Server Microprocessor Market Overview:

Global Server Microprocessor Market was valued at $14 billion in 2016 and is projected to reach $16 billion by 2023, growing at a CAGR of 2.1% from 2017 to 2023.

Server microprocessors are central processing units used in the servers to handle the analytical decision-making processes. These server microprocessors are used inside the servers used in data centers and various enterprises among others.

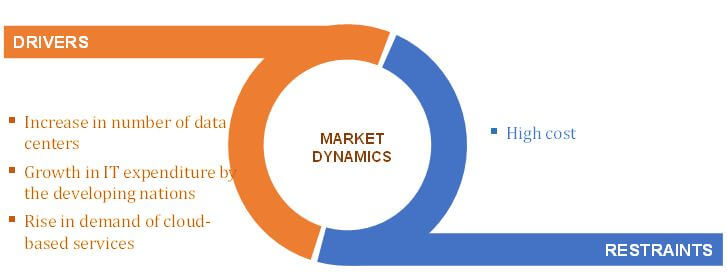

The factors that drive the market are a rise in several data centers, growth in IT expenditure by developing nations, and a rise in demand for cloud-based services. However, high cost restrains the market growth. Moreover, the rise in the trend of the Internet of Things (IoT) is anticipated to provide new opportunities in the market.

Segment Review

The global server microprocessor market is segmented based on design, end user, and geography. Based on design, it is bifurcated into advanced RISC machines (ARM) and x86. Based on end users, it is categorized into large enterprise, medium enterprise, and small enterprise. Geographically, it is analyzed across North America (U.S., Mexico, and Canada), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, Taiwan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Global Server Microprocessor Market Segmentation

Top Impacting Factors

Increase In the Number Of Data Centers

In the last decade, the penetration of the internet has considerably increased globally leading to a rise in several data centers where server microprocessors are used. The rise in user-based online services such as Facebook, YouTube, Twitter, and cloud computing has given rise to the demand for data centers. These centers store personal data in a centralized system that uses servers on a large scale leading to market growth.

Europe and Asia-pacific Are Expected to be a Lucrative Region

The Europe and Asia-Pacific server microprocessor market is expected to grow at a high CAGR during the forecast period, owing to the increase in the number of data centers, cloud-based services, and the rise in IT expenditure.

Competitive landscape

The report provides a comprehensive analysis of the key market players and the significant strategies adopted by them. The key players include Advanced Micro Devices (AMD), Inc., Baikal Electronics, OJSC, Hisilicon Technologies Co., Ltd., IBM Corporation, Intel Corporation, Mediatek Inc., NVIDIA Corporation, Qualcomm Technologies, Inc., Texas Instruments Incorporated, and Toshiba Corporation.

Key Benefits

- provides an in-depth analysis of the global server microprocessor market to elucidate the prominent investment pockets from 2017 to 2023.The study

- Current trends and future estimations are outlined to determine the overall market scenario.

- The report provides information about key drivers, restraints, and opportunities with a detailed impact analysis.

Server Microprocessor Market Report Highlights

| Aspects | Details |

| By Design |

|

| By End User |

|

| By Geography |

|

| Key Market Players | ADVANCED MICRO DEVICES, INC, BAIKAL ELECTRONICS, OJSC, TOSHIBA CORPORATION, MEDIATEK INC, QUALCOMM TECHNOLOGIES, INC., IBM CORPORATION, NVIDIA CORPORATION, INTEL CORPORATION, HISILICON TECHNOLOGIES CO., LTD, TEXAS INSTRUMENTS INCORPORATED |

Analyst Review

Microprocessor is an integrated circuit used to perform analytical and arithmetic functions in a system. Server microprocessors are used inside the servers, which are an integral part of data center, enterprises, internet providers, cloud-based service providers, and others. The global server microprocessor market is driven by rise in number of data centers, increase in IT expenditure by the developing nations, and rise in demand of cloud-based services.

Furthermore, rise in trend of Internet of Things is anticipated to provide new opportunities in the market.

In 2016, North America was the highest revenue contributor in the global market, attributed to large number of data centers and well-established cloud-based services. However, Asia-Pacific is anticipated to dominate the market during the forecast period.

The key players in the server microprocessor market are Advanced Micro Devices (AMD), Inc., Baikal Electronics, OJSC, Hisilicon Technologies Co., Ltd., IBM Corporation, Intel Corporation, Mediatek Inc., NVIDIA Corporation, Qualcomm Technologies, Inc., Texas Instruments Incorporated, and Toshiba Corporation.

Loading Table Of Content...