Semi-Trailer Market Research, 2033

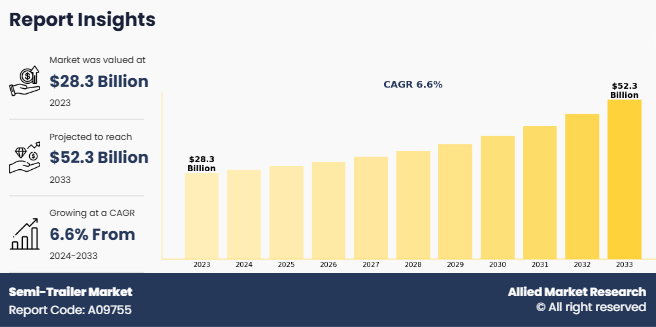

The global semi-trailer market size was valued at $28.3 billion in 2023, and is projected to reach $52.3 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033.

Report Key Highlighters:

- The semi-trailer market forecast covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($billion) for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market. The semi-trailer market share is highly fragmented, into several players including China International Marine Containers (Group) Co., Ltd., Fontaine Trailer , Great Dane, a division of Great Dane LLC, Hyundai Translead, KRONE Trailer, MAC Trailer, STI HOLDINGS, INC., Timpte Inc, Utility Trailer Manufacturing Company, LLC. , and Wabash National Corporation. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Semi-trailers are non-motorized vehicles designed to be towed by heavy-duty trucks or tractors, primarily used for transporting goods and materials across various industries. The market includes a diverse array of trailer types tailored to specific transportation needs, such as dry vans, reefers, flatbeds, tankers, lowboys, and specialized trailers like automobile carriers and livestock trailers.

Rise in e-commerce has increased the demand for efficient transportation of goods from distribution centers to consumers, with dry vans playing a crucial role in securely transporting a diverse array of products such as electronics, clothing, and household goods. Dry vans provide protection from environmental elements and theft, making them important to the e-commerce industry. Furthermore, advancements in logistics and supply chain management have further created demand for dry vans across a wide range of industries, including retail, manufacturing, and food distribution.

Factors such as expansion of e-commerce distribution networks, growing use of multiple transportation modes, and technological advancements drive the market demand. However, factor such as high initial costs of semi-trailer, and strict regulations of emissions and safety regulations hinders the growth of the market to some extent. On the contrary, factors such as surge in investment in green technologies and sustainable practices and introduction of smart trailers with integration of IoT and telematics offers lucrative semi-trailer market opportunities.

The global semi-trailer industry is experiencing a significant boost due to technological innovations. New technologies are making trailers smarter, more efficient, and safer as compared to traditional trailers. For example, the integration of telematics systems allows fleet managers to track their trailers in real-time, monitor cargo conditions, and optimize routes. This not only improves operational efficiency but also enhances security and reduces theft risks.

Moreover, introduction of 60-foot trailers is further driving the market growth, the industry standard has traditionally been 53-foot trailers. However, the push for greater efficiency and capacity is driving interest in longer trailers. The 60-foot trailer offers more cargo space as compared to its 53-foot counterpart, allowing shippers to move more goods in fewer trips. This increased operational capacity which is particularly attractive for industries dealing with lightweight, high-volume cargo, such as e-commerce and consumer goods industry.

For instance, in December 2023, the Ontario Trucking Association finalized its stance on the Ministry of Transportation's (MTO) proposed 60-foot trailer permit program, also known as extended semi-trailers. The MTO's detailed proposal aims to regulate 60-foot trailers within a tightly controlled permit environment and special vehicle configuration regime (SVC), with ongoing consultations to refine the program. Such programs have the potential to significantly reshape the semi-trailer industry in the coming years.

Key Developments in the Semi-Trailer Market Analysis

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On April, 2024 Fontaine Trailer introduced Magnitude 75 trailer. This 3+3+2 modular multi-purpose trailer is designed and crafted to efficiently transport a diverse range of loads. The trailer offered in three distinct deck options: flat (MFLD), drop side rail (MDSR), and beam (MBMD). Furthermore, it carries up to 70 tons load in 12 feet trailer connected with tandem axle EQ2 spreader system.

- On August 2023, Wabash National Corporation opened an advanced dry van trailer manufacturing facility in Lafayette, Indiana. Its new facility features advanced manufacturing technology that improves the worker's experience while providing a more repeatable process.

- On August 2023, Fontaine Trailer launched Magnitude 65 trailer. It is 3+2 modular multi-purpose trailer designed and built to efficiently transport a wide array of loads with its three deck options: flat (MFLD), drop side rail (MDSR), and beam (MBMD). It carries up to 65 tons in 16 feet as a 3+2 or can be configured with five close coupled axles to transport up to 70 tons in 12 feet.

- On June, 2023 Timpte Inc. opened Customer Support Center (CSC) for trailer service in Odessa, Texas. The 19,000 sq. ft. facility is conveniently located at 17724 W I20 Odessa, TX along Interstate 20 and feature sales offices, parts warehouse, and 5-bay service shop sitting on 5 acres of land.

Segmental Analysis

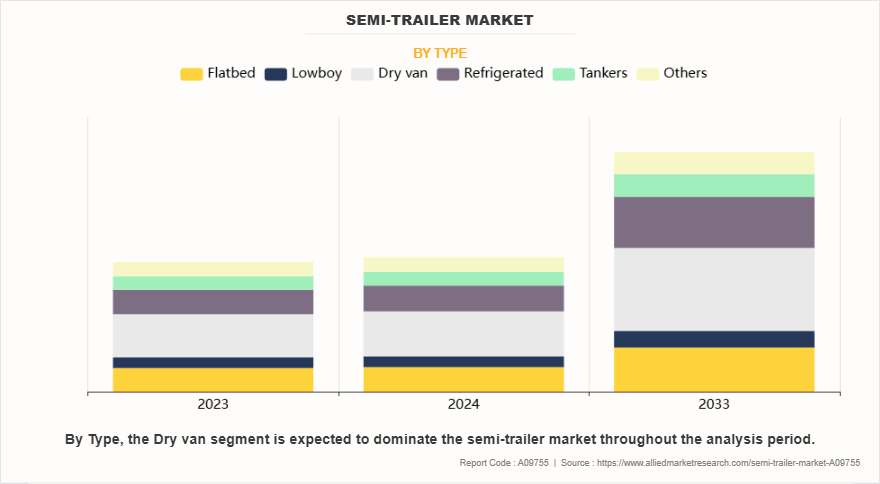

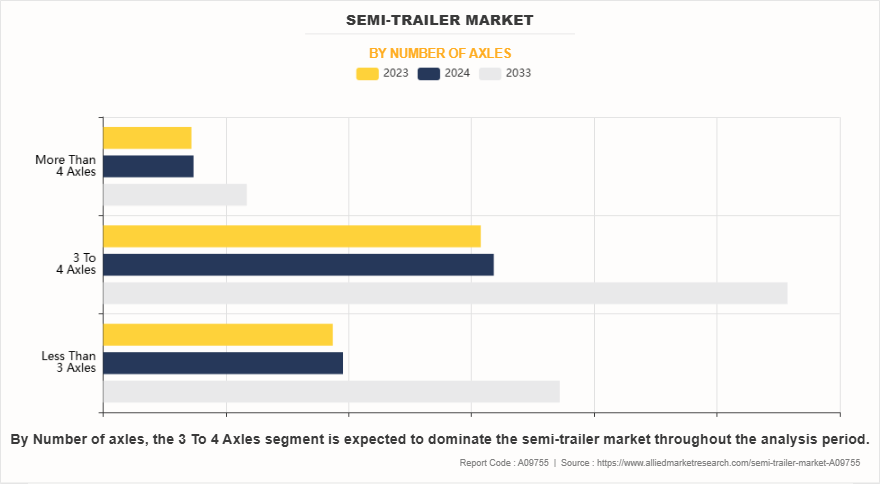

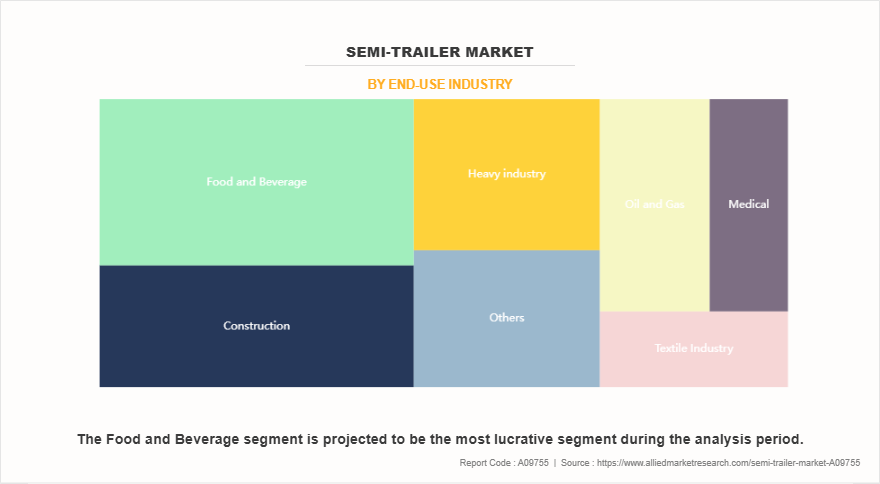

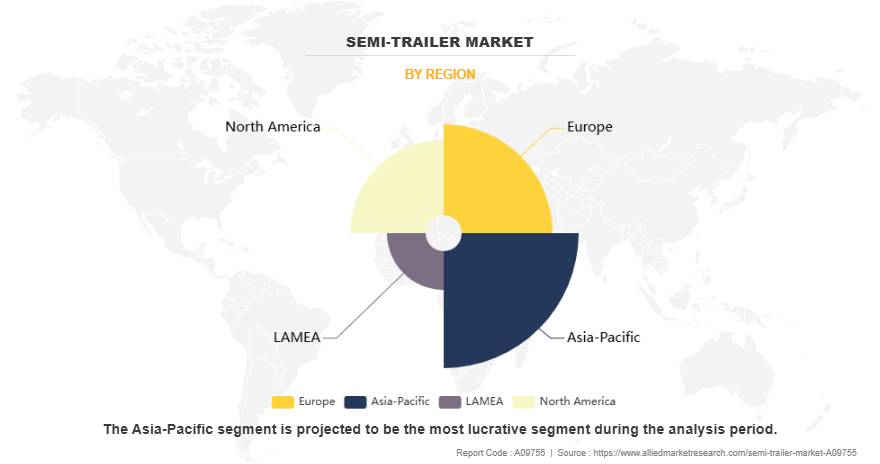

The global semi-trailer market trends is segmented into type, number of axles, end user and region. By type the global market is segregated into flatbed, lowboy, dry van, refrigerated, tankers, and others. By number of axles the global market is analysed into less than 3 axles, 3 to 4 axles, and more than 4 axles. Based on end user the market is segregated into heavy industry, construction, medical, food and beverage, oil and gas, textile industry, and others. Region wise the global market is studied across North America, Europe, Asia-Pacific and LAMEA.

By Type

By Type, the semi-trailer market growth is segregated into flat boy, lowboy, dry van, refrigerated tankers and others. The dry van segment dominated the global semi trailer market in 2023, owing to these trailers are designed to protect cargo from weather elements such as rain, snow, and wind, making them suitable for transporting goods that require protection from the environment. Dry vans are extensively used for transporting retail goods such as clothing, electronics, groceries, and other consumer products from distribution centers to retail stores.

By Number of Axles

By number of axles, the semi-trailer market demand is categorized into less than 3 axles, 3 to 4 axles and more than 4 axles. The 3 to 4 axles segment dominated the semi-trailer market in 2023 owing to, these trailers can carry substantial loads over both short and long distances, making them ideal for a wide range of industries, including manufacturing, construction, and agriculture. They are often used to transport industrial goods, machinery, building materials, and agricultural products. The additional axles provide greater stability and load capacity, enabling these trailers to handle heavier and bulkier cargo compared to those with fewer axles.

By End Use Industry

By end-use industry, the semi-trailer market insights is categorized into heavy industry, construction, medical, food and beverage, oil and gas, textile industry and others. The food and beverage segment dominated the semi-trailer market in 2023 owing to, growing demand for transportation of perishable goods, beverages, and bulk food items. These trailers are equipped with refrigeration units, insulated walls, and climate control systems to maintain the freshness and quality of the products during transit. They are essential for the distribution of goods from farms and processing plants to supermarkets, restaurants, and other retail outlets.

By Region

Region wise the global semi-trailer market size is analyzed into North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region dominated the semi trailer market in 2023 owing to, growth in large-scale infrastructure projects particularly in countries like China, India, Japan, and South Korea are driving up the demand for semi-trailers. Likewise, with increasing investments in smart logistics, automation, sustainable transportation and growing shift towards electric and hydrogen-powered trucks is also driving the need for lightweight and energy-efficient trailers. Moreover, in Asia-Pacific counties such as China, Japan, and India are some of the largest manufacturing hub, and is witnessing higher demand for specialized trailers to support industries like automotive, electronics, and renewable energy.

Growing Use of Multimodal Transportation

Rise in use of multiple transportation modes, is also known as intermodal transportation, and it is a key driver for the growth of the semi-trailer market. Intermodal transportation involves the use of more than one mode of transportation such as trucks, trains, and ships to move goods efficiently over long distances. This approach is particularly helps in optimizing logistics operations, reducing costs, and improving delivery times.

Growing focus on sustainability and reducing carbon emissions also drives the adoption of intermodal transportation. This approach combines the use of rail and ship transport, which are typically more fuel-efficient for long-distance travel, with semi-trailers for shorter routes. The use of multiple transportation modes allows companies to reduce operational cost. For instance, in January 2024, Bison Transport announced a partnership with Canadian Pacific Kansas City (CPKC) to offer international intermodal services, aiming to provide greater transportation flexibility to its customers. This collaboration addresses the growing demand from global shippers for diverse routing options. The partnership is expected to leverage CPKC's north-south rail corridor, which links Canada, the U.S., and Mexico, along with Bison Transport's fleet of 3,000 tractors and 10,000 trailers. CPKC operates 17 intermodal facilities across North America.

Semi-trailers play a vital role in this intermodal system. They are designed to be easily transferred between different modes of transportation without unloading the cargo, ensuring a seamless transition from one mode to another. For instance, a semi-trailer can be loaded onto a flatcar for rail transport over long distances, then transferred to a truck for final delivery. This flexibility makes semi-trailers indispensable in intermodal transportation.

Expansion of E-Commerce Distribution Networks

The global semi-trailer market is benefiting from rapid growth and expansion of e-commerce distribution channels. With rise in online shopping, there is increase in demand for efficient and reliable delivery systems. Companies such as Amazon, Walmart, and other major retailers are continuously expanding their distribution networks to meet consumer expectations for fast and accurate delivery.

For instance, in May 2024, Amazon introduced a fleet of 50 battery-electric heavy-duty trucks in California. These trucks will be utilized in the initial stage of logistics, transporting goods from container ships at the ports to fulfillment centers, and in the intermediary stage, moving packages between fulfillment centers and delivery centers. Also, packages are expected to be distributed by Amazon's last-mile fleet, which includes electric delivery vans manufactured by Rivian.

To accommodate the growth of e-commerce, more semi-trailers are required to transport goods from warehouses to various distribution points and final delivery locations. Semi-trailers, particularly dry vans and refrigerated trailers, are essential in this logistics chain as they offer the flexibility and capacity needed to handle large volumes of diverse products. For example, during peak shopping seasons such as Black Friday and Cyber Monday, the need for additional semi-trailers increases to handle the surge in online orders. Thus, expansion of e-commerce coupled with increase in demand for semi-trailers for logistics, further fuels the market growth.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the semi trailer market analysis from 2023 to 2033 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Semi-Trailer Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 52.3 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 280 |

| By Type |

|

| By Number of axles |

|

| By End-use industry |

|

| By Region |

|

| Key Market Players | STI HOLDINGS, INC., HYUNDAI TRANSLEAD, LLC, Wabash National Corporation, China International Marine Containers (Group) Co., Ltd., Fontaine Trailer, Great Dane, a division of Great Dane LLC, Timpte Inc, MAC Trailer, Utility Trailer Manufacturing Company, LLC., KRONE Trailer |

Development of hybrid models, IoT integration, and development of autonomous features, and advanced safety systems are the upcoming trends of Semi-Trailer Market in the globe.

The food and beverage is the leading end-use industry of semi-trailer market.

Asia-Pacific is the largest regional market for semi-trailer market.

The global semi-trailer market size was valued at $28.3 billion in 2023, and is projected to reach $52.3 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033.

China International Marine Containers (Group) Co., Ltd., Fontaine Trailer , Great Dane, a division of Great Dane LLC, Hyundai Translead, KRONE Trailer, MAC Trailer, STI HOLDINGS, INC. are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...