Seamless Steel Tubes Market Research: 2032

The Global Seamless Steel Tubes Market size was valued at $45.5 billion in 2022, and is projected to reach $84.9 billion by 2032, growing at a CAGR of 6.3% from 2023 to 2032.

A seamless steel tube is a specific kind of hollow cylindrical structure made from a single steel billet using a precise manufacturing process. This type of tube ensures a uniform composition, improved pressure and corrosion resistance, and reliable transmission of fluids and gases across various industries.

Market Dynamics

Seamless tubes have gained popularity for their usage in exhaust systems and other critical parts as the automobile industry encourages lighter components and improved manufacturing techniques. The manufacturing sector, which comprises sectors such as machinery, aircraft, and electronics, depends heavily on structural integrity and fluid conveyance.

Furthermore, seamless pipes are a preferred choice for many applications due to the advantages, such as better strength, superior corrosion resistance, and increased reliability offered over welded pipes. Another factor that drives the demand for seamless pipes is the advancement of manufacturing techniques that enable producers to produce pipes of higher quality and larger sizes.

Strict quality requirements as well as performance and safety guidelines further favor the use of seamless tubes. The surge in demand for seamless tubes is mostly attributed to the development of infrastructure in developing countries and the globalization of trade. The steel sector has expanded significantly due to this, and seamless tubes are crucial for meeting the increased demand in numerous industries.

Seamless steel tubes are often used in construction for tasks such as plumbing, heating, and structural support due to their strength, durability, and resistance to corrosion. In the automotive sector, there are similar movements toward modern manufacturing techniques and lightweight materials. Seamless steel tubes are frequently utilized in automotive applications, particularly in exhaust systems where they offer better performance, high-temperature resistance, and enhanced fuel efficiency. Such instances are expected to drive the seamless steel tubes market growth.

The cost of raw materials restrains the market for seamless steel tubes. High-quality raw materials, typically steel billets or solid steel bars are necessary for the manufacture of seamless steel tubes. The price of these raw resources is influenced by a number of variables, including geopolitical events, market speculation, and global supply and demand dynamics. Price fluctuations for raw materials such as iron ore and scrap metal have a direct effect on the total cost of manufacturing seamless steel tubes. The high cost of the raw material is thus expected to restrict the growth of the market.

Steel makers have invested in innovative furnace technology that minimizes greenhouse gas emissions and increases energy efficiency in response to rise in environmental concerns and regulatory measures to limit emissions. Low emission furnaces reduce carbon dioxide and other pollutants throughout the steelmaking process by implementing innovative combustion systems, enhanced burner designs, and waste heat recovery strategies. These investments help achieve sustainability goals while enhancing the market competitiveness of seamless steel tube manufacturers. Steel companies are projected to provide seamless steel tubes that abide by stringent environmental standards by using low-emission furnaces, attracting eco-conscious customers, and gaining a competitive edge in the market. These instances are anticipated to present opportunities for the growth of the seamless steel tubes industry.

Segmental Overview

The seamless steel tubes market is segmented on the basis of material, process, end user and region. On the basis of material, the market is divided into carbon steel, stainless steel, alloy steel, and others. On the basis of process, it is bifurcated into cold rolled and hot rolled. On the basis of end user, it is classified into oil & gas, automotive, construction, energy & power, others.

On the basis of region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By Material:

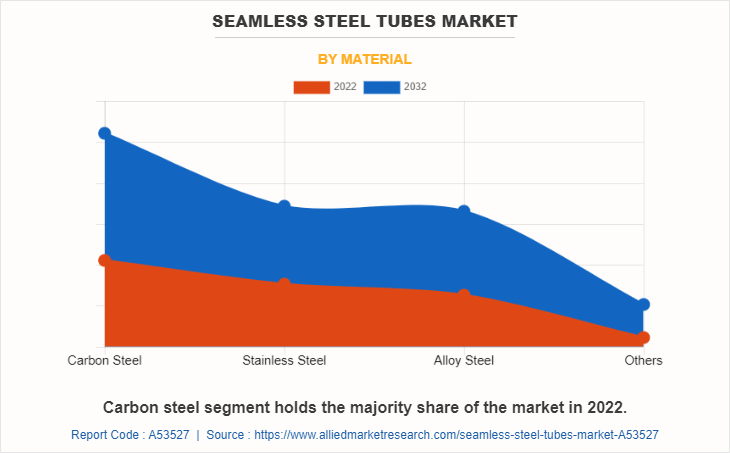

The seamless steel tubes market is categorized into carbon steel, stainless steel, alloy steel, and others. Carbon steel for seamless steel tubes is a type of steel alloy with carbon as the major alloying element that is used to create seamless tubes for a variety of industrial purposes. A corrosion-resistant alloy noted for its excellent durability and capacity to tolerate extreme temperatures, stainless steel is ideal for the fabrication of seamless tubes in a variety of industries. It is principally composed of iron, chromium, and other elements.

Alloy steel for seamless steel tubes describes a type of steel that has additional alloying components added to it, such as manganese, nickel, chromium, or molybdenum. These alloying components improve mechanical properties of the steel and give it unique qualities for use in seamless tube applications in industries that demand strength, toughness, and resistance to wear and corrosion. The others segment includes low-carbon steel, chrome-moly alloy steel, and ferritic alloy steel. The carbon steel segment is expected to be the largest revenue contributor during the forecast period and the carbon steel segment is expected to exhibit the highest CAGR share in the seamless steel tubes market during the forecast period.

By Process:

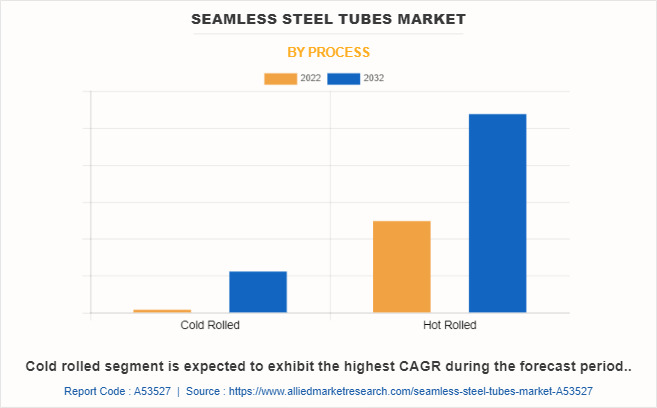

The seamless steel tubes market is categorized into cold rolled and hot rolled. Cold rolled for seamless steel tubes describes a manufacturing procedure where steel tubes are processed at room temperature. This improves surface finish, dimensional accuracy, and mechanical properties of the steel tubes, making them suitable for applications requiring exact tolerances and high-quality surfaces. Hot rolled for seamless steel tubes describes a manufacturing process where steel tubes are formed at high temperatures, resulting in a rougher surface finish and less precise dimensions, and providing benefits such as increased material strength and cost-efficiency for applications that do not strictly require dimensional accuracy. The hot rolled segment is expected to be the largest revenue contributor during the forecast period and the cold rolled segment is expected to exhibit the highest CAGR share in the by process segment in the seamless steel tubes market during the forecast period.

By End User:

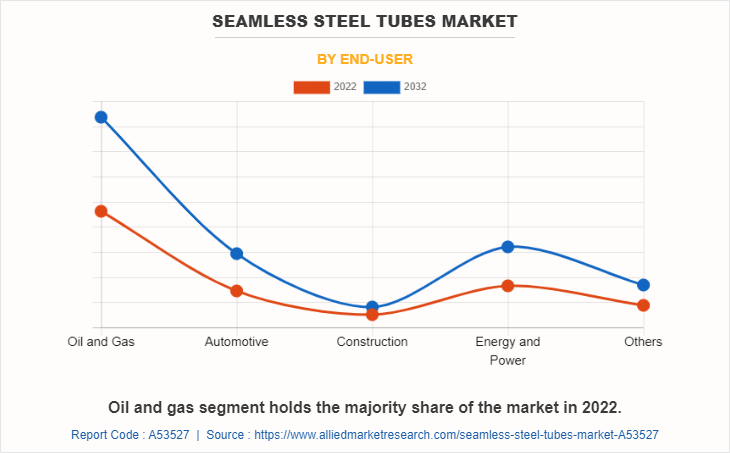

The seamless steel tubes market is classified into oil & gas, automotive, construction, energy & power, and others. Seamless steel tubes are projected to withstand high pressures, corrosive environments, and extreme temperatures. Oil and gas industry relies on them for a variety of applications, including drilling, production, and transportation. This ensures the safe and effective extraction, processing, and distribution of oil & gas resources. Seamless steel tubes are used in the automotive industry for fuel injection systems, exhaust systems, and structural components.

These applications benefit from high strength, durability, and ability to withstand adverse conditions, of the seamless steel tubes which enhances the overall performance, effectiveness, and safety of vehicles. Seamless steel tubes are used in power plants, renewable energy systems, and transmission pipelines due to their high-pressure resistance, thermal stability, and corrosion resistance, ensuring efficient and reliable energy generation, distribution, and storage. The oil & gas segment is expected to exhibit the largest revenue contributor during the forecast period and the automotive segment is expected to exhibit the highest CAGR share in the end user segment in the seamless steel tubes market during the forecast period.

By Region:

The seamless steel tubes market forecast is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2022, Asia-Pacific had the highest contribution in seamless steel tubes market share and is expected to exhibit the highest CAGR during the forecast period.

Competitive Analysis

The major players profiled in the global seamless steel tubes market include ArcelorMittal S.A., Jindal SAW Ltd., Nippon Steel Corporation, Sandvik AB, Shandong Tanglu Metal Material Co., Ltd, SHENQIANG STEEL MANUFACTURING CO., LTD., TATA Steel, Tenaris., United States Steel Corporation, and Vallourec S.A.

Major companies in the market have adopted business expansion, partnership, and other strategies as their key developmental strategies to offer better products and services to customers in the seamless steel tubes market.

Some examples of business expansion and acquisition that support the markets growth

In January 2022, Jindal SAW signed a partnership with Hunting Energy with 51%- 49% stake, respectively. Investment is focused to set-up Oil Country Tubular Goods (OCTG) threading facility in Nasik, India. In addition, the company has planned to start premium seamless pipe production.

In April 2023, Sathavahana Ispat Company was merged with Jindal SAW. The merger is focused to resolve debt issue of Sathavahana Ispat company and to enhance business in Hyderabad India.

In July 2022, Tenaris S.A. has entered into a legally binding agreement to buy 100% of the shares of Benteler Steel & Tube Manufacturing Corporation from Benteler North America Corporation, a Benteler group company, for an overall sum of US$460 million on a debt-free and cash-free basis. A working capital totaling $52 million is anticipated to be used for the transaction.

In February 2021, Ostrava tube and pipe mill of ArcelorMittal in the Czech Republic has invested approximately $7.6 million in modernization and to increase its production capacity by 18,000 tons per year.

In June 2022, TATA Steel had announced investment of approximately $8.5 million green investment in Hartlepool Tube Mill in north-east England. The investment is focused toward improving plant efficiency, decreasing carbon emission, and strengthening the UK business by reducing costs.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the seamless steel tubes market analysis from 2022 to 2032 to identify the prevailing seamless steel tubes market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the seamless steel tubes market opportunity and segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global seamless steel tubes market overview, trends, key players, market segments, application areas, and market growth strategies.

Seamless Steel Tubes Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 84.9 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 240 |

| By Material |

|

| By Process |

|

| By End-User |

|

| By Region |

|

| Key Market Players | Tata Steel Limited, Tenaris SA., Shenqiang Steel Manufacturing Co., Ltd., Shandong Tanglu Metal Material Co., Ltd, Jindal Saw Limited, United States Steel Corporation, Vallourec SA, Nippon Steel Corporation, ArcelorMittal, Sandvik AB |

Analyst Review

The global seamless steel tubes market witnessed a huge demand in Asia-Pacific followed by North America & Europe. The highest share of the Asia-Pacific market is attributed to the increase in demand for automation and construction activities.

Dependency on foundational strength and fluid transmission in commercial manufacturing, which includes sectors such as machinery, aerospace, and electronics, is significantly aided by seamless tubes. Seamless steel tubes are often used in construction for tasks such as plumbing, heating, and structural support due to their strength, durability, and resistance to corrosion. In addition, changes in the price of raw materials such as iron ore and scrap metal directly affect the overall cost of producing seamless steel tubes. Moreover, the costs of transportation and logistics for acquiring raw materials increase the final cost which restrain market growth. Furthermore, customers increasingly demand environment-friendly, and low-carbon solutions, particularly those in the automotive, construction, and energy sectors. Such instances and increase in the number of manufacturing companies are expected to create growth opportunities for expansion of the seamless steel tubes market.

The global seamless steel tubes market was valued at $45,528.0 million in 2022, and is projected to reach $84,888.83 million by 2032, registering a CAGR of 6.3% from 2023 to 2032.

The forecast period considered for the global seamless steel tubes market is 2022 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

The latest version of global seamless steel tubes market report can be obtained on demand from the website.

The base year considered in the global seamless steel tubes market report is 2022.

The major players profiled in the seamless steel tubes market include ArcelorMittal S.A., Jindal SAW Ltd., Nippon Steel Corporation, Sandvik AB, Shandong Tanglu Metal Material Co., Ltd, SHENQIANG STEEL MANUFACTURING CO., LTD., TATA Steel, Tenaris., United States Steel Corporation., and Vallourec S.A.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Based on material the carbon steel segment was the largest revenue generator in 2022.

Loading Table Of Content...

Loading Research Methodology...