Satellite Internet Market Insights:

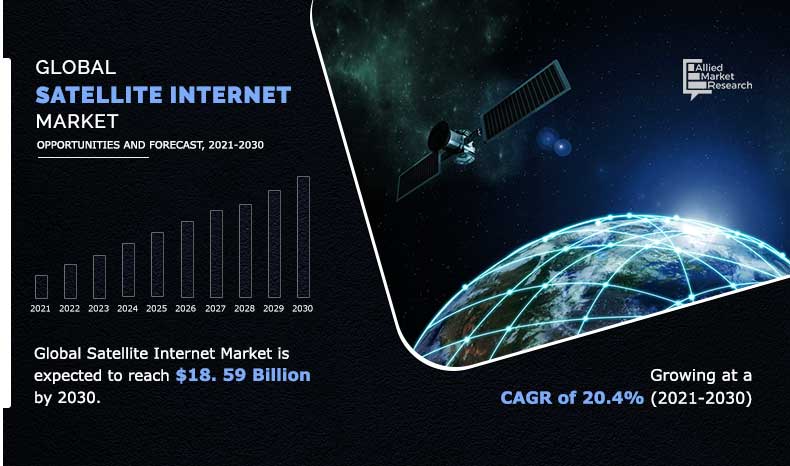

The global satellite internet market size was valued at USD 2.93 billion in 2020 and is projected to reach USD 18.59 billion by 2030, growing at a CAGR of 20.4% from 2021 to 2030.

The key factors driving the growth of the global satellite internet market trends include surge in adoption of satellite services in police, fire, and other departments of various developing nations and advancement in communication technology across the globe. In addition, increase in government initiative for adopting satellite broadband communications services positively impacts the satellite internet market growth.

Satellite internet is accessed through the high-speed internet connectivity from satellites orbiting the earth. It is much quicker than traditional internet service and different than land-based internet services, such as DSL and cable, which transmit information through wires. The radio waves used in satellite internet technology communicate with satellites encircling the earth. Satellite internet platform retrieves and sends the information through a communication network and travels the data out to a satellite space through satellite dish, then back to earth to ground stations.

However, high implementation and maintenance cost of satellite internet hampers the growth of the market. On the contrary, increased adoption of artificial intelligence (AI), machine learning (ML), and cloud computing in the space sector and adoption of satellite broadband in smart cities and connected cars for increasing public safety are expected to provide lucrative opportunity for the market.

Segment Review:

The global satellite internet market is segmented on the basis of band type, end user, and region. By band type, the market is divided into C-band, X-band, L-band, K-band, and others. By end user, it is categorized into commercial users and individual. The commercial users segment is further sub divided into law enforcement agencies, emergency relief centers, and public health organizations. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Band Type

C-Band is projected as one of the most lucrative segments.

The C-band segment contributed the largest market share in 2020, owing to increase in adoption of C-band satellite internet services among the end users due to high-speed internet connectivity provided by the C-band satellite in areas with heavy rainfall and a weaker communication channel. However, the K-band segment is expected to grow at the highest rate during the forecast period, owing to rapid adoption of K-band in marine and other rescue operation due to its ability for searching and tracking a specific target, which drives the growth of the market in this segment. In addition, it provides communication antenna systems, which help rescue teams provide email and internet access for operational and crew use, thereby further propelling the growth of the market in this segment.

By End User

Individuals is projected as one of the most lucrative segments.

Region-wise, the satellite internet market was dominated by North America in 2020, and is expected to retain its position during the forecast period. This is attributed to the growing adoption of cloud-based technology across the region and rise in government initiatives for providing satellite technology across various parts of North America. However, Asia-Pacific is expected to witness significant growth rate during the forecast period, owing to rise in adoption of satellite internet by various venders to communicate with their employees and consumers immediately. Moreover, Chinese government has started investing in creating its own company full owned by the government to create and operate satellite broadband constellation which provides lucrative opportunity for the market.

By Region

Asia-Pacific would exhibit the highest CAGR of 22.4% during 2021-2030.

The key players operating in the global satellite internet industry include Embratel, Eutelsat Communications SA, Freedomsat, Hughes Network Systems, LLC, OneWeb, Singtel, Skycasters, SpaceX, Viasat, Inc, and Wireless Innovations, Ltd. These players have adopted various strategies to increase their market penetration and strengthen their foothold in the satellite internet industry.

Top Impacting Factors:

Rise in Need for Satellite Internet in Rural Areas

There has been a rise in demand for satellite internet among rural areas due to the unavailability of any other mode of internet. Furthermore, satellite internet can provide internet to every corner of the earth from hilly areas to desert where internet availability is very hard to reach, which enhances the demand for satellite internet in such areas. In addition, satellite offers some of the fastest available internet for rural areas.

Moreover, satellite internet technology has evolved to provide more speed and data for users, thus developing nations of various LAMEA and Asian countries are rapidly adopting this service, which is propelling the growth of the market. Furthermore, modern satellite internet service requires only a small satellite dish that fits neatly on the user’s property, unlike the giant one’s people used 40 years ago. In addition, it helps people in rural areas to connect to the world as it is very expensive for telecommunication companies to provide services in rural or hard to reach areas. These factors drive the satellite internet market growth in rural areas.

Growing Supportive Government Regulation Across Developing Nations

Rise in government initiatives for penetration of enhanced satellite internet services for building a digital country and to increase the safety & security of the general public drives the growth of the market. In addition, various governments are investing heavily in satellite broadband systems for providing broadband services to rural populations across developing nations, which also enhances the growth of the market.

For instance, in November 2020, Russia planned to develop its own cluster of at least 500 next-generation, multi-spectrum satellites. The project has been included in the ‘Digital Economy’ state program and the first satellite could be launched in 2024. Thus, the number of such development across the globe is driving the growth of the market.

Furthermore, governments are investing in various satellite broadband companies and running trials to provide internet connections to public and also to provide a secured communication channel for the general public, which propel the growth of the market. For instance, Canadian government invested to support broadband projects across the country. The new project will provide enhanced network connectivity in various rural areas of the country and enhance the communication channels of the country in different emergency situations, which is expected to drive the growth of the market.

Moreover, many countries are providing subsidies to companies and the public to increase the use of satellite internet and support its growth. For instance, the German government will subsidize the purchase of Starlink satellite dishes and similar providers of wireless internet connections with grants to households worth $611. This will provide citizens the power to buy satellite internet subscription and fasten digitalization in rural areas. In addition, this subsidy scheme will be open to all internet providers in rural areas. Such government initiatives are expected to support the growth of the satellite internet market.

Regional Insights:

The satellite internet market is experiencing rapid growth across multiple regions, driven by the increasing need for reliable connectivity in underserved and remote areas.

North America leads the satellite internet market, with the U.S. being a major contributor. The high demand for satellite internet in rural areas, where traditional broadband infrastructure is lacking, is fueling market growth. Companies like SpaceX's Starlink are playing a key role by providing low-latency satellite internet services across the region. Additionally, government initiatives, such as the Federal Communications Commission’s (FCC) Rural Digital Opportunity Fund, are accelerating the deployment of satellite internet to bridge the digital divide.

Europe is another significant market, with countries like the U.K., Germany, and France leading satellite internet adoption. The region’s focus on rural connectivity and digital inclusion is driving demand for satellite services. European governments and organizations, including the European Space Agency (ESA), are investing heavily in satellite technologies to enhance connectivity in remote regions and ensure high-speed internet access for all citizens. The EU’s initiative to develop its own satellite internet system is also expected to boost the regional market.

Asia-Pacific is one of the fastest-growing regions in the satellite internet market, with countries like China, India, Japan, and Australia leading the way. Rapid urbanization, vast rural landscapes, and the lack of reliable internet infrastructure in remote areas are driving demand for satellite-based services. In particular, India's government is partnering with private companies to improve rural internet connectivity through satellite technology, while Australia’s National Broadband Network (NBN) is expanding its satellite services to underserved regions.

Latin America and the Middle East and Africa are emerging markets for satellite internet. In Latin America, countries like Brazil, Argentina, and Mexico are experiencing growth as satellite services become a key solution for expanding internet coverage in rural and remote areas. Meanwhile, in the Middle East and Africa, countries such as South Africa, Kenya, and Saudi Arabia are investing in satellite internet to improve connectivity, especially in regions where terrestrial infrastructure is limited or non-existent.

Key Industry Developments:

January 2023: SpaceX's Starlink expanded its satellite internet services to rural and remote areas in Brazil, providing low-latency, high-speed internet access to underserved communities. This expansion is part of Starlink’s global push to enhance connectivity in remote regions.

March 2023: The European Union announced its plan to develop a sovereign satellite internet system to provide secure, high-speed internet access across Europe. The project, which aims to reduce dependency on foreign satellite systems, is expected to be operational by 2027 and will enhance connectivity in remote regions.

July 2023: OneWeb, a global satellite internet provider, completed the deployment of its satellite constellation to provide global internet coverage. This marks a significant milestone in OneWeb’s goal of offering high-speed satellite internet services to underserved regions worldwide, particularly in remote and rural areas of Africa, Asia, and the Arctic.

August 2023: India’s Bharti Enterprises announced a collaboration with Hughes Communications to launch satellite broadband services targeting rural and underserved areas across India. The partnership aims to enhance internet accessibility and support India’s digital transformation initiatives.

Impact of COVID-19:

The emergence of COVID-19 is expected to have a positive impact on the growth of the satellite internet market. The spending on the satellite internet industry is expected to increase as compared to the spending planned before this pandemic, owing to growing need for providing a host of voice, data, and broadcast communications solutions for organizations, government customers, and consumers around the globe. Furthermore, companies and governments are collaborating to provide a number of initiatives to provide community and employee support during the pandemic. For instance, global space agencies, such as NASA, are also harnessing the power of satellites to illustrate the planet-wide changes resulting from COVID-19. Moreover, with the increased shift of work from home during COVID-19, many workers shifted to their hometowns in rural areas, thereby driving the growth of the market.

The report focuses on growth prospects, restraints, and trends of the global satellite internet market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the global satellite internet market.

Key Benefits for Stakeholders:

- The study provides an in-depth analysis of the global satellite internet market forecast along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on global satellite internet market is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market from 2021 to 2030 is provided to determine the satellite internet market potential.

Satellite Internet Market Report Highlights

| Aspects | Details |

| By BAND |

|

| By END USERS |

|

| By Region |

|

| Key Market Players | Freedomsat, .Hughes Network Systems, LLC, Wireless Innovations, Ltd., Embratel, SpaceX, .EUTELSAT COMMUNICATIONS SA, OneWeb, Viasat, Inc., Singtel, Skycasters |

Analyst Review

The use of satellite internet has increased over the years as it provides internet connection to all parts of the world from remote places to busy cities. In addition, it provides a type of connection that uses a satellite to get an internet signal from the internet service provider (ISP) to the end user. Growing adoption of AI in satellite internet for improving connection in space and providing safety from various accidents in space drives the growth of the market. The main features of satellite internet is to maintaining communication networks among the satellites, monitoring the condition of the satellites and their operating routines, and providing real-time update of the satellite to the end users. Furthermore, growing adoption of satellite internet across SMEs and rural areas is expected to drive the growth of the market. In addition, satellite internet system is usually implemented in remote areas where mobile connectivity is weak. The key feature of the system includes the transmission of voice over internet and surfing of high-definition video and audio in remote regions.

The market is expected to witness significant growth in the future due to increase in use of satellite broadband network among domestic users and rise in adoption of internet of things-oriented business models among various governments across the globe. The global satellite internet market is highly concentrated, and companies are focusing on leveraging new technologies for offering new broadband services to meet the emerging requirements of the user. In addition, presence of a large number of service providers in the global satellite internet market increases the competition between key players. Therefore, satellite broadband in public safety technology providers is differentiating themselves from competitors and driving revenue growth by incorporating new digital business technologies, such as artificial intelligence, machine learning, and low-cost data, into their offerings to gain a competitive lead and retain their market position.

Furthermore, the vendors operating in the market are taking several initiatives, such as product launch and partnership, to stay competitive and to strengthen their foothold in the market. For instance, in June 2021, Iridium Communications Inc. launched Iridium Certus 200 service for maritime, land mobile, and government markets. It is a new L-band broadband service, which is used to provide enhance communication services to various end users in critical situations. According to the industry experts, the satellite internet market is expected to witness increased adoption in the coming years, owing to digital transformation across the globe, satellite broadband adoption in developing countries, such as India, and rapid adoption of IIoT among various sectors. North America is expected to dominate the market during the forecast period while emerging countries in Asia-Pacific and Latin America are projected to offer significant growth opportunities.

The global satellite internet market is expected to grow at a compound annual growth rate (CAGR) of 20.4% from 2020 to 2030 to reach USD 18.59 billion by 2030

Major key players operating in the market are mbratel, Eutelsat Communications SA, Freedomsat, Hughes Network Systems, LLC, OneWeb, Singtel, Skycasters, SpaceX, Viasat, Inc, and Wireless Innovations, Ltd.

The global satellite internet market size was valued at USD 2.93 billion in 2020 and is projected to reach USD 18.59 billion by 2030

Asia-Pacific is expected to witness significant growth rate during the forecast period

Major driving factors such as rise in need for satellite internet in rural areas & growing supportive government regulation across developing nations

Loading Table Of Content...