The global satellite image data services market size was valued at $6.3 billion in 2022, and is projected to reach $46.3 billion by 2032, growing at a CAGR of 22.2% from 2023 to 2032.

Report Key Highlighters:

- The satellite image data services market studies more than 15 countries. The research includes a segment analysis of each country in terms of value ($ million) for the projected period 2022-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The satellite image data services market is highly fragmented, with several players including Maxar Technologies, ICEYE, Planet Labs PBC, Airbus, L3Harris Technologies, Inc., Ursa Space Systems, Inc., EAST VIEW GEOSPATIAL, INC., BlackSky, LAND INFO Worldwide Mapping, LLC, and Satellite Imaging Corporation. Key strategies such as partnership, contract, product launch, expansion, agreement, and other strategies of the players operating in the market are tracked and monitored.

Satellite image data, also known as satellite imagery, refers to information collected by artificial satellites, which orbit the Earth. Satellite image data services involve collecting, processing, and analyzing earth observation data to provide valuable insights for various industries. These services are utilized in sectors such as agriculture, forestry, environmental monitoring, urban planning, infrastructure development, and defense.

Satellite image data serves diverse purposes. In agriculture, it assists in monitoring crop health, assessing vegetation patterns, and optimizing irrigation and fertilization practices. In forestry, satellite imagery supports forest management, deforestation monitoring, and biodiversity assessment. Environmental monitoring utilizes satellite data for tracking land cover changes, analyzing water resources, and monitoring natural disasters such as floods and wildfires. In urban planning and infrastructure development, satellite imagery aids in land use mapping, site evaluation, and construction project monitoring.

Factors such as rise in demand for geospatial information from various industries, increase in demand for earth observation satellites, and supportive government initiatives and regulations drive the growth of the satellite image data services market. However, regulatory and legal challenges and high cost hinder the growth of the market. Furthermore, integration of AI, ML, and cloud computing in satellite image data services, and surge in adoption of global connectivity and data accessibility offer remarkable growth opportunities for the players operating in the market.

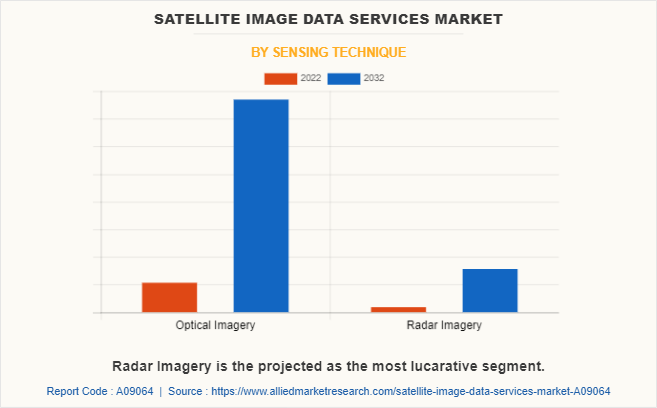

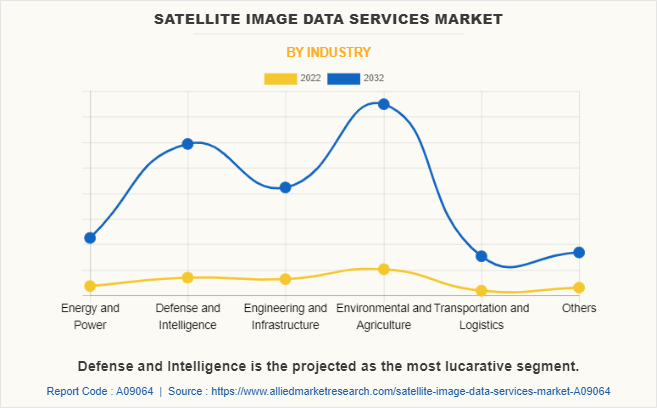

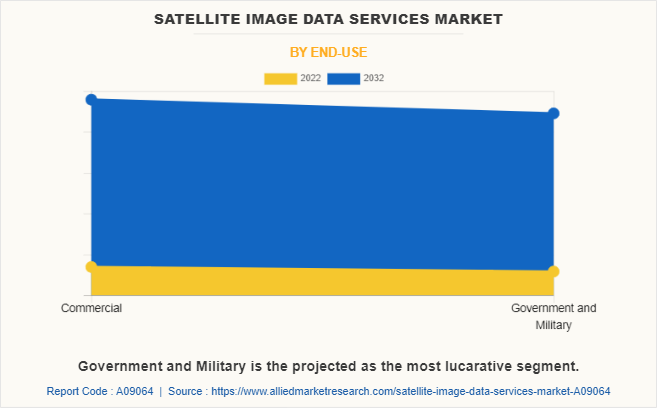

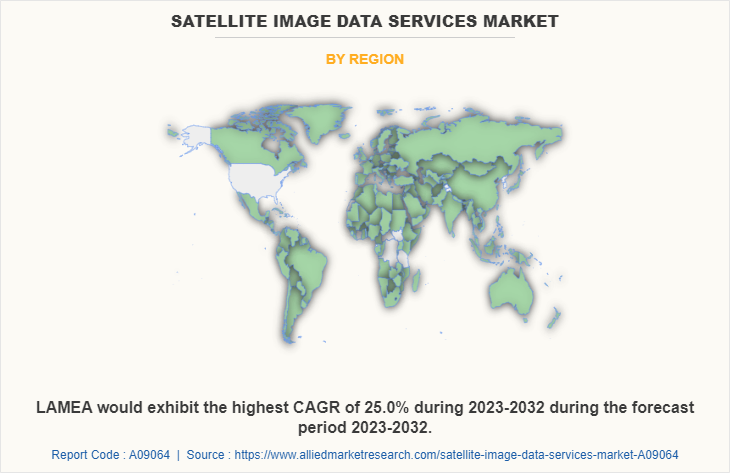

The satellite image data services market is segmented on the basis of sensing technique, industry, end use, and region. By sensing technique, it is bifurcated into optical imagery and radar imagery. By industry, the market is classified into energy & power, defense & intelligence, engineering & infrastructure, environmental & agriculture, transportation & logistics, and others. By end use, it is fragmented into commercial and government & military. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading companies profiled in the satellite image data services industry report include Maxar Technologies, ICEYE, Planet Labs PBC, Airbus, L3Harris Technologies, Inc., Ursa Space Systems, Inc., EAST VIEW GEOSPATIAL, INC., BlackSky, LAND INFO Worldwide Mapping, LLC, and Satellite Imaging Corporation. Satellite image data service providers increase the satellite image data services market share through strategies such as expanding satellite fleets and enhancing the quality and resolution of the satellite imagery. Such plans attract a larger customer base and allow the market players to offer a broader range of applications. Furthermore, numerous companies are investing in advanced analytics and AI technologies to extract valuable insights from the data, thereby increasing the value and attractiveness of their services to various industries such as agriculture, urban planning, and disaster management.

North America includes the U.S., Canada, and Mexico. Satellite image data services witness an escalating demand in multiple sectors throughout North America. Industries including agriculture, forestry, environmental monitoring, urban planning, infrastructure development, and defense are progressively adopting satellite imagery to facilitate decision-making, resource management, and operational activities. There is a rise in the development of various programs, which utilize satellite image data to enhance agricultural practices, improve yield predictions, optimize resource management, and mitigate risks related to climate variability and extreme events. For instance, in 2019, National Aeronautics and Space Administration (NASA) developed a NASA Harvest program, which focuses on providing satellite data specifically tailored for farmers and agricultural purposes.

The program effectively raises awareness regarding the advantageous applications of satellite imagery in the agricultural domain, thereby fostering the adoption of such technologies in other industries. The program's emphasis on collaborations and partnerships with diverse stakeholders stimulates innovation and drives technological advancements within the sector, which is expected to drive the growth of the market.

Rise in demand for geospatial information from various industries

The rise in the need for geospatial information across diverse industries is a major driver for the expansion of the satellite image data services market. Industries such as agriculture, forestry, urban planning, transportation, and environmental management heavily rely on accurate and up-to-date geospatial information. For instance, satellite imagery aids farmers to monitor crop health, detect potential pest infestations or nutrient deficiencies, and optimize irrigation practices. In urban planning, geospatial data enables city officials to assess land usage patterns, plan infrastructure development, and make well-informed decisions for urban growth.

Moreover, there is a rise in demand for satellite image data services in various sectors such as the maritime industry to enhance maritime safety and security. For instance, in May 2023, European Space Imaging (EUSI)partnered with Airbus to provide satellite imagery services to European Maritime Safety Agency (EMSA). This collaboration is expected to contribute to the growth of the satellite image data services market by offering enhanced capabilities and solutions to support maritime safety and security. The availability of reliable and up-to-date satellite imagery enables EMSA to make informed decisions and take proactive measures to ensure maritime safety and environmental protection. Furthermore, the increase in demand for geospatial information from diverse industries to enhance operational efficiency, risk management, and resource optimization drives the growth of the market.

Increase in demand for earth observation satellites

Earth observation satellites are specifically designed to capture detailed images and data of the Earth's surface from space. This data serves a wide range of purposes, including monitoring the environment, managing natural resources, responding to disasters, and planning urban development. The primary driver behind the increase in demand for earth observation satellites is the need for accurate and up-to-date information about the planet. Moreover, governments, organizations, and researchers require dependable data to monitor and comprehend environmental changes owing to the rise in concerns related to climate change, deforestation, and natural calamities.

Earth observation satellites play a crucial role as a valuable means of collecting data on a global scale, facilitating comprehensive monitoring and analysis of various phenomena. In addition, space agencies continue to enhance satellite-based Earth observation capabilities to gather important data for a range of applications such as environmental monitoring, disaster management, agriculture, and urban planning. For instance, in November 2022, the Indian Space Research Organization (ISRO) launched a satellite, designed specifically for Earth observation purposes, which involves capturing imagery and data about the Earth's surface from space. The satellite is equipped with advanced sensors and instruments to collect valuable information related to various aspects of the Earth, including land cover, climate, natural resources, and environmental changes. Such developments increase the availability of high-quality data, enabling more comprehensive solutions, which is expected to drive the demand for satellite image data.

Regulatory and legal challenges

Regulatory and legal challenges present significant obstacles for the satellite image data services market. These challenges stem from the need to comply with regulations and laws that govern satellite operations, data privacy, and security. A major hurdle is to obtain the necessary licenses and permits to operate satellite systems and acquire imagery data. Government and regulatory bodies have strict requirements and procedures, which service providers are expected to follow. The process of obtaining approvals may be time-consuming and complex, potentially delaying the deployment of satellite systems and impeding market growth. Data privacy and security regulations also pose difficulties for satellite image data services. As satellite imagery often captures sensitive information, such as infrastructure or personal property, protecting data confidentiality and integrity becomes crucial. Service providers are anticipated to adhere to applicable laws and regulations to ensure data is safeguarded during collection and processing. Therefore, the regulatory and legal challenges pose significant restraints on the satellite image data services market.

High cost

The high cost of satellite image data services is a major factor that hampers market growth. These services involve significant expenses related to acquiring, processing, and accessing satellite imagery, which poses challenges for both users and service providers. Acquiring satellite imagery requires investing a substantial amount of money in manufacturing, launching, and operating satellites. Costs associated with satellite infrastructure are often too high for smaller companies or organizations with limited financial resources, making it difficult for companies to enter the market or expand their services. In addition, processing and storing large amounts of satellite image data is believed to be quite expensive. It requires powerful computers, advanced algorithms, and skilled personnel to analyze the data and extract valuable insights. These factors contribute to the overall costs of satellite image data services, which is expected to hamper the growth of the market.

Integration of AI, ML, and Cloud Computing in satellite image data services

The integration of AI, ML, and cloud computing in satellite image data services offers a significant opportunity for the market. Traditionally, working with satellite image data is complex and requires a lot of manual effort. However, the combination of advanced technologies provides a solution that can simplify and enhance the capabilities of satellite image data services.AI and ML algorithms are key in automating and optimizing the processing of satellite images. These algorithms can be trained to identify and classify objects, detect changes over time, and extract important features from

the images. Satellite image data services can speed up the analysis process, reduce errors caused by human involvement, and improve the accuracy and reliability of the results by using AI and ML. For instance, ML algorithms are used in agriculture satellite imagery to analyze satellite images to provide valuable insights for farmers. Training algorithms on large amounts of satellite data is helpful to identify patterns, detect crop diseases, predict yields, and optimize irrigation and fertilizer usage. This technology has the potential to revolutionize agriculture by enabling data-driven decision-making and improving productivity and sustainability in farming practices.

This integration also allows for advanced analytics on satellite image data. ML models can be trained on extensive historical satellite imagery to identify patterns, predict trends, and detect anomalies. This opens new possibilities in various sectors, including agriculture, urban planning, environmental monitoring, and disaster management. Therefore, the adoption of these technologies is expected to bring significant opportunities for the growth of the market.

COVID-19 Impact Analysis

The outbreak of COVID-19 resulted in disrupted global supply chains, and travel restrictions in 2020. Lockdown measures hampered the production and delivery of satellite imagery-related hardware and equipment. Thus, leading to delays in data collection and updates, affecting the availability and timeliness of satellite image data. However, post-pandemic, post-pandemic, there is an increase in recognition of the value and importance of remote monitoring and planning capabilities. In addition, industries such as agriculture, forestry, and infrastructure development require remote solutions to adapt to new circumstances. These initiatives led to a surge in demand for satellite image data services and are expected to drive market growth.

Recent Developments

- In March 2023, L3Harris Technologies, Inc. received a contract of $765.5 million from the national oceanic and atmospheric administration (NOAA) to develop the imager for NOAA's geostationary extended observations (GeoXO) satellite program.

- In May 2023, Ursa Space Systems, Inc. entered into a partnership with Umbra, a satellite operator company to pursue more advanced applications of synthetic aperture radar imagery. SAR satellites possess the capability to penetrate through challenging conditions such as darkness, clouds, adverse weather, smoke, and other factors that can hinder the effectiveness of electro-optical imaging satellites.

- In November 2021, BlackSky signed an agreement with the National Aeronautics and Space Administration (NASA) to provide high revisit satellite imaging data. This data helps NASA with its existing Earth observation research to advance predictive capabilities.

- In October 2020, EAST VIEW GEOSPATIAL, INC. entered into a partnership with Capella Space to offer high-resolution synthetic aperture radar (SAR) imagery products. Through the use of advanced SAR technology, Capella Space plans to offer continuous all-weather earth observation imagery that provides global coverage through clouds, smoke, fog, and darkness.

- In March 2022, Johnson Electric Holdings Limited launched an ECI-043 brushless motor platform that provides high torque low-speed applications and delivers a stable torque output with a high level of controllability.

- In August 2021, Johnson Electric Holdings Limited launched a smart braking electric brake booster motor that measurably shortens emergency braking distances that improves vehicle energy efficiency.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the satellite image data services market analysis from 2022 to 2032 to identify the prevailing satellite image data services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the satellite image data services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global satellite image data services market trends, key players, market segments, application areas, and market growth strategies.

Satellite Image Data Services Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 46.3 billion |

| Growth Rate | CAGR of 22.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 251 |

| By Sensing Technique |

|

| By Industry |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Maxar Technologies, L3Harris Technologies, Inc., Airbus, Satellite Imaging Corporation, ICEYE, BlackSky, EAST VIEW GEOSPATIAL, INC., Ursa Space Systems, Inc., LAND INFO Worldwide Mapping, LLC, Planet Labs PBC |

The top companies to hold the market share in satellite image data services are Maxar Technologies, ICEYE, Planet Labs PBC, Airbus, L3Harris Technologies, Inc., Ursa Space Systems, Inc., EAST VIEW GEOSPATIAL, INC., BlackSky, LAND INFO Worldwide Mapping, LLC, and Satellite Imaging Corporation.

The estimated industry size of satellite image data services is $6.3 billion in 2022.

The largest regional market for satellite image data services is North America.

The leading industry of satellite image data services market is environmental and agriculture.

The upcoming trends of satellite image data services market in the world are integration of AI, ML, and cloud computing in satellite image data services, and surge in adoption of global connectivity and data accessibility.

Loading Table Of Content...

Loading Research Methodology...