Satellite Services Market Research, 2033

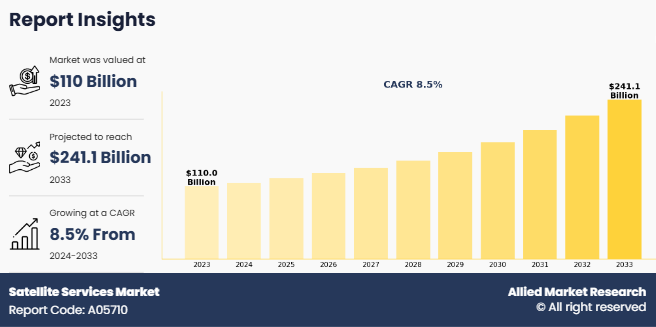

The global satellite services market size was valued at $110 billion in 2023, and is projected to reach $241.1 billion by 2033, growing at a CAGR of 8.5% from 2024 to 2033.

Report Key Highlighters

• The satellite services market studied more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value available from 2022 to 2032.

• The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market and help stakeholders make educated decisions to achieve ambitious growth objectives.

• The research reviewed more than 3,700 product catalogues, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

• The satellite services market share is marginally fragmented, with players such as EUTELSAT COMMUNICATIONS SA, Inmarsat plc, Intersputnik, MEASAT, Asia Satellite Telecommunications Co. Ltd. (Asiasat), Echostar Corporation, SES S.A., Viasat, SKY Perfect JSAT Group, and Intelsat S.A. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Market Definition and Introduction

Satellite services encompass a wide range of applications, such as communication, Earth observation, navigation, and scientific research, and using satellites orbiting the Earth. These services rely on advanced satellite systems and technologies, including geostationary, medium Earth orbit (MEO), and low Earth orbit (LEO) satellites, to deliver data and connectivity. Each satellite is equipped with transponders, sensors, or communication payloads that enable data transmission, imaging, or navigation support.

One of the major factors driving the satellite services market size is the increasing demand for high-speed broadband connectivity in remote and underserved areas. Furthermore, the rise in adoption of LEO satellite constellations for real-time communication and Earth observation significantly contributes to market growth. Technological advancements, such as the use of artificial intelligence (AI) and machine learning (ML) for data processing and satellite operation, enhance the efficiency and reliability of satellite services. However, high launch costs, risks of space debris, and stringent government regulations related to satellite launches pose challenges to market expansion.

For instance, in September 2022, SpaceX launched its Starlink Gen 2 satellite services, providing high-speed, low-latency internet connectivity across the globe. The advanced satellites offer improved bandwidth, reduced latency, and expanded coverage, addressing the growing demand for reliable internet services in rural and remote regions. Additionally, these satellites support multiple applications, including disaster management, maritime communication, and military operations, with enhanced performance and versatility.

Key Developments/Strategies in Satellite Services

- In January 2022, Intelsat collaborated with Gilat Satellite Networks in commercial aviation. Intelsat is to use the SkyEdge II-c system from Gilat to boost business and commercial aviation services throughout the region. According to Dave Bijur, Senior Vice President of Commercial Aviation at Intelsat, this partnership will significantly increase Intelsat's in-flight connectivity (IFC) revenue.

- In February 2022, Intelsat's largest integrated satellite operator in the world increased its partnership with SKY Perfect JSAT Corporation, to use the latter's JCSAT-1C High-throughput Satellites (HTS) over Asia-Pacific. The agreement enables airlines and clients to deliver an improved passenger experience on board planes through better Internet connection speeds.

- In March 2024, Arabsat and Telesat signed a contract of Understanding (MoU) to form a long-term strategic partnership focused on commercializing the Telesat Lightspeed constellation in the Middle East and North Africa (MENA) region, addressing regulatory issues and orbital resources.

- In September 2023, Telesat and SpaceX announced an agreement for SpaceX to support the deployment of the Telesat Lightspeed constellation into Low Earth Orbit (LEO).

Market Dynamics

Rise in need of high-resolution imaging services

Satellites provide high-resolution imagery for monitoring and verifying applications in various sectors, including civil engineering & construction, government, defense & intelligence, agriculture & forestry, transportation, real estate, and others. Satellite imaging is applicable in topographic mapping, understanding land applications such as infrastructure planning and construction, exploiting new energy sources, mitigating the impact of disasters, and monitoring drilling projects in the oil & gas industry.

Moreover, high-resolution satellite imagery assists in monitoring vegetation, green mapping, vegetation damage due to leaching, traffic management, tracking of fleet, and others. In the coming years, satellite imaging is expected to be significantly used in the real estate industry for an enhanced view of buildings and properties, and in the insurance sector for accessing environmental risk through accurate and updated geographical data. Thus, high utilization of satellite imagery in various sectors is expected to drive the satellite services market growth during the forecast period.

Decrease in demand for television services from developed economies

The television services have significantly decreased in developed countries such as the U.S., which has significantly impacted the consumer services segment in North America. The main factor responsible for the decrease in demand for television services is the availability of another source for watching the same programs. Reduced television subscriptions have made direct-to-home (DTH) operators or providers increase their subscription prices to manage their number of subscription losses. The decrease in television services has impacted consumer services but the increase in revenue of satellite broadband service in the U.S. has balanced the overall loss of the consumer services segment in the North America region.

High demand from emerging economies

Space-based internet services are also gaining traction in developing regions such as Asia-Pacific, thereby offering numerous growth opportunities for the market in the coming years. In countries such as India where the commercial sector is increasing at a considerable rate, the demand for satellite services is also increasing. For instance, the growth of the services sector has surged the demand for fixed broadband connection services. Also, the rise in disposable income in countries such as China and India has increased the demand for fixed broadband connections in residential places. Asia-Pacific is expected to be the fastest-growing region during the forecast period owing to numerous factors such as the growth of the telecom sector in the region, increase in direct-to-home (DTH) subscriptions and others. In addition, in the Middle East and Africa, the penetration of D2H channel subscriptions is currently low as compared to other regions, which is expected to increase in the coming years.

Segment Review

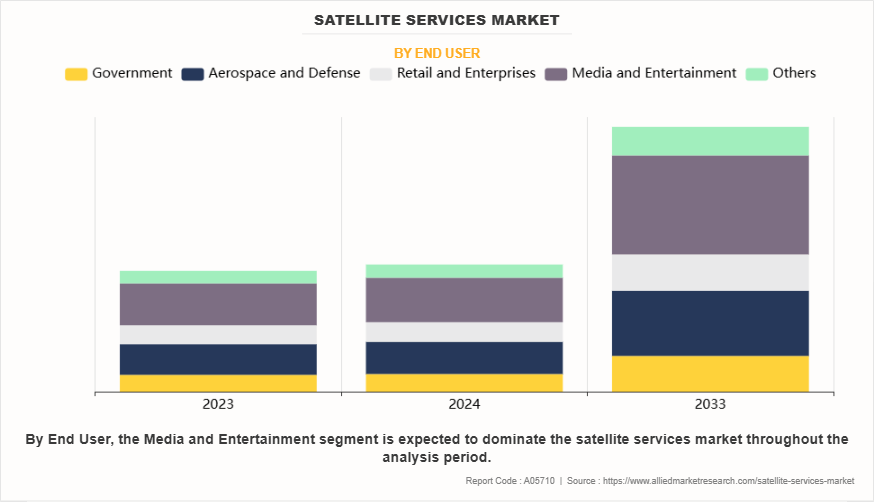

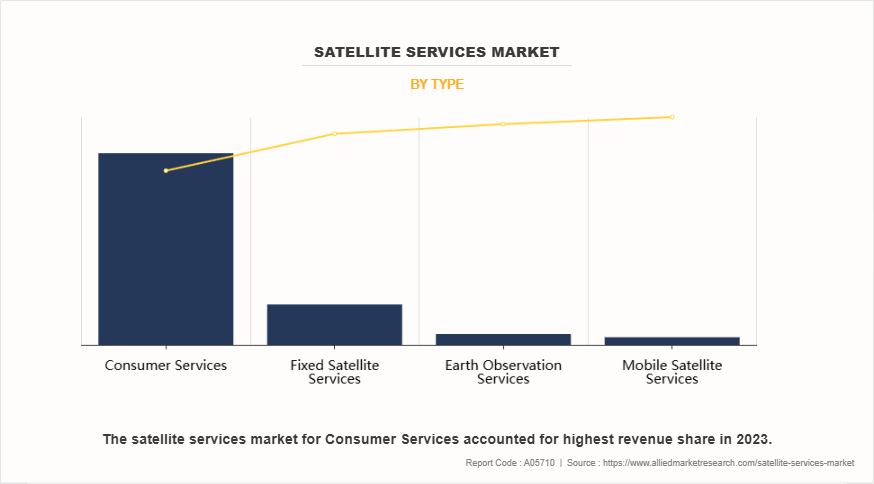

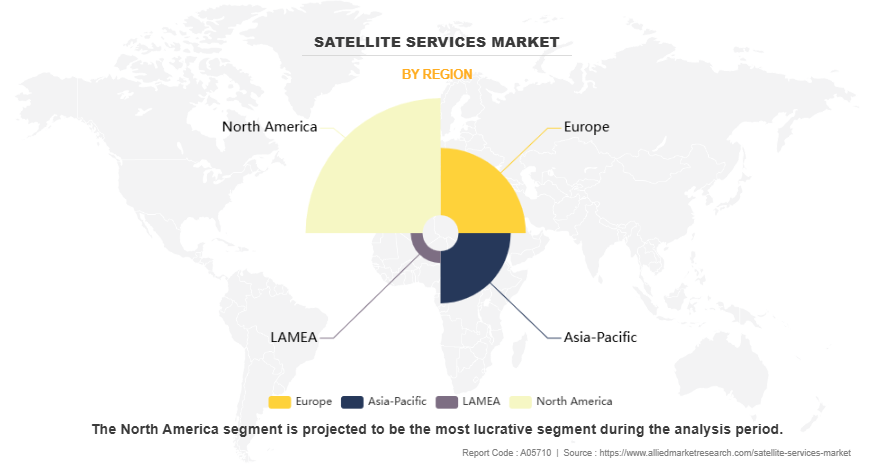

The satellite services market is segmented into type, end-user industry, and region. By type, the market is divided into consumer services, fixed satellite services, mobile satellite services, and earth observation services. Based on end-user industry, the market is classified into media & entertainment, government, defence, aerospace, retail & enterprise, and others. Region-wise, the satellite services market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and the rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By End User

On the basis of end-user industry, the market is classified into media & entertainment, government, defense, aerospace, retail & enterprise, and others. Media and entertainment segment accounted for the largest share in 2023. Growing demand for high-quality broadcasting, satellite-based internet, and real-time content delivery. Satellite services play a crucial role in enabling global coverage for television, radio, and digital platforms, allowing broadcasters to reach diverse audiences across remote and urban regions alike. The rise of over-the-top (OTT) streaming platforms, along with the increasing consumption of high-definition (HD) and ultra-high-definition (UHD) content, has significantly bolstered the demand for satellite services in the media sector.

By type, the market is divided into consumer services, fixed satellite services, mobile satellite services, and earth observation services. Consumer services dominated the market in 2023. Consumer services dominated the market in 2023, driven by the increasing demand for satellite-based solutions such as direct-to-home (DTH) television, satellite internet, and mobile communication services. With the rise of remote work, digital entertainment, and the growing need for reliable connectivity in underserved and rural areas, consumer services have become a key focus for satellite providers. Advancements in satellite technology, including the deployment of high-throughput satellites (HTS) and low Earth orbit (LEO) constellations, have enhanced service quality and accessibility, further fueling the growth of consumer-facing solutions. The increasing penetration of satellite broadband, especially in regions with limited terrestrial infrastructure, has led to an expansion in market reach and consumer adoption.

By Region

Region-wise, the satellite services market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). North America generated the largest revenue in 2023.

Competitive Analysis

Competitive analysis and profiles of the major global satellite services market players that have been provided in the report include EUTELSAT COMMUNICATIONS SA, Inmarsat plc, Intersputnik, MEASAT, Asia Satellite Telecommunications Co. Ltd. (Asiasat), Echostar Corporation, SES S.A., Viasat, SKY Perfect JSAT Group, and Intelsat S.A. The key strategies adopted by the major players of the global satellite services market are product launches and mergers & acquisitions.

Top Impacting Factors

The global satellite services market is expected to witness notable growth registering a CAGR of 5.7% during the satellite services market forecast, The satellite services market is expected to witness notable growth owing to a rise in demand for high-speed connectivity, advancements in satellite communication technologies, expansion of remote sensing applications, and rise in deployment of low Earth orbit (LEO) satellite constellations.

Historical Data & Information

The global Satellite Services Industry is competitive, owing to the strong presence of existing vendors. Vendors in the global satellite services market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they can cater to market demands, which are higher than the supply. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Key Benefits For Stakeholders

- This satellite services market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the satellite services market analysis from 2023 to 2033 to identify the prevailing satellite services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the satellite services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global satellite services market trends, key players, market segments, application areas, and market growth strategies.

Satellite Services Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 241.1 billion |

| Growth Rate | CAGR of 8.5% |

| Forecast period | 2023 - 2033 |

| Report Pages | 224 |

| By End User |

|

| By Type |

|

| By Region |

|

| Key Market Players | Intersputnik, Viasat, Inc., EUTELSAT COMMUNICATIONS SA, ASIA SATELLITE TELECOMMUNICATIONS CO. LTD., Inmarsat Global Limited, SES S.A., Intelsat, MEASAT, EchoStar Corporation, SKY Perfect JSAT Holdings Inc. & SKY Perfect JSAT Corporation |

Media and Entertainment is the leading end user of satellite services market.

The upcoming trends of satellite services market includes rise in demand for high-speed connectivity, advancements in satellite communication technologies.

Consumer Services is the leading type of Satellite Services Market.

The satellite services market was valued at $110 billion in 2023.

EUTELSAT COMMUNICATIONS SA, Inmarsat plc, Intersputnik, MEASAT are the top companies to hold the market share in Satellite Services.

Loading Table Of Content...

Loading Research Methodology...