Scaffolding Market Research: 2031

The Global Scaffolding Market was valued at $52.2 billion in 2021, and is projected to reach $81 billion by 2031, growing at a CAGR of 4.6% from 2022 to 2031. Scaffolding is also known as staging and scaffold. It is a temporary structure used to support a crew member and laborers. It can be made by wooden planks and metal poles such as aluminum and steel. It is used on construction sites for advanced access to areas. It is used to support structures, grid systems, mobile stages, seating, and barricades.

It is used to help cleaning, building, repair, and renovation works. Scaffolding is an essential and integral part of almost all construction projects and has been used ever since the ancient period when the first structures were either built or renovated or painted.

Types of scaffolding vary with the type of construction work to get access to structures at height during construction. Sometimes it is used to support workers and their tools, but other times it is used to support significant loads from building materials, like bricks, blocks, stucco, or cast-in-place concrete, which is called ‘shoring’ instead of ‘scaffolding’.

Increase in disposable income of individuals and surge in awareness of attractive outdoor designs have shifted the inclination toward home remodeling among residential end users, especially in urban areas, which in turn increases the demand for scaffolding products that drive the growth of the global scaffolding market. For instance, the disposable income of South African population increased by 5.7% to 4th quarter (September-December) 2020.

Market Dynamics

A rise in investment in the housing sector and increased spending on construction spending across various countries such as the U.S., Japan, India, and others fuel the growth of the market and helps in expansion of scaffolding market size. In addition, rise in urbanization and population growth are expected to increase the demand for scaffolding system for renovation, new building construction, and many other applications, which drive the growth of the global scaffolding industry. For instance, urbanization in Mexico grew from 79.87% in 2017 to 80.73% by 2020.

There are different accidents that could occur while construction of a building. As construction is a dynamic task, it includes lot of materials to be carried through the use of scaffolds repeatedly that arises the risk of accidents and falls during the process. Thus, with the use of various advanced materials such as aluminum and steel, the scaffolds are now gaining the strength and helps in providing efficient operation.

Scaffolding safety is a combination of practices and safety procedures that enforces proper and safe use of scaffoldings. It involves a set of preemptive actions in building, inspecting, using, and tagging scaffolds. Compliance with OSHA’s standard rules and requirements for working on scaffoldings can minimize or remove workers’ exposure to hazards such as falls, electrocutions, and falling objects.

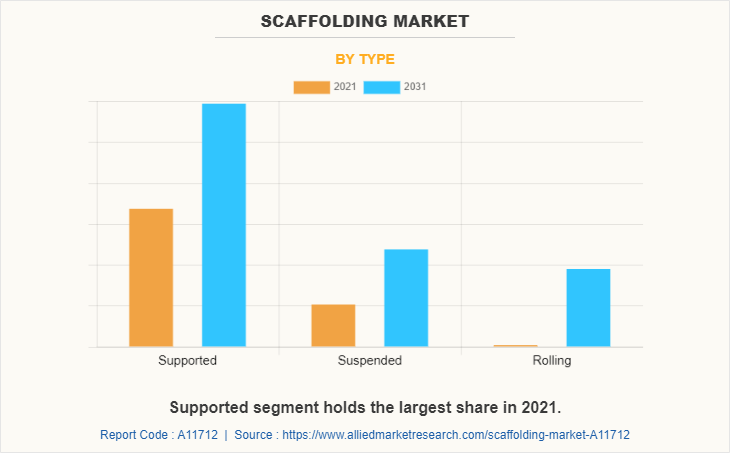

By Type:

The scaffolding market is divided into supported, suspended and rolling. In 2021, suspended registered the highest revenue and rolling is expected to grow at a significant CAGR, owing to high portability and flexibility rolling scaffolding systems offers. In addition, suspended scaffolding is lightweight, easy to assemble &disassemble, cost-efficient, portable, operated with electrical motor, and durable. In addition, there is a rise in adoption of suspended scaffolding for cleaning along with replacement of glass panels in skyscrapers, shipbuilding, and at construction sites. Thus with such a benefits, different construction site managers are adopting the use of scaffolding systems to perform different construction and maintenance task at sites.

Moreover, major players such as BrandSafway, PERI Group, and others are engaged in adopting business expansion and acquisition as key development strategies to improve the product portfolio of suspended scaffolding products. For instance, PERI Group planned to expand a new manufacturing facility in Gunzburg, Germany. The business expansion was done by $117.1 million. The manufacturing facility was completed by 2019. All such favorable instances drive the growth of the global scaffolding market.

Around 65% of the construction industry work on scaffolds and experience 4,500 injuries and 60 fatalities annually in the U.S. alone. Scaffolding safety is important because it can help prevent workplace incidents from recurring. With baseline scaffold requirements to keep workers safe such as better inspections, training, and controls, frontline teams can ensure scaffolding safety and be proactive about building a safety culture from the ground up. To ensure scaffolding safety, different scaffold manufacturers are launching scaffolding systems that could be built under the supervision of a competent person; someone who has been thoroughly trained on safe work practices when working on scaffoldings.

And workers must be trained by a qualified person before they use the scaffold. The scaffold and its components should also be checked by a competent person and properly tagged before the start of the shift to ensure its integrity and safety. Thus, this is gaining the trust for installing scaffolds in different construction sites, which in turn drives the growth of the market.

A government spending on home retrofitting and remodeling activities globally foster the growth of the global market. For instance, U.S. improvement and repair expenditure increased by over 30% from the first quarter of 2015 to the last quarter of 2020. Suspended scaffolding is lightweight, easy to assemble & disassemble, cost-efficient, portable, operated with electrical motor, and durable, which increase the adoption of suspended scaffolding in construction and building maintenance sites that drive the growth of the suspended scaffolding market. Suspended scaffolding is used for cleaning and replacement of glass panels in skyscrapers, shipbuilding, and construction sites, which boost the growth of the global market.

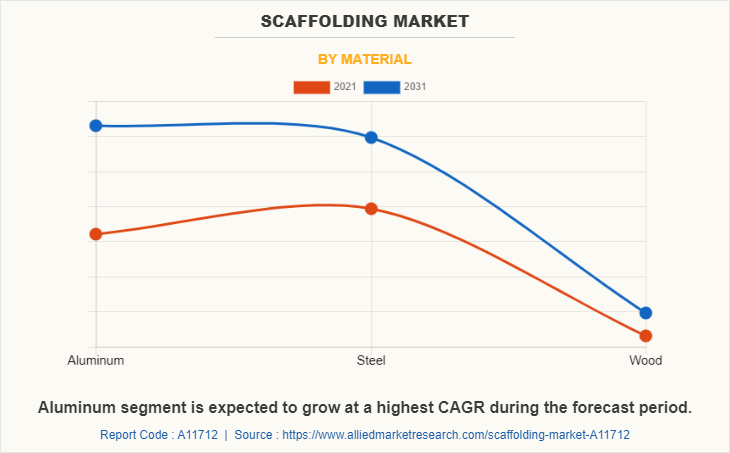

By Material:

The scaffolding market is divided into aluminum, steel and wood. In 2021, steel registered the highest revenue and aluminum is expected to grow at a significant CAGR, owing to growing use of aluminum scaffolding systems for oil & gas industry. In addition, the growth in new construction and renovation properties leads to rise in demand for scaffolding systems for interior decoration and building renovation. For instance, the U.S. government’s spending on renovation activities increased by 7.9% from 2020 to 2021.

Furthermore, there is a large scope for application of marble and granite tiles in flooring in commercial spaces such as educational buildings, airports, offices buildings, malls, and large public spaces. In addition, there is a rapid expansion of household furnishing industry. For instance, annual expenditure on furnishing and flooring activities in the UK has increased by 2% from 2020 to 2021.

Rise in construction related activities has been witnessed in countries such as India, Brazil, Dubai, and others. For instance, France government planned to spend $341 million on building the University campus of Paris. The work started in 2019 and is expected to be completed by end of 2022. Such growth in the construction industry is expected to drive the growth of the segment.

Growth in response to rise in consumer demand for home renovation and replacement is one of the major factors boosting the global scaffolding market growth. For instance, according to Harvard Joint Center for Housing Studies article published in January 2021, the growth of house remodeling and repair expenditures is expected to increase from 3.5 percent at the end of 2020 to 3.8 percent by the year-end of 2021.

However, fluctuation in raw material prices and unreliability in harsh weather conditions are anticipated to hamper the growth of the market. In addition, during the outbreak of the COVID-19 pandemic, construction, manufacturing, hotel, and tourism industries were majorly affected. Construction activities were halted or restricted. This led to decline in scaffolding market. Conversely, industries are gradually resuming their regular construction and services. This is expected to lead to re-initiation of scaffolding companies at their full-scale capacities, that helped the market to recover by end of 2021.

On the contrary, government investments in the building infrastructure sector are expected to provide lucrative scaffolding market opportunity.

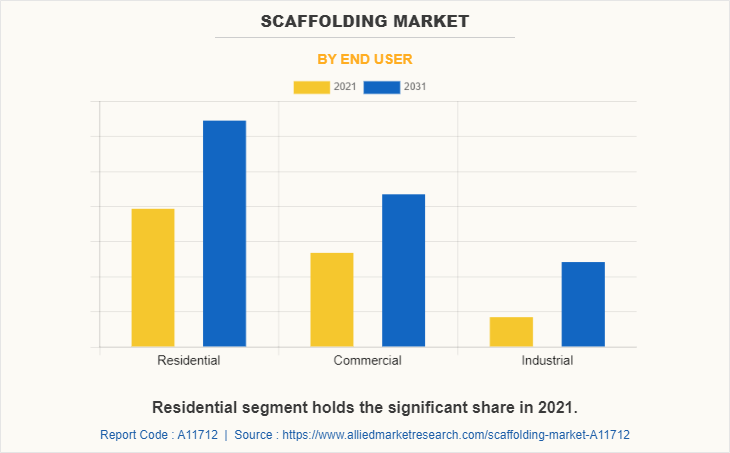

By End User:

The scaffolding market is divided into residential, commercial and industrial. In 2021, residential registered the highest revenue and commercial segment is expected to grow at a significant CAGR, owing to growing number of commercial building construction projects. In addition, the economic growth and high urbanization in developing countries is expected to grow at a faster pace, owing to rise in construction and infrastructure development. Market growth is supported by the improvement in the residential construction expenditure, mainly from China, India, Australia, and others. Thus, the surge in residential and non-residential construction activities and rise in expenditure on home improvement in Europe are expected to boost the market growth.

Moreover, the residential construction expenditure of China is expected to increase every year until 2030. In addition, the Asian countries are expected to witness growth in the construction market, owing to rise in income levels, rapid urbanization & industrialization, increase in population, and surge in household income, which are expected to fuel the market growth during the forecast period. For instance, disposable income of South African population increased by about 3% from 2020 to 2021.

The scaffolding market is segmented on the basis of type, material, end user, and region. On the basis of type, the market is divided into supported scaffolding, suspended scaffolding, and rolling scaffolding. The supported scaffolding segment generated the highest revenue in 2021. On the basis of material, the market is classified into aluminum, wood, and steel. The steel segment dominated the market in 2021. On the basis of end user, the market is categorized into residential, commercial, and industrial. The residential segment generated the highest revenue in 2021.

Region Wise,

The scaffolding market forecast is made across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

In 2021, Asia-Pacific was the highest contributor to the global scaffolding market share, and LAMEA is anticipated to secure a leading position during the forecast period.

By Region:

The scaffolding market is divided into North America, Europe, Asia-Pacific and LAMEA. In 2021, Asia-Pacific registered the highest revenue and LAMEA is expected to grow at a significant CAGR, owing to growing number of construction projects in developing countries of LAMEA. In addition, there is an increase in urbanization and industrialization in emerging countries such as India, Japan, and others propels the growth of the market in Asia-Pacific. For instance, urbanization in India grew by 2.5% from 2020 to 2021.

In addition, the Government of India initiated National Smart Cities Mission (NSCM), which is expected to develop 100 smart cities by 2025. Moreover, government investment for infrastructure buildings is anticipated to cater to the growth of the market. For instance, China government is projected to invest around $13 trillion in construction activities by 2030.

Competition Analysis

The major players profiled in the scaffolding market report included are Atlantic Pacific Equipment (AT-PAC), LLC, PERI GmbH, ULMA C Y E. S Coop, ADTO Group, ALTRAD, MJ-Gerust GmbH, Changli XMWY Formwork Scaffolding Co Ltd, WACO, Brand Safway, and Wilhelm Layher GmbH & Co KG.

Major companies in the market have adopted product launch, partnership, business expansion, and acquisition as their key developmental strategies to offer better products and services to customers in the scaffolding market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the scaffolding market analysis from 2021 to 2031 to identify the prevailing scaffolding market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the scaffolding market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global scaffolding market trends, key players, market segments, application areas, and market growth strategies.

Scaffolding Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 81 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 219 |

| By Type |

|

| By Material |

|

| By End User |

|

| By Region |

|

| Key Market Players | Wilhelm Layber GmbH & Co KG, MJ Gerust GmbH, Atlantic Pacific Equipment LLC, Peri Group, ULMA C Y E, S. COOP., Waco Equipment, Brand Safway, Changli Xingminweiye Architecture Equipment Limited Corporation, ADTO Group Xiang, Altrad Investment Authority |

Analyst Review

There is a growth in residential and commercial construction activities along with rise in government support for renovation activities globally. Moreover, surge in disposable income of population and rise in demand for home renovation activities drive the growth of the global scaffolding market. For instance, the disposable income of Brazil population increased by about 4% from 2020 to 2021.

In addition, increase in construction activities in museum, churches, commercial buildings, and others, drives the growth of the global scaffolding market. Moreover, increase in investment in construction activities is expected to drive the growth of the global scaffolding market. For instance, the government of India announced an ambitious investment agenda plan of $1.5 trillion in construction sectors for a six-year period ending 2025. This investment focuses on improving quality of construction for schools & higher education, health, sports, and basic infrastructure.

However, fluctuation in raw material prices and unreliability in harsh weather conditions are anticipated to hamper the growth of the global scaffolding market. Furthermore, government investments in the building infrastructure sector are expected to provide lucrative opportunities for the growth of the global scaffolding market.

The global scaffolding market was valued at $52.2 billion in 2021, and is projected to reach $81 billion by 2031, growing at a CAGR of 4.6% from 2022 to 2031.

The forecast period considered for the global scaffolding market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

The latest version of global scaffolding market report can be obtained on demand from the website.

The base year considered in the global scaffolding market report is 2021.

The top companies holding the market share in the global scaffolding market report are Atlantic Pacific Equipment (AT-PAC), LLC, PERI GmbH, ULMA C Y E. S Coop, ADTO Group, ALTRAD, MJ-Gerust GmbH, Changli XMWY Formwork Scaffolding Co Ltd, WACO, Brand Safway, and Wilhelm Layher GmbH & Co KG.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

By type, the supported segment is the highest share holder of scaffolding market.

Loading Table Of Content...