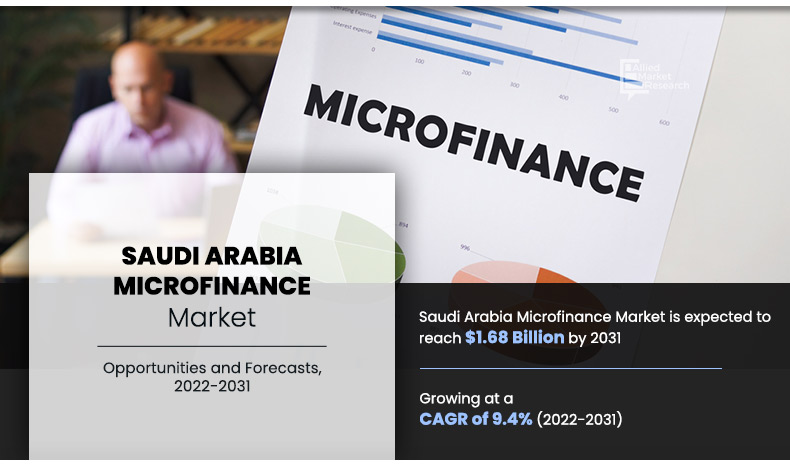

Saudi Arabia Microfinance Market Outlook – 2031

The Saudi Arabia microfinance market size was valued at $0.68 billion in 2021, and is projected to reach $1.68 billion by 2031, growing at a CAGR of 9.4% from 2022 to 2031.

Microfinance is a type of financial service that is provided to unemployed or low-income individuals or groups with no other access to financial services. The aim of these institutions is the simple service of offering micro-loans to the world’s unbanked populations, such as savings, insurance, and payment products. The services in the market are designed to become affordable to poor and socially marginalized customers, households with a wide variety of high-quality financial products and services, and to help them become self-sufficient.

The major Saudi Arabia microfinance market growth include rise in adoption of microfinance in developing nations for improving lifestyle and lesser operating & low market risk of micro lending significantly boost the growth of the global Saudi Arabia microfinance market. In addition, rise in the potential of entrepreneurs, to bring in more businesses and to start from zero level with less capital support positively impacts the growth of the Saudi Arabia microfinance market. However, small loan amount and shorter repayment time for paying loans are expected to hamper the Saudi Arabia microfinance market growth. On the contrary, with an increased adoption of advance technology in microfinancing, microfinance platform help reduce the operational costs by decreasing the cost of physical branches, staffing, and maintenance of branches, thus expected to provide lucrative opportunities for the Saudi Arabia microfinance industry in the upcoming years.

Depending on end-user, the small enterprises segment dominated the Saudi Arabia microfinance market size in 2021, and is expected to continue this trend during the forecast period, as it helps small size business users to easily manage their business operations and funding it enables effective planning and management of the inflow & outflow of monetary funds, thereby driving the adoption of microfinance services in this segment. However, the solo entrepreneurs & self-employed segment is expected to witness the highest growth in the upcoming years, owing to the increase in internet penetration and the use of the internet for day-to-day activities.

The report focuses on growth prospects, restraints, and analysis of the Saudi Arabia Microfinance market. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the Saudi Arabia microfinance market share.

Segment Review

The microfinance market is segmented into the provider, end-user and region. Providers covered in the study include banks, Micro Finance Institute (MFI), NBFC (Non-Banking Financial Institutions), and others. By end-user, the market is segregated into small enterprises, micro-enterprises, and solo entrepreneurs or self-employed.

The Saudi Arabia microfinance market growth is dominated by key players such as Alinma bank, Al Rajhi bank, ANB, Bank Albilad, Banque Saudi Fransi, Gojo & Company, Inc., Kiva, Riyad Bank, SABB, Saudi Arabia, SNB. These players have adopted various strategies to increase their market penetration and strengthen their position in the Saudi Arabia microfinance industry.

COVID-19 Impact Analysis

The COVID-19 outbreak has had a moderate impact on the growth of the microfinance market as the outbreak of the COVID-19 pandemic has enabled lending activities including past-due or non-collectible loans to become an implicit part of the financial sector. Hence, the need to implement new software for debt management in microfinance institutions (MFIs) has increased considerably.

Furthermore, various microfinance institutes in Saudi Arabia were stopped by the government owing to the growing number of COVID patients. In addition, various other digital platforms were adopted by microfinance companies to sell their products and attract their customers, which negatively impacts the growth of the Saudi Arabia microfinance market opportunities. Moreover, the COVID-19 pandemic has caused numerous challenges for the microfinance market players and microfinance institutes, which include difficulties in disbursements, collection of reimbursements and meeting with clients face-to-face, and reorganizing internal systems and the flow of work.

Thus, all these factors have a huge impact on Saudi Arabia microfinance Industry. In addition, microfinance providers are expected to face a serious liquidity crunch during COVID-19, the gap between revenue and operational expenditures is increasing with depleting reserves. This shrinking liquidity may not create a problem for large MFIs or those with strong stable backups but is sufficient to haunt small and mid-size MFIs.

Top Impacting Factors

Increase in Adoption of Microfinance in Developing Nations for Improving Lifestyle

Microfinance is changing the lifestyle of various people in developing countries such as Saudi Arabia by helping them financially. In addition, the surge in government initiatives for microfinance such as the Deferred Payments Program, a Guaranteed Facility Program, a Loan Guarantee Program, and a Point of Sales and E-Commerce Service Fee Support Program helps to mitigate the impacts of the precautionary measures on the micro, small, and medium enterprise sector by reducing the burden generated from cash flow fluctuations, backing up the sector’s working capital process, and enabling and maintaining its growth and level of employment. This supports the banking system and increases its adoption of microfinance services in this country and is driving the growth of the microfinance market. Furthermore, people in rural areas are taking loans from microlenders for setting up their own businesses and raising their standard of living, which propels the growth of the Saudi Arabia microfinance market.

By Provider

Banks segment is projected as one of the most lucrative segments.

Shift From Traditional Lending to Microfinance

With the increase in penetration of smartphones and internet users across Saudi Arabia, online financing has witnessed significant growth in recent years. Microfinance is considered one of the convenient and widely used options for lenders, as it provides instant affordability for applications. Multiple businesses and individuals have started filling out applications online for taking loans in recent years rather than getting into the time-consuming lending process. According to a report by industry bodies MFIN and KPMG, the entry of new-age Fintech (Financial Technology) has enabled the microfinance sector to fast-track its transition to a more efficient digital model to serve a larger population at lower costs. In addition, the ease of applying for loans for borrowers and numerous other benefits for lenders, such as automated loan management, and rapid approval are shifting their attention toward digital microfinance, thus driving the Saudi Arabia microfinance market growth.

By End User

Small Enterprises segment is projected as one of the most lucrative segments.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the Saudi Arabia microfinance market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on Saudi Arabia microfinance market analysis is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the Saudi Arabia microfinance market outlook.

- The quantitative analysis of the Saudi Arabia microfinance market trends from 2022 to 2031 is provided to determine the market potential.

Saudi Arabia Microfinance Market Report Highlights

| Aspects | Details |

| By Provider |

|

| By End-User |

|

| By Key Market Players |

|

Analyst Review

Microfinance is a way to provide small business owners and entrepreneurs access to capital. Often, these small and individual businesses don’t have access to traditional financial resources from major institutions, so it is harder for them to access loans, insurance, and investments that will help grow their business. In addition, it provides resources and access to capital to the financially underserved, such as those who are unable to get checking accounts, lines of credit, or loans from traditional banks promising new opportunities for the growth of the process analytics market in the coming years.

Key providers of the process analytics market such as Alinma Bank, Al Rajhi bank, and ANB. account for a significant share in the market. With larger requirements from microfinance services, various companies are establishing strategic partnerships and acquisitions to increase microfinance capabilities. For instance, in March 2021, Alinma Bank partnered with Doyof Al Rahman and developed banking services for Hajj and Umrah pilgrims. Alimna bank developed banking solutions and services, to serve pilgrims in need of robust payment and financial services, and to support the growth of the rapidly expanding religious tourism sector.

In addition, with the increase in demand for microfinance, various companies are expanding their product presence by partnering with other giant companies. For instance, in June 2022, Al Rajhi bank partnered with Ministry of Human Resources and Social Development's Future Work Company. This partnership provided integrated banking services to self-employed business owners. Self-employed business owners were benefited from the bank's digital banking system.

Moreover, market players are expanding their business operations and customers by increasing their partnerships. For instance, in April 2021, ANB partnered with General Organization for Social Insurance. This agreement has provided special and distinguished financial services to beneficiaries of Taqdeer Program’s Initiatives, including retirees (civilians and military).

The saudi arabia microfinance market is estimated to grow at a CAGR of 9.4% from 2022 to 2031.

The saudi arabia microfinance market is projected to reach $1.68 billion by 2031.

To get the latest version of sample report

Rise in adoption of microfinance in developing nations for improving lifestyle and lesser operating & low market risk of micro lending significantly boost.

The key players profiled in the report include Alinma bank, Al Rajhi bank, ANB, Bank Albilad, Banque Saudi Fransi, and many more.

On the basis of top growing big corporations, we select top 10 players.

The saudi arabia microfinance market is segmented on the basis of provider, end-user, and region.

The key growth strategies of saudi arabia microfinance market players include product portfolio expansion, mergers & acquisitions, agreements, regional expansion, and collaboration.

Micro Finance Institute (MFI), segment would exhibit the highest CAGR of 10.1% during 2022-2031.

Solo entrepreneurs or Self-Employed, region will dominate the market by the end of 2031.

Loading Table Of Content...