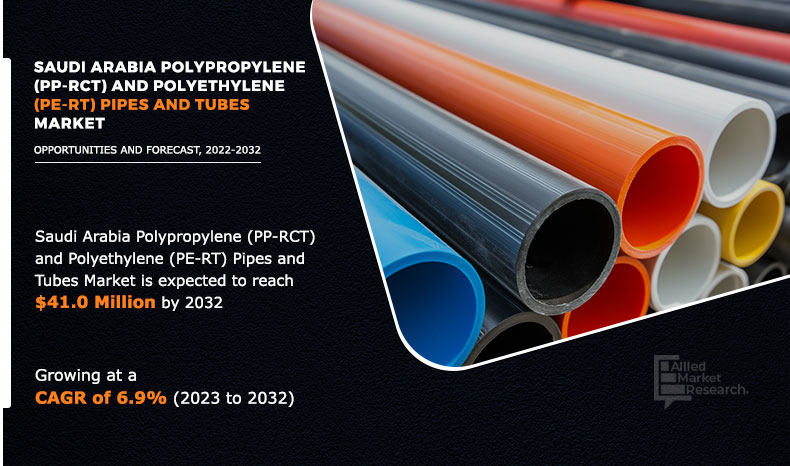

Saudi Arabia Polypropylene (PP-RCT) and Polyethylene (PE-RT Type 2) Pipes and Tubes Market Research, 2032

The Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market was valued at $21.2 million in 2022 and is projected to reach $41.0 million by 2032, growing at a CAGR of 6.9% from 2023 to 2032. The surge in demand for sewerage and drainage and growth in new refineries and downstream facilities is expected to drives the growth of polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market. Competition from other materials is expected to restrain the growth of market. An increase in demand for water management systems and expansion of oil & gas industry is expected to provide lucrative opportunities in the Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market.

Introduction

Polypropylene random copolymer with modified crystallinity and temperature resistance (PP-RCT) is a type of thermoplastic polymer that exhibits high heat resistance and improved mechanical properties compared to traditional polypropylene. PP-RCT pipes and tubes are mostly used in plumbing and heating systems due to their excellent resistance to high temperatures and pressure, making them suitable for both hot and cold-water applications. These pipes are also lightweight, corrosion-resistant, and easy to install, making them a preferred choice for residential, commercial, and industrial plumbing projects.

Polyethylene of raised temperature resistance (PE-RT type 2) is a type of polyethylene resin specifically designed to withstand higher temperatures than standard polyethylene materials. PE-RT type 2 pipes and tubes offer excellent flexibility, strength, and thermal stability, making them ideal for applications where elevated temperatures and pressures are encountered. PE-RT type 2 Pipe is also called heat-resistant Polyethylene Pipe. The PE-RT type 2 pipe is a heat-resistant high-density polyethylene pipe. It inherits the PE-RT type 2-1 pipe with hygienic, non-toxic, low temperature resistance, good flexibility, however, with improved heat resistance, compressive strength, physical and chemical properties. PE-RT type 2 pipe has higher tensile strength and better stability for long-distance laying. PE-RT type 2 type has stronger creep resistance and higher rigidity than PE-RT type 2 type 1.

One of the key advantages of PP-RCT pipes is their long service life, which exceeds 50 years when installed and maintained. Their smooth inner surface minimizes the risk of scaling and sediment buildup, reducing the likelihood of clogs and blockages in the plumbing system. In addition, PP-RCT pipes are environmentally friendly and recyclable, making them a sustainable option for water distribution and waste management systems.

PE-RT type 2 pipes offer exceptional flexibility, enabling straightforward installation and bending to navigate obstacles without requiring extra fittings or joints. This flexibility minimizes the chances of leaks and eliminates the potential weak spots in plumbing systems, strengthening reliability and longevity. Furthermore, PE-RT type 2 pipes exhibit superior resistance to stress cracking and environmental stress cracking, ensuring long-term performance in harsh operating conditions.

In Saudi Arabia, PP-RCT pipes are utilized in various industrial processes, including chemical transportation, air conditioning systems, and compressed air lines. Their resistance to chemical corrosion and abrasion makes them ideal for conveying a wide range of fluids and gases in industrial settings. In addition, PP-RCT pipes are lightweight, corrosion-resistant, and easy to install, offering significant advantages over traditional metal piping systems in terms of efficiency.

Key Takeaways

- The Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market is highly fragmented, with several players including Abrah Dashte Markazi Company, Al Mona Plastic Products Factory, Alcapipe, s.r.o., Aquatherm, Borouge, Georg Fischer Ltd., KE KELIT GmbH, Mega-Therm, Modern Plastic Industry, and The Heim-Weh-GmbH.

- More than 6,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study covers nearly 20 countries. The segment analysis of each country in terms of value and volume during the forecast period 2022-2032 is covered in the Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market report.

Market Dynamics

The Saudi government’s emphasis on infrastructure development plays a significant role in driving the demand for modern sewerage and drainage systems. As part of its Vision 2030 initiative, the government has allocated substantial funds toward enhancing infrastructure across various sectors, including water management. This investment creates a conducive environment for the adoption of advanced piping solutions such as PP-RCT and PE-RT type 2, which align with the country’s goals of sustainability and efficiency.

In 2023, Saudi Arabia announced numerous water projects for desalinization, transmission, strategic reservoirs, and wastewater treatment. Saudi Arabia announced at the 3rd MENA Desalination Projects Forum some 60 water projects worth (35 billion Saudi riyals) $9.33 billion. These projects increase the desalination capacity from 2.54 cubic meters per day in 2021 to 7.5 million cubic meters of water per day in 2027. PP-RCT pipes are gaining popularity for conveying wastewater within treatment facilities. They are resistant to corrosion and chemical degradation, which makes them suitable for handling the diverse composition of wastewater. Thus, the surge in demand for sewerage and drainage is expected to boost the demand for Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market.

In Saudi Arabia, the polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market faces stiff competition from alternative materials such as metal and concrete pipes. Metal pipes, notably steel and copper, have long been favored for their perceived durability and strength in demanding applications. Industries such as oil and gas, where high-pressure and high-temperature conditions are prevalent, often opt for metal pipes due to their robustness and ability to withstand harsh environments. In addition, metal pipes are often considered superior in terms of fire resistance compared to plastic alternatives, reinforcing their market presence in certain sectors.

PP-RCT and PE-RT type 2 pipes play a crucial role in water treatment plants for conveying raw water, treated water, and chemicals used in the treatment process. As per the International Trade Administration, Saudi Arabia has allocated significant funds, with over $80 billion earmarked for water projects, aligning with the United Nations sustainable development goals to ensure equal access to clean water. PP-RCT and PE-RT type 2 pipes are preferred for water distribution systems in urban areas due to their corrosion resistance, durability, and ease of installation, making them ideal for accommodating the expanding water infrastructure needs of growing cities. The industrial sector in Saudi Arabia, including petrochemicals, manufacturing, and mining, requires significant quantities of water for various processes. PP-RCT and PE-RT type 2 pipes are used in industrial water supply and wastewater treatment systems due to their resistance to chemical corrosion, high-pressure capabilities, and ability to withstand harsh operating conditions, thus supporting the water management needs of industrial facilities.

Segments Overview

The Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market is segmented into type and application. On the basis of type, the market is bifurcated into polypropylene (PP-RCT) pipes and tubes, and polyethylene (PE-RT type 2) pipes and tubes. On the basis of application, the market is categorized into water supply, irrigation, sewerage and drainage, gas supply, buildings and commercial centers cooling, and others.

By Type

PP-RCT is projected as the most lucrative segment.

On the basis of type, the PP-RCT segment dominated the Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market. PP-RCT pipes withstands high temperatures, making them suitable for hot water distribution systems, which are common in Saudi Arabia due to the climate. PP-RCT pipes are lightweight and flexible, allowing for quick and hassle-free installation, which is particularly advantageous in large-scale construction projects where time and labor efficiency are paramount. However, PE-RT Pipes type-2 is the fastest growing segment representing the CAGR of 7.1% during the forecast period.

By Application

CNG is projected as the most lucrative segment.

On the basis of application, the water supply segment dominated the Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market. Water sources in Saudi Arabia contain various chemical contaminants due to industrial activities, agricultural runoff, or natural geological conditions. PP-RCT and PE-RT type 2 pipes exhibit superior chemical resistance, making them suitable for transporting potable water even in challenging environments. However, buildings and commercial centers cooling is the fastest growing segment growing with the CAGR of 7.5% from 2023 to 2032. PP-RCT and PE-RT type 2 pipes are also commonly used in air conditioning systems within buildings and commercial centers. These pipes transport chilled water to air handling units (AHUs) or fan coil units (FCUs) for cooling purposes. Their flexibility allows for easy installation in new construction and retrofit projects, making them a preferred choice for heating, ventilation, and air conditioning (HVAC) contractors.

Competitive Analysis

The major players operating in the Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market include Abrah Dashte Markazi Company, Al Mona Plastic Products Factory, Alcapipe, s.r.o., Aquatherm, Borouge, Georg Fischer Ltd., KE KELIT GmbH, Mega-Therm, Modern Plastic Industry, and The Heim-Weh-GmbH.

Historic Trends of Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes

- In 2001 the use of polyethylene pipes for water distribution systems gained traction in Saudi Arabia due to their corrosion resistance and durability in harsh environmental conditions.

- In 2005 polypropylene pipes started to gain attention in the Saudi Arabian market for plumbing and heating applications due to their high-temperature resistance and low thermal conductivity.

- In 2008 Saudi Arabia witnessed increased adoption of PE-RT type 2 pipes for radiant floor heating systems in residential and commercial buildings due to their flexibility and ease of installation.

- In 2012 the Saudi Arabia government introduced regulations promoting the use of plastic pipes in various applications, including water supply, sewage systems, and industrial piping, leading to a surge in demand for PP-RCT and PE-RT type 2 pipes.

- In 2015 technological advancements in polymer processing and material formulation led to the development of enhanced PP-RCT and PE-RT type 2 pipes with improved mechanical properties and longer service life.

KEY BENEFITS FOR STAKEHOLDERS

- The report provides in-depth analysis of the global integrated pest management market along with the current trends and future estimations.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analysis during the forecast period.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the integrated pest management market for strategy building.

- A comprehensive market analysis covers the factors that drive and restrain the global integrated pest management market growth.

- The qualitative data about market dynamics, trends, and developments is provided in the report.

Saudi Arabia Polypropylene (PP-RCT) and Polyethylene (PE-RT) Pipes and Tubes Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| Key Market Players | Georg Fischer Ltd., Mega-Therm, Modern Plastic Industry, Abrah Dashte Markazi Company, Al Mona Plastic Products Factory, Borouge, The Heim-Weh-GmbH., Aquatherm, KE KELIT GmbH, Alcapipe, s.r.o. |

Analyst Review

According to the insights of the of the top-level CXOs, the Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT) pipes and tubes market was dominated by the CNG segment in 2022. The rise in demand for new refineries and downstream facilities drives the growth of Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market. Major oil and gas companies such as Aramco, Sinopec, and SABIC are prioritizing operational efficiency and safety in their refineries and downstream facilities in oil and gas. These companies are increasingly using advanced piping for oil and gas where PP-RCT and PE-RT type 2 pipes are expected to gain popularity due to factors such as high-pressure flow or external loads.

Compatibility with fittings and connectors is expected to restrain the growth of polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market. PP-RCT pipes have a narrower range of compatible fittings and connectors compared to more commonly used piping materials such as PVC or copper. Limited compatibility with fittings and connectors complicates the installation process for PP-RCT pipes, requiring additional time and effort to find suitable components and ensure proper alignment and sealing. This increases labor costs and project timelines, particularly in complex or large-scale installations.

The surge in demand for sewerage and growth in new refineries and downstream facilities drives the growth of Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market.

The Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market was valued at $21.2 million in 2022 and is projected to reach $41.0 million by 2032, growing at a CAGR of 6.9% from 2023 to 2032.

The major players operating in the Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market include Abrah Dashte Markazi Company, Al Mona Plastic Products Factory, Alcapipe, s.r.o., Aquatherm, Borouge, Georg Fischer Ltd., KE KELIT GmbH, Mega-Therm, Modern Plastic Industry, and The Heim-Weh-GmbH.

Increase in demand for water management systems and expansion of oil & gas industry are the opportunities for the Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market.

The Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes market is segmented into type and application. On the basis of type, the market is bifurcated into polypropylene (PP-RCT) pipes and tubes, and polyethylene (PE-RT type 2) pipes and tubes. On the basis of application, the market is categorized into water supply, irrigation, sewerage and drainage, gas supply, buildings and commercial centers cooling, and others.

Competition from other materials restrains the growth of Saudi Arabia polypropylene (PP-RCT) and polyethylene (PE-RT type 2) pipes and tubes.

Water supply segment dominated based by application in the market.

Loading Table Of Content...