The global satellite market size was valued at $286 billion in 2022, and is projected to reach $615.7 billion by 2032, growing at a CAGR of 8.1% from 2023 to 2032.

Key Highlighters:

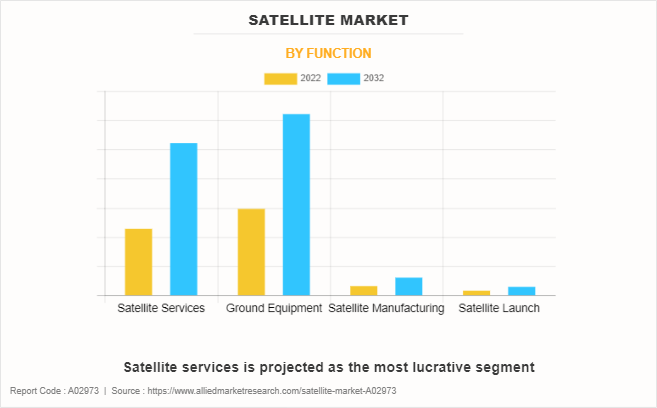

- The report covers segments such as satellite services, ground equipment, satellite manufacturing, and satellite launch. The report is studied across different regions such as North America, Europe, Asia-Pacific, and LAMEA.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

The satellite market refers to a dynamic and multifaceted industry that revolves around designing, manufacturing, launch, operation, and utilization of artificial satellites. These satellites are deployed into various orbits around the Earth or other celestial bodies for diverse purposes, including communication, Earth observation, navigation, scientific research, space exploration, and more. The satellite market encompasses the entire lifecycle of satellites, from their conceptualization and design to their deployment, operation, and eventual decommissioning or replacement.

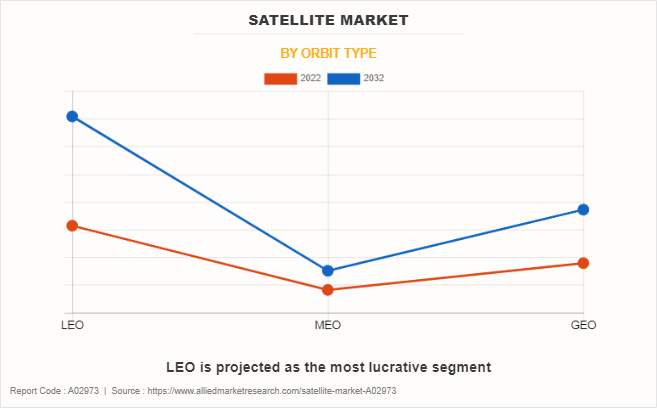

Since LEO satellites have advantages such shorter orbital periods, faster orbital velocities, shorter trips, lower costs, and lower latency, their adoption has grown over time. Because of their proximity to the Earth and capacity to produce high resolution imagery, satellites in this orbit are frequently utilized for satellite imaging. Surge in LEO satellites has resulted from a combination of technological advancements in higher resolution small cameras and greater attitude control along with superior demand for Earth observation, internet connectivity, and voice communications.

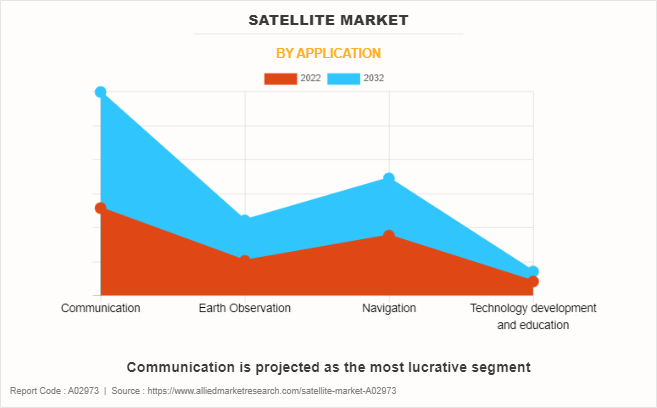

Furthermore, a significant trend in satellite services is the expansion of satellite-based internet services, especially in remote and underserved areas, effectively bridging the digital divide and offering global connectivity. The market is witnessing advancements in high-throughput satellites, which offer faster data speeds and improved broadband services, enhancing the quality of service. Satellite service providers are extending their coverage to even the most remote regions, providing connectivity in areas with limited terrestrial infrastructure, ensuring global accessibility.

Factors such as increase in the number of space exploration missions, rise in demand for satellite-based warfare, and increase in deployment of small satellites drive the growth of the market across the globe. In addition, factors such as interference in satellite data transmission and stringent government regulations act as a barrier for the growth of the market across the globe. However, factors such as increase in demand for space data and new application areas for satellites create ample opportunities for the growth of the market during the forecast period.

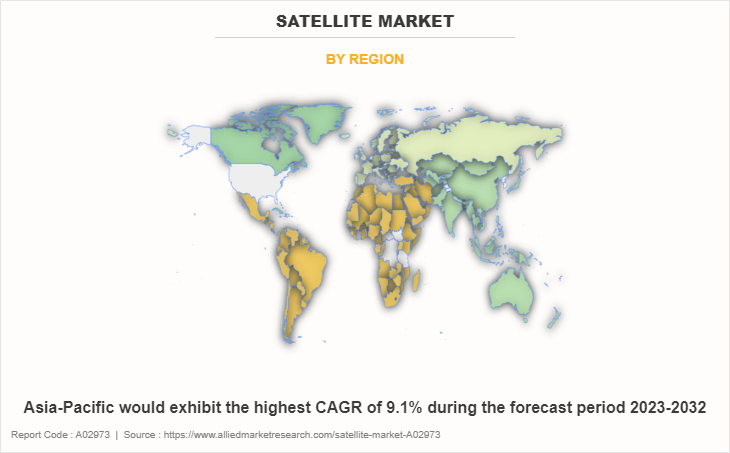

The satellite market is segmented on the basis of orbit type, function, application, end use, and region. By orbit type, the market is segmented into LEO, MEO, and GEO. By function, the market is segmented into satellite services, ground equipment, satellite manufacturing, and satellite launch. By application, the market is segmented into communication, Earth observation, navigation, and technology development and education. By end use, the market is divided into military, government and civil, and commercial. By region, the market is studied across North America, Europe, Asia-Pacific and LAMEA.

The North America satellite market is analyzed across the U.S., Canada, and Mexico. The existence of contemporary infrastructure for conducting space endeavors and the extensive utilization of commercial satellite imaging across diverse sectors within the area are expected to drive the expansion of the satellite industry in North America. The United States is predicted to emerge as a prominent player in the regional satellite market, owing to the presence of leading satellite corporations and space agencies in the vicinity.

Moreover, the demand for satellite networks and services for commercial applications has witnessed substantial growth in recent times. The surge in investments has given rise to intensified competition and innovation, facilitating the emergence of novel business models like mega constellations. These mega constellations entail the deployment of hundreds or even thousands of satellites in Low Earth Orbit (LEO) to offer services such as low-latency broadband.

For instance, in September 2022, SpaceX launched 3,399 Starlink satellites into orbit, including prototypes and spacecraft. Numerous satellite enterprises are experiencing growth in the U.S., driven by the increasing need for communication and space-based internet services.

Satellite constellations are poised to be a significant driver of the space industry in the foreseeable future. Consequently, there is a potential for a heightened need for satellite integration, components, and launch vehicles. Unlike individual satellites, satellite constellations have the capacity to offer global or near-global coverage, ensuring the availability of at least one satellite at any location on Earth at any given time. Nevertheless, meeting the increased demand brought about by reduced costs would necessitate launch service providers elevating both their production and launch frequencies.

Government agencies, private enterprises, and research institutions are progressively harnessing space-derived data to bolster a diverse array of applications, including satellite broadband. Among these beneficiaries, communication service providers and earth observation service providers stand to gain the most from the information yielded by satellites.

Dedicated space-focused firms have the capacity to design, possess, and manage satellites, offering data and communication solutions to clients. This approach liberates end-users, allowing them to concentrate on enhancing their primary business activities. Such a solution empowers customers to subscribe to space-based data services, tailoring data sets to suit their specific use cases. In addition, in February 2022, MDA (a Canadian space technology company) was selected as the prime contractor for Globalstar Inc.'s new Low Earth Orbit (LEO) satellite. Under this contract, MDA announced manufacturing, assembling, and testing of satellites at its new satellite manufacturing facility in Montreal. Commercial space businesses' stronger emphasis on creating sophisticated satellites for a range of purposes has been credited to the growth of the satellite industry in Canada.

Additionally, prominent satellite corporations are anticipated to invest in the advancement of advanced satellite technologies to enhance the capabilities of satellite services in the region, further propelling the expansion of the North American satellite market.

The key players profiled in the global satellite market include Airbus, Boeing, Intelsat, Lockheed Martin Corporation, SPACEX, L3Harris Technologies, Inc., Safran SA, SES S.A., Inmarsat Global Limited, and Northrop Grumman Corporation. These players are adopting strategies to enhance their satellite market share.

Increase in the number of space exploration missions

In recent years, the number of space exploration missions increased as launch costs reduced, technologies advanced, and public interest in space exploration increased. The missions of space expeditions are mostly focused on human Low-Earth-Orbit missions and unmanned scientific research. Moreover, various countries plan to collaborate with other countries for space exploration. For instance, in September 2022, China disclosed its intentions to establish collaborations with other nations for its forthcoming lunar and solar system exploration missions.

Furthermore, as a component of the National Defense Authorization Act for 2020, the U.S. government established the U.S. Space Command, which comprises a Space Operations Force and a Space Development Agency. This advancement is poised to have a significant positive impact on the U.S. Department of Defense, as well as the aerospace and defense industries. It will enable a more targeted and expeditious allocation of resources towards pioneering technologies and enhanced capabilities. There is an increase in the launches of satellites to augment space exploration missions. For instance, in July 2021, Virgin Orbit launched seven satellites using a 747 airliner for three different customers namely the U.S. Defense Department, the Royal Netherlands Air Force, and Poland’s SatRevolution company. The increase in private investments in space exploration missions is projected to be a major driver for the growth of the satellite market during the forecast period.

Increase in deployment of small satellites

In recent years, the number of space exploration missions increased as launch costs reduced, technologies advanced, and public interest in space exploration increased. The missions of space expeditions are mostly focused on human Low-Earth-Orbit missions and unmanned scientific research. Moreover, various countries plan to collaborate with other countries for space exploration. For instance, in September 2022, China disclosed its intentions to establish collaborations with other nations for its forthcoming lunar and solar system exploration missions.

Furthermore, as a component of the National Defense Authorization Act for 2020, the U.S. government established the U.S. Space Command, which comprises a Space Operations Force and a Space Development Agency. This advancement is poised to have a significant positive impact on the U.S. Department of Defense, as well as the aerospace and defense industries. It will enable a more targeted and expeditious allocation of resources towards pioneering technologies and enhanced capabilities. There is an increase in the launches of satellites to augment space exploration missions. For instance, in July 2021, Virgin Orbit launched seven satellites using a 747 airliner for three different customers namely the U.S. Defense Department, the Royal Netherlands Air Force, and Poland’s SatRevolution company. The increase in private investments in space exploration missions is projected to be a major driver for the growth of the satellite market during the forecast period.

Recent Developments:

- In October 2023, Intelsat signed a multiyear agreement with Relativity Space for multiple launches of Terran R. Terran R is a medium-to-heavy-lift reusable launch vehicle to meet growing satellite launch demand. It provides both government and commercial customers access to space.

- In September 2023, SpaceX signed an agreement with Canada's Telesat to launch its low-Earth-orbit (LEO) satellite constellation called Lightspeed starting in 2026, to offer broadband service globally from space by the end of 2027.

- In June 2023, L3Harris Technologies, Inc. received contract from the U.S. Air Force to deliver a new multi-orbit, multi-waveform satellite communications (SATCOM) capability.

- In March 2023, Northrop Grumman Corporation and IHI Corporation signed contract at DSEI Japan to develop small, highly maneuverable satellites to enhance awareness of increasingly contested Geosynchronous Earth Orbit (GEO) environment, and other solutions for missions such as Space Domain Awareness (SDA) for Japan.

The satellite market is segmented into Function, Orbit Type, Application and End Use.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the satellite market analysis from 2022 to 2032 to identify the prevailing satellite market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the satellite market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global satellite market trends, key players, market segments, application areas, and market growth strategies.

Satellite Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 615.7 billion |

| Growth Rate | CAGR of 8.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 330 |

| By Function |

|

| By Orbit Type |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Airbus, SES S.A., Intelsat, Boeing, Safran SA, L3Harris Technologies, Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, Inmarsat Global Limited, SPACEX |

The global satellite market was valued at $286.0 billion in 2022, and is projected to reach $615.67 billion by 2032, registering a CAGR of 8.1% from 2023 to 2032.

The leading companies in the market include Airbus, Boeing, Intelsat, Lockheed Martin Corporation, SPACEX, L3Harris Technologies, Inc., Safran SA, SES S.A., Inmarsat Global Limited, and Northrop Grumman Corporation.

The largest regional market for satellite is North America.

The leading application is communication.

The upcoming trends in the satellite market include increase in the number of space exploration missions, rise in deployment of small satellites, and growth in demand for space data.

Loading Table Of Content...

Loading Research Methodology...