Securities Lending Market Overview

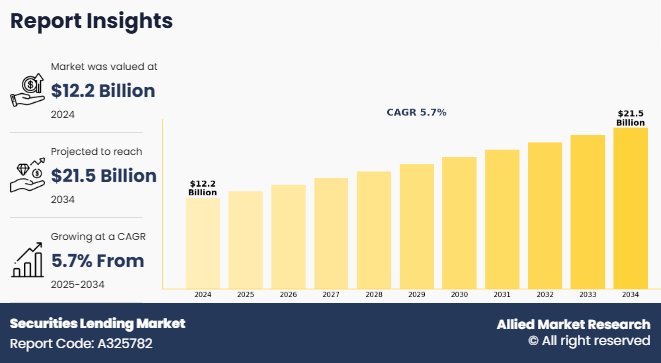

The global securities lending market size was valued at $12,157.3 million in 2024, and is projected to reach $21,499.9 million by 2034, growing at a CAGR of 5.7% from 2025 to 2034. Rising demand for short selling, greater focus on collateral and liquidity management, and the growth of passive investing through ETFs and index funds, are contributing to the growth of the market.

Market Dynamics & Insights

- The securities lending industry in North America held a significant share of 41% in 2024.

- By type, the equities segment dominated the segment in the market, accounting for the revenue share of 74% in 2024.

- By borrower, the hedge funds segment dominated the industry in 2024 and accounted for the largest revenue share of 86%.

- The securities lending industry in Africa is expected to grow significantly at a CAGR of 8.9% from 2025 to 2034.

Market Size & Future Outlook

- 2024 Market Size: $12.15 Billion

- 2034 Projected Market Size: $21.49 Billion

- CAGR (2025-2034): 5.7%

- North America: dominated the market in 2024

- LAMEA: Fastest growing market

What is Meant by Securities Lending

Securities lending is the temporary transfer of securities (such as stocks or bonds) from one party (the lender) to another (the borrower), with the agreement that the borrower will return the same or equivalent securities at a later date. In return, the borrower provides collateral usually in the form of cash, other securities, or a letter of credit, to protect the lender against default. This practice is commonly used by institutional investors to facilitate short selling, improve market liquidity, and earn additional income through lending fees. Securities lending is generally facilitated between brokers or dealers and not directly by individual investors. To finalize the transaction, a securities lending agreement or loan agreement must be completed. This sets forth the terms of the loan including duration, interest rates, lender’s fees, and the nature of the collateral.

Key Takeaways

- By Type, the equites segment held the largest share in the securities lending market for 2024.

- By Borrower, the hedge funds segment held the largest share in the securities lending market for 2024.

- Region-wise, North America held the largest market share in 2024. However, LAMEA is expected to witness the highest CAGR during the forecast period.

Factors such as rise in the demand for short selling and increase in focus on collateral and liquidity management have positively impacted the growth of the securities lending market. In addition, the growth of passive investing, particularly through ETFs and index funds, is expected to fuel the securities lending market growth during the forecast period, as these vehicles often participate in lending programs to enhance returns. Furthermore, the expansion into alternative assets, such as private credit, digital assets, and real estate investment trusts (REITs) is expected to open new avenues for securities lending, diversifying the market and attracting a broader range of participants. Moreover, advancements in financial technology such as the adoption of blockchain for real-time settlement and artificial intelligence for predictive analytics, are streamlining operations, improving risk assessment, and enhancing transparency, thereby driving greater efficiency and trust within the securities lending ecosystem, creating lucrative securities lending market opportunity for the growth.

Securities Lending Market Segment Review

The securities lending market is segmented into securities type, borrower, and region. On the basis of securities type, the market is classified as equities, government bonds, corporate bonds, and others. By borrower, the market is fragmented into hedge funds, large asset managers, pensions fund, and retail brokers. Region-wise, the securities lending market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of borrower, the global securities market share was dominated by the hedge funds segment in 2024 and is expected to maintain its dominance in the upcoming years, owing to rise of fintech platforms allowing retail investors to participate in these markets, leading to increase in market liquidity and competition. In addition, the government's regulations aimed at enhancing transparency, reducing counterparty risk, and improving market stability have further supported the development of non-traditional securities lending, driving the growth of the securities lending market in the segment. However, the retail brokers segment is expected to experience the highest growth during the securities lending market forecast period. This segment is experiencing increase in the adoption of securities lending programs to boost revenue and offer more value to clients by earning fees from lending client-held stocks and sharing some of the income with investors, thus propelling the growth of the securities lending market.

Region wise, North America dominated the securities lending market share in 2024 for the securities lending market. This is due to the adoption of technologies such as blockchain, artificial intelligence (AI), and automation enhancing operational efficiency, reducing settlement times, and improving transparency, contributing significantly to the region’s market growth. However, LAMEA is expected to experience the fastest growth during the forecast period. The region is experiencing a growing trend of fintech platforms offering easier access to securities lending. These platforms facilitate peer-to-peer lending, allowing smaller investors to participate in securities lending activities, which is expected to provide lucrative growth opportunities for the securities lending market in the region.

Competition Analysis

The report analyzes the profiles of key players operating in the securities lending market are BNP Paribas, State Street Corporation, JPMorgan Chase & Co, Goldman Sachs Group, UBS, The Charles Schwab Corporation, ClearStream, Deutsche Bank AG, Societe Generale, Mizuho Securities Co., Ltd., Royal Bank of Canada, SIX Group Services Ltd., Invesco Ltd, StoneX Group Inc, and The Bank of New York Mellon Corporation. These major players have adopted various key development strategies such as business expansion, new product launches, partnerships, among others which help to drive the growth of the securities lending market globally. These players have adopted various strategies to increase their market penetration and strengthen their position in the securities lending industry.

What are the Recent Developments in the Securities Lending Market

- In January 2025, Clearstream launched its Lending Analytics Dashboard, a tool designed to enhance transparency and strategic oversight in the securities lending industry. The dashboard provides lenders with a comprehensive, data-driven view of their lending activity across accounts and products. It features customizable reports, benchmarking tools, and pre-defined KPIs and visualizations, enabling users to monitor performance, identify trends, and make informed decisions. This initiative reflects Clearstream’s commitment to innovation in post-trade services and supports clients in optimizing their securities lending strategies in securities lending market.

- In May 2024, Deutsche Bank joined the Monetary Authority of Singapore’s Project Guardian, a global initiative exploring the use of asset tokenization in regulated financial markets. As part of the asset and wealth management workstream, Deutsche Bank is testing a blockchain-based platform for servicing tokenized and digital funds. This move reflects the bank’s commitment to digital innovation and its role in shaping future standards for interoperable and secure asset servicing.

- In April 2023, J.P. Morgan partnered with fintech firm Sharegain to enhance its digital securities lending capabilities through Sharegain’s SLTech solution. This strategic alliance aims to expand J.P. Morgan’s agency securities lending services, particularly for wealth managers and online brokers across 30 markets. Sharegain’s end-to-end digital platform enables clients to lend out financial assets such as stocks, bonds, ETFs, and earn lending revenue, all while simplifying the operational and technological complexities typically involved in securities lending.

What are the Top Impacting Factors in Securities Lending Market

Driver

Rising demand for short selling

Rise in the demand for short selling is a significant driver of the securities lending market. The major factor is increased market volatility, as traders and hedge funds look to profit from falling stock prices during times of economic uncertainty or geopolitical tensions. This surge in activity directly fuels growth in both stock lending and equity lending, as market participants seek to borrow securities for strategic trading opportunities. In addition, the growth of hedge funds and quantitative trading strategies has amplified the demand for short selling, as these investors often use it as part of long/short equity strategies. Furthermore, the broader access to securities lending platforms also plays a role, making it easier for institutional investors, such as pension funds and mutual funds, to participate in securities lending and earn additional income. In addition, the rise of retail participation in speculative trading, especially with platforms such as Robinhood and eToro, has further boosted short selling activity, particularly in volatile stocks. These factors are expected to boost the securities lending market growth.

Moreover, regulatory advancements and increased transparency, such as the Securities Financing Transactions Regulation (SFTR) in Europe and Rule 10c-1 proposed by the U.S. Securities and Exchange Commission (SEC) in the U.S., have helped reduce information asymmetries, making the market more accessible to institutional borrowers. This is expected to augment the growth of the securities lending market. Moreover, the expansion of the derivatives market, including options, futures, and swaps, has created a need for short positions to manage hedge strategies or exploit arbitrage opportunities. In addition, corporate events and special situations, such as earnings reports, mergers, or restructurings, often result in temporary mispricing, which further drives the demand for short selling. For instance, in November 2023, Asia Securities recently emphasized the promising opportunities for investors following the Colombo Stock Exchange’s (CSE) introduction of Stock Borrowing and Lending (SBL) and Regulated Short Selling (RSS). These mechanisms are expected to significantly enhance market liquidity, transparency, and efficiency in Sri Lanka. SBL enables investors to lend and borrow shares using collateral, laying the groundwork for short selling, while RSS allows participants to sell borrowed shares with the intent to repurchase them at a lower price. The CSE has implemented robust risk controls, including restrictions on shortable stocks and stringent collateral requirements, to ensure market stability. This is expected to boost investor confidence, attract more institutional participants, and further develop the local securities lending market, contributing to a more efficient and dynamic trading environment.

Restraints

Regulatory constraints and capital requirements

The major challenge for the growth of the securities lending market is the increasingly stringent regulatory environment and the associated capital requirements. Regulatory bodies across jurisdictions have implemented reforms aimed at enhancing transparency, reducing systemic risk, and strengthening the resilience of financial institutions. One of the most significant constraints comes from the higher capital charges imposed under Basel III. The leverage ratio framework and risk-weighted asset (RWA) requirements have made it more expensive for banks to engage in securities lending. These capital rules discourage large financial institutions from maintaining extensive securities lending books by increasing the cost of holding and transacting in certain assets. This is particularly impactful for borrowers and intermediaries who rely on the balance sheets of banks to execute their strategies efficiently.

Furthermore, regulatory requirements around collateral, such as mandatory central clearing and haircuts on non-cash collateral, add complexity and reduce the pool of eligible assets. This not only limits flexibility in structuring lending agreements but also reduces the overall volume of transactions that institutions can engage in without breaching regulatory thresholds. These constraints have shifted activity from traditional banks to non-bank institutions like pension funds and asset managers, which face lighter regulation, preserving some market activity but raising concerns over regulatory gaps and emerging risks. To address this challenge, regulators and market participants should refine capital rules to better reflect the low-risk nature of many securities lending activities and promote standardization in collateral practices to reduce complexity and expand eligible assets.

Opportunity

Expansion into alternative assets

The expansion into alternative assets presents a significant growth opportunity for the securities lending market, as institutional investors increasingly seek higher returns and diversification beyond traditional stocks and bonds. In a low-interest-rate environment, institutional investors are increasingly turning to alternative assets such as hedge funds, private equity, and real estate, to seek higher yields and diversification. These assets, often less correlated with traditional markets, offer the potential for stronger long-term returns. As a result, many alternative asset managers are now actively participating in securities lending to unlock additional income from their holdings. In addition, securities lending is moving beyond traditional stocks and bonds into alternative assets, prompting innovation in collateral management, custody, and loan structuring to meet the unique challenges of less liquid investments. This is expected to create remunerative opportunities for the growth of the securities lending market.

Moreover, lending alternative assets offers institutions enhanced returns through new income streams, improved portfolio diversification, and greater flexibility in liquidity management. It also promotes market efficiency by enabling borrowing in less liquid sectors like private equity and real estate. In addition, the expansion of the securities lending market into alternative assets is paving the way for a broader range of participants. Non-traditional asset managers, family offices, and even individual investors are finding new opportunities to engage in this space. This shift is further accelerated by the globalization of financial markets and the emergence of digital platforms, which simplify cross-border lending and borrowing. For instance, in December 2024, Maybank Securities partnered with Citi to bring global securities lending to retail investors in Singapore. By leveraging Citi’s Securities Lending Access (CSLA) platform, Maybank enabled its clients to lend their global equity holdings and earn a share of borrower fees. This collaboration marked the introduction of CSLA in Asia, combining Citi’s global lending capabilities with Sharegain’s technology to digitize and democratize the securities lending process. The initiative is aimed to unlock new income opportunities for secutities lending market and optimize client portfolios, supporting in market expansion.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the securities lending market outlook from 2024 to 2034 to identify the prevailing securities lending market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the securities lending market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global securities lending market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the securities lending market analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Securities Lending Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 21.5 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2024 - 2034 |

| Report Pages | 255 |

| By Type |

|

| By Borrower |

|

| By Region |

|

| Key Market Players | BNP Paribas, SIX Group Services Ltd., Invesco Ltd, UBS, The Charles Schwab Corporation, Mizuho Securities Co., Ltd., Deutsche Bank AG, The Bank of New York Mellon Corporation, State Street Corporation, Goldman Sachs, StoneX Group Inc, ClearStream, JPMorgan Chase & Co, Royal Bank of Canada, Societe Generale |

Analyst Review

The securities lending market is experiencing notable growth, driven by increasing demand for liquidity optimization and enhanced portfolio returns. As global financial markets evolve, institutional investors are leveraging securities lending as a strategic tool to generate incremental income while maintaining portfolio flexibility. Technological advancements, including blockchain integration, real-time risk analytics, and automated collateral management systems, are enhancing operational efficiency and transparency across lending transactions. Moreover, regulatory developments aimed at improving market stability and risk oversight, along with rising interest from hedge funds and asset managers, are propelling the expansion of this market. With growing emphasis on market efficiency, capital optimization, and transparency, the securities lending market is poised for continued growth in both mature and emerging financial markets.

Furthermore, technological advancements in blockchain, AI-driven analytics, and automated trading platforms are significantly propelling the growth of the securities lending market. Modern solutions now offer enhanced capabilities such as real-time trade execution, automated collateral optimization, dynamic risk assessment, and seamless integration with front-to-back office systems, enabling market participants to manage lending operations more efficiently and securely. The rise of fintech startups, combined with increasing collaboration among custodians, asset managers, and technology providers, is unlocking new opportunities for innovation and efficiency in the securities lending ecosystem. These developments are fostering a more agile, transparent, and data-driven market environment, positioning securities lending as a critical component of modern portfolio management.

Moreover, evolving regulatory frameworks and government policies aimed at enhancing market transparency and financial stability are significantly influencing the growth of the securities lending market. Across various jurisdictions, regulators are introducing measures to improve disclosure practices, ensure robust collateral management, and mitigate systemic risk, thereby fostering investor confidence. Initiatives such as mandatory reporting requirements, guidelines on beneficial ownership transparency, and incentives for efficient collateral usage are supporting the structured expansion of the market. However, challenges persist, particularly in areas such as regulatory harmonization across borders, data privacy, and the absence of universally accepted technology standards. Ensuring the protection of trading data and managing counterparty risks remain key concerns for market participants. Despite these challenges, the securities lending market is expected to expand, especially as institutional investors seek enhanced yield opportunities and operational efficiencies through secure, technology-enabled lending practices in emerging financial markets.

The securities lending market is projected to reach $21,499.9 million by 2034.

The securities lending market is estimated to grow at a CAGR of 5.7% from 2025 to 2034.

The securities lending market is expected to witness notable growth due to rise in demand for short selling, focus on collateral and liquidity management, and growth of passive investing.

The key players profiled in the report include BNP Paribas, State Street Corporation, JPMorgan Chase & Co, Goldman Sachs Group, UBS, The Charles Schwab Corporation, ClearStream, Deutsche Bank AG, Societe Generale, Mizuho Securities Co., Ltd., Royal Bank of Canada, SIX Group Services Ltd., Invesco Ltd, StoneX Group Inc, and The Bank of New York Mellon Corporation.

The key growth strategies of securities lending market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...