The global semiconductor in military and aerospace market size was valued at $6.3 billion in 2021, and is projected to reach $12.9 billion by 2031, growing at a CAGR of 7.6% from 2022 to 2031.

A semiconductor refers to a material with properties of a conductor and insulator both. These are sometimes referred to as microchips or integrated circuits (ICs). Generally, semiconductors are made from pure elements such as silicon or germanium, or compounds such as gallium arsenide. In addition, semiconductors are of two types such as N-type and P-type. Moreover, semiconductors are widely utilized in several sectors such as government, industrial, consumer automotive, communications and electronic devices. Furthermore, in military and aerospace sector, semiconductors are used in manufacturing of numerous devices & systems such as communication & navigation systems, safety equipment, engine & flight control systems, missile systems, avionics systems and others.

![]()

The semiconductor in military and aerospace market is driven by rise in military expenditure, rise in aircraft upgradation & modernization programs, and use of radiation tolerant semiconductor components. However, scarcity of semiconductors is the factor hampering the growth of the market. Furthermore, growth in investments by several governments in space technology, and defense modernization are the factors expected to offer growth opportunities during the forecast period.

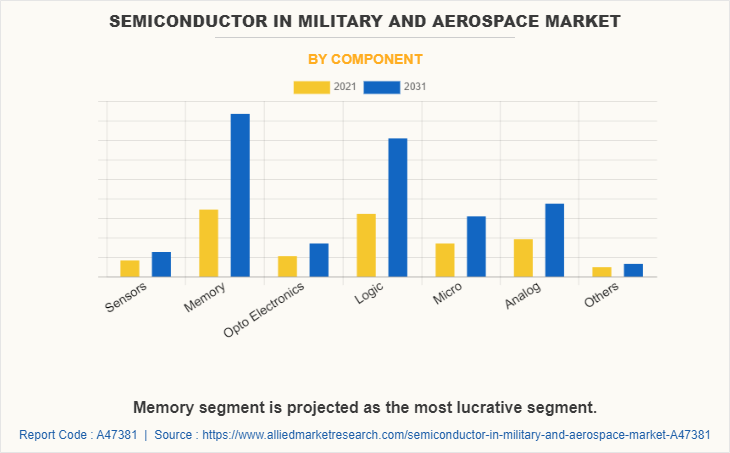

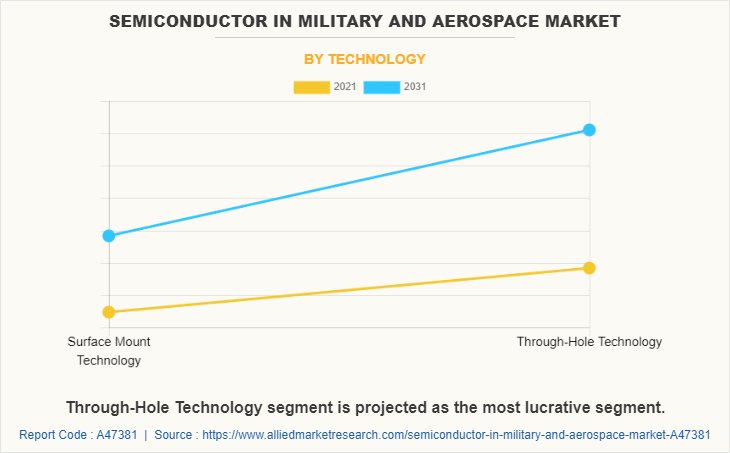

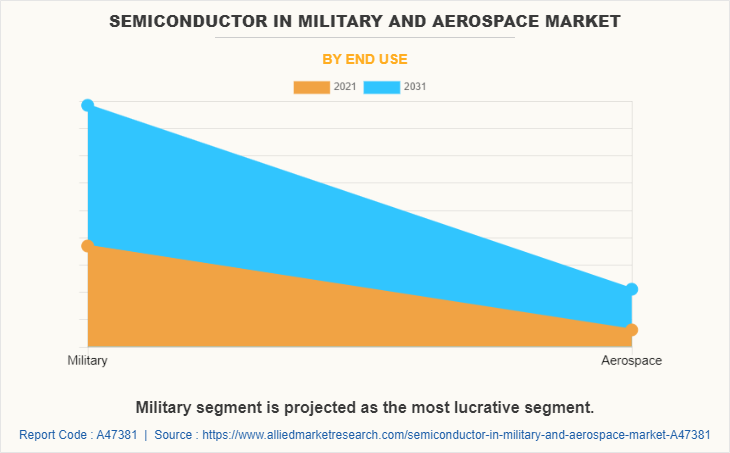

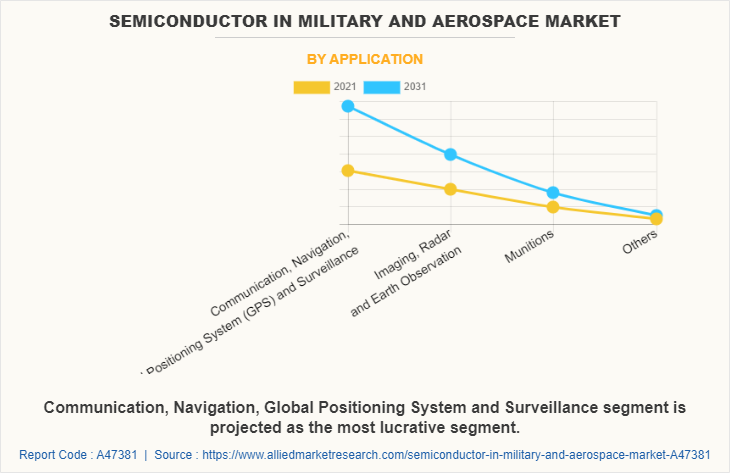

The semiconductor in military and aerospace market is segmented on the basis of component, technology, end use, application, and region. By component, it is fragmented into up to sensors, memory, opto electronics, logic, micro, analog, and others. By technology, it is categorized into surface mount technology, and through-hole technology. By end use, it is fragmented into military, and aerospace. By application, it is classified into communication, navigation, global positioning system & surveillance; imaging, radar & earth observation; munitions, and others. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Europe includes countries such as UK, Germany, France, Italy, and rest of Europe. Rest of Europe includes Spain, Netherlands, Sweden, Poland, and others. In Europe, several projects are currently in progress to produce advanced semiconductor-based space electronics with enhanced capability to shield space perturbations at low cost, which supplements the growth of the market across Europe.

Increased military spending towards the development of defense sector across European countries creates ample opportunities for the growth of semiconductor in military and aerospace market across Europe. For instance, Netherlands government announced $14.26 billion of the defense budget for the financial year 2022, a 5.4% real increase over last year’s defense budget. In addition, Europe is heavily focused on strengthening its space domain. For instance, in December 2021, European Space Agency (ESA) has given a contract to CAES, to develop a fault- and radiation-tolerant system-on-chip. Furthermore, it is funded by the Swedish National Space Agency, the project will improve performance and power efficiency in satellite and spacecraft applications by developing a 16-core, space-hardened microprocessor based on the instruction set architecture (ISA).

France is one of the major countries in Europe, which plays pivotal role in space sector. Space is a huge market with unlimited opportunities, and semiconductor-based space electronics components are required across all platforms to function. The favored strategy for the companies has been collaboration for their position in the semiconductor in military and aerospace market. For instance, in March 2022, STMicroelectronics introduced economical radiation hardened ICs for space satellites. The new series of radiation-hardened power, analog, and logic ICs in low-cost plastic packages provide important functions for the satellites’ electronic circuitry. The first nine devices in this series have just been released and include a data converter, a voltage regulator, a low-voltage differential signaling transceiver, a line driver, and five logic gates that are used throughout systems like power generation and distribution, on-board computers, telemetry star trackers, and transceivers. Also, in April 2021, Exxelia introduced a high-performance space-graded resistor that help in requirements of weapons platforms, modern electronic warfare, and a wide range of space applications.

Italy is among the top nations in Europe, in terms of defense expenditure. The Italian government announced $18.4 billion of the defense budget for the financial year 2022, as compared to $17.3 billion in 2021. The part of budget devoted to procurement stands at $5.58 billion, a rise of 34% from $4.12 billion spent in 2021. Rise in Italian defense spending is expected to propel growth of the market in the country during the forecast period. Moreover, Italy is drawing its focus towards modernizing its space electronic. For instance, in August 2021, STMicroelectronics collaborating with Xilinx, Inc. to build a power solution for the Xilinx kintex ultraScale XQRKU060 radiation-tolerant field programmable gate array. Such developments collectively contribute in growth of the market in Italy.

European countries, such as Russia, Spain, Switzerland, the Netherlands, Norway, Denmark, Sweden, Belgium, Luxemburg, Finland, and others are also among the major contributors to the rest of Europe semiconductor in military and aerospace market. In Rest of Europe, increased government spending towards enhancing the defense sector of European countries and strengthening them against unknown threats creates an increased demand for advanced semiconductor components. This increased demand creates a wider scope for the growth of the market across the region.

Some leading companies profiled in the semiconductor in military and aerospace market report include Advanced Micro Devices Inc. (Xilinx Inc.), Analog Devices, Inc., Infineon Technologies AG, Microchip Technology Inc., Northrop Grumman Corporation, NXP Semiconductors NV, ON Semiconductor Corporation, Raytheon Technologies Corporation, Teledyne Technologies Inc., and Texas Instruments Incorporated.

Rise in military expenditure

Leading countries such as the U.S., Russia, China, Saudi Arabia, and India are strengthening the defense sectors by investing huge amounts in the procurement and development of advanced military systems. In addition, due to the rise in concern for border security and terrorism, the emerging economies across the globe are modernizing their conventional defense equipment and systems to tackle the enemy. For instance, according to Stockholm International Peace Research Institute (SIPRI), military spending by the U.S amounted to a total of $801 billion in 2021 and the U.S. military burden decreased from 3.7% of GDP in 2020 to 3.5% in 2021. Moreover, military spending of China was $293 billion in 2021, a 4.7% increase compared with 2020.

Moreover, in defense, semiconductors have their application in communication equipment, fire control systems, propulsion systems, auxiliary power units, navigation systems, and others. Furthermore, advancements of weapons and attacking capabilities worldwide have created the demand for modernization and installation of sophisticated defense infrastructure by governments to be prepared for any unprecedented threats and offensive attacks from foreign countries. Therefore, militaries across the globe are investing in the UAV solutions such as drones for effective operations of advanced security systems, which in turn is creating demand for enhanced semiconductor components. Thus, rise in military spending is driving the growth of the market during the forecast period.

Rise in aircraft upgradation and modernization programs

As per SIPRI, Europe’s military spending in 2019 witnessed a 5% year on year growth to reach $356 billion and account for 19% of the global military spending. In addition, the UK, France, Russia, Germany, and Italy have consistently ranked amongst the highest global defense spending nations each year, signifying substantial investments towards the R&D of advanced weapons and procurement of sophisticated military assets. For instance, in January 2019, the French government signed a $2.3 billion contract to upgrade the Rafale fleet with the F4 standard. The aircraft fleet would include upgraded radar sensors and front-sector optronics and improved helmet-mounted displays (HMDs). The upgrade of aircraft fleet would also include provisions to use MBDA’s Mica NG air-to-air missile and the 1,000 kg AASM air-to-ground modular weapon and the Scalp missiles. Such type of numerous modernization programs are currently underway in most nations in Europe, thereby creating a positive outlook for the market in focus during the forecast period.

Use of radiation tolerant semiconductor components

The space environment comprises high-level radiations that cannot be sustained by normal electronic devices as they are vulnerable to radiation effects. To overcome these challenges, radiation-hardened semiconductor-based electronic devices are designed and manufactured to sustain malfunctions caused by particle radiation and electromagnetic radiation in space. The major problem caused by radiation is electronic noise and signal spikes. A single charged particle can generate such electronic noise and signal spike that can kill thousands of loose electrons. This results in errors in the implementation of electronic devices used in satellites and spacecraft. To avoid these obstructions for critical applications, the manufacturers must implement radiation-hardened techniques in electronic components.

The rise in satellite launch and space activities related to low earth orbit (LEO) has allowed operators to incline toward radiation-tolerant components. The electronics components being operated in LEO are exposed to 12 to 28.8 million rads per day. The radiation-hardened semiconductor-based electronics are designated to operate effectively over 100krad, whereas the radiation-tolerant components are designed to operate below the 100krad limit. The radiation tolerant components are considerably more economical than radiation-hardened electronics. Also, radiation-tolerant components are much easier to manufacture, and the lead time for manufacturing is also eligible as compared to radiation-hardened components. Benefits such as lower acquisition cost and less lead time are primary factors attracting end-users to shift from radiation-hardened electronics to radiation-tolerant electronics for LEO operations.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the semiconductor in military and aerospace market analysis from 2021 to 2031 to identify the prevailing semiconductor in military and aerospace market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the semiconductor in military and aerospace market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global semiconductor in military and aerospace market trends, key players, market segments, application areas, and market growth strategies.

Semiconductor in Military and Aerospace Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 12.9 billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 302 |

| By Component |

|

| By Technology |

|

| By End Use |

|

| By Application |

|

| By Region |

|

| Key Market Players | Texas Instruments Incorporated, Microchip Technology Inc., Northrop Grumman Corporation, Raytheon Technologies Corporation, Teledyne Technologies Inc., ON Semiconductor Corporation, NXP Semiconductors NV, Advanced Micro Devices Inc.(Xilinx Inc.), Analog Devices, Inc., Infineon Technologies AG |

Analyst Review

The global semiconductor in military and aerospace market is expected to witness growth owing to rise in military expenditure and rise in aircraft upgradation & modernization programs.

Defense organizations in numerous countries are working toward enhancing their aircraft fleet capabilities by upgrading their existing fleet aircraft. For instance, in March 2022, USAF unveiled a $6.3 billion F-16 fighter Jet Upgrade program. Under the program, F-16s will be equipped with Northrop Grumman APG-83 Scalable Agile Beam Radar (SABR) with an active electronically scanned array (AESA). Other elements of the new program include a large center pedestal display unit, programmable data generator, new generation electronics warfare capability, modernized mission computer, and communication suite upgrade.

Moreover, to gain a fair share of the market, major players adopted different strategies, for instance, product launch, and joint venture. Among these, product launch is the leading strategy used by prominent players such as Infineon Technologies AG, Microchip Technology Inc., and Teledyne Technologies Inc.

The global semiconductor in military and aerospace market was valued at $6,309.4 million in 2021, and is projected to reach $12,940.6 million by 2031, registering a CAGR of 7.6%.

Military is the leading end use of Semiconductor in Military and Aerospace Market.

North America is the largest regional market for Semiconductor in Military and Aerospace.

The upcoming trends of Semiconductor in Military and Aerospace Market include increase in military expenditure and aircraft modernization programs.

Some leading companies profiled in the report include Advanced Micro Devices Inc. (Xilinx Inc.), Analog Devices, Inc., Infineon Technologies AG, Microchip Technology Inc., Northrop Grumman Corporation, NXP Semiconductors NV, ON Semiconductor Corporation, Raytheon Technologies Corporation, Teledyne Technologies Inc., and Texas Instruments Incorporated.

Loading Table Of Content...