Satellite IoT Market Insights:

The global satellite iot market was valued at USD 1.3 billion in 2022 and is projected to reach USD 8.7 billion by 2032, growing at a CAGR of 21.1% from 2023 to 2032.

Factors such as growth in digitalization and increase in adoption of advanced technologies are positively impacting the growth of the market. In addition, the increase in adoption of satellite IoT in various industries such as utilities, maritime, defense & military, among others to enhance productivity, are expected to fuel the growth of the market. Furthermore, the increase in investments in advanced technologies such as AI, ML, cloud-based services and IoT is expected to provide lucrative growth opportunities for the market during the forecast period. Moreover, integration of satellite with mainstream technologies for business intelligence positively impacts the growth of the market.

However, the high cost of technologies and regulatory issues and lack of comprehensive government policies regarding satellite IoT are expected to hamper the market growth. Furthermore, rise in adoption of cloud-based solution and increase in application of augmented reality (AR) & virtual reality (VR) technologies in information system are expected to offer remunerative opportunities for the expansion of the global satellite IoT market during the forecast period.

Satellite IoT refers to the use of satellite communication networks and services to connect terrestrial IoT sensors and IoT end-nodes to a server, either in conjunction with or as an alternative to terrestrial communication networks. Satellite IoT because there is no need to keep terrestrial and satellite communication options separate, consumers and industrial users can take advantage of a reduction in running costs. Modern businesses and organizations rely on IoT to enable millions of intelligent data conversations, helping them track, monitor and manage assets; ensure the safety of their workers, and improve remote operations. For many business operations, IoT technology offers critical elements of the economy, such as the global supply chain, which can be managed remotely.

For instance, trucks carrying perishable goods can be monitored in real time, merchant ships can be piloted from the safety of the shore, and this can be made possible by some form of connectivity. But since cellular coverage only reaches approximately 15% of the planet, technology developers have had to find ways to extend their reach beyond the limits of terrestrial infrastructure. This need led more companies to look to satellite communications to create coverage continuity, and as a result, satellite IoT has emerged as a new category of option to solve issues. Such factors are expected to provide lucrative growth opportunities for the satellite IoT market during the forecast period.

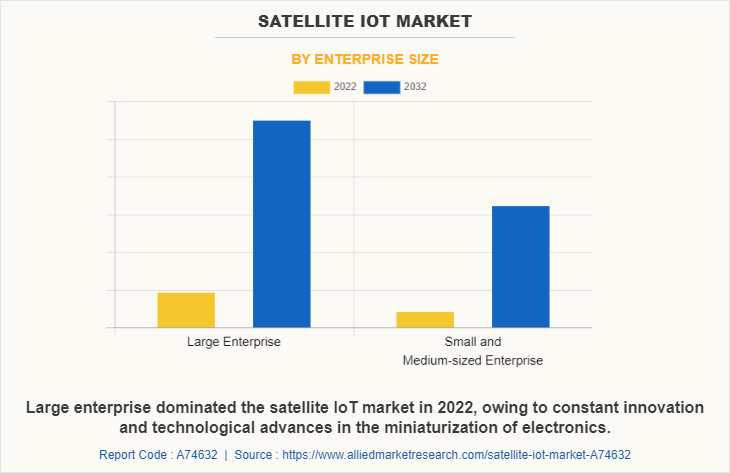

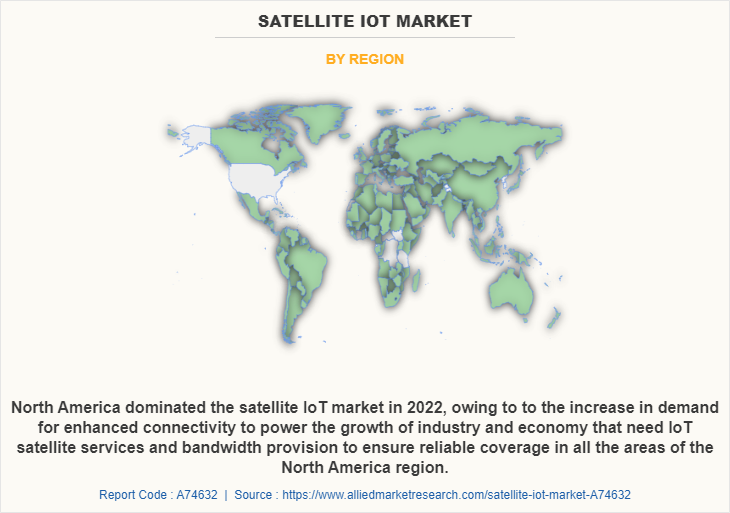

The satellite IoT market is segmented into service type, frequency band, enterprise size, industry vertical, and region. By service type, it is bifurcated into Direct-to-Satellite and Satellite IoT Backhaul. By frequency band, it is divided into L-Band, Ku and Ka Band, S-Band and Others. By enterprise size, the market is segregated into small & medium-sized enterprises and large enterprises. By industry vertical, the market is classified into oil and gas, transportation and logistics, energy and utilities, agriculture, maritime, healthcare, military and defense and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global satellite IoT industry is dominated by key players such as ORBCOMM, Iridium Communications Inc., Inmarsat Global Limited, Airbus, Astrocast, Intelsat, Globalstar, Thales, OQ Technology, and Eutelsat Communications S.A.. These players have adopted various strategies to increase their market penetration and strengthen their position in satellite IoT industry.

On the basis of enterprise size, the large enterprise segment dominated the satellite IoT market size in 2022 and is expected to continue this trend during the forecast period. The surge in adoption of satellite IoT in large businesses opens numerous opportunities for the market growth. However, the small and medium-sized enterprise segment is expected to experience the fastest growth in the coming years. Factors such as surge in digitalization and increase in government initiatives through various digital small and medium-sized enterprise campaigns throughout the world fuel the growth of the market.

By region, North America dominated the satellite IoT market share in 2022 for the market. The increasing investment in advanced technologies such as cloud-based services, AI/ML, business analytics solution and IoT to improve businesses and the customer experience are anticipated to propel the growth of the market. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. This is attributed to the increase in penetration of digitalization and higher adoption of advanced technology are expected to provide lucrative growth opportunities for the market in this region.

Top Impacting Factors:

Rise in Demand for Interconnectivity Between Devices in Remote Areas:

The demand for Interconnectivity between devices has increased in remote areas. This is attributed to satellite IoT because it enables devices to communicate and exchange data over long distances, even in remote areas where traditional communication networks are unreliable. In addition, satellite IoT allows devices to connect to the internet and other devices through satellite networks, which use low-power, low-bandwidth communication protocols to transmit data. As a result, satellite IoT enables a wide range of devices, such as sensors, trackers, and other Internet of Things (IoT) devices, to operate in areas where cellular or other terrestrial networks are not available.

Furthermore, as satellite IoT, devices can be connected and communicate with each other regardless of their location it allows for seamless data exchange, remote monitoring, and control. Satellite IoT is useful in industries such as agriculture, transportation, and energy, where assets are spread over large geographic areas, and real-time data monitoring and analysis are critical for efficient and effective operations. As a result, key players in the market adopted various strategies such as product launch and product development to enhance their services and strengthen their position in the satellite IoT market. For instance, in April 2023, Sateliot Barcelona based company launched the first satellite in a new low earth orbit (LEO) constellation designed to provide a big coverage boost for terrestrial 5G Internet of Things applications. The project essentially merges satellite and terrestrial cellular-based connectivity to improve IoT coverage.

Increase in Use of Satellite IoT to Automate Routine Processes in Agriculture Industry:

The use of satellite IoT to automate routine processes in the agriculture industry increased as satellite IoT allows farmers to remotely monitor their crops and livestock in real-time. This is attributed to satellite IoT services as it allows early detection of issues such as pest infestations, diseases, or irrigation problems, which can be quickly addressed before they escalate. In addition, satellite IoT enables precision agriculture, which involves using data-driven insights to optimize crop yields, reduce waste, and conserve resources such as water and fertilizer. As a result, by collecting all the data from sensors and other IoT devices, farmers can create accurate maps of their fields and tailor their farming practices to the specific needs of each area.

Moreover, with satellite IoT, farmers can also streamline their operations and make more informed decisions based on data insights. Key players in the market adopted various strategies such as collaboration and partnership to enhance their services and strengthen their position in the satellite IoT market. For instance, in August 2021, ORBCOMM and Farmbot monitoring solutions collaborated to enable their smart agriculture solutions, which help farmers improve the visibility and management of their water resources. Farmbot’s solution is powered by ORBCOMM’s global satellite OGi modem and Inmarsat’s ultra-reliable L-band connectivity to deliver remote monitoring of farm water supplies, including tanks, dams, and reservoirs, and capturing images in real-time. As a result, such collaborations and developments increase efficiency and productivity, as well as better resource management, resulting in satellite IoT market growth. Furthermore, by using IoT sensors to track the temperature and humidity of storage facilities, farmers can ensure that their produce meets strict quality standards and is not spoiled during transport. Thus, satellite IoT boosts the connectivity and automation process in agriculture industry, resulting in market growth.

Key Benefits for Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the satellite iot market analysis from 2022 to 2032 to identify the prevailing satellite iot market opportunities.

- The satellite IoT market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the satellite iot market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global satellite iot market trends, key players, market segments, application areas, and market growth strategies.

Satellite IoT Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.7 billion |

| Growth Rate | CAGR of 21.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 469 |

| By Service Type |

|

| By Frequency Band |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Thales, Eutelsat Communications S.A., OQ Technology, Iridium Communications Inc., INMARSAT GLOBAL LIMITED, Globalstar, ORBCOMM, Astrocast, Intelsat, Airbus |

Analyst Review

In accordance with several interviews that were conducted of the top level CXOs, an increase has been witnessed in the adoption of satellite IoT among organizations as this data adds more value to the business. In addition, governments across the globe are investing heavily in satellite IoT technology, as it helps in boosting the technology economy of countries. Moreover, the demand for satellite IoT solution is increasing in various Asian countries due to its application for disaster recovery & incidence management, mapping, in transportation, and development of smart cities projects.

Furthermore, increase in advancements in technologies such as artificial intelligence (AI), machine learning (ML) technologies, cloud computing and big data, have become more widely used in various sectors, which provide lucrative opportunities for the market growth during the forecast period. Also, key market players are adopting strategies such as partnership, collaboration and product development which will drive the market globally. For instance, in February 2022, Astrocast SA launched its commercially available cost-effective, bidirectional satellite IoT (SatIoT) service, to connect IoT devices globally. Accessibility to Astrocast’s Satellite IoT service has the potential to transform the business model for global IoT. These powerful applications are expected to accelerate change and deliver tangible value to businesses, individuals, and the environment.

Moreover, satellite-backed IoT will greatly benefit the transportation infrastructure. Satellite communications have made it possible to use broadband connections on trains, ships, and cargo vehicles. For instance, in December 2022, Iridium Communications Inc. introduced the Iridium Messaging TransportSM (IMTSM), a two-way cloud-native networked data service optimized for use over Iridium Certus® and designed to make it easier to add satellite connections to existing or new IoT solutions. IMT provides an IP data transport service unique to the Iridium® network, designed for small-to-moderate-sized messages supporting satellite IoT applications. Integrated with Iridium CloudConnect and Amazon Web Services (AWS), the new service can reduce development costs and speed time to market for new Iridium Connected® IoT devices. Such an initiative is expected to provide lucrative opportunities for the market growth during the forecast period.

Furthermore, city administrators around the world are harnessing the power of the IoT to drive energy efficiency measures and smarter resource allocation to help make cities more sustainable; for instance, satellite IoT is key to enabling smart grids to be extended to remote regions where terrestrial networks fall short. For instance, in December 2021, ST Engineering invested $30 million for IoT satellite terminal company hiSky. With the new funding, hiSky aims to accelerate research and development while adding to its engine fleet and building up its outreach with key industry buyers. ST Engineering, which sells communications and IoT sensor products through its electronics division, is picked up the distribution rights to the terminals. It will set to market them through its direct-to-business satellite communications arm such as “ST Engineering iDirect”. Meanwhile, Vodafone IoT partnered with Inmarsat that offers the first global cellular and satellite IoT managed connectivity service. The partnership with Inmarsat, a leading satellite communications provider enables additional flexibility and coverage for IoT customers and partners to connect all their assets on a single contract without having to spend the time and resource dealing with multiple connectivity providers, or the cost and complexity of multiple roaming agreements.

Factors such as growth in digitalization and increase in adoption of advanced technologies are positively impacting the growth of the market.

the increase in investments in advanced technologies such as AI, ML, cloud-based services and IoT is expected to provide lucrative growth opportunities for the market during The forecast period. Moreover, integration of satellite with mainstream technologies for business intelligence positively impacts the growth of the market.

North America is the largest regional market for satellite IoT

The satellite IoT market valued for $1,315.20 million in 2022 and is estimated to reach $8,691.35 million by 2032, exhibiting a CAGR of 21.1% from 2023 to 2032.

The global satellite IoT industry is dominated by key players such as ORBCOMM, Iridium Communications Inc., Inmarsat Global Limited, Airbus, Astrocast, Intelsat, Globalstar, Thales, OQ Technology, and Eutelsat Communications S.A.. These players have adopted various strategies to increase their market penetration and strengthen their position in satellite IoT industry.

Loading Table Of Content...

Loading Research Methodology...