Satellite Manufacturing And Launch Systems Market Research, 2033

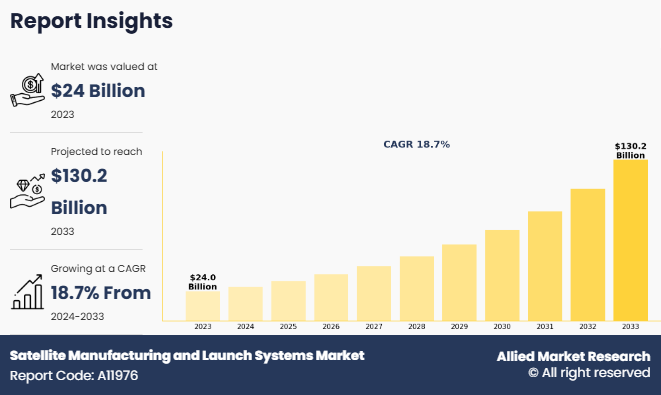

The global satellite manufacturing and launch systems market size was valued at $24 billion in 2023, and is projected to reach $130.2 billion by 2033, growing at a CAGR of 18.7% from 2024 to 2033.

Satellite Manufacturing and Launch Systems refer to the processes, technologies, and infrastructure involved in designing, building, testing, and deploying satellites into space. This includes the development of various satellite types, such as communication, navigation, Earth observation, and scientific research satellites. The manufacturing process involves assembling components like payloads, power systems, propulsion units, and communication modules to ensure operational efficiency in orbit. Furthermore, Launch systems encompass rockets and other vehicles used to transport satellites into space, ranging from small launch vehicles for low Earth orbit (LEO) missions to heavy-lift rockets for geostationary and deep-space missions. These systems include reusable and expendable launch vehicles, as well as emerging technologies like air-launch platforms.

Furthermore, with growing demand for satellite-based services, advancements in miniaturization, reusable rockets, and cost-effective launch solutions are shaping the industry. Governments, commercial space companies, and defense agencies play a crucial role in expanding satellite deployment for communication, navigation, surveillance, and scientific exploration.

For instance, in March 2025, HEX20 successfully launched India's first private payload hosting satellite, "Nila," aboard SpaceX Transporter-13. This product marks a significant achievement in India's private space sector, enabling commercial and research payloads to operate in orbit. The launch reflects growing private sector participation in satellite deployment and advancements in space technology.

Moreover, in March 2025, Rocket Lab USA, Inc. announced the successful operation of its third Pioneer spacecraft for Varda Space Industries, Inc. on orbit. The W-3 mission, launched on March 14 from Vandenberg Space, follows the successful re-entry of Varda’s W-2 mission, also powered by Rocket Lab’s Pioneer Spacecraft, just 15 days earlier.

The growth of satellite manufacturing and launch systems industry is driving demand in the market by enabling cost-effective and frequent satellite deployments. Advancements in miniaturized satellites, reusable launch vehicles, and private sector investments are making space more accessible. Increasing demand for satellite-based communication, Earth observation, and navigation is pushing manufacturers to develop high-performance and low-cost satellite solutions. Governments and private companies are expanding satellite networks for broadband, 5G, and remote sensing applications. Innovations in small satellite constellations and commercial space exploration are further accelerating market growth, making satellite deployment faster, more affordable, and efficient for various industries worldwide. Furthermore, rise in government and private investments and expansion of commercial space activities have driven the demand for satellite manufacturing and launch systems market share.

However, the high initial investment and development costs are restraining demand in the satellite manufacturing and launch systems market growth. Building and launching satellites require significant financial resources for research, development, testing, and deployment. The cost of advanced materials, propulsion systems, and payload integration adds to the expenses, making entry difficult for new players. The need for specialized infrastructure, such as launch pads and ground stations, further increases costs. Small and emerging companies struggle to compete due to limited funding. These financial challenges slow down market expansion, delaying satellite projects and reducing accessibility for commercial and government applications. Moreover, stringent regulatory and compliance requirements is major factors that hamper the growth of the satellite manufacturing and launch systems market trends.

On the contrary, the growing demand for satellite internet and 5G connectivity presents a lucrative opportunity for the Satellite Manufacturing and Launch Systems market forecast. Expanding global broadband coverage, especially in remote and underserved regions, is driving the deployment of low Earth orbit (LEO) satellite constellations. Companies such as Starlink, OneWeb, and Amazon’s Project Kuiper are investing in large-scale satellite networks to enhance internet access. Additionally, the integration of 5G technology with satellite communications is fueling demand for advanced satellites capable of supporting high-speed data transmission. This trend is opening new revenue streams, attracting investments, and accelerating innovation in satellite manufacturing and launch technologies.

Segment Review

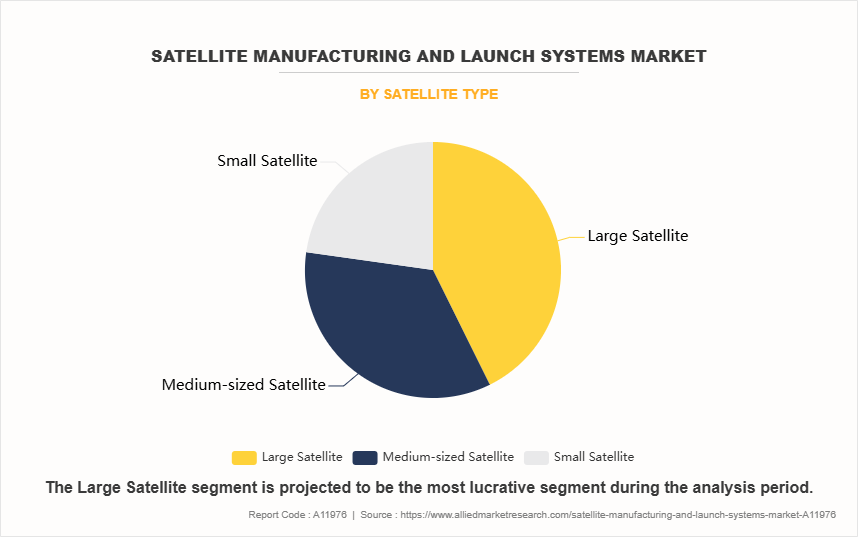

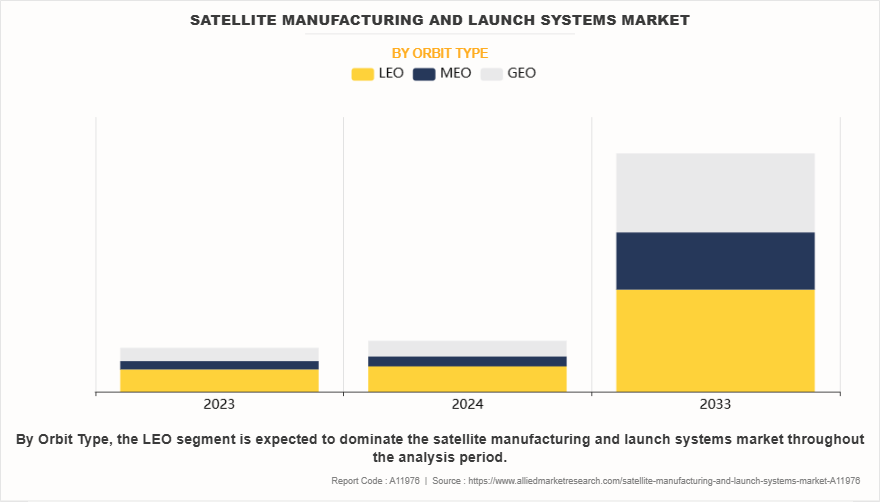

The global satellite manufacturing and launch systems market is segmented on the basis of satellite type, orbit type, application, and end user. On the basis of satellite type, the market is segmented into large satellites, medium-sized satellites, and small satellites. By orbit type, the market is divided into LEO, MEO, and GEO. On the basis of application, the market is categorized into communication satellites, earth observation satellites, navigation satellites, military surveillance, and others. By end user, the market is segmented into commercial and government. Region wise, it is analyzed across North America, Europe, Asia-Pacific, LAMEA.

By Satellite Type

On the basis of satellite type, the large satellite segment attained the highest market share in the satellite manufacturing and launch systems market revenue due to its extensive use in communication, Earth observation, and military applications. These satellites offer higher payload capacity, longer operational lifespans, and advanced technological capabilities, making them essential for global connectivity, weather forecasting, and defense surveillance. Governments and space agencies heavily invest in large geostationary satellites for strategic applications, further driving demand. The need for high-speed internet, satellite television, and secure military communications has fueled the deployment of large satellites, solidifying their dominance in the market over smaller alternatives.

By Orbit Type

On the basis of orbit type, the LEO segment attained the highest market share in the satellite manufacturing and launch systems market report due to its growing adoption for communication, Earth observation, and remote sensing applications. LEO satellites operate at lower altitudes, enabling low-latency communication, high-resolution imaging, and faster data transmission. The expansion of satellite internet services, such as Starlink and OneWeb, has significantly increased demand for LEO satellites. The lower cost of manufacturing and launching these satellites, combined with advancements in small satellite constellations and reusable launch vehicles, has made LEO the preferred choice for commercial and government applications.

By Region

Region wise, North America attained the highest market share in 2023 and emerged as the leading region in the satellite manufacturing and launch system market. This is due to its strong space industry, advanced technology, and significant government and private sector investments. The presence of leading space agencies such as NASA and private companies such as SpaceX, Blue Origin, and Lockheed Martin has driven innovation and frequent satellite launches. The region’s focus on defense, satellite internet, and Earth observation has boosted demand. The U.S. government’s initiatives for national security, climate monitoring, and deep-space exploration further contribute to market dominance. Investments in reusable rockets and mega-constellations also strengthen North America's leadership.

However, Asia-Pacific is projected to grow at the fastest rate during the forecast period. due to rising government investments, expanding commercial space activities, and advancements in satellite technology. Countries such as China, India, and Japan are heavily investing in satellite deployment, space exploration, and defense applications. Organizations such as ISRO, CNSA, and JAXA are driving innovation with cost-effective satellite launches and reusable rocket technology. The region’s growing demand for satellite-based internet, navigation, and Earth observation further fuels market expansion. The emergence of private space companies and increasing collaborations for international satellite projects contribute to rapid market growth.

The report focuses on growth prospects, restraints, and trends of the satellite manufacturing and launch system market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the satellite manufacturing and launch system market.

Competitive Analysis

The report analyzes the profiles of key players operating in the satellite manufacturing and launch system market such as Airbus SE, ArianeGroup, Lockheed Martin Corporation, Maxar Technologies Inc., Blue Origin, SpaceX, Boeing, Northrop Grumman, ISRO, Rocket Lab. These players have adopted various strategies to increase their market penetration and strengthen their position in the satellite manufacturing and launch system market.

Growing Demand for Satellite-Based Services

The growing demand for satellite-based services is significantly driving the expansion of the Satellite Manufacturing and Launch Systems market. Satellites are essential for communication, navigation, Earth observation, defense, and scientific research, increasing the need for advanced manufacturing and efficient launch systems. The rising demand for high-speed satellite internet, 5G connectivity, remote sensing, and global positioning services has accelerated investments in satellite deployment. For instance, in March 2025, Airtel partnered with SpaceX to bring Starlink’s high-speed satellite internet to its customers in India, aiming to enhance broadband connectivity in remote and underserved regions. The objective of this partnership is Airtel expanding affordable and reliable internet access across the country, supporting digital inclusion and connectivity growth. Moreover, governments and private players are launching satellite constellations to enhance broadband access, climate monitoring, disaster management, and national security. In addition, advancements in miniaturized satellites, cost-effective launch solutions, and reusable rocket technology are making space missions more accessible and frequent. The increasing number of commercial satellite operators and public-private partnerships is further fueling market growth. As industries continue to rely on satellite-based services for real-time data, connectivity, and security, the demand for innovative satellite manufacturing and launch systems is expected to grow steadily in the coming years.

Rise in Government and Private Investments

The rise in government and private investments is significantly driving the demand for the Satellite Manufacturing and Launch Systems market. Governments worldwide are increasing funding for space exploration, defense, and satellite-based communication, leading to advancements in satellite technology and launch capabilities. Space agencies such as NASA, ISRO, ESA, and CNSA are investing in deep-space missions, Earth observation satellites, and national security programs, boosting market growth. For instance, in August 2024, ISRO successfully launched the Earth Observation Satellite EOS-08, aiming to design and develop a microsatellite, create compatible payload instruments, and integrate new technologies essential for future operational satellites, enhancing Earth observation capabilities. Furthermore, private companies like SpaceX, Blue Origin, and Rocket Lab are revolutionizing the industry with cost-effective reusable rockets, small satellite constellations, and commercial space ventures. The demand for satellite-based internet, 5G connectivity, and remote sensing has further attracted private sector investments, expanding satellite deployment. Moreover, public-private partnerships are accelerating technological innovation, reducing launch costs, and making space more accessible. As financial support continues to grow, the satellite manufacturing and launch systems market is poised for sustained expansion, meeting increasing global connectivity and security demands.

High Initial Investment and Development Costs

The high initial investment and development costs are significantly hampering the growth of the satellite manufacturing and launch systems market. Developing and launching satellites require substantial capital for research, design, testing, and regulatory compliance. The costs associated with advanced propulsion systems, high-precision manufacturing, and integration of cutting-edge technologies further increase financial barriers. In addition, launch services involve extensive infrastructure, including launch pads, ground stations, and tracking systems, which demand continuous maintenance and upgrades. These high expenditures make it challenging for new entrants and smaller players to compete with established companies. Furthermore, delays in satellite development due to rigorous testing and regulatory approvals add to overall expenses, making it difficult for organizations to achieve cost efficiency. Governments and private players are exploring reusable launch technologies and cost-sharing partnerships to mitigate these challenges. However, the financial burden remains a key constraint, limiting market expansion and slowing down the adoption of satellite-based services globally.

Growing Demand for Satellite Internet and 5G Connectivity

The growing demand for satellite internet and 5G connectivity presents a lucrative opportunity for the satellite manufacturing and launch systems market. As the need for high-speed, reliable internet access expands globally, especially in remote and underserved areas, satellite-based solutions are becoming a critical component of digital connectivity. Companies such as SpaceX, OneWeb, and Amazon’s Project Kuiper are deploying large satellite constellations to enhance global broadband coverage. For instance, in October 2023, Project Kuiper is Amazon’s initiative to provide fast, affordable broadband to unserved and underserved communities by deploying thousands of satellites in low Earth orbit (LEO). Integrated with ground-based infrastructure, it aims to bridge the digital divide and enhance global connectivity.

In addition, the integration of satellites with 5G networks is enabling seamless communication, supporting applications in autonomous vehicles, smart cities, and industrial IoT. Governments and private organizations are investing in satellite-based connectivity to bridge the digital divide and enhance communication infrastructure. With advancements in satellite miniaturization and cost-effective launch solutions, the market is poised for significant growth. As demand increases, companies that innovate in satellite technology and network integration will have substantial opportunities to capitalize on the expanding satellite internet and 5G ecosystem.

Rise in Interest in Deep Space Exploration

The rise in interest in deep space exploration presents a lucrative opportunity for the satellite manufacturing and launch systems market. Governments, space agencies, and private companies are investing heavily in missions to the Moon, Mars, and beyond, driving demand for advanced satellite technology. Initiatives such as NASA’s Artemis program, ESA’s deep space missions, and private ventures from SpaceX and Blue Origin are accelerating the need for robust satellite communication, navigation, and observation systems. These missions require next-generation satellites for interplanetary communication, space weather monitoring, and scientific research. For instance, in January 2023, SpaceX successfully launched the UAE’s Thuraya-4 mobile connectivity satellite to enhance global satellite communication, providing advanced voice and data services to remote and underserved regions.

In addition, the increase in commercialization of space exploration, including asteroid mining and space tourism, is further fueling demand for reliable satellite infrastructure. The development of deep space habitats and lunar gateways also necessitates sophisticated satellite networks to support long-duration missions. As deep space exploration advances, companies that specialize in high-endurance satellite systems and deep-space communication technologies are well-positioned to capitalize on this expanding market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the satellite manufacturing and launch systems market analysis from 2023 to 2032 to identify the prevailing Satellite Manufacturing and Launch system market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Satellite Manufacturing and Launch system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Satellite Manufacturing and Launch system market trends, key players, market segments, application areas, and market growth strategies.

Satellite Manufacturing and Launch Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 130.2 billion |

| Growth Rate | CAGR of 18.7% |

| Forecast period | 2023 - 2033 |

| Report Pages | 456 |

| By Satellite Type |

|

| By Application |

|

| By Orbit Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Lockheed Martin Corporation, Maxar Technologies Inc., Northrop Grumman, ISRO, ArianeGroup SAS, Boeing, Rocket Lab USA, BLUE ORIGIN LLC, Airbus SE, SpaceX |

The global satellite manufacturing and launch systems market is witnessing key trends such as the rise of small satellites and mega-constellations, advancements in reusable rockets and 3D printing, integration of AI and automation, increasing private sector participation, and growing demand for Earth observation and direct-to-device connectivity. These developments are driving significant growth and innovation in the industry.

The leading application in the satellite manufacturing and launch systems market is communication satellites, driven by the growing demand for global broadband connectivity, mobile networks, and data transmission services.

North America is the largest regional market for Satellite Manufacturing and Launch Systems

$ 6865.9 billion is the estimated industry size of Satellite Manufacturing and Launch Systems

Airbus SE, ArianeGroup, Lockheed Martin Corporation, Maxar Technologies Inc., Blue Origin, SpaceX, Boeing, Northrop Grumman, ISRO, Rocket Lab.

Loading Table Of Content...

Loading Research Methodology...