Server Operating System Market Research, 2031

The global server operating system market was valued at $15.2 billion in 2021, and is projected to reach $45.3 billion by 2031, growing at a CAGR of 11.9% from 2022 to 2031.

The rise in spending of the business to build up the robust data center infrastructure drives the growth of the server operating system market. Moreover, the surge in adoption of the hybrid cloud environment along with increasing rollouts of 5G networking technology further drive the growth of the server operating system market. However, the high server downtime and cost related to server operating systems, as well as the lack of trained IT staff in data center facilities restrict the growth of the market. On the contrary, the technological proliferation and increasing security needs in IT infrastructure are expected to offer remunerative opportunities for expansion of the server operating system market growth during the forecast period.

The server operating system is a cutting-edge version of an operating system, having features and abilities needed within a client-server architecture or associated enterprise computing environment. The system has an advanced-level combination of hardware, software, and network configuration services alongside a central interface to integrate security and other essential administrative processes. In addition, end-users are increasingly implementing the operating system and server technologies to enable faster and safer resource sharing alongside saving money.

The report focuses on growth prospects, restraints, and trends of the global server operating system market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the server operating system industry.

Segment Review

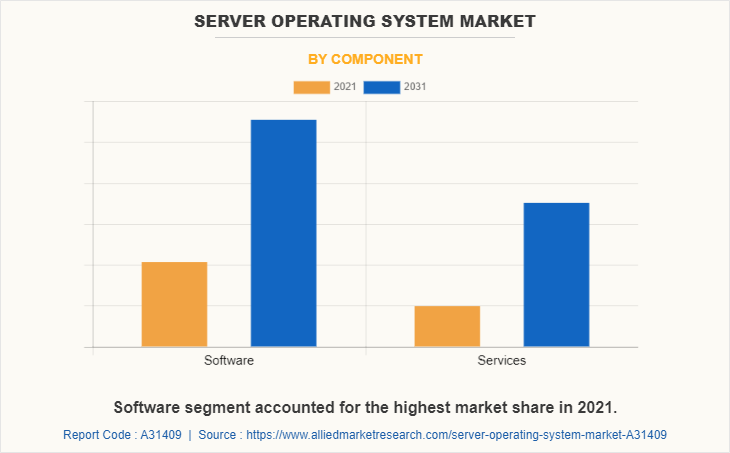

The server operating system market is segmented on the basis of by component, type, deployment mode, virtualization, organization size, industry vertical, and region. On the basis of component, the market is categorized into software and service. On the basis of type, it is segmented into Windows, Linux, UNIX, and others. On the basis of deployment mode, it is segregated into on-premises and cloud. Based on virtualization, it is segregated into physical server and virtual server. By organization size, it is categorized into large enterprises and small to medium enterprises (SMEs). By industry vertical, it is segregated into IT & telecom, BFSI, manufacturing, retail & e-commerce, government, healthcare, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of components, the software segment holds the largest server operating system market size owing to high demand for cost savings, increasing integration of artificial intelligence and machine learning capabilities, and increased demand for greater speed & quality to improve & strengthen the existing networking infrastructure. However, the service segment is expected to grow at the highest rate during the forecast period owing to a rise in demand for design and consulting services for the installation of new server operating systems as a part of sophisticated advancements and a rising focus on critical business issues and current business requirements to improve business performance.

Region wise, the server operating system market share was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to increasing adoption and growth of advanced and latest technology, such as cloud computing, artificial intelligence (AI), and machine learning (ML) is positively impacting the growth of server operating system industry. However, Asia-Pacific is expected to witness significant growth during the forecast period, due to the increasing transformation initiative across the IT and telecommunication sector coupled with growing investments in IT and data storage solutions is anticipated to drive the market growth.

The key players that operate in the server operating system market are Apple Inc., Amazon Web Services, Canonical Ltd, Dell Technologies Inc., Fujitsu, IBM Corporation, Microsoft Corporation, Red Hat, Inc., SUSE, LLC, and Hewlett Packard Enterprise. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Top Impacting Factors

Increase in spending on data center infrastructure

Data centers have to turn out to be an indispensable part of modern-day computing infrastructures across enterprises. They are now considered integral business parameters, not external facilities, for data storage and business operation models. This requirement is driven by the exponential rise of data centers and uses across a range of industries, which has created the lucrative need for data center and server operating systems. Servers are often considered the growth engine for the data center infrastructure. On servers, the processing and memory utilized to run applications may be physical, virtualized, distributed across containers, or circulated among remote nodes in an edge computing model. Therefore, the need for a server operating system plays a prominent role in the networking of the data center infrastructure, which eventually drives server OS market growth.

Growing adoption of hybrid cloud environment

Globally, the adaption of the cloud-based solution has been increasing rapidly and creating a huge need for computing. This requirement is primarily driven by the factors, such as the advent of IoT and Big Data technology. Further, the rise in the number of cloud-native server users and the increase in spending on the implementation of cloud services has accelerated the market growth. Moreover, companies have unique reasons for trusting cloud technology support in improving customer support, greater flexibility, and speed improvement. Thus, multiple benefits related to cloud technology are expected to open new avenues for the expansion of the global server OS market in the near future.

COVID-19 Impact Analysis

The server operating system market has witnessed significant growth in the past few years; however, due to the outburst of the COVID-19 pandemic, the market is anticipated to observe a slight downfall in the short run, especially in 2020. This is attributed to the imposition of lockdown by government authorities in a range of countries and the shutdown of business and travel across the world to prevent the transmission of the virus. However, the server operating system industry is likely to gain huge traction in the upcoming years after the recovery from the COVID-19 pandemic scenario.

Moreover, many companies have incorporated new strategies such as business expansion and new product launches to support companies in their work culture of manufacturing and innovation on server operating systems in these crucial times. For instance, in January 2022, Amazon Web Services launched a new speed optimization solution for Microsoft Windows Server on Amazon Elastic Compute Cloud (EC2), providing 65% faster speed on EC2 while reducing the risk of costly delays. These new strategic initiatives notably prosper the market growth in the forecasting years.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global server operating system market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global server operating system market trends is provided in the report.

- The Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The server operating system market analysis from 2022 to 2031 is provided to determine the market potential.

Server Operating System Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Type |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By Virtualization |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Red Hat, Inc., Amazon Web Services, Apple Inc., Fujitsu Ltd., IBM Corporation, Hewlett Packard Enterprise, Dell Technologies Inc., Microsoft Corporation, Canonical Ltd, SUSE, LLC |

Analyst Review

Server operating systems are integrated toward controlling resources and data security. This system further supports organizations to remain in compliance with data protection norms and IT networking requirements and can perform activities such as huge data transfer with simplicity. Furthermore, several end-use industries are deploying server operating systems with an exceptional focus is to enable security, stability, and cooperation across the Client/server network operating systems. As a result, businesses nowadays prefer robust servers and operating systems in dealing with such tasks to streamline operations.

The global server operating system market is expected to register high growth due to the rising instances of business spending to build up the robust data center infrastructure and a surge in government regulations & policies regarding networking infrastructure. Moreover, with the continued efforts for rolling out 5G networks, the need for efficient networking services increases to manage the massive data traffic driving the growth of the server operating system market. With the growth in requirement for server operating systems, various companies have established business expansion strategies to increase their capabilities. For instance, in November 2021, Red Hat Enterprise Linux (RHEL) 9 Beta released new features and several product improvements. This new product offering is intended for demanding hybrid multi-cloud deployments, ranging from physical, on-premises, and public cloud to edge, which notably contribute to the market growth during the forecast period.

In addition, with further growth in investment in data center infrastructure across the world, and the rise in demand for server operating systems, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in February 2022, NxtGen Datacenter and Cloud Technologies are gearing up to capitalize $163 million to set up almost 10 data centers and 236 edge centers in India. These investments are set to accelerate the market demand for server operating systems in the forecasting years.

Moreover, with the increase in competition, major market players have started new partnerships and collaborations as a part of a key strategy to expand their market penetration and reach. For instance, in February 2021, the global leader in open source innovation, SUSE strengthened its strategic partnership with SAP by endorsing SUSE Linux Enterprise Server for SAP applications. This strategic partnership further reinforces the customer confidence to install SAP solutions faster and more efficiently.

The server operating system market is estimated to grow at a CAGR of 11.9% from 2022 to 2031.

The server operating system market is projected to reach $45,259.53 million by 2031.

Rise in spending of the business to build up the robust data center infrastructure, surge in adoption of the hybrid cloud environment, and increasing rollouts of 5G networking technology contribute toward the growth of the market.

The key players profiled in the report include Apple Inc., Amazon Web Services, Canonical Ltd, Dell Technologies Inc., Fujitsu, IBM Corporation, Microsoft Corporation, Red Hat, Inc., SUSE, LLC, and Hewlett Packard Enterprise.

The key growth strategies of server operating system market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...