Satellite Manufacturing Market Overview, 2031

The global satellite manufacturing market was valued at $16.2 billion in 2021, and is projected to reach $27.3 billion by 2031, growing at a CAGR of 5.7% from 2022 to 2031. Several new firms have entered the satellite industry in recent years, intending to launch small, relatively affordable satellites with capabilities equal to those given by established large-size satellites. The arrival of this new paradigm has sparked rivalry with current large-satellite producers, altering the game's rules and posing a challenge to long-established industry participants, whose old manufacturing processes are being challenged.

As a result, in the current space-industry environment, adopting innovative manufacturing methods by the satellite manufacturers is not only desirable, but also necessary for increasing efficiency and competitiveness. Currently, the majority of GEO communications satellites must be custom-built, which increases their cost. On-orbit software upgrades are expected to allow manufacturers to mass-produce homogenous satellite that operators can subsequently customize to their unique, changing needs via software uploads.

The satellite manufacturing market is segmented into Application, Satellite Type and Size.Due to the materials necessary in the manufacturing process, particularly for the basic standards to be satisfied, building a satellite is a high-cost operation. These devices must be able to withstand space radiation (to avoid damage to internal components), be sufficiently resistant to the pressure of travelling through space at a constant speed of 700 kilometers per hour, and be strong enough to withstand possible impacts from space debris or smaller asteroids.

The global satellite manufacturing market is expected to witness growth during the forecast period, due to increased technical innovation, lower launch costs, and the development of automation technologies. Advanced satellite technologies such as CubeSats and small satellites offer completely new designs for a wide range of space operations, with the potential for exponential leaps in transformational research, due to technological innovation. For instance, SpaceX launched a Falcon 9 rocket with 143 small satellites from Cape Canaveral in January 2021. The evolution of space technology has helped the satellite manufacturers in lowering the size of the satellite and increasing its functionality.

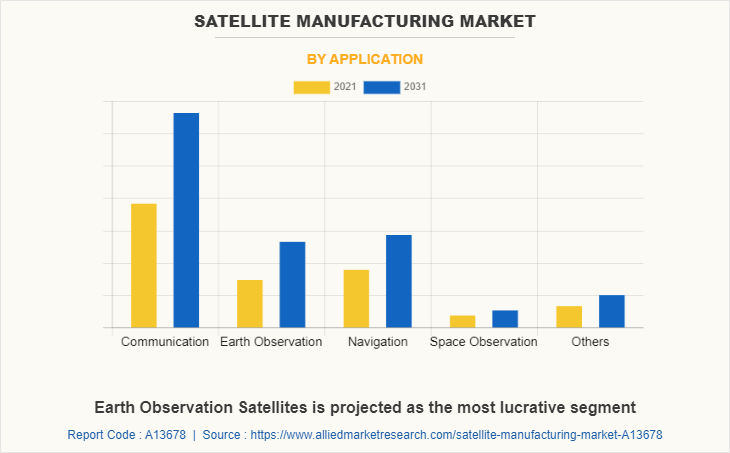

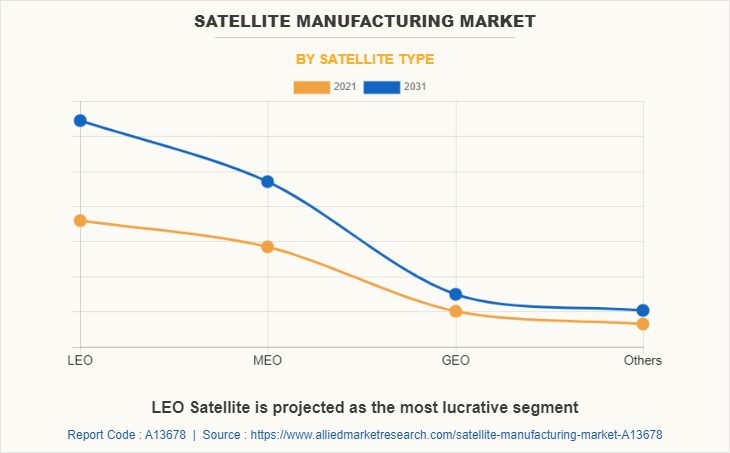

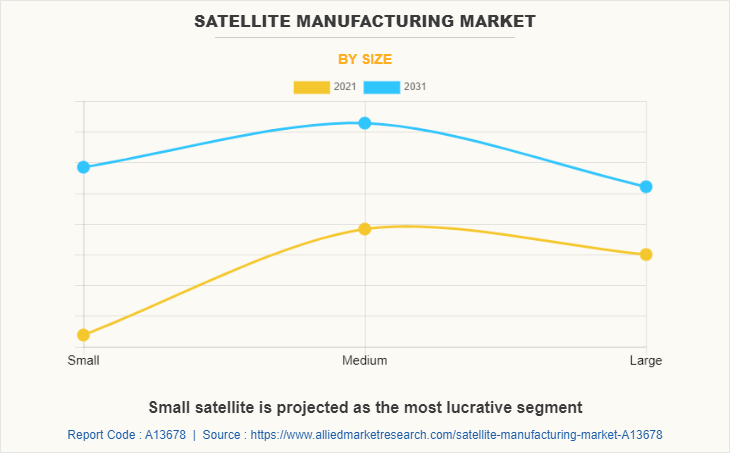

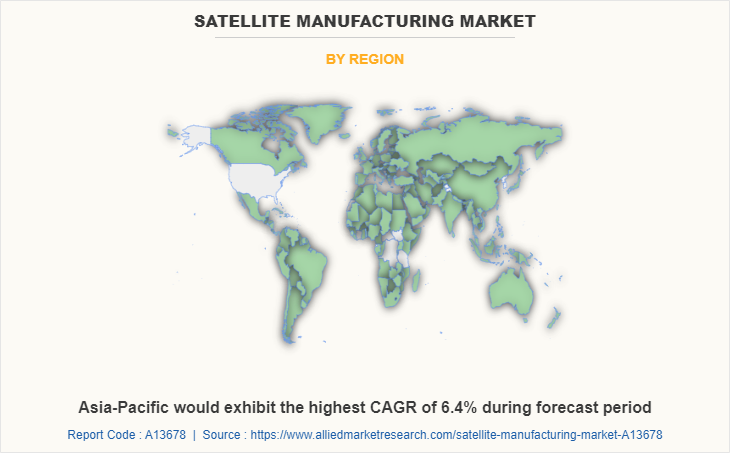

The satellite manufacturing market is segmented into application, satellite type, size, and region. By application, the satellite manufacturing market is segmented into communication, earth observation, navigation, space observation, and others. On the basis of satellite type, the satellite manufacturing market is segmented into LEO, MEO, GEO, and others. By size, the market is segmented into small, medium, and large. Region-wise, the satellite manufacturing market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key players operating in the global satellite manufacturing market include Airbus, Arianespace, Ball Corporation, Geooptics, Inc., L3Harris Technologies, Inc., Lockheed Martin Corporation, Maxar Technologies, Mitsubishi Electric Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Sierra Nevada Corporation, SpaceX, Thales Group, The Boeing Company, and Viasat, Inc.

Increase in the Number of Space Exploration Missions

In recent years, the number of space exploration missions increased as launch costs reduced, technologies advanced, and public interest in space exploration increased. The missions of space expeditions are mostly focused on human Low-Earth-Orbit missions and unmanned scientific research. Moreover, various countries plan to collaborate with other countries for space exploration. For instance, in September 2022, China announced its plans to build partnerships with other countries for its upcoming missions to moon and solar system exploration. In addition, the Space Force, which was expected to be established as a sixth branch of the U.S. military in 2019 as well as increased interest from Russia and China, are projected to boost public-sector investment in the space industry in the coming years. As part of the National Defense Authorization Act for 2020, the U.S. government formed a U.S. Space Command, which includes a Space Operations Force and a Space Development Agency, in December 2019. This development will most certainly benefit the U.S. Defense Department as well as the aerospace and defense sectors, allowing for more focused and faster investment in breakthrough technologies and capabilities. There is an increase in the need for satellite manufacturing to augment space exploration missions with the rise in number of space expedition missions. For instance, in July 2021, using a 747 airliner, Virgin Orbit launched seven satellites from three different customers namely the U.S. Defense Department, the Royal Netherlands Air Force, and Poland SatRevolution company. An increase in private investments in space exploration missions is projected to be a major driver for growth of the satellite manufacturing market during the forecast period.

Rise in Demand for Satellite Aided Warfare

Several tests and demonstrations are being carried out by government organizations and defense forces around the world to establish space warfare capabilities. Ground-to-space warfare, such as attacking satellites from the ground, space-to-space warfare, such as satellites attacking satellites, and space-to-ground warfare, such as satellites targeting Earth-based objects, are all different forms of space warfare. Moreover, the military collaborates with satellite manufacturers for designing, developing and fabricating communication satellites to train its officers.

For instance, in July 2022, the Indian army aimed to use a small communication satellite for training its students from the Corps of Signals at the Military College of Telecommunication Engineering. The U.S, Russia, and India as well as other big economies, have developed dedicated space force groups to establish space defense infrastructure. For instance, the Indian government formed the Defense Space Agency (DSA) in April 2019. The agency is in charge of India's space warfare and satellite intelligence assets. Satellite technologies are rapidly being used by military forces around the world to supplement their defense capabilities.

For instance, United Launch Alliance (ULA), launched the fifth Space-Based Infrared System satellite for the U.S. Space Force in May 2021. With the help of its onboard infrared sensors, the $1 billion satellite, built by Lockheed Martin, is designed to identify and track plumes produced by missile launches throughout the world. Its capabilities will allow the U.S to prepare for any imminent attacks. The increase in efforts to expand space defense capabilities by the government and defense organizations boosts the growth of the satellite manufacturing market.

Interference in satellite data transmission

Satellite systems are designed for transmitting and receiving signals on the internet, telephony, backhaul, and other services. Interference in the satellite transmission operations severely impacts the performance of the satellite and results in a significant loss of income for the operators. Moreover, additional costs have to be spent on fixing and debugging the problems in communication to further enable normal communications. Interference in satellite data transmission occurs due to various factors such as interference from high-power radar, intentional jammers, unauthorized transmissions namely piracy, adjacent satellite interference (ASI), interference from broadcast FM transmitters, aircraft interference, and adjacent frequency emissions from other signals.

For instance, in February 2021, Dish demonstrated interference in the 12GHz spectrum between Starlink satellite internet service, and Dish terminals. Moreover, in August 2022, after several incidents of harmful radio interference have been brought to the attention of the ITU Radio Regulatory Commission, a recent circular advised ITU Member States to prevent radio navigation satellite service (RNSS) signals from interfering with receivers. In addition, purposeful interference by terrorists and criminals to alter satellite broadcasts adds to the difficulty of satellite data transfer.

Furthermore, the proliferation of satellites in space also increases interference in the transmission of data between the ground station and the satellite. Factors such as increase in the number of satellites and adjacent frequency emissions generate interference in data transmission through satellites, further acts as a restraint for the growth of the satellite manufacturing market.

Advancement in satellite mission technologies

The driving factor for advancement in satellite mission technologies is the demand for telecommunications to provide faster internet and accessibility to people around the world. Satellites that produce high-resolution multispectral imagery and advanced geospatial analysis are driving new developments that make navigation easier, roads safer, and vehicles more accessible. GPS is powered by more detailed and accurate maps created by the ability of satellites to map a location's terrain and its spatial context in detail. Satellites also cover a much wider area and can return to a specific location multiple times a day for more detailed information.

The small satellite standard was developed to offer universities and research organizations with faster and more cost-effective access to space. Leading players across the world are making many advancements in satellite technology (such as hyperspectral and multispectral imaging and additive manufacturing) to further expand the capabilities of satellites, decrease the cost, and improve the customizability of satellites. Hyper-spectral and multi-spectral imaging enhance the capabilities of satellites in collecting precise data about changes in the environment. Hyperspectral sensors produce images comprising highly detailed spectral data that allow the detection of micro-level changes in the environment such as in soil, crops, and water.

Multispectral sensors, on the other hand, provide a clear perception of details on the ground, such as spotting pest-infested trees. The need for cost reduction by prominent rocket manufacturers, as well as a growing worldwide awareness of the need to reduce the CO2 footprint of rocket launches, are driving the development of reusable rockets, which further provides a cost-effective and environment-friendly opportunity for launching satellites by the space organizations. The advancement in satellite technologies and launch systems technologies provide an opportunity for the satellite manufacturing business to flourish.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the satellite manufacturing market segments, current trends, estimations, and dynamics of the satellite manufacturing market analysis from 2021 to 2031 to identify the prevailing satellite manufacturing market opportunities.

- The satellite manufacturing market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the satellite manufacturing market segmentation assists to determine the prevailing satellite manufacturing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global satellite manufacturing market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the satellite manufacturing market players.

- The report includes the analysis of the regional as well as global satellite manufacturing market trends, key players, market segments, application areas, and market growth strategies.

Satellite Manufacturing Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 27.3 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 311 |

| By Application |

|

| By Satellite Type |

|

| By Size |

|

| By Region |

|

| Key Market Players | Spacex, Raytheon Technologies Corporation, Thales Group, Lockheed Martin Corporation, Arianespace, Mitsubishi Electric Corporation, Maxar Technologies, L3Harris Technologies, Inc., Ball Corporation, Viasat Inc., Sierra Nevada Corporation, Airbus, Geooptics, Inc., The Boeing Company, Northrop Grumman Corporation |

Analyst Review

The satellite manufacturing market is expected to witness significant growth globally due to rise in demand for advanced communication and monitoring technologies across the world. The overall space economy consists of revenue-generating commercial space activities and government investments in space. The government investments shaped the space industry in the 20th century, whereas commercial activities are now setting the pace. The private spaceflight industry is evolving at a fast pace with new entrants and private funding is creating opportunities for innovations in products, services, and processes.

Increasing investments by governments across the globe for improvement of infrastructure and rising need to deliver high quality telecommunication services to consumers provide growth opportunities for this market. High demand for satellite imagery in the government sector, including federal agencies, local, and state governments for various purposes, such as urban planning, border mapping, infrastructure security, and homeland security is contributing significantly to the growth of the market. One of the major factors positively affecting the growth of the market is the large number of satellites that have been launched by various agencies, such as NASA, European Space Imaging, and Japan Aerospace Exploration Agency.

Satellite manufacturing is being driven by a greater focus of the commercial space industry on lowering costs associated with developing and launching satellites. Leading market players are creating customized platforms and applications to meet customers' growing demands, as well as investigating innovative technologies and applications through scientific research and technological demonstrations.

Satellites are employed in applications such as Earth observation and technological demonstration, which are projected to be profitable investment sectors. However, they are fast being embraced in other areas such as commercial, defense, and government for communication and scientific research. Collaborations and acquisitions are expected to help the market leaders increase their product portfolios and expand into new markets.

Factors such as an increase in the number of space exploration missions, rise in demand for satellite aided warfare, increase in demand for a satellite in a satellite communication system and increase in deployment of small satellites accelerate the growth of the satellite manufacturing market. However, interference in satellite data transmission, increase in space debris and stringent government regulations hamper the growth of the satellite manufacturing market. Conversely, advancement in satellite mission technologies, new application areas for satellites and an increase in demand for space data are expected to provide lucrative opportunities for the expansion of the satellite manufacturing market.

Satellites are also utilized for space exploration by academics and specialists all around the world. Revolutionary satellite technologies such as small satellites, and CubeSats, are ideal for quick manufacturing and testing due to their small size and weight, making them an ideal and affordable platform for the research and development of new technologies and concepts

Key players operating in the global satellite manufacturing market include Airbus, Arianespace, Ball Corporation, Geooptics, Inc., L3Harris Technologies, Inc., Lockheed Martin Corporation, Maxar Technologies, Mitsubishi Electric Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Sierra Nevada Corporation, SpaceX, Thales Group, The Boeing Company, and Viasat, Inc.

The global satellite manufacturing market was valued at $16.21 billion in 2021, and is projected to reach $27.32 billion by 2031, registering a CAGR of 5.7%.

North America is the largest regional market for satellite manufacturing

Communication is the leading application of satellite manufacturing market

Increase in demand for space data, increase in deployment of small satellites, and advancement in satellite mission technologies are the upcoming trend in satellite manufacturing market

Loading Table Of Content...