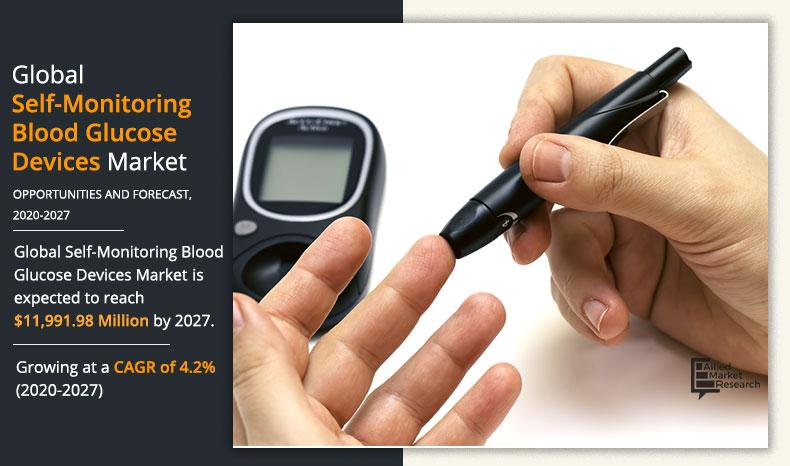

The global self-monitoring blood glucose devices market was valued at $8,490.79 million in 2019, and is projected to reach $11,991.98 million by 2027, growing at a CAGR of 4.2% from 2020 to 2027.

Blood glucose monitoring helps diabetic patients to make daily management decisions such as food intake, insulin dose, and physical exercise. Self-monitoring blood glucose (SMBG) is a modern diabetes management procedure, which involves usage of blood glucose meters by patients to check their glucose levels quickly and provide an accurate measure of capillary glucose concentration. SMBG technology uses test strips, lancets, and blood glucose meters to achieve long-term glycemic control.

The self-monitoring blood glucose devices market is expected to witness a significant growth during the forecast period. The growth can be attributed to factors such as increase in incidence rate of diabetes and rise in risk factors that lead to diabetes. Moreover, technological advancements in the field of blood glucose monitoring devices and rise in geriatric population boost the self-monitoring blood glucose devices market growth. However, blood glucose monitoring devices do not measure the exact level of glucose in blood and can give inaccurate results, which hamper the market growth. Conversely, increase in awareness for diabetes monitoring devices is expected to provide significant opportunities for the growth of the market. Moreover, high growth potential in untapped markets for diabetes monitoring devices are expected to provide lucrative opportunities for the expansion of the global self-monitoring blood glucose devices market in the near future.

Though most of the self-monitoring blood glucose devices markets are witnessing decline in growth, COVID-19 outbreak has positively affected various healthcare-related markets, one of them being self-monitoring blood glucose devices. It has been noted that diabetic patients are more vulnerable to becoming severely ill with the COVID-19 virus. In addition, the pandemic resulted in surge in adoption of self-monitoring blood glucose devices for home settings to reduce from hospitals and clinics visits. Therefore, presently, the self-monitoring blood glucose devices market is witnessing a significant growth owing to high demand in self-monitoring blood glucose devices.

Global Self-monitoring Blood Glucose Devices Segmentation

The self-monitoring blood glucose devices market is segmented into product, application, end user, and region. Depending on product, the market is divided into test strips, lancets, and blood glucose meters. The applications covered in the study include 1 diabetes, type 2 diabetes, and gestational diabetes. On the basis of end user, the market is fragmented into hospitals, home settings, and diagnostic centers. Region wise, the self-monitoring blood glucose devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment review

On the basis of product, the test strips segment acquired major share of the global self-monitoring blood glucose devices, and is expected to experience rapid growth during the forecast period, owing to increase in awareness about self-testing that allows diabetic patients to keep record of their blood glucose level regularly without visiting a clinic or diagnostic laboratory. Moreover, rise in prevalence of diabetes and high demand for better screening & monitoring methods boost the global self-monitoring blood glucose devices growth.

By Product

Test strips segment holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

By application, type 2 diabetes segment dominated the self-monitoring blood glucose devices market, owing to high prevalence of type 2 diabetes. Moreover, type 2 diabetes segment is expected to grow at the fastest rate during the forecast period, owing to increase in geriatric population, rise in prevalence of obesity, and sedentary lifestyle.

Depending on end user, the hospitals segment dominated the self-monitoring blood glucose devices market, owing to development of healthcare settings across emerging economies and overall increase in number of hospitalizations. However, the home settings segment is expected to grow at the fastest rate during the forecast period, owing to high adoption of self-monitoring blood glucose devices and rise in preference of people toward portable and high-end technological products.

By Application

Type 2 diabetes segment is projected as one of the most lucrative segment.

In 2019, North America acquired a major share of the self-monitoring blood glucose devices market, owing to high incidence rate of diabetes in the region. In addition, presence of key players in the region supplements the growth of the market. However, Asia-Pacific is expected to grow at the fastest rate during the forecast period, due to increase in prevalence rate of diabetes in the region. In addition, the countries in the region such as India and China, have the highest population base, which is undiagnosed with diabetes. Furthermore, the constantly evolving healthcare industry drives the growth of the market in the developing economies.

The global self-monitoring blood glucose devices is highly competitive, and prominent players have adopted various strategies to garner maximum market share. These include collaboration, product launch, partnership, and acquisition. Major players operating in the market include Abbott Laboratories, Bionime Corporation, B. Braun Melsungen AG, F. Hoffmann-La Roche Ltd., LifeScan IP Holdings, LLC, PHC Holdings Corporation, Terumo Corporation, Trividia Health, Inc. (Sinocare Inc.), ARKRAY, Inc., and Ypsomed Holding AG.

By Region

Asia-Pacific region would exhibit the highest CAGR of 5.5% during 2020-2027.

Key Benefits For Stakeholders

- This report entails a detailed quantitative analysis of the current market trends from 2019 to 2027 to identify the prevailing opportunities.

- Self-monitoring blood glucose devices market size and market estimations are based on comprehensive analysis of the key developments in the industry.

- In-depth analysis based on region assists to understand the regional market and the strategic business planning.

- The development strategies adopted by key manufacturers are enlisted to understand the competitive scenario of the market.

Self-Monitoring Blood Glucose Devices Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | TRIVIDIA HEALTH, INC. (SINOCARE), ABBOTT LABORATORIES, PHC HOLDINGS CORPORATION, F. HOFFMANN-LA ROCHE LTD., YPSOMED HOLDING AG, LIFESCAN IP HOLDINGS, LLC (PLATINUM EQUITY), ARKRAY, INC., B. BRAUN MELSUNGEN AG, TERUMO CORPORATION, BIONIME CORPORATION |

Analyst Review

Self-management of blood glucose is performed by piercing the finger to draw blood, and subsequently smearing blood to disposal test-strip. SMBG technique is highly recommended for people with diabetes to prevent the development of hypoglycemia and other diabetes-related problems.

According to the analyst, the adoption of diabetes care devices is expected to increase in the near future, owing to high prevalence rate of diabetes, rise in geriatric population, technological advancements in diabetes care devices, and changes in lifestyle of people, which make them highly susceptible to develop diabetes.

Thus, diabetes care devices are gaining popularity among patients as well as healthcare providers, owing to the benefits associated with them and their easy operation. Moreover, due to the outbreak of the COVID-19 pandemic, lockdown has been implemented to follow social distancing norms across the globe.

This has urged the need to reduce contact between healthcare providers and patients in hospital settings, which, in turn, is augmenting the demand of self-monitoring blood glucose devices. In addition, rise in preference of people toward portable technological products is expected to boost the adoption of Self-monitoring blood glucose devices.

However, adverse effects of some of these devices have been monitored in few patients. For instance, incorrect blood glucose readings may lead to treatment errors, for example, incorrect insulin dosing, which restrains the market growth.

The analyst further added that the use of self-monitoring blood glucose devices is highest in North America, owing to increase in awareness toward management of diabetes and heavy expenditure by the government on healthcare, followed by Europe and Asia-Pacific. In addition, self-monitoring blood glucose device providers and distributors have focused on expanding their presence in emerging economies, which is anticipated to drive the market growth.

The total market value of self-monitoring blood glucose devices market is $8,490.79 million in 2019.

The forcast period for self-monitoring blood glucose devices market is 2020 to 2027

The market value of self-monitoring blood glucose devices market in 2020 is anticipated to be $8,983.26 million.

The base year is 2019 in self-monitoring blood glucose devices market

Top companies such as, F. Hoffman-La Roche Ltd., PHC Holdings Corporation, LifeScan Inc., Abbott Laboratories, B. Braun Melsungen AG, and Sinocare held a high market position in 2019. These key players held a high market postion owing to the strong geographical foothold in different regions.

Type 2 diabetes segment is the most influencing segment owing to factors such as high prevalence of type 2 diabetes and increasing adoption of self monitoring blood glucose devices.

The major factor that fuels the growth of the global self-monitoring blood glucose devices market includes increase in the incidence rate of diabetes, rise in geriatric population, technological advancements in diabetes monitoring devices, and rise in risk factors that lead to diabetes. This leads to surge in demand for self monitoring blood glucose devices which contribute to the growth of the market.

Asia-Pacific has the highest growth rate in the market which is growing due to the contribution of the following emerging countries such as India with a CAGR of 7.50%. This is due to improvement in health awareness, development in healthcare infrastructure, and rise in number of hospitals & diagnostic centers equipped with advanced medical facilities.

Self-monitoring blood glucose devices are devices that are used to track and monitor blood glucose in diabetic patients with the help of test strips, lancets, and glucose meters.

The self-monitoring blood glucose devices are used to track and monitor blood glucose in diabetic patients for the management of diabetes.

Loading Table Of Content...