Serum Free And Specialty Media Market Research, 2033

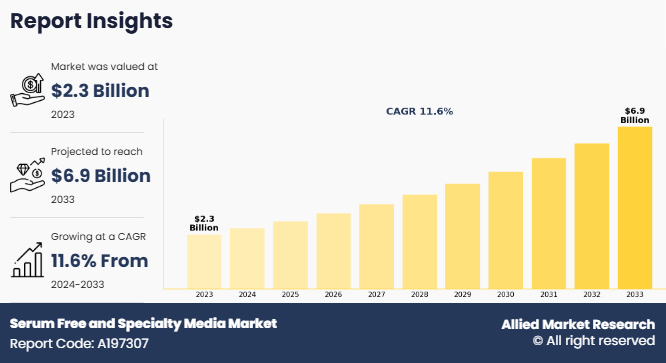

The global serum free and specialty media market was valued at $2.3 billion in 2023, and is projected to reach $6.9 billion by 2033, growing at a CAGR of 11.6% from 2024 to 2033. The biopharmaceutical production sector is witnessing significant growth, driven by the increasing incidence of chronic diseases and the global demand for innovative therapies. Governments worldwide are investing significantly in biomanufacturing infrastructure. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), manufacturing investments in China have grown on average 19% each year, in 2022, a rate significantly higher than that observed in Europe and the U.S, thereby driving the market growth.

The rise in demand for biologics and cell therapies is a significant factor driving the growth of the serum-free and specialty media market, as these advanced therapies depend on precise and consistent cell culture processes. Biologics, including monoclonal antibodies, vaccines, and recombinant proteins, require high-purity production methods to meet regulatory standards and ensure therapeutic efficacy. Serum-free media plays a key role in these processes by offering consistency, reducing contamination risks, and eliminating variability associated with animal-derived components. This drives biopharmaceutical companies to adopt serum-free formulations for more reliable and scalable production.

The serum-free and specialty media market refers to the segment of the biotechnology and pharmaceutical industries dedicated to the production and use of advanced culture media designed to support the growth and maintenance of cells in vitro. Serum-free media are formulations that exclude animal-derived serum components, offering greater consistency, reproducibility, and reduced risk of contamination or ethical concerns. Specialty media are tailored to meet the specific nutritional and environmental needs of particular cell types, such as stem cells, T-cells, or hybridomas, making them essential for applications in cell therapy, vaccine production, and regenerative medicine.

Key Takeaways

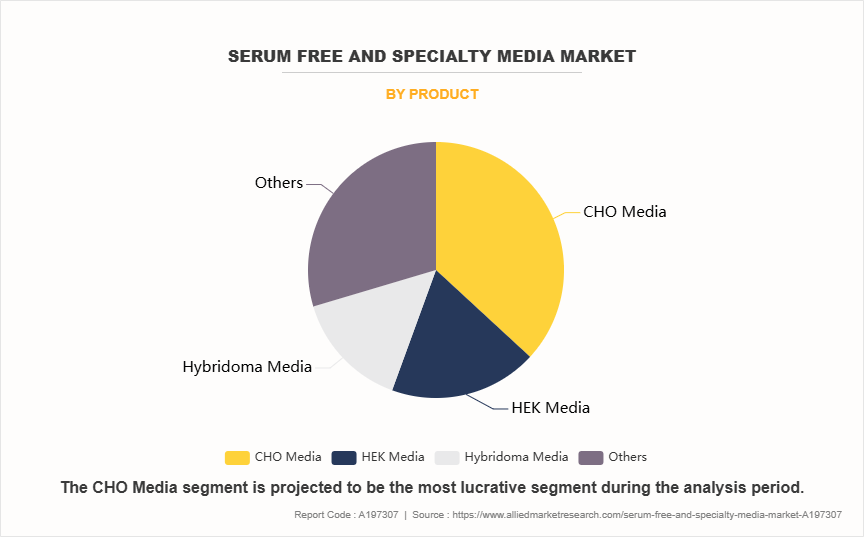

- On the basis of product, the CHO media segment dominated the serum free and specialty media market size in terms of revenue in 2023. However, the others segment is expected to register the highest CAGR during the forecast period.

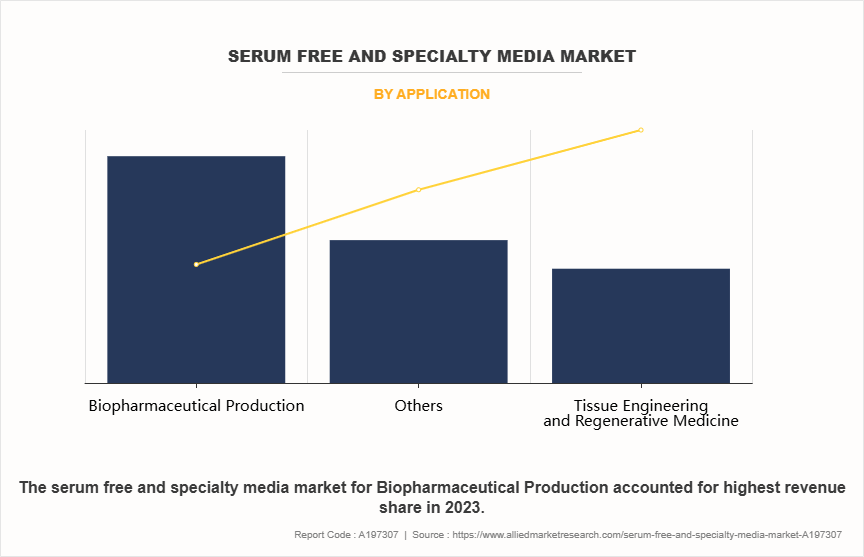

- On the basis of application, the biopharmaceutical production segment dominated the market in terms of revenue in 2023. However, the others segment is expected to register the highest CAGR during the forecast period.

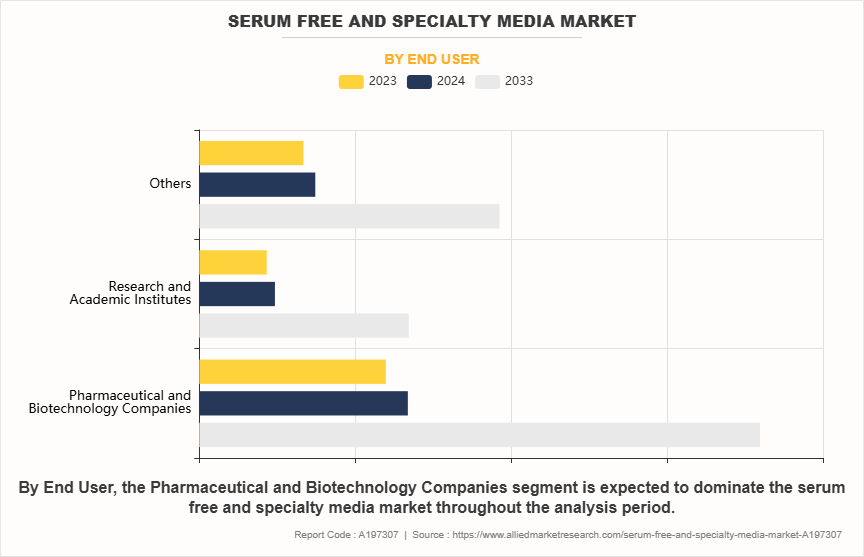

- On the basis of end user, the pharmaceutical and biotechnology companies segment dominated the market share in 2023. However, the research and academic institutes segment is expected to register its highest CAGR during the forecast period.

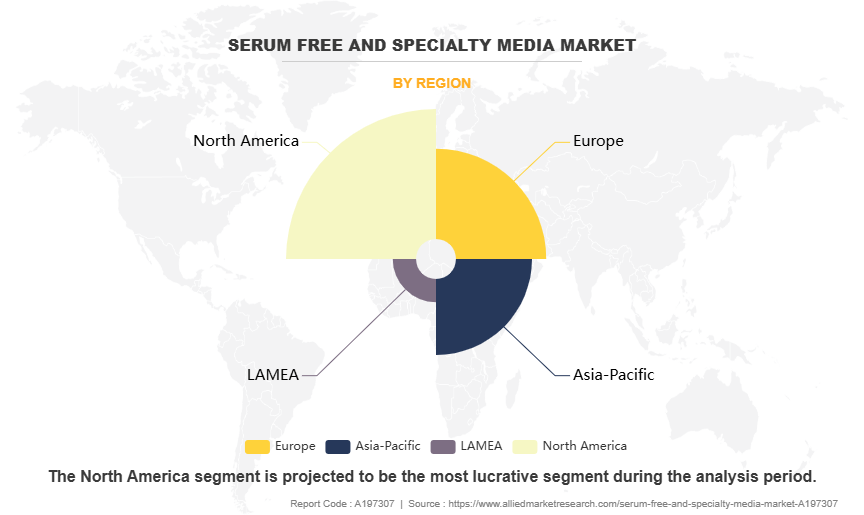

- By region, North America held the largest serum free and specialty media market share in 2023. However, Asia-Pacific is anticipated to grow at the fastest CAGR during the forecast period.

Market Dynamics

Specialized cell culture formulations are designed to support the growth of cells providing a controlled environment that enhances consistency and reproducibility. These media contain defined nutrients, growth factors, and hormones tailored for specific cell types, allowing for precise evaluations of cellular function and improved productivity. They are majorly serum free as serum-free media (SFM) eliminates variability associated with serum, reducing contamination risks and simplifying downstream processing. Specialty media include tailored formulations for specific applications. Various specialty media are available such as CHO media, hybridoma, stem cell culture, HEK media and others. Serum-free specialty media are essential in biopharmaceutical research and manufacturing, facilitating the development of innovative therapies.

The rise in demand for biologics and cell therapies is a significant driver for the serum free and specialty media market growth, as these advanced therapies depend on precise and consistent cell culture processes. Biologics, including monoclonal antibodies, vaccines, and recombinant proteins, require high-purity production methods to meet regulatory standards and ensure therapeutic efficacy. Serum-free media plays a key role in these processes by offering consistency, reducing contamination risks, and eliminating variability associated with animal-derived components. This drives biopharmaceutical companies to adopt serum-free formulations for more reliable and scalable production.

Similarly, the increasing adoption of cell therapies, such as stem cell therapies, CAR-T therapies, and regenerative medicine, increases demand for specialty media tailored to support the unique nutritional and growth requirements of specific cell types. These therapies require optimized media formulations to maintain cell viability, proliferation, and functionality. As cell therapies gain traction for treating chronic diseases and cancer, the need for high-quality, specialized culture media will continue to rise, driving serum free and specialty media market growth.

However, regulatory challenges and strict approval processes create significant restraints on the serum-free and specialty media market, as compliance with rigorous standards can be both time-consuming and costly. Biopharmaceutical and biotechnology companies must adhere to strict guidelines set by regulatory bodies such as the U.S. FDA, EMA, and other global authorities to ensure the safety, consistency, and efficacy of their products. Developing serum-free and specialty media that meet these regulatory requirements often requires extensive testing, validation, and documentation, which can delay product approvals and market entry.

On the other hand, the transition from traditional serum-based media to serum-free or chemically defined alternatives can trigger further regulatory scrutiny. Manufacturers must demonstrate that these media formulations achieve the same or improved results in cell culture processes while ensuring stability and reproducibility. This process can create hurdles for smaller companies with limited resources, impacting their ability to innovate and compete. As a result, regulatory challenges add complexity to product development, slowing down adoption and market growth.

Furthermore, the rising focus on personalized medicine is creating significant serum free and specialty media market opportunity, as these advanced therapies depend on precise and tailored cell culture processes. Personalized medicine involves developing treatments customized to individual patients, such as cell and gene therapies, which require specialized media formulations to support specific cell types like T-cells, stem cells, and CAR-T cells. Serum-free media ensure consistent and reproducible results, which are critical for maintaining the efficacy and safety of personalized therapies while adhering to stringent regulatory standards.

Moreover, the demand for high-purity, animal-component-free media is rising as personalized medicine gains traction in treating diseases like cancer, genetic disorders, and autoimmune conditions. Specialty media, designed to optimize cell growth, viability, and functionality, are increasingly used in the production of autologous and allogeneic therapies. As healthcare systems shift toward precision medicine to improve patient outcomes, the need for advanced, customizable media solutions will continue to grow, driving innovation and serum free and specialty media market forecast.

Segments Overview

The serum-free and specialty media market analysis is segmented into product type, application, end user, and region. By product type, the market is segregated into CHO media, HEK media, hybridoma media, and others. By application, the market is fragmented into biopharmaceutical production, tissue engineering & regenerative medicine, and others. By end user, the market is segregated into pharmaceutical & biopharmaceutical companies, research & academic institutes, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Product Type

The CHO media segment dominated the serum free and specialty media market share 2023, due to the widespread use of CHO cells in biopharmaceutical production, particularly for monoclonal antibodies, vaccines, and recombinant proteins. CHO cells are favored for their high productivity, adaptability to serum-free and chemically defined media, and ability to produce human-like glycosylation patterns, essential for therapeutic efficacy. However, the others segment is expected to register the highest CAGR during the forecast period. This is owing to the expanding applications of these cell types in emerging areas of biotechnology and biopharmaceutical production. Immunology media are crucial for developing immunotherapies, including CAR-T cell therapies, which are gaining traction in cancer treatment. Insect cell media growing utilization in recombinant protein production, gene therapy, and vaccine development further increases the segment growth. Stem cell media are witnessing significant demand owing to advancements in regenerative medicine, cell therapies, and tissue engineering.

By Application

The market is segmented into biopharmaceutical production, tissue engineering & regenerative medicine, and others. The biopharmaceutical production segment dominated the serum free and specialty media market size in 2023 due to the increasing demand for biologics, including monoclonal antibodies, recombinant proteins, and vaccines, to treat chronic diseases such as cancer, diabetes, and autoimmune disorders. Biopharmaceutical production relies heavily on serum-free and specialty media to ensure consistent, high-quality cell culture processes, minimizing contamination risks and meeting stringent regulatory standards. The shift toward chemically defined and animal-component-free media has further driven adoption, supporting scalable and reproducible production. However, the others segment is expected to register the highest CAGR during the forecast period. This is owing to the growing applications of serum-free and specialty media in these fields. In drug discovery and development, vaccine development advanced media formulations are essential for optimizing cell growth, viability, and productivity, particularly for high-throughput screening and compound testing.

By End User

The pharmaceutical and biopharmaceutical companies segment held the largest serum free and specialty media share in 2023. This is attributed to them being primary users of serum-free and specialty media, as they require high-purity, scalable, and consistent cell culture processes to meet the growing demand for biologics, such as monoclonal antibodies and recombinant proteins. The adoption of serum-free media ensures compliance with regulatory requirements, reduces contamination risks, and enhances the efficiency of biomanufacturing processes. However, the others segment is expected to register the highest CAGR during the forecast period. This is owing to the growing applications of serum-free and specialty media in these fields. In drug discovery and development, vaccine development advanced media formulations are essential for optimizing cell growth, viability, and productivity, particularly for high-throughput screening and compound testing.

By Region

The serum free and specialty media industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the serum free and specialty media market share in 2023. This dominance is attributed to its well-established biopharmaceutical sector and high demand for biologics and monoclonal antibodies. The region benefits from substantial investments in biotechnology, research, and development, which enhances the adoption of advanced technologies such as bioprocessing and biomanufacturing, 3D cell culture and organoid development, tissue engineering and regenerative medicine.

However, Asia-Pacific is anticipated to register the highest CAGR during the forecast period owing to rapid advancements in biotechnology and pharmaceutical manufacturing. The region has witnessed increased investments in biomanufacturing facilities and infrastructure, which boosts the demand for 3D cell culture and tissue engineering and regenerative medicine in serum-free and specialty media market.

Competitive Analysis

Key players such as Merck KGAA and FUJIFILM Irvine Scientific have adopted expansion and product launch as key developmental strategies to improve the product portfolio of the serum free and specialty media market. For instance, in December 2021, FUJIFILM Corporation begins operations at its new, state-of-the-art cell culture media manufacturing facility located in Tilburg, Netherlands to meet an increasing global demand for biopharmaceuticals.

Recent Development in the Serum Free and Specialty Media Industry

- In December 2021, FUJIFILM Corporation begins operations at its new, state-of-the-art cell culture media manufacturing facility located in Tilburg, Netherlands to meet an increasing global demand for biopharmaceuticals. The facility provides state-of-the-art life science manufacturing and joins locations in the U.S. and Japan to enable increased production capacity of cell culture media products, acting as a hub for both European and global markets.

- In July 2024, Merck, a leading science and technology company announced the start of commercial production of its first GMP (Good Manufacturing Practices) compliant manufacturing line for cell culture media (CCM) in China. The approximate €6.6 million investment at its Life Science Center in Nantong a major industrial hub in the Yangtze River Delta region aims to address the growing local demand for quality custom CCM used in biopharmaceuticals, vaccines, and novel therapeutics.

- In July 2023, Merck announced the expansion of its facility in Lenexa, Kansas, U.S. adding 9,100 sq m2 of lab space and production capability to manufacture cell culture media.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the serum free and specialty media market analysis from 2023 to 2033 to identify the prevailing serum free and specialty media market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the serum free and specialty media market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global serum free and specialty media market trends, key players, market segments, application areas, and market growth strategies.

Serum Free and Specialty Media Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 6.9 billion |

| Growth Rate | CAGR of 11.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Product |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Merck KGaA, MP Biomedicals, Bio-Techne, Danaher Corporation, Corning Incorporated, Fujifilm Holdings Corporation, Sartorius AG, PAN-Biotech, Lonza, Thermo Fisher Scientific Inc. |

Analyst Review

According to insights from CXOs, the serum-free and specialty media market is projected to witness substantial growth, driven by the increasing demand for biologics, vaccines, cell-based therapies, and regenerative medicine. The shift toward serum-free formulations is primarily attributed to the need for consistency, ethical considerations, and compliance with strict regulatory frameworks. Specialty media, designed to support specific cell types like stem cells and T-cells, are gaining traction owing to their critical role in advancing cell therapy and immunotherapy research. Advancements in media formulations, including chemically defined and xeno-free options, have significantly improved reproducibility and reduced contamination risks, making these products indispensable for modern biotechnology.

CXOs further highlight the rising prevalence of chronic diseases and the growing emphasis on personalized medicine as key drivers of the market. The demand for efficient and high-purity production methods for biologics, vaccines, and cell therapies has accelerated the adoption of serum-free and specialty media. Continuous improvements in media technology, such as enhanced nutrient formulations and scalability, have also made production processes cost-effective and aligned with industrial needs. Government investments in biomanufacturing infrastructure and collaborative efforts between academia and industry further contribute to the market's rapid expansion.

Furthermore, North America leads the market owing to its advanced biopharma sector and stringent quality standards, while Asia-Pacific is emerging as a high-growth region owing to increased investments in biotechnology and rise in demand for biologics. Europe continues to adopt innovative solutions to align with its robust regulatory environment, presenting diverse opportunities across regions.

2023 is the base year of serum free and specialty media market.

2024 to 2033 is the forecast year of serum free and specialty media market.

Biopharmaceutical production is the leading application of serum free and specialty media market

North America is the largest regional market for serum free and specialty media market.

The estimated industry size of serum free and specialty media market in 2033 is 6.9 billion

Thermo Fischer, Merck KGAA, Danaher Corporation (Cytiva), Sartorius AG are the top companies to hold the market share in serum free and specialty media market

Loading Table Of Content...

Loading Research Methodology...