). Increased military and commercial usage of satellite ground station services fosters the expansion of the North American satellite ground station industry.

Furthermore, international cooperation in space research and exploration leads to the establishment of ground station networks that can support multiple missions and provide global coverage. This collaboration creates opportunities for ground station operators to participate in and support various space research initiatives.

In addition, portable ground stations are crucial for disaster management and emergency response teams. They enable rapid communication restoration in affected areas, facilitating coordination, relief efforts, and gathering critical information during natural disasters or humanitarian crises. Portable ground stations are utilized in scientific research, exploration missions, and remote sensing applications. They enable communication with satellites for data collection, monitoring environmental changes, and conducting research in remote areas such as the polar regions or deep sea.

Key Developments

The leading companies are adopting strategies such as collaboration, agreement, partnership, contracts, and product launches to strengthen their market position.

In June 2023, SES S.A. collaborated with Aerkomm to provide Medium Earth Orbit (MEO) connection services throughout Taiwan. The collaboration helps the SES to acquire new customers in the Asia-Pacific region.

- In May 2023, SES S.A. and TESAT partnered in the development and implementation of Europe's quantum secure communications initiative, EAGLE-1. EAGLE-1 is a quantum key system integrating both space and ground segments that will deliver safe transmission of encryption keys across geographically dispersed areas and connect the EU's national quantum communications infrastructures.

- In April 2023, Intelsat and Public Broadcasting Services (PBS) signed an agreement. According to the agreement Intelsat started delivering Public Broadcasting Service (PBS) educational, music and arts content across the continental U.S., as part of an exclusive satellite distribution agreement. The agreement is expected to increase the geographical outreach of the company.

- In February 2022, the Indian Space Research Organization (ISRO) successfully launched the earth observation satellite EOS04 along with two other satellites, on the PSLV-C52 mission. The EOS-04, formerly known as RISAT-1A, is a land based earth observation satellite. It functions in all weather conditions and is used for agricultural and forestry applications such as terrain mapping and soil moisture monitoring.

- In, March 2022, Hughes (a wholly owned subsidiary of Echostar) Collaborated with OneWeb and introduces Groundbreaking New Flat Panel Antenna Technology and Multi-Transport Satellite-LTE Capability. The phased array antenna is low-profile and has no moving parts, making it perfect for fixed and mobile communication.

Increase in Internet of Things (IoT) and autonomous systems

Robust IoT, AI, and autonomous technologies are being increasingly implemented throughout several industries namely automobile, defense, and healthcare. These technical tools are employed to increase the efficiency and effectiveness of the new installation or existing infrastructure. For instance, in September 2020, Microsoft announced the development of a healthcare cloud service.

The healthcare cloud service is a digital health technology aimed to provide seamless interactions among various IoT devices, sensors, and users. Multiple tech giants have started developing smart technologies to support the growth and adoption of autonomous systems in real-world applications.

Moreover, autonomous systems provide extended safety and comfort for their users by analyzing real-time data to facilitate overall user experience. For instance, in March 2023, Samsung Electronics developed an autonomous driving chip to be installed in vehicles for providing central control and obtain autonomous driving by further exchanging information in real-time through the data centers of Google. Furthermore, smart technologies such as IoT and autonomous systems need extensive and secure network connections for their operation.

A satellite ground station is being increasingly utilized to provide these systems with the required communication channel. For instance, in March 2021, SpaceX filed for approval from the US Federal Communications Commission (FCC) to enable broadband capabilities in moving autonomous vehicles, which is expected to further ensure connectivity in remote areas through SpaceX's satellite system. An increase in the adoption of the satellite ground station system to enhance the potential of IoT and autonomous technologies is anticipated to propel the growth of the global satellite ground station market during the forecast period.

Rise in demand for military and defense satellite ground station solutions

Military and defense forces across the globe require flexible, secure, and reliable communications networks to facilitate information sharing for critical missions. Military and defense users work with private organizations for developing mission-specific satellite ground station solutions. For instance, in February 2021, the French defense procurement agency (DGA) chose Thales Alenia Space for developing the satellite ground stations system Syracuse IV for the French armed forces. Syracuse IV is expected to be a highly resilient satellite ground station system and is anticipated to possess the quality to be operated in highly contested environments.

Moreover, military and defense forces across the globe have upgraded their existing infrastructure to enhance their battle and defense efficacy. For instance, in February 2021, Hanwha Systems, a defense contractor in South Korea announced the development of an on-the-move military satellite ground station terminal in partnership with Intellian Technologies.

The terminal is expected to enable support for real-time command and control for the ground forces on the battlefield. Commercial players have further increased the development of advanced hardware and services owing to an increase in demand for satellite ground station solutions from the defense industry. For instance, ThinKom Solutions, Inc. developed a new version of Aero Satellite ground station Antennas in March 2021.

The new product variant enables embedded phased-array applications and allows flexibility in the installation for military beyond-line-of-sight (BLOS) missions. Satellite ground stations augment military and defense communication, which is expected to be a major driver for the growth of the satellite ground station market during the forecast period.

Cybersecurity threats to satellite ground station

Rapid increase in operational in-orbit satellites further increases concerns and security risks associated with satellite ground station. Satellite systems are responsible for global bandwidth communication and are at risk of exploitation by cyber criminals. Government and private organizations are dependent on satellites for critical services and operations, namely meteorological and weather monitoring, remote sensing, communications, navigation, and imaging. Critical systems and infrastructure such as electrical grids, mobile networks, and Global Positioning System (GPS) technologies are also reliant on satellites.

Moreover, satellites are operated from ground systems, which enable cyber criminals to take advantage of security loopholes and hack in the satellite system. Even a minor disruption in satellite ground station service can result in huge economic losses and security issues for the crucial and vital frameworks of any country. In addition, the downlink and uplink transmission carried out by satellites with open telecom networks can be intercepted and altered by hackers. The long-range telemetry utilized for satellite ground stations is also susceptible to cyberattacks. These security threats restrain the growth of the satellite ground station market.

Technological advancements in satellite missions

An increase in scientific and commercial space programs further lead to the development of cost-effective satellite systems and infrastructure, such as CubeSats, small satellite technology, and Low Earth Orbit (LEO) satellites. Private and government organizations have increased the utilization of small satellites in space missions owing to factors such as reliable and flexible service. For instance, in February 2021, IT-SPINS and MySat-2 (DhabiSat) CubeSats were launched on the Northrop Grumman NG-15 Cygnus spacecraft. The IT-SPINS and MySat-2 CubeSats enable researchers to develop, test, and implement software modules for control systems and attitude determination. Moreover, evolution in launch vehicle technology further improves flexibility in satellite launches. For instance, Aevum developed the rocket-launching drone RAVN-X in December 2020. RAVN-X is expected to enable the launching of small satellites without a Launchpad or a pilot in orbit.

In addition, small satellites offer lower development time and cost in comparison to conventional satellites, which further facilitates the implementation of small satellites. For instance, in April 2019, AISAT (Exseed Sat2) was manufactured in six working days by Satellize. Satellize’s AISAT small satellite works without an antenna and power system, which further reduces the overall cost. These advanced technologies along with increased space launches present an opportunity for the growth of the satellite ground station market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the satellite ground station market analysis from 2022 to 2032 to identify the prevailing satellite ground station market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the satellite ground station market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global satellite ground station market trends, key players, market segments, application areas, and market growth strategies.

Satellite Ground Station Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 178.9 billion |

| Growth Rate | CAGR of 11.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 298 |

| By Platform |

|

| By Function |

|

| By Orbit |

|

| By End User |

|

| By Region |

|

| Key Market Players | Inmarsat Global Limited, EchoStar Corporation, SES S.A., Comtech Technologies Inc., Viasat, Inc., GILAT SATELLITE NETWORKS, ST Engineering, Satcom Technologies, Kratos Defense & Security Solutions, Inc., Intelsat |

The Satellite Ground Station Market was valued at $58.70 billion in 2022 and is estimated to reach $178.94 billion by 2032.

Key players profiled in the report include Viasat, Inc., SES S.A., Intelsat, Gilat Satellite Networks, Inmarsat Global Limited, Kratos Defense & Security Solutions, Inc., EchoStar Corporation, ST Engineering, Comtech Technologies Inc. and Satcom Technologies.

Technological advancements in satellite missions and deployment of 5G network through satellites are the upcoming trends of satellite ground station market.

Commercial is the leading application of satellite ground station market.

North America is the largest regional market for satellite ground station

Loading Table Of Content...

Loading Research Methodology...