Semiconductor Inspection System Market Research, 2031

The global semiconductor inspection system market size was valued at $5.2 billion in 2021, and is projected to reach $8.9 billion by 2031, growing at a CAGR of 5.4% from 2022 to 2031. Inspection is important in controlling the semiconductor manufacturing process. The entire manufacturing process for semiconductor wafers involves 400-600 steps and takes 1-2 months. If an error occurs early in the process, all the work in the time-consuming steps that follow will be wasted. Therefore, inspection processes are set at critical points in the semiconductor manufacturing process to ensure and maintain specific yields.

Semiconductor inspection system equipment defect review, analysis, and classification of the means to monitor and control the quality of individual steps in the semiconductor manufacturing sequence. The semiconductor inspection system market is growing owing to the expansion of the semiconductor industry in countries such as China and, U.S. Japan and Taiwan. Further, the increase in demand for electronic products such as smartphones, wearables, laptops, computers, televisions, and others is creating lucrative opportunities for the semiconductor inspection system market growth. Moreover, growth in demand for hybrid circuits from medical, military, photonics, and wireless electronics applications is propelling the semiconductor inspection system market opportunity. However, fluctuation in raw material prices is expected to hinder market growth.

![]()

Moreover, nations such as China, South Korea, the U.S., and India are witnessing an increase in investments in semiconductor manufacturing industries. For instance, in June 2022, the Indian government announced that India would spend $30 billion to restructure its IT industry and build up a semiconductor supply chain. According to Gourangalal Das, director-general of the India-Taipei Association. The investment initiative is aimed at boosting local production of semiconductors, displays, advanced chemicals, networking and telecom equipment, as well as batteries and electronics. All such factors are fueling the semiconductor inspection system market growth.

Major players have adopted various strategies, such as product launches and acquisitions, to sustain the competition and improve their product portfolio. For instance, in April 2022, ASML Holdings N.V. launched HMI eScan 1100, the first multiple e-beam (multibeam) wafer inspection system for in-line yield enhancement applications, including voltage contrast defect inspection and physical defect inspection.

Segment Review

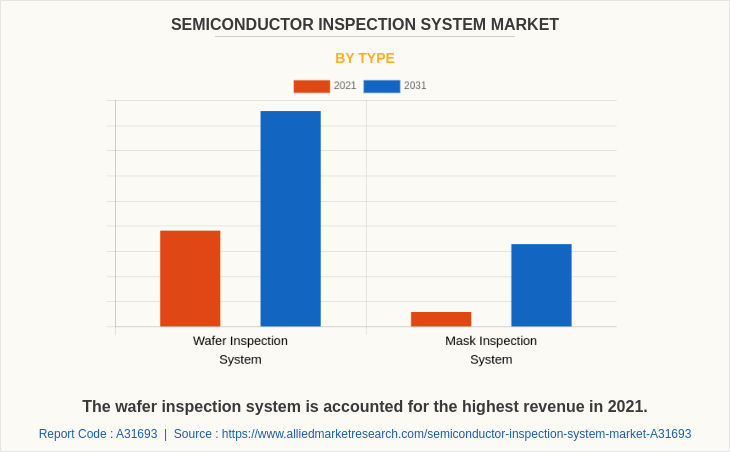

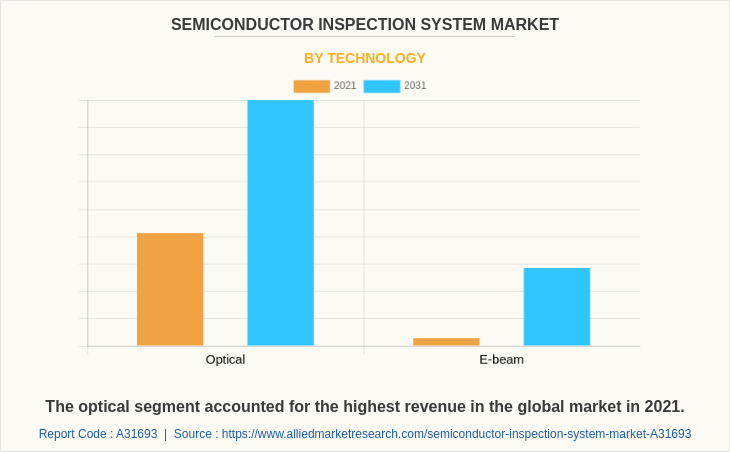

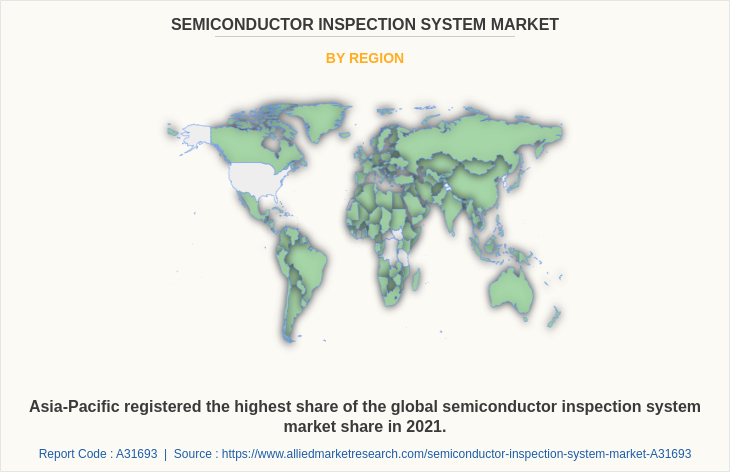

The semiconductor inspection system market is segmented into TYPE, Technology, and End-User. On the basis of type, the market is segmented into wafer inspection systems and mask inspection systems. On the basis of technology, the market is divided into optical and E-beam. Based on end-user, the market is divided into integrated device manufacturers (IDM), foundries, and memory manufacturers. Region-wise, the global market analysis is conducted across North America, Europe, Asia-Pacific, and LAMEA.

Based on type, the wafer inspection system segment generated the highest revenue in 2021, owing to it being aimed at finding the position coordinates of defects (X, Y). One of the causes of defects is the adhesion of dust or particles. It is therefore not possible to predict where defects will occur. It is a process for detecting any particles or defects in a wafer. It allows engineers to quickly detect, resolve, and monitor excursions to provide greater control of quality for improved device performance.

On the basis of technology, the optical segment accounted for the highest revenue in the global market in 2021. The technology is commonly used in the production line, as it is faster and is being stretched to the advanced nodes. Optical technology is used for tool and line monitoring in fabrication.

Based on region, Asia-Pacific registered the highest share of the global semiconductor inspection system market in 2021, owing to the expansion of the semiconductor industry in South Korea, China, Japan, Taiwan, and India. Furthermore, the region's high concentration of IC makers is expected to drive the demand for semiconductor inspection systems in the Asia-Pacific. ICs are widely used in a variety of industries, including consumer electronics, industrial, telecommunications, data centers, and automotive.

Competition Analysis

The key players that operate in the semiconductor inspection system market are Applied Materials Inc., ASML Holding N.V., C&D Semiconductor Services Inc., Hitachi High-Technologies Corp., KLA Corporation, Lasertec Corporation, Nikon Metrology NV., Onto Innovation, Inc., Thermo Fisher Scientific Inc., and Toray Engineering.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging global semiconductor inspection system market trends and dynamics.

- In-depth market global semiconductor inspection system market analysis is conducted by constructing market estimations for key market segments between 2022 and 2031.

- An extensive analysis of the semiconductor inspection system market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The semiconductor inspection system market forecast analysis from 2022 to 2031 is included in the report.

- The key players in the semiconductor inspection system market are profiled in this report, and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the semiconductor inspection system industry.

Semiconductor Inspection System Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 8.9 billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 186 |

| By Type |

|

| By End-User |

|

| By Technology |

|

| By Region |

|

| Key Market Players | Applied Materials, Inc., KLA Corporation, Onto Innovation Inc., Nikon Corporation, Thermo Fisher Scientific Inc., Lasertec Corporation, Toray Industries, Inc., C&D Semiconductor Services Inc., ASML Holdings N.V., Hitachi Ltd. (Hitachi High-Tech Corporation) |

Analyst Review

Semiconductor manufacturing is a complicated process in which quality assurance is critical. The equipment ensures wafer fabrication, semiconductor component assembly, and device testing. Attributed to the rising demand for electronics and gadget services, the market is projected to grow during the forecast period. In addition, due to its widespread usage in solar panels, sensors, plug-in electric vehicles, wind turbines, smart meters, and other applications, the demand for the product is continually rising. The demand for semiconductor inspection systems in the global market is fueled by the usage of semiconductors in consumer electronics.

Furthermore, key players are implementing various strategic moves, such as partnerships and collaboration, to expand their business and product portfolio in the market. A rise in the manufacturing of digital devices and 5G connectivity around the globe will create opportunities for the key players to strengthen their place in the market. For instance, in April 2022, Lasertec Corporation launched a new mask inspection system, the Matrics X9ULTRA Series, this system is designed for pellicle-less EUV mask inspection in the technology nodes of 3nm and beyond. Thus, the increased need for ICs as a result of the strong demand for electronic devices has provided many opportunities for the country's semiconductor sector. Therefore, it will provide a positive impact on the market during the forecast period.

The rise in demand for electronic devices by consumers drives the demand for chips is one of the upcoming trends of the Semiconductor Inspection System Market in the world.

Integrated Device Manufacturers (IDM) is the leading end-user of Semiconductor Inspection System Market.

Asia-Pacific is the largest regional market for Semiconductor Inspection System.

The global semiconductor inspection system market was valued at $5,194.3 million in 2021.

Applied Materials Inc., ASML Holding N.V., C&D Semiconductor Services Inc, Hitachi High-Technologies Corp., KLA Corporation, Lasertec Corporation, Nikon Metrology NV., Onto Innovation, Inc., Thermo Fisher Scientific Inc, Toray Engineering are the top companies to hold the market share in Semiconductor Inspection System.

Loading Table Of Content...